Understand the differences between trading and investing to be able to choose your strategy for approaching the stock market

By Guy Avtalyon

Trading or investing? Actually they are two very different strategies of trying to profit in the financial markets. The goal of investing is to continuously build wealth over a long time through the buying and holding of a portfolio of stocks, mutual funds, bonds, and other investment products.

Investors usually increase their profits through compounding or reinvesting any profits and dividends into new stocks

Trading versus Investing

Investments are usually kept for years, sometimes even decades. There are many advantages to investing for a long time, for example, interest, dividends, can give profits also. Investors are more concerned with market fundamentals, such as price/earnings ratios and management predictions.

On the other hand, trading involves the more frequent buying and selling of stock, commodities, currency pairs, or other, with the goal of generating returns that outperform buy-and-hold investing. Trading profits are generated by buying at a lower price and selling at a higher price within a short period of time. But, trading profits are made also by selling at a higher price and buying to cover at a lower price (known as “selling short”) to profit in falling markets.

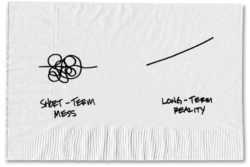

For traders, the stock price action is more important. If the selling price goes up, they will usually want to sell the stocks they hold. Trading is more the art of right timing while investing is the ability to create wealth by increasing interest, plus dividends over the years. Investors’goal is to keep excellent stocks in the market. Trading will give you a chance to profit on short-term market movements.

Investing means to hold stocks for a longer time, longer than 5 years, for example. But some investors hold their excellent stocks for decades and sometimes they are the part of the inheritance.

Stock investor versus stock trader

Stock traders and stock investors approach the stock market with the same objective but use different modus operandi. But stock investor tries to achieve this through a single transaction, whereas the stock trader chooses multiple transactions but in quick succession. The stock investor just buys and holds while the stock trader buys and sells stocks on a continuous basis.

Select stocks for investment

Stock investors are very patient and have the tendency to hold stocks until the market realizes their actual worth.

Stock traders are simply concerned about the price movement and they are ready to buy an overvalued stock if the price movement suggests so. They are least worried about the valuation of the stock.

Trading tools for trading and investing

Stock investors rely on fundamental analysis for identifying investment avenues. They utilize top-down and bottoms-up approach together with ratio analysis for stock selection.

Stock traders employ technical analysis to maximize their returns. They are concerned about past and current price movements.

Different market niche

Stock investors pay more attention to taking dividends payments while traders never or rarely pay attention to dividends. This limitation makes the derivative market more suitable for traders and the cash market for investors.

Why you have to know all of this?

You have to know, to recognize, your own psychology before entering the market. To find which of this technique suits you better. Identifying your personality will enable you to employ the right tools and techniques to be a winner.

If you are comfy with speculation, be a trader, and if you are a hunker, choose to be an investor.