The simplest answer is why not, but here is a more complex one.

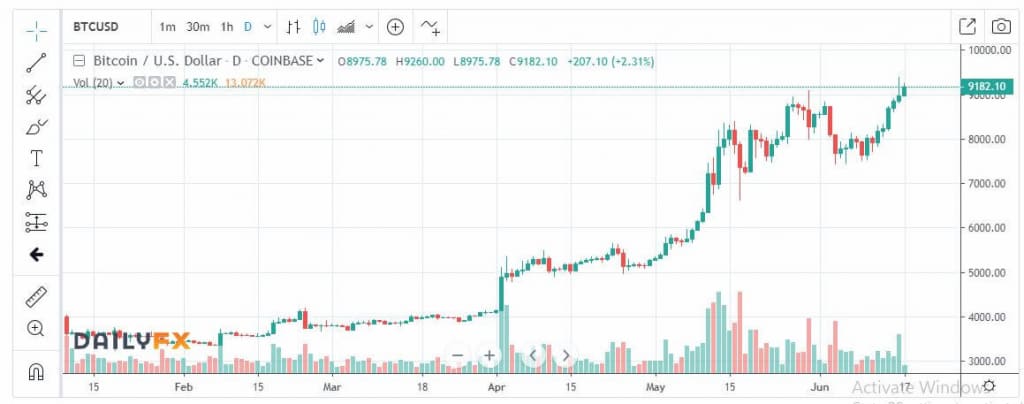

Why now Bitcoin? Honestly, I did not meet statistics and exact figures on this topic. But in 2017 the number of searches in the Google search engine on the topic bitcoin – increased by 450%, compared with the previous year.

The last time such a large survey was conducted in the USA, back in 2013 by the firm On Device in preparation for a London conference. At that time bitcoin awareness by Americans was about 25%.

By 2018 bitcoin awareness has jumped by more than twice that number according to Survey Monkey and Global Blockchain Business Council. And though bitcoin acknowledgment is growing, actual participation seems somewhat low.

Nearly six in ten respondents revealed they’d at heard of bitcoin. That up some 33 points from 2013’s measure. The two surveys are not linked. More than 5,000 people participated in the current questionnaire.

More about survey

According to the same survey, only 5% hold a digital asset. But 21 percent of that number claim to be “considering adding it to their portfolios.” The majority of holders are male, under 34 years of age (58%), white.

The results basically show ten percent of millennials own bitcoin while older Americans barely break one percent. Bitcoin holders’ politics are politically independent by half. Less than 20% trust their government more than the Bitcoin network (almost a quarter).

That’s the reason why now bitcoin!

Asked about possible 2018 asset crashes, 38 percent of all Americans (and 41% of owners) see BTC as a bubble poised to pop this year. Still, the survey did note that almost 70 percent expect BTC to increase in value over the coming half of a decade.

A little more than 10 percent believe it will die out.

According to data compiled by Bitinfocharts.com, there are almost 22 million bitcoin wallets. However, most bitcoin users have several BTC wallets and use multiple wallet addresses to increase their financial privacy when transacting in bitcoin. Therefore, the number of bitcoin users is likely less than 22 million.

Anonymity

A 2017 study by the Cambridge Centre for Alternative Finance suggests that the “current number of unique active users of cryptocurrency wallets is estimated to be between 2.9 and 5.8 million.”

It is important to note that this study focuses on active users as opposed to bitcoin holders or ‘hodlers’. This gives us insight into how many individuals are actual users as opposed to buy-and-hold investors.

This surveys also show that the end of 2018 is the right time is the time to get to know BTC. So, let start!

What is Bitcoin?

For the majority, it is still an open question. The first step to understanding Bitcoin is admitting you don’t understand Bitcoin.

Let’s say, Bitcoin is a protocol. But, honestly, the protocol itself is just our best try to describe what BTC actually is. No one can be sure of the protocol’s final form.

Bitcoin is a digital currency created in 2009 by a mysterious figure using the alias Satoshi Nakamoto. You can use it to buy or sell from people and companies that accept bitcoin as payment. But it differs in several key ways from traditional currencies.

Most obviously, bitcoin doesn’t exist as a physical currency. There are no actual coins or notes. It exists only online.

Interesting explanations about what Bitcoin:

Mental construct – Because value is subjective and we feel value for Bitcoin units.

Social construct – people feel value for Bitcoin units. And they become an intermediate commodity suitable for exchange, accounting, and store of value.

Legal construct – As an intermediate commodity it serves to cancel formal agreements such as debts, purchases, and pay taxes.

Economic construct – As it may be used to cancel debts and pay taxes it may be used as money facilitating commerce between untrusting strangers in different incompatible jurisdictions.

Technical construct – It is just software that enables a network. But that network organically emerges as a useful system or technical tool for the other constructs.

More…

Protocol construct – The technical system is actually the system of rules imagined and designed to maintain a highly secure Nash Equilibrium between node operators and users.

Mechanical construct – Although many see Bitcoin as a social construct only, it is as much of an objective mechanical system as it is subjective. Although people design and run it, it is immutable, just like the laws of physics in nature.

Physical construct – Bitcoin is designed to mimic gold in nature, but in a computer system and transferable thru communication channels. This is why we call it “digital commodity”.

Natural construct – All of the above emerge from nature. They are not imaginary or magical things, they are as natural as energy, matter, or living organisms.

We can play with semantics here, you can say that it’s a protocol. And also the open-source project that implements the software needed to fit the protocol. Or you can try to call Bitcoin as a kid in the adults’ world.

Bitcoin has no central bank and isn’t linked to or regulated by any state. The supply of the cryptocurrency is decentralized. And can only be increased by a process known as “mining”. For each BTC transaction, a computer owned by a bitcoin “miner” must solve a difficult mathematical problem.

The miner then receives a fraction of a bitcoin as a reward. At present, the mining power of Bitcoin’s network is 300 times more powerful than the world’s top 5 supercomputers combined

Anonymity matters

A record of each transaction, using anonymized strings of numbers to identify it, is stored on a huge public ledger – blockchain. This is necessary to ensure the integrity of the currency.

For most people, it is strange that bitcoin doesn’t exist as a physical currency. There are no actual coins or notes. It exists only online. And it is hard for the majority to imagine such a thing.

But can you imagine the internet?

We all use the internet in every segment of our lives but we can’t point out the finger and say “Here! This is the internet!”

Or how some understand the universe is infinite and how they understand the meaning of infinite, you would be surprised by the answers.

Do you exactly know how your mobile device works? Maybe some of you, but the majority don’t.

Frankly, for me is a total mystery how my dishwasher works but it will not stop me to use it.

“Writing a description for this thing for general audiences is bloody hard. There’s nothing to relate it to.” wrote Satoshi, July 5, 2010.

Fiat money is managed by a central bank, which manages the money supply to keep prices steady. They can print more money or withdraw some from circulation. Yes, if they think it’s needed, as well as using other monetary policy controls such as adjusting interest rates.

My teachers taught me how interest was compounded. The reasons may not be so clear. If we would learn banking history and monetary theory in schools, no one would use the fiat system. It is so obvious.

On the other hand, BTC is a lot simpler than the fiat system. And people are legally compelled to adopt fiat.

The people teaching youngsters these days have grown up under Keynesian economic theory. Also called Keynesianism. So, they strongly believe that money is defined as money only if you can touch it, smell it or hear the sound of counting money.

Number of users

The most popular BTC wallet and exchange provider, Coinbase, reportedly has over 13 million users. This would suggest that the number of bitcoin users is between 13 million and 22 million.

We can assume that the number of bitcoin users outside of the 32 countries that Coinbase services, will be several million. But this data doesn’t include major bitcoin economies in Asia.

So we can conclude that around 20 million bitcoin users globally can be considered as a fair estimate.

Why use bitcoin?

With Bitcoin people get the liberty to exchange value. Without intermediaries which translate to greater control of funds and lower fees. It’s faster, cheaper, more secure, and immutable.

The banks control the cash while bitcoin has owners.

Bitcoin is very useful as a service for fast remittances for an international system of payments, for example. It can help us do online shopping. It’s like an e-wallet which makes blockchain technology to store, track, and spend digital money.

BTC has a global acceptance and is less volatile than cash / local currency.

Due to this feature, it becomes easier to conduct transactions across boundaries and online. You can use this crypto all over the world without going through a conversion process. It is par with Gold and combines the best of cash and gold.

By providing an open market and no restrictions imposed by banks or governments. Bitcoin is peer-to-peer and open, but secure.

Bitcoin is making the biggest revolution in the finance industry in the last 200 years. Leading all cryptocurrencies, Bitcoin is at the forefront of the bleeding edge of blockchain innovation. I think it is necessary to stay patient and witness history first hand.

Nothing can stop that!