Why do you think you must have a lot of money to start investing in stocks? It is completely opposite.

By Guy Avtalyon

Many think that can’t invest in the stock market with little money. Honestly, you don’t need thousands of dollars to start investing. Yes, we know a lot of people who believed it’s impossible to invest in stocks with little money.

Think you don’t have enough money to invest?

Frankly, you can start with as little as $4. So, the money isn’t the reason why shouldn’t you start earning now. Truth is the opposite, not investing in stocks may be risky. Even a few dollars can go far. It’s understandable why many think that can’t invest in the stock market with little money. That’s because investing can be confusing. Also, there is a belief that only wealthy people can make money in the stock market.

You don’t have to be a master to invest in the stock market. Also, you don’t need to have thousands of dollars to start.

There are many tools that can help the new investors do pretty well, especially with limited resources.

There are a lot of schemes to invest in stocks with little money.

Many online and app-based platforms making it easier than ever. All you have to do is start somewhere.

Once you do, it will get easier as time goes on. In the future, you will love what you did in the past.

Here are some ways to start:

- Use a robo advisor to automatically invest.

- Buy individual stocks through a discount brokerage firm.

- Purchase securities.

- Find low minimum mutual funds.

Use robo advisor to invest in stocks with little money

Thanks to the rise in the popularity of robo advisors, investing is now more available than ever. You don’t have to go it individual, be rich, have a lot of investment experience. You don’t need to hire an expensive financial advisor.

Why?

Because robo advisors can do all of this for you and at a low annual fee. Robo advisors, also known as automated online advisors, are technology-based investment platforms that offer fully automated online investing. These fintech firms are developing fast and mostly target new and younger investors, such as Millennials, for example.

But which ones are the best choice for your investment?

Robo advisors have a big advantage. They have lower minimums than financial advisors have. By having minimums as low as $0, robo advisors dispense previously unaffordable retirement planning and portfolio balancing advice to a broader selection of people. Robo advisors generally cost 0.25%-0.5% of the portfolio. They are algorithms that ordinarily look for the lowest cost solution to fit a client’s needs.

It will always be available as long as you have access to the internet.

Robo advisors also will offer you an advanced feature, tax-loss harvesting, to balance gains in a portfolio. The divested security is then replaced by similar security, helping you to maintain the optimal asset allocation by keeping a portfolio’s diversification. Due to their value proposition, robo advisors are growing very fast.

Trading apps allow investments as low as $5 for a list of funds.

Buy individual stocks through a discount brokerage firm

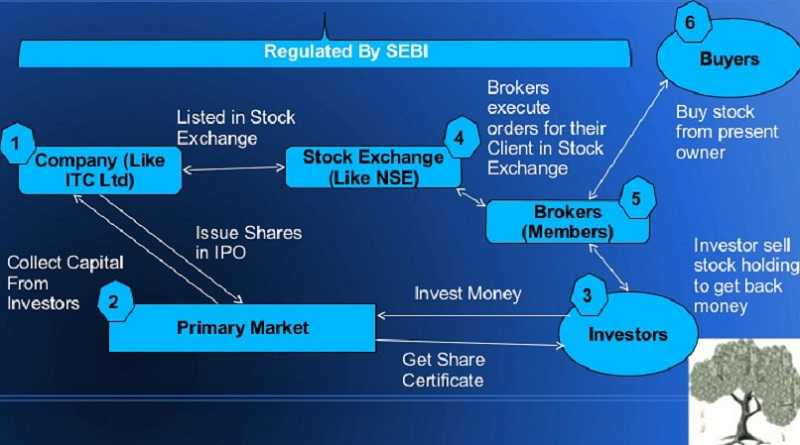

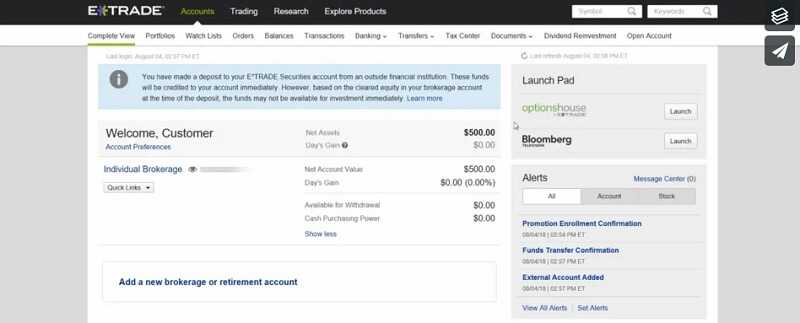

Opening a brokerage account is so easy. Just fill the account application, present proof of identification, and decide how you want to fund the account. You may fund your account by mailing a check or transferring funds electronically.

At most brokers suitable for new investors, stock trading commissions run between $5 and $10. Low commission costs are important to active traders, those who place 10 or more trades per month.

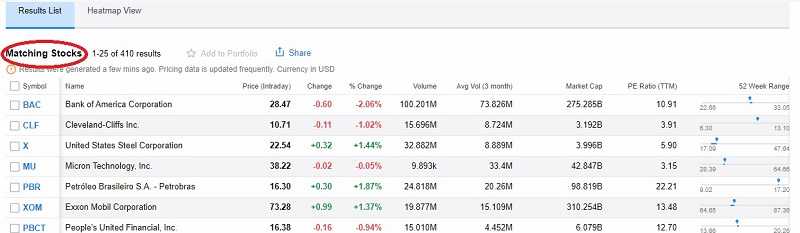

Having a lot of individual stocks inside a single investment gives you prompt diversification. Also, it minimizes risk over time. The stocks owned within a fund may go down, that’s the truth. But they can be compensated by others that rise. You should look for terms like large-cap, mid-cap, and small-cap in the names of stock funds.

What is the cap?

Cap is short for market capitalization. That is the value of a company’s stock shares. Hence, a large-cap mutual fund means that it only owns shares of big companies.

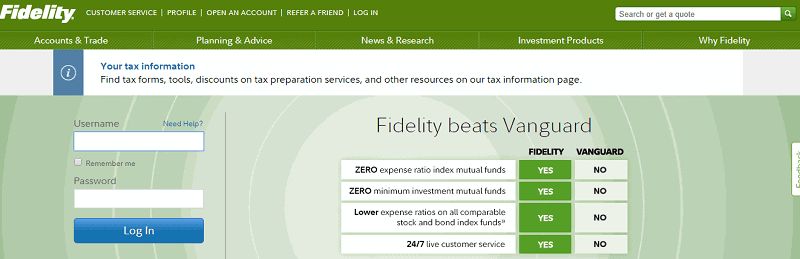

Low minimum mutual funds

Mutual funds are investment securities that allow you to invest in a portfolio of stocks with a single transaction. That is excellent for new investors.

The problem is many mutual fund companies require initial minimum investments of between $500 and $5,000. If you’re a new investor with little money to invest, those minimums can be a problem. But some mutual fund companies will ignore the account minimums if you agree to automatic monthly investments of between $50 and $100.

Purchase securities

Assume you want to invest with the lowest imaginable risk. Well, treasury securities are good for you. They have a fantastic advantage. The securities do not change as the market does. Treasury securities are predictable.

Each security has its own maturity date. They vary from 30 days to 30 years.

Make sure to only invest money you can divide with until the maturity date. If you cash the bill in earlier, you risk losing a portion of the principal.

Start to invest in stocks with little money

If you don’t have a lot of extra money at the end of the month, it’s easy to put off long-term needs like investing.

Your delusions about investing may be holding you far away from saving for your future. The myth is that you must have a fat wallet to use a brokerage account.

Contrary, there are so many online brokerage firms allowing investments lower than $1,000.

Some brokerages ignore their minimum investment demand in exchange for regular monthly deposits, as we said. All you have to do is to sign a contract to agree to a specific monthly deposit. You can easily find firms that offer minimum deposit requirements of $100 per month. And with really low initial investments.

You could invest $100 in a diversified fund. Why wouldn’t you take that chance? Diversification in your portfolio is the best way to reduce your risk. Moreover, it’s not for rich investors only. Many companies offer ETFs. So, it is possible to invest in a mixture of investments with little money. Think about the S&P 500 index.

Buying ETF shares gives you a piece of the portfolio of the complete index. Some stocks in the index may play well, but others may do unsuccessfully. They balance each other out. That lowers your risk.

You are not limited to penny stocks until you earn big money.

Of course, being a new investor, you don’t want to invest in extremely volatile penny stocks.

Yes, penny stocks are stocks trading for less than $5. But they’re priced low for a reason. The companies behind them are just starting out. Investing with little money is better with blue-chip companies. The highs and lows are normally less volatile than penny stocks. Our opinion, here in Traders Paradise, is that everyone should invest. But we will never tell when the right time is for you. Only you know when the time is right.

Don’t invest if you have a card debt. Never start without an emergency fund.

But the earlier you begin the faster you can grow your capital.

What are the main types of stocks, what are the main types of stock trading? Here is all about them you ever wanted to know.

What are the main types of stocks, what are the main types of stock trading? Here is all about them you ever wanted to know.

If you understand the terms overvalued and undervalued you will find plenty of stocks that look cheap

If you understand the terms overvalued and undervalued you will find plenty of stocks that look cheap