Read to the end.

By Guy Avtalyon

Do you need a broker to trade crypto?

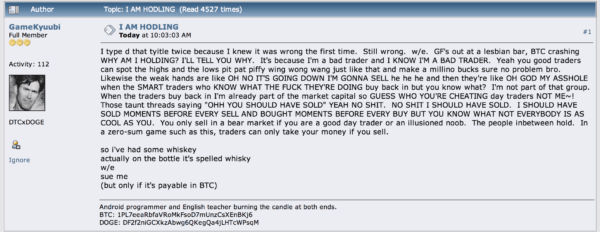

Nowadays, everything revolves around Bitcoin and cryptos. Due to the exponential increase in the price of most cryptos, an increasing number of people are considering how they can profit from it. So far, you’ve only been watching from the side of the other, watching others fill their pockets … it’s certainly an unpleasant feeling. It’s time for you to start trading!

When you first start taking an interest in cryptocurrency you may think you are so lost in this huge sea of unknowns.

Do you know how does the cryptocurrency market work? FIND HERE

Where do you start? What are the useful keywords to look up and keep in mind? What are the available helpful resources?

The question: Do I need a broker to trade crypto is the mother of all questions.

To whom I can trust is the main and most powerful weapon when you have to choose the way to trade crypto.

Over time, many have proven themselves to be scammers, and people lost trust. But you still have wonderful platforms. So, the answer is:

No, you DO NOT need a broker to trade crypto.

And of course, you may trade bitcoins with anyone without having to pay fees to a centralized exchange. True is that you don’t need any kind of mediator or agent between you and the crypto seller. I think the big advantage of bitcoin is no middle man.

You don’t need a broker to trade crypto

All you have to do is to use one of the trading platforms’ equipment with very good software. And there are scores of trading platforms. Powerful, to which you can trust.

The most common place where people buy and trade cryptocurrency is on the exchanges. Those are places where you may buy and sell your crypto, using fiat. There are multiple measures to judge the reliability and quality of an exchange, such as liquidity, spread, fees, purchase and withdrawal limits, trading volume, security, insurance, user-friendliness.

The first thing you really need is access to the “marketplace” from where to buy these cryptocurrencies. In other words, if you want to trade cryptocurrency you need:

1) cryptocurrency wallet

2) cryptocurrency exchange to trade on.

Simple as that.

Choose some respectable exchange and follow instructions. It mostly comes down to the following. After setting up an intermediary bank account and verifying your details, you are only five simple steps away from a Bitcoin purchase:

1) Access the ‘Buy/Sell Bitcoin’ tab

2) Select the payment method using the drop-down menu

3) Enter the desired amount

4) Click ‘Buy Bitcoin Instantly.’

5) View your credited Bitcoins on your dashboard

This process sometimes should be repeated several times.

But it’s worth it in the end. Of course, it isn’t without any fees but fees are much lower than if you use a broker.

If you’re interested in trading Bitcoin then you have a broad range of cryptocurrency exchanges from where to choose. But first make sure the exchange you pick accept fiat deposit so you can buy Bitcoin directly with your fiat money (US Dollar, Euros, etc.). Secondly, you want to make sure your preferred cryptocurrency is listed on the exchange. The most popular Crypto Exchange is CoinBase. But you can also use GDAX, BitFinex, Wirex, Binance, Coinmama, Bitpanda, or similar.

If you want a bunch of fancy tools with which you can buy and sell cryptocurrencies you’ll want to use one of the exchanges that offer you a large variety of order types.

An important factor when deciding your preferred cryptocurrency exchange is to research it thoughtfully and also listen to other user reviews and experiences.

So, the answer to the question is – NO!

If you want to invest in cryptocurrency, and not just buy/sell/trade, then you have a few options:

a) New investors can choose an exchange to buy coins on and a wallet to store the coins in.

b) An exchange-broker-wallet hybrid that allows customers to buy/sell/store cryptocurrency or some else options which I don’t want to recommend one until I reviewed them.

But that is a completely different story.

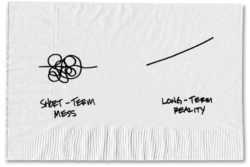

Should you buy or trade crypto? Before you make a decision it is important to consider the differences between these two strategies in detail.

Should you buy or trade crypto? Before you make a decision it is important to consider the differences between these two strategies in detail.