4 min read

From 27 January 2019, 17 of the 19 national central banks in the euro area is no longer issue €500 banknotes. In order to ensure a smooth transition and for logistical reasons, the Deutsche Bundesbank and the Oesterreichische Nationalbank will continue issuing the notes until 26 April 2019.

Existing €500 banknotes will continue to be legal tender, so you can still use them as a means of payment and store of value (i.e. spend and save them). Similarly, banks, bureaux de change and other commercial parties can keep recirculating the existing €500 notes.

Like all denominations of euro banknotes, the €500 note will always retain its value and can be exchanged at a national central bank of the euro area at any time.

To be charitable, you could say the euro has proved itself merely by surviving until its 20th birthday this January.

That is a low bar.

Some politicians and economists would say that the European monetary union has failed as an economic and political endeavor.

The evidence of Europe’s ‘Lost Decade’ is that it can only ever be made to work under a regime of technocrats.

That is to say, nation-state elected parliaments, was cleared out of their control over taxation, spending, and the core economic policies.

“One day, the house of cards will collapse,” says Professor Otmar Issing, the founding chief economist of the European Central Bank.

The EMU adventure has led to the “most serious economic crisis in the history of the European Union, said the others. It has done “more lasting damage” to Europe than the Great Depression of the 1930s and put eurozone states against each other. All of them are fighting for control over the policy.

With 2019 beginning, the leading EU economists analyze the bloc’s single currency the EU. Which they argue has caused more harm than good.

The political dynamics have become poisonous. Years of rolling crisis “entrenched and amplified the power and influence of creditor countries such as Germany”, working through the ECB and the European Council.

EU bodies enforcers of a German-imposed strategy of debt deflation and fiscal contraction. The responsibility of adjustment fell on the weaker states. That was leading to a bias for the whole system.

Yet nothing is actually changing.

There is no attempting to probe the disaster

Those in power of the EU still think they were right. Everything is about ideology.

One of the aspects of the present situation is disappointment with the “European Dream”. The belief that policies preferring concepts like community relationships, sustainable development, and international cooperation would give Europeans an advantageous lifestyle and influence in the world, collapsed. Europe, particularly as the idea of the European Union, is no longer the object of dreams. It becomes a cause of concern and even fear. And the euro carries part of the guilt for this shift of perspective.

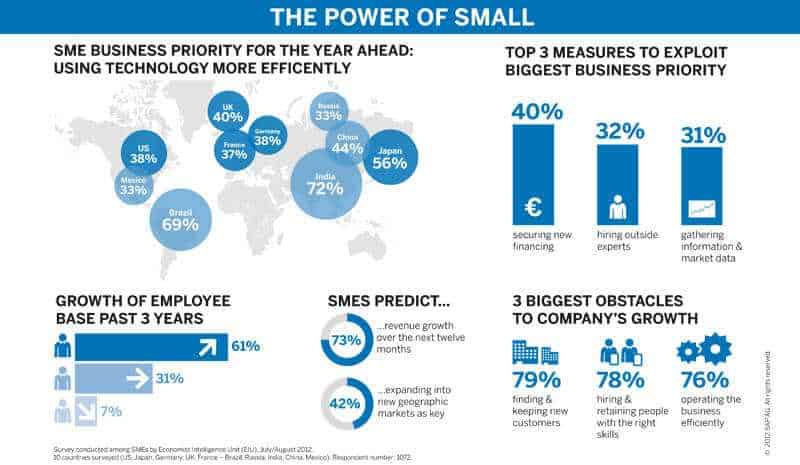

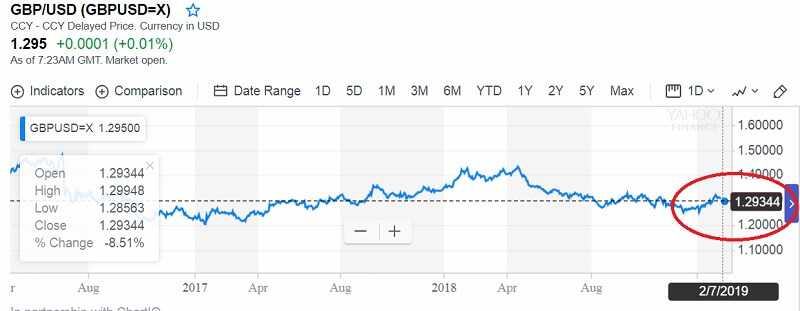

The common currency was put into place in 2002, by 19 of the 28 EU member states. But the growth in eurozone countries has been inferior compared with countries that did not join the monetary union. Notably, the United Kingdom, Norway, and Sweden showed more progress. This aspect is important to understand the public disappointment with the EU. People couldn’t see the realization of the promise declared at the time of the euro’s launch.

Today, most Europeans are assured that the common currency has negative impacts on their economy.

Most of the countries have low growth but rising unemployment

So it looks that the eurozone is in the middle of the crisis. The basic problems first posed isn’t resolved.

For example, the unitary currency system locks the relative exchange rates between countries.

For a stable economy, it is necessary to have the possibility to adjust exchange rates. Moreover, there is no such thing as a true European budget. Without exchange rate adjustments or budget transfers, it is left to the labor market. Therefore salaries have a negative effect on the hunt for budget balance.

What is clear is that the status quo cannot persist indefinitely if the Euro is to survive in the long term.

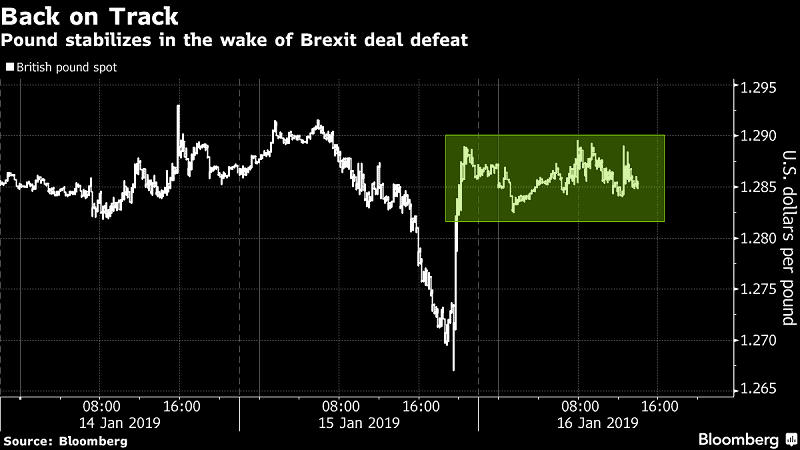

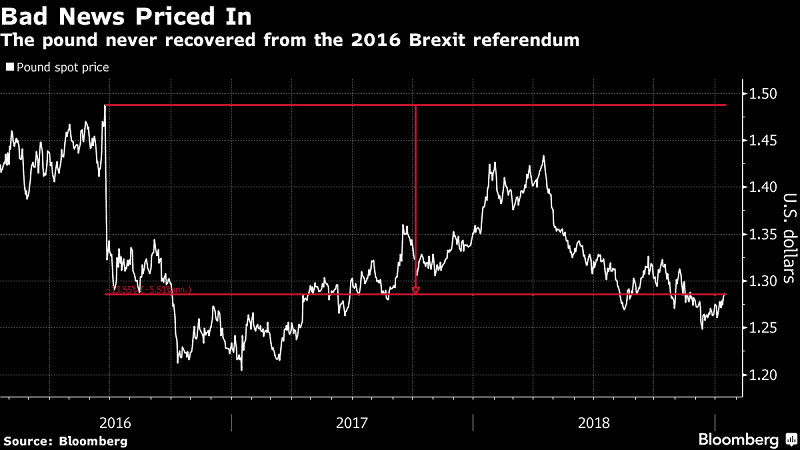

The Brexit devastated EU economic capability

Truth is, youth jobless rates reached 57% in Greece, 56% in Spain, and much the same across Italy. These levels are illogical in a modern developed democracy.

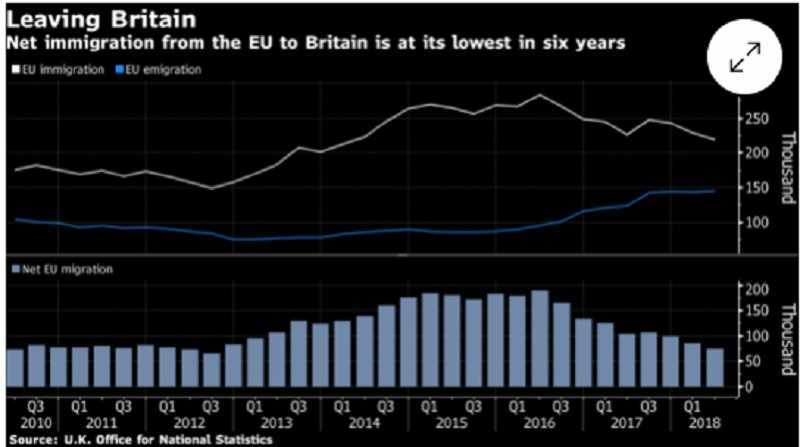

Hundred thousand economic refugees came to work in Britain. From Eastern Europe came to the UK instead of going to the eurozone as they did before. The wave had a great impact before the Referendum UK.

EU budget talks for 2019 collapsed

The last year’s negotiations between the Council of the EU and the European Parliament for the 2019 budget failed to reach a compromise by the legal deadline. Later in December, they made the deal.

But Europe’s economy is weakening. It would not have said the recession was imminent but the article by economist Victor Hill connects some events in directions many haven’t considered.

Hill begins the article this way.

”Across Europe, and particularly in the 18-member Eurozone, the economic news is sobering. It’s now clear that the credit crunch in emerging markets which has played out over most of this year, plus the slowdown in China, are having negative consequences in Europe. Yet, despite the ongoing trauma of Brexit, the UK is cruising along relatively smoothly—for now.”

The first such event is the coming end of the European Central Bank’s quantitative easing “Asset Purchasing Programme.”

The ECB has been buying bonds, stocks, and anything else that isn’t nailed down wholesale.

Asset prices have gone up

Mario Draghi and his team borrowed the US Federal Reserve’s plan and made it more insane. Since 2017, they have been stepping down purchases. The step should reach zero in early this year.

The EU needs a growing core to stimulate growth for the whole continent.

Where the EU has made practically zero progress is crisis prevention. In some areas, they are even growing back.

The politics have gotten worse. The price to pay for those bailouts, reform packages, rescue funds, and European Central Bank bond-buying schemes has been political fragmentation, at first. But by now, this becomes outright polarization. And this is happening in both “core” and “periphery countries”.

The eurozone still relies on the European Central Bank to hold everything together. And instead of a treasury, they have a politically unstable consensus on the need for the ECB to act as a lender of last resort for governments.

Policymakers need to support the ECB. But the eurozone will not be able to avoid a discussion on better fiscal alternatives forever.

The eurozone is still dangerously imbalanced

The size of the northern countries’ account surplus is an obvious symptom of the basic differences. It will need to rebalance to solve the problem.

And moreover, there is the weak governance of some parts of Southern Europe. This will be very difficult to support politically.

The current state of the global economy is like to be the crash. There are unsolved problems everywhere. There’s the Brexit issue, Italy’s populists, the US-China trade conflict and a lot more. The bad news everywhere.

The defenders of the euro at the European Central Bank (ECB) sit in Mario Draghi’s trap of a zero-interest policy. The bank president’s inaction could prepare the territory for the next big crisis.

The world’s largest asset management firm, BlackRock, is warning its clients against investing in European stocks. They are saying the risks of doing so are too high and that the bullish period is most likely over on the Continent. There’s the concern, seeing investors increasingly putting resources into US sovereign bonds in pursuit of safe yield.

And it’s a warning signal when yields on longer-term bonds are lower than those on bonds with a shorter maturity.

Such an inverse yield curve could be an indication of a downturn

Today’s debt is higher than before the global financial crisis, amounting to 225% of global GDP (according to the IMF) or 245% (according to the Bank for International Settlements). The eurozone stipulates its members must not let their debt exceed 60% of GDP. But, global debt is rising faster than growth.

The bottom line

What does this mean?

This means that the economic growth we’ve seen in the past years has been achieved on credit.

When the bubble explodes all will have to tighten their belts. Some nations will no longer be able to take the multibillion-dollar rescue packages. And the ECB’s Mario Draghi cannot lower the lender’s interest rates to lever up the economy.

The ineluctable conclusion is that a monetary union of budgetary sovereign states cannot be made to work.

The euro is essentially unsustainable. And, therefore, it is going to die.

risk disclosure