The structure of the investment portfolio depends on many factors but risk appetite is maybe the most influential one.

The structure of the investment portfolio depends on many factors but risk appetite is maybe the most influential one.

By Guy Avtalyon

How to structure your stock portfolio? The answer to that question depends on your attitude to risk. Here are three sample portfolios.

What is the best structure of a portfolio?

Laith Khalaf, a senior analyst at UK wealth adviser Hargreaves Lansdown suggests this model of your stock portfolio structure:

Adventurous investor

20%: JPM Emerging Markets

20%: Legal & General International Index

20%: Man GLG Japan CoreAlpha

20%: Threadneedle European Select

20%: Standard Life Global Smaller Companies

Balanced investor:

20%: Invesco Perpetual Tactical Bond

25%: Newton Global Income

10%: Stewart Investors Asia Pacific Leaders

25%: Legal & General UK Index

20%: Baillie Gifford Managed

Conservative investor:

25%: Newton Real Return

20%: Investor Perpetual Tactical Bond

10%: Legal & General Global Inflation-Linked Bond

20%: Threadneedle Equity Income

25%: Troy Trojan

How you will structure your portfolio depends on are you a defensive, middle-of-the-road, or aggressive investor. This will partly determine where you invest.

What is a portfolio structure?

The portfolio construction is the process of organizing your investments as a whole, rather than piecemeal.

How can you have the best chance of constructing a portfolio that meets your investment goals?

At a broader level, portfolio construction should be about structuring your portfolio in a way that stands the best chance of meeting you have stated investment aims within your acceptable level of risk.

But be careful, well thought out structuring of your assets will have an enormous impact on your long-term wealth creation. Conversely, the wrong structure could cost you in both ongoing charges or unexpected tax liability.

What factors do you have to consider in deciding on the combination of stocks, bonds, and perhaps commodities to use in building up your retirement portfolio?

Let’s say that the further one is from retirement, the more risk one can take. Thus at 30, you might have a portfolio of 70% stocks, and 30% bonds. At 50, the ratio might be half stocks and half bonds and at 70, 70% bonds and 30% stocks.

This model of stock portfolio structure allows for a more predictable and more stable income from bonds. But it does not take into account the characteristics of the individual or the nature of the stocks and bonds. Moreover, not all stocks are equal.

Structure of the stock portfolio based on risk tolerance

Find how the structure of the stock portfolio matches your risk tolerance.

If your stock portfolio at 30 or 50 is loaded with, for example, half small caps with no dividends, mining stocks with low dividends then the need for bonds is higher. Or if the bond portion of a portfolio is loaded with high-yield bonds subordinated debt, the fixed-income portfolio needs to be rebuilt for security.

As we move from working years during which it is possible to raise savings and make up for investment losses into retirement, the need to cut volatility grows. A mixture of short and long government bonds and corporate bonds can’t compete with the potential of small companies’ stocks to rise. But it does have fundamental security.

But you can implement some other model of structuring your portfolio. For example, you can buy stocks from developed and emerging markets around the world. And you can own real estate through a low-fee fund as a part of your portfolio.

If you live in the USA, Treasury inflation-protected securities, or TIPS are a very good choice. Some of these parts will possibly increase and drop and increase again. It will happen at different times and at different rates. So you can rebalance at least once a year to maintain your target allocation in your portfolio.

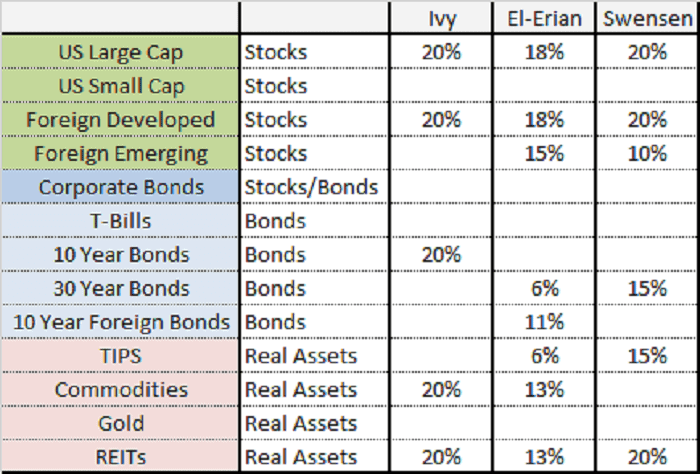

David Swensen, chief investment officer, Yale University suggests this, take a look at the image below.

How do the fees influence the structure of the stock portfolio

Fees can make terrible damage to your investment returns.

Even if you hold the higher-risk, but also, higher-return asset classes. In case of, for example, stocks, you can expect high but one-digit or low double-digit returns over a long time. In fact, Swensen said you can end up losing more than half of your returns. The math is simple, you’ll have to pay 1% for your financial advisor, the additional costs are mutual funds fees which are approximately 1-2%. Finally, you’ll have to adjust your returns for the percentage of inflation.

The odds, he said, are in favor of index funds. In his opinion, very-low-fee index funds make the most sense for individual investors.

When it comes to investing there is no such thing as one size fits all.

Speaking about how to structure your stock portfolio, your portfolio has to be well-diversified, equity-oriented for long-term investors, and efficient in the sense that it is as good or better than other alternatives.

Portfolio structure depends on how long you want to stay invested

When you’re investing for the long run, for example, 20 or 30 years, you are expected to make more money holding a fairly large part of your portfolio in stocks or some other assets that have a high rate of return. That’s because historically, stocks offer greater returns than safer alternatives over the long term.

But in the short term, stocks tend to be much more volatile. So as you approach retirement age, investment advisers suggest moving more assets to the “safer than stocks” class.

Let’s say the stock market crashes and you need to spend money out of your portfolio as income in retirement. So, you don’t want to lose 20 – 30% of your savings and to sell your stocks at a lower price. If you’re younger and market crash, you can just stay invested and wait for the market to recover.

But it isn’t all about age

How to structure your stock portfolio is also about the appetite for risk. Risk tolerance is different for each investor. Risk-averse investors will prefer to hold a mixture of the stock portfolio and cash. Cash could reduce overall risk. When wealth increases, it could happen a tolerance for risk to increase also. But when you grow older, tolerance for risk could decrease. Each investor needs to find his/her own stock portfolio structure that suits their risk tolerance. That’s the main point.