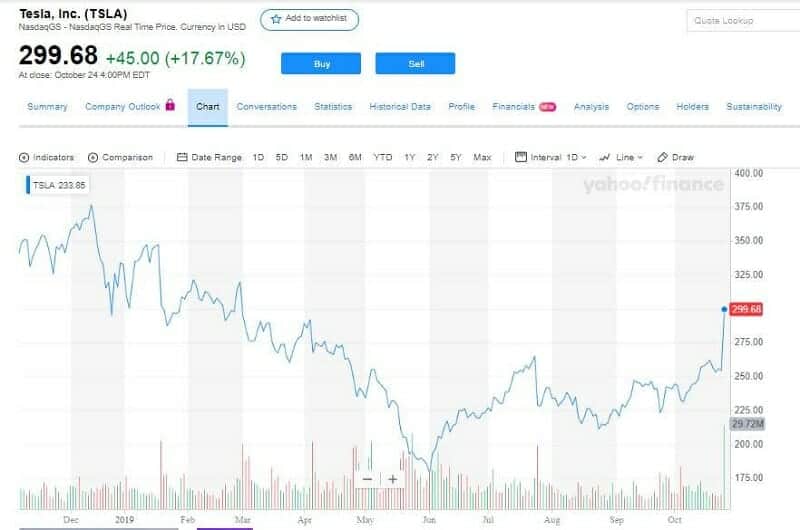

Tesla stock rose an incredible 17% on Tuesday, but Morgan Stanley recommended selling Tesla for the first time since 2012.

UPDATE 07/02/20:

Yesterday 47 million shares of $TSLA traded at an average price of $750/share – equating to a nominal value of $35 billion. The last price was $748.96 on February 7.

Tesla bubble is turning heavy bulls into short-sellers.

The short-seller Andrew Left’s Citron Research tweeted: “even Elon would short the stock here if he was a fund manager.”

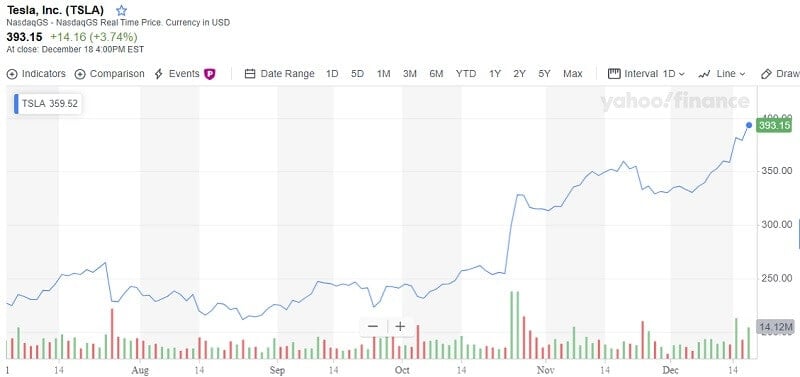

Tesla’s (NASDAQ:TSLA) rally has seen the stock double in 2020 alone. The company’s market cap is over $160 billion. Great news to CEO Elon Musk and his bonus.

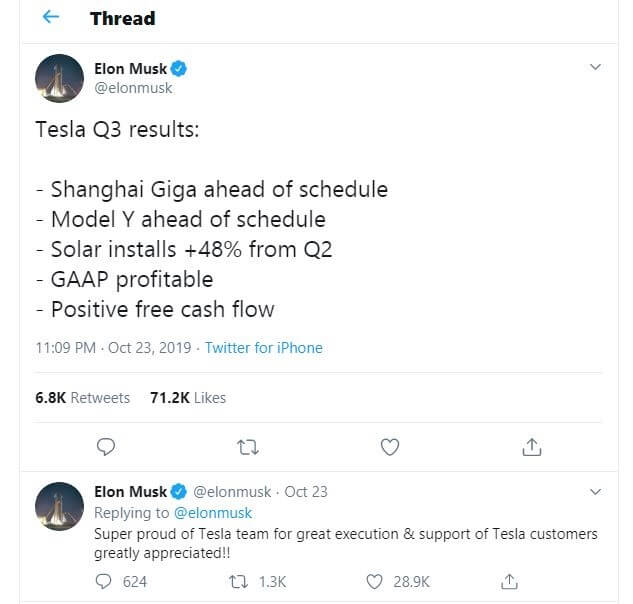

The surge is getting headlines but what caused this change? Actually nothing. Tesla’s revenue growth dropped in the last quarter. The traders recognized it as a Tesla bubble and it isn’t surprising that a lot of them want to short it.

One is Citron Research as we mentioned.

In a tweet posted on Tuesday, Citron Research said that they were shorting the stock again. Citron changed its mind after the recent run, despite their earlier statement that they would never do it again.

On Thursday, even Morgan Stanley recommended selling Tesla for the first time since 2012. The bank downgraded Tesla to “underweight” from “equal-weight.” This new rating came at the time of a record rally for Tesla. Morgan Stanley also recognized rising downside risks. Shares of this electric-vehicle maker dropped 4% in early trading Thursday. It looks that traders who bet against Tesla’s victory are the ones who have to push the share price higher. What an irony!

Tesla bubble causes fears. How is that? Can you recall bitcoin’s surge back in 2017? Exactly.

The climbing for shares of Tesla provokes some investors to compare this jump to the bitcoin bubble. Tesla’s shares have grown 36% to a record price of around $887 in the last two sessions. This Silicon Valley favorite has jumped 180% during the last three months. Just to give you the right perspective, on June 3 Tesla’s traded low at $178.97, on February 4, Tesla’s shares have gained almost 395%.

And now Andrew Left said he’s betting Tesla will go back down. For the market winner 2020? Also, Michael Novogratz compared the surge in Tesla to bitcoin’s likewise parabolic progress.

The gains have come too greatly, too wild

The parabolic rally put shares up 21% Tuesday, after a 19% increase Monday. That put gains at over 100% for the past 12 months. Bulls are clapping the record run, but short-sellers are also measuring in on what’s next for the electric car-maker.

But Citron Research doesn’t think the company is bankrupt, Andrew Left said Citron is shorting Tesla only because of the valuation.

Citron Research tweeted more: “when the computers start driving the market, we believe even Elon would short the stock here if he was a fund manager. This is no longer about the technology, it has become the new Wall St casino.”

Morgan Stanley downgraded shares of Tesla to “underweight”

Now it is the “sell” rating. Tesla gets this rating from Morgan Stanley for the first time after seven years. According to Bloomberg, in September 2012 Morgan Stanley gave a selling rating to Tesla. This one came after a record rally and amid optimism about Tesla’s China factory. The bank saw the problem in “sentiment around the stock” that is “admittedly very strong, but we ultimately question the sustainability of the momentum.”

Morgan Stanley also lowered the valuation for the company’s mobility unit and increased the expectations for the core auto business. That resulted in a higher target price.

Why Tesla Bubble?

Tesla’s current valuation is more downside risk for the stock than upside. Even the company’s increased price target from $250 to $360 indicates a 30% downside from the last trade price on Wednesday.

Also, the optimism around the China factory had a great influence on Tesla’s stock. The problem is that the risks are not entirely recognized.

Adam Jonas of Morgan Stanley in his Thursday note wrote that investors “continue to harbor concerns whether an auto business commercializing advanced, dual-purpose technology in economically sensitive industries could be a long-term winner in the Chinese market.”

Tesla has entered into the bubble-zone, everyone is following what’s going on with it, even the people who are out of the stock market are reading news about Tesla’s stock price. And cheering. The surge was too fast, too far. That’s why it looks like a bubble. Who is surprised by short-sellers’ appearance now?

What is a bubble?

A bubble is when the fast rise of asset prices is followed by a shortening. It is generated by a surge in asset prices and driven by an enthusiastic market reaction. When fewer and fewer investors want to buy at a high price, a massive sell-off happens. That causes the bubble to decrease. After the new Morgan Stanley’s gave Tesla shares a “sell” rating it is quite possible the stock price will fall quickly. That is the situation with Tesla stock. The share value grows beyond asset value. So, investors withdraw their money faster in fear that supply will exceed the demand. That could cause the share price to drop.

Tesla’s 2020 rally has been strong. The stock was all the time very high and reached new all-time highs each week. But on Tuesday investors assumed that holes may arise whenTesla fell by over $100 just 15 minutes before the closing bell. This drop was followed by a large volume, implying that it wasn’t quite a healthy correction. Yes, TSLA finished the day up 17%, but the mini-drop was visible. It looks like the air is coming out of the bubble.

Bottom line

Everyone should be skeptical when such a massive run in stock in a short time with very few visible reasons, appears. If we have in mind the recent rise of retail ownerships, we must consider that the further drops for Tesla stock are near.

Citron’s current change on Tesla stock can be accurate as the last one was. As an illustration, according to Bloomberg, Tesla overtook Apple as the most shorted US stock and analysts have bearish ratings on the asset. Everyone is predicting TSLA short squeeze. That can be right but on the other hand, it is more likely this stock price will decline slowly. Increasing short selling is more possible than a sharp fall. One of the analysts, Ihor Dusaniwsky said: “This is due to the amount of short hedging that is being done to offset Tesla convertible bond and options exposure.”

Before Tuesday’s rally, Tesla short-sellers had taken a $2.89 billion loss last year and a loss of $8.31 billion from the beginning of 2020.

Tesla shares were trading 12.73% higher at $879.30 on Tuesday.

By the way, analysts that cover Tesla, predict the average price target is $506, which is around 35% below the closing price on Monday.

But who can predict the market’s movement or what Elon Musks’ next move?

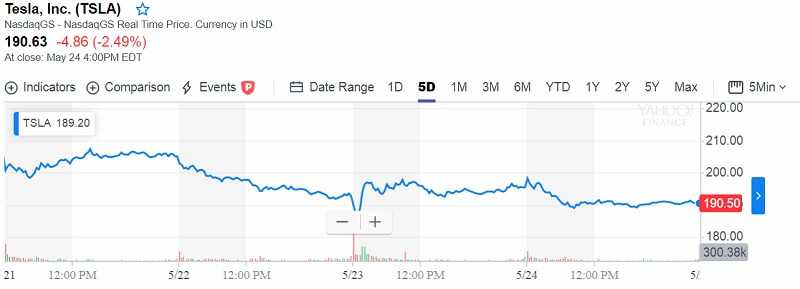

Image source: Yahoo Finance

Image source: Yahoo Finance