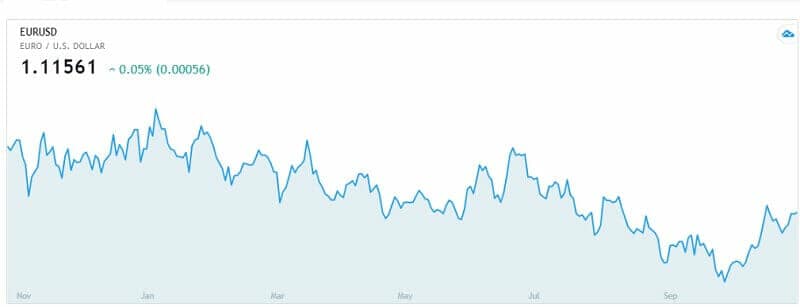

Behind Forex trading lies simple mathematical operations easy to learn.

Okay, math has never been your excellent skill but this math guide for Forex trading will make you clear. The truth is that you are afraid of math and this will help you.

Anyway, let’s see how simple it can be. There are some mathematical formulas that every trader has to know if he wants to be successful in the Forex market.

These math concepts are very simple and easy to learn even if you think that math is difficult.

Change in currency pairs value is estimated in pips. The minimum pip you can see is the fourth digit after the decimal place. The exception to this rule is Yen pairs. The minimum pip there you can see in the second digit after the decimal place.

Let’s use the hypothetical values in this math guide for Forex trading

For example, if the EUR/USD currency pair increases from 1.2530 to 1.32560. It is an increase of 30 pips for this currency pair. In Yen pairs, if the USD/JPY pair rises from 85.20 to 85.40, that is an increase of 20 pips for this pair.

The value of a pip is different for different currency pairs.

Let’s use the forex math formula to calculate the pip value of a currency pair:

Value of a pip is calculated

1 pip/exchange rate x trade size

We are going to use the EUR/USD currency pair with imaginary values.

One Pip = 0.0001

Base Currency: EUR

Exchange Rate: 1.3500

Trade Size: 1 lot meaning 100,000 units of currency

Pip Value = 0.0001 / 1.3500 x 100,000 = 7,407 EUR

How it works on the example on the USD/JPY currency pair

One Pip = 0.01

Base Currency: USD

Exchange Rate: 85.50

Trade Size: 100,000 units of currency which is 1 lot

Pip Value = 0.01 / 85.50 x 100,000 = 11.468 USD

Or let’s see this example GBP/CHF

One Pip = 0.0001

Base Currency: GBP

Exchange Rate: 1.3840

Trade Size: 100,000 ( 1 lot)

Pip Value = 0.0001 / 1.3840 x 100,000 = 7.22 GBP

Let’s talk about probability and numbers to see what lies behind the successful forex trading. Let’s find if a math talent necessary for good trading. We are focused on short-term forex strategies.

So, this math guide for Forex trading led us to the margin and leverage.

In Forex trading, leverage provides you to control a larger position. You will use a smaller part of your own funds and the rest you will borrow from your broker.

Margin is the deposit demanded by your broker. He or she will ask you for a margin/deposit to allow you to open a position.

Leverage is calculated by math formula:

Trade Size/Account Size = Leverage

In this math guide for Forex, here is a realistic example to illustrate this.

For example, you want to enter the position with a value of $200,000. But you have $ 4,000 on your trading account. Your goal is to control $200,000 with the $4,000 you actually have.

$200,000/$2,000 = 50

Your leverage in our example is expressed as 50:1.

What will happen if you instead of $4,000 have $10,000?

You will control $200,000 with the $10,000.

$200,000/$10,000 = 20

Your average will be 20:1.

Brokers can offer from 50:1 leverage for forex trading up to 500:1. But think twice before you accept any offer. It is true that leverage may increase returns but also increase losses.

Position Sizing

This is one of the most serious and frequent estimations that you have to make if you want to be a forex trader. Actually, before you decide to enter any trade, you have to calculate the position size.

We suggest you use one of the simplest calculations. It is a fixed fractional calculation strategy. The best is to risk 1-2% per trade, 1% is better and here is why. Take it as the rule for the fixed fractional risk.

So, you have to decide how much you can afford to risk a per-trade. When you make this decision you have to decide where to place the stop-loss.

Take a look where the most current swings are. Find support and resistance points. When you settle a level where you want to place stop-loss, you have to measure the distance in pips between this level and the entry you plan. Write down that number.

Then, discover the value of each pip. And you can calculate your position size.

Math is in this formula.

current account size x risk per trade/distance between entry and stop x value of the pip

Let’s say your current account size is $20,000 and the fixed fractional risk per trade is 2%. The distance between entry and stop is 100 pips

And the value of each pip is $20

$ 20,000 x 0,2 / 100 x 20 = 0.80 lots

This is just an example and you will find different situations but the principle is the same.