How to find the best Forex strategies and win the market? Here are some suggestions.

How to find the best Forex strategies and win the market? Here are some suggestions.

By Guy Avtalyon

The best Forex strategies are those that fit your circumstances and personality best. Right? We wish we could give you a direct answer about what are the best Forex strategies.

Well, we get this question frequently because we are the portal where everyone wants to find some answers about trading and investing.

However, this is a complicated question.

This article is essentially for those who are new to the world of currency trading. Also, they are questioning how they can make money from the forex market.

The traders who are trading on demo or live accounts should also find some helpful advice in this article. Opposite to popular belief, you don’t have to be rich in order to trade forex today. All you need to start is a computer with fast internet and a small account with a broker.

Before you enter into a position, you need to know when you are going to exit the market. WHEN is the most important resolution.

A trader is not going to hold onto a position endlessly.

How long you want to hold onto your open position will define your exit points and prices. If you pick to hold a position for a week, your profit goal would naturally be higher than if you were to hold it for a few hours. That is because you would expect the price to move further, given a longer period of time.

You have to make your personal decision w depending on your risk tolerance level, lifestyle, and the amount of time to be dedicated to analyzing the market.

Here are Traders Paradise’s choices that we want to show you better.

The best Forex strategies that work:

- scalping

- day trading

- swing trading

- position trading

So, we have to explain each of them.

Scalping

This is the shortest time frame in trading. It employs small changes in currency values. It is the ultra-rapid action of opening and closing of a position within a few seconds or minutes. The aim is ‘stealing’ a few pips from each trade. The profit of the winning trade is not big. Hence, the number of such winning trades should be big enough so that these small profits can add up to a decent amount.

Scalpers must have access to the tightest spreads and fastest connection speeds possible. Of course, in order to carry out this very fast trading, with the tiny profits. They perform this many times a day. Scalpers have to perform many sequences, to collect small profits. Losses must be limited but in a way that one large loss does not delete out the profits from winning trades.

Many forex market makers will not allow this type of trading. Simply, they think it is difficult to cover the opposite side of the transactions. The reason behind this is fast speed and numerous orders entered into their systems.

Day trading is one of the best Forex strategies

This is one of the popular types of trading. The traders open and close positions within a day. They also almost never hold their positions overnight due to the higher risk. What to do if prices change dramatically while they sleep?

Their trades last from minutes to hours. Day trading relies constantly on intraday momentum to bring the current price to the aspired price level in one direction.

Day traders are looking out for signs that a currency pair has a high probability of moving in a particular direction. For day traders, a currency pair must go from point A to point B, within a day. Doesn’t matter whether the price is moving in a trend or range. Such traders know to wait for good trading opportunities, instead of trading madly like scalpers tend to do. This style of trading requires full concentration. It is the priority, the positions must be closely monitored on the price charts.

Swing trading

Swing traders hold their positions for a few days, but rarely more than a week.

Identifying and driving on trends early is the central objective of this trading style. The profit goal tends to be set higher than that of day trading. Hence, the swing trader is expecting that by holding out for a few days, there is a better chance of capturing a larger price movement.

Unlike the day trader, the swing trader has to deal with overnight risk. Swing trading requires less monitoring of the market. This type of trading is generally favored by people who hold their day jobs.

Honestly, if swing trader wants to be successful, such must still keep up-to-date with the latest fundamental and technical changes in the market. Even if they are not monitoring the market all the time.

Position trading as one of the best Forex strategies

For many traders, this is one of the best Forex strategies. Position trading involves the longest period. It refers to traders holding their position for weeks or even months. Position traders attempt to recognize and trade currency pairs that signal that a medium to long term trend is playing out, but will take more than a few days to play out.

Position traders usually close their positions while the trend is most powerful before it loses power.

This trading time frame doesn’t demand a lot of time. That is the difference from others. There is not much need for absolute monitoring.

If you practice position trading, it is smart to place a trailing stop. This will automatically close your position if the price retraces past a particular point

When you try to find what are the best Forex strategies, you must have several things on your mind

As a general rule of thumb: the smaller the time frame you trade then the more time is needed to be devoted to monitoring the markets. For example, day traders tend to be more in touch with the price swings and the goings-on of the market. You know, the positions are opened and closed on the same day.

On the other hand, a position trader does not have to monitor the market so intensively. This is simply because the market has more time to move against them. It can move a lot further against them than it is possible in a smaller time frame.

However, you have to decide on the length of your holding period. That must suit your personal preference by adjusting the profit target and stop-loss accordingly. Of course, the size of the profit goal and stop-loss will be equivalent to the length of your holding period.

What does it mean?

If your trading time frame is small, your target profit and stop-loss should be smaller. And vice versa. If you have a longer time frame, your profit target and stop-loss should be wider.

Don’t waste your money! Never traded in your life? Stay tuned!

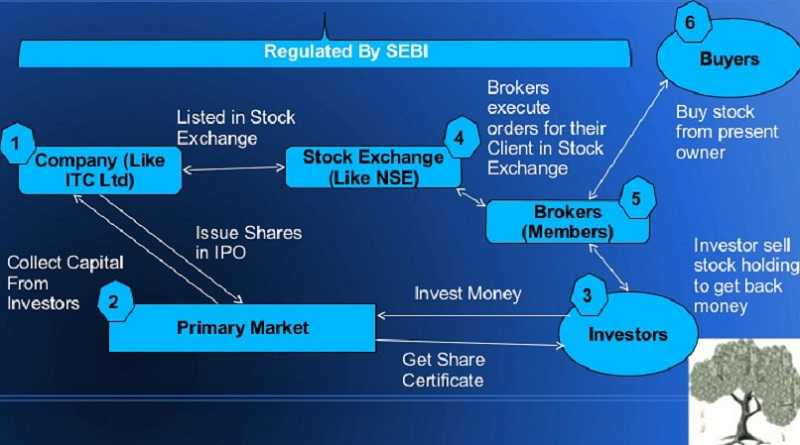

What are the main types of stocks, what are the main types of stock trading? Here is all about them you ever wanted to know.

What are the main types of stocks, what are the main types of stock trading? Here is all about them you ever wanted to know.

by Gorica Gligorijevic

by Gorica Gligorijevic

What is a stock market correction and how to deal with it?

What is a stock market correction and how to deal with it?