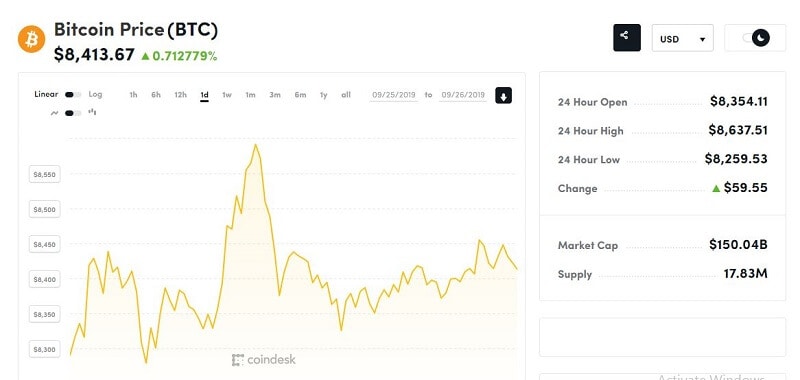

Bitcoin rose above $7.402 and market cap moved upward by +0.89% to $137.68 billion

The Bitcoin price may rise further since it has continued being above the level of $7,000. That is important not from psychological only. Over the weekend, it traded between the $7.100 and $7.200 and by now has grown to reach a bit over $7.402 according to the Coindesk and at the moment of writing,

The weekend began with cryptocurrencies retracing, but it ended with a rally. Bitcoin (+4.5%), Bitcoin Cash (+4.14%), Ethereum (3.7%), and Litecoin(+4.73%) were the best among the top ten cryptos.

That caused crypto analysts to be hopeful about the short-term price action of Bitcoin. One of them suggests a price range to which Bitcoin may rise this week.

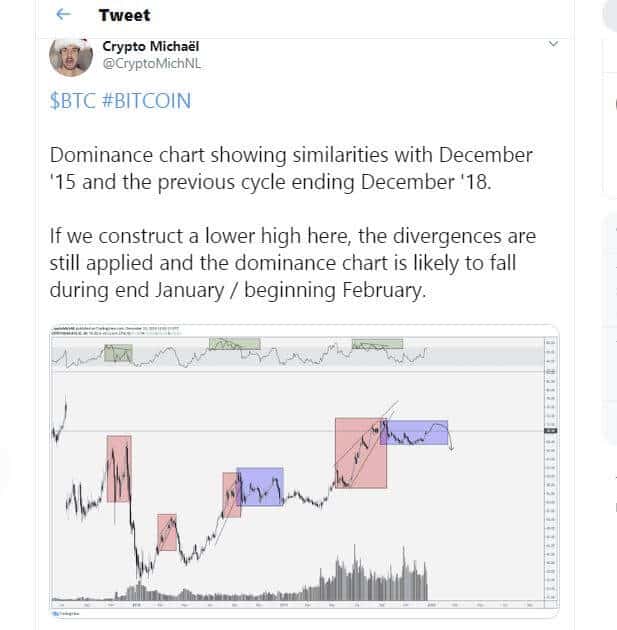

@CryptoMichNL wrote:

“Currently at potential local resistance. Wouldn’t be surprised with the continuation of ranging for the coming days, before we make another push to $7,800-8,000 resistances later next week.”

Today ( December 23) followed by another tweet:

Last week, the famous investor and BTC bull Tim Draper had stood by his previous forecast about Bitcoin popping $250,000 by the end of 2022 or by early 2023.

And CNBC’s crypto expert Brian Kelly said that technically this price action is possible and described how it could befall.

Brian Kelly said:

“It sounds bizarre but it wouldn’t be out of the realm of what Bitcoin has done in the past.”

Kelly showed a chart of Bitcoin price movements since 2013 and pointed out that since then Bitcoin price has been moving within a rising channel. The top of that channel, Kelly says, is right about $200,000 – $250,000.

As for the fundamentals that could lead to this price leap, Brian Kelly calculated that by late 2022 or early 2023, Bitcoin could take half of the market share from all the world’s gold and by that time the market cap of Bitcoin should be almost $4,5 trillion.

Could #bitcoin hit $250,000 in the next two years? @BKBrianKelly and @fundstrat‘s Tom Lee help us break down longtime venture capitalist Tim Draper’s bold call. pic.twitter.com/dGW4nJL86f

— CNBC’s Fast Money (@CNBCFastMoney) December 20, 2019

If that arises, Kelly said, Tim Draper’s prediction “isn’t too far out of whack.”

The Bitcoin market cap moved upward by +0.89% to $137.68 billion and trading volume is at $27.23 billion.

Bitcoin dominance increased lightly and is now 68.65%.

Bitcoin has broken the sideways movement after the bullish impulse that made last December 18. The price moved up from $7,150 to exceed the $7,650 value but fall again to $7.402.

This $500 movement was the confirmation of the trend reversal that was expecting. Will the move proceed until it touches the upper descending trendline at $7,800? We’ll see.