3 min read

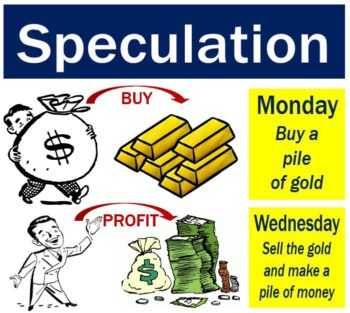

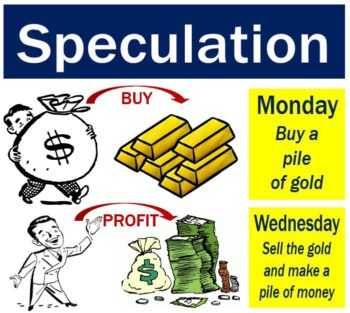

The definition of speculation says:

The speculation involves trading a financial instrument involving high risk, in expectation of significant returns.

The motive is to take maximum advantage of fluctuations in the market.

Who are speculators?

Speculators are prevalent in the markets where price movements of securities are highly frequent and volatile. They play very important roles in the markets. Because they can absorb excess risk. And provide much-needed liquidity in the market by buying and selling when other investors don’t participate.

What is speculation?

Let’s be clear.

Speculation is the purchase of an asset (a commodity, goods, or real estate) with the hope that it will become more worthy in the future.

Speaking about finance as a field, speculation is also the practice of engaging in risky financial transactions. In an attempt to profit from short-term fluctuations in the market value of a tradable financial instrument.

Rather than attempting to profit from the underlying financial attributes embodied in the instrument such as capital gains, dividends, or interest.

Not one speculator pay attention to the fundamental value of a security. Instead, speculators are focused purely on price movements. Speculation can involve any tradable good or financial instrument. Speculators are particularly familiar with markets for stocks, bonds, commodity futures, currencies, fine art, collectibles, real estate, and derivatives.

Why speculators are important?

Speculators play one of four primary roles in financial markets, besides hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageurs who look for profit from situations where fungible instruments trade at different prices in different market segments, and investors who seek profit through long-term ownership of an instrument’s underlying attributes.

Speculators play one of four primary roles in financial markets, besides hedgers, who engage in transactions to offset some other pre-existing risk, arbitrageurs who look for profit from situations where fungible instruments trade at different prices in different market segments, and investors who seek profit through long-term ownership of an instrument’s underlying attributes.

Why wouldn’t we consult history?

The appearance of the stock ticker machine in 1867, removed the obligation for traders to be physically present on the floor of a stock exchange. Since then, stock speculation went through a dramatic expansion through the end of the 1920s.

The number of shareholders increased tremendously. Let’ say, from 4.4 million in 1900 to 26 million in 1932.

Whether speculation has a place in the portfolios of investors is the subject of much debate. Some investors believe the market is always fairly priced. They are thinking about speculation as an unreliable and unwise way to profits. Speculators believe that the market has a lot of variables and each of them is the opportunity for capital growth.

The view of what distinguishes investment from speculation and speculation from excessive speculation varies widely among pundits, legislators, and academics.

Speculation as higher risk

Some sources note that speculation is simply a higher risk form of investment. Others define speculation more narrowly as positions not characterized as hedging.

The U.S. Commodity Futures Trading Commission defines a speculator as “a trader who does not hedge, but who trades with the objective of achieving profits through the successful anticipation of price movements.”

The agency emphasizes that speculators serve important market functions. But defines excessive speculation as harmful to the proper functioning of futures markets.

Frankly, some speculation is necessary and unavoidable.

Why?

In many common-stock situations, you can find substantial possibilities of both profit and loss, and the risks therein must be assumed by someone.

True?

Many long-term investors, even those who buy and hold for decades, maybe classified as speculators. Of course, excepting only the rare few who are primarily motivated by income. Or the safety of principal and not eventually selling at a profit.

We already conclude the trading is art.

But we have to admit that speculators are real artists.

Yes, we know that some market pros have the opinion that speculators are gamblers. But as we said above, a healthy market is made up of not only hedgers and arbitrageurs, but also speculators.

Economist John Maynard Keynes said that speculation is knowing the future of the market better than the market itself.

And you know who Keynes was. This giant of finance, English economist, journalist, and financier is best known for his Keynesian economics, theories on the causes of prolonged unemployment.

He developed, so-called, Keynesian economics during the 1930s in an attempt to understand the Great Depression. Keynesian economics is a theory of total spending in the economy (called aggregate demand). And its effects on output and inflation.

A Keynesian believes that aggregate demand is influenced by a host of economic decisions, both public and private and sometimes behaves erratically.

Let’s go back to speculations.

Speculation usually involves more risks than investment.

That’s true.

But, everyone has to recognize the price-stabilizing role of speculators. One who tends to even out price-fluctuations due to changes in the conditions of demand or supply. Only because they have better than average foresight.

One of them explained the benefits of speculation. Victor Niederhoffer, in his book “The Speculator as Hero” wrote:

”Let’s consider some of the principles that explain the causes of shortages and surpluses and the role of speculators. When a harvest is too small to satisfy consumption at its normal rate, speculators come in, hoping to profit from the scarcity by buying. Their purchases raise the price, thereby checking consumption so that the smaller supply will last longer. Producers encouraged by the high price further lessen the shortage by growing or importing to reduce the shortage. On the other side, when the price is higher than the speculators think the facts warrant, they sell. This reduces prices, encouraging consumption and exports and helping to reduce the surplus.”

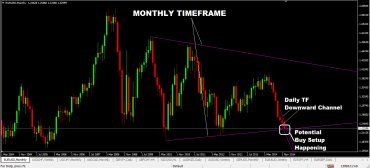

The art of speculating covers a wide range of trading tactics. Including pairs trading, swing trading, employing hedging strategies and recognizing chart patterns. Speculators are well skilled at fundamental analysis. Including spot over- or under-valued companies, the amount of short interest a company holds. And, analysis of earnings and other SEC statements. A speculator with skills and good performance knows that the short-term movements of the investment markets are largely tied to world events.

The art of speculating covers a wide range of trading tactics. Including pairs trading, swing trading, employing hedging strategies and recognizing chart patterns. Speculators are well skilled at fundamental analysis. Including spot over- or under-valued companies, the amount of short interest a company holds. And, analysis of earnings and other SEC statements. A speculator with skills and good performance knows that the short-term movements of the investment markets are largely tied to world events.

According to the Los Angeles Times, baby boomers are trying a new investment strategy for their retirements accounts.

Instead of the passive investment strategy that most employees use, an increasing number of people have turned to speculate. In an attempt to catch up on shortfalls in their retirement accounts.

How to become speculator?

Every trader who wants to become speculator has to spend many years of learning, watching, practicing.

Such one must learn how the market behaves and watch how favorite stocks react to market events.

For many traders, the book, “How to Make Money in Stocks” by William O’Neil, is a value for learning the art of speculation.

This book and many others provide ambitious trader practical tips on trading and risk management.

Speculation popularity is spreading rapidly because of the easy access to world investment markets through online brokerage portals.

But speculation is difficult to master, so you have to learn a lot if you mean to become speculator one day.

After you have a continuous track record of success through both up and down markets, it’s time to consider speculating with real money.

Successful speculating takes a lot of skill, time and experience to master. Most people who work outside of the financial industry don’t have that.

That’s why the speculators are real artists.

Risk Disclosure (read carefully!)