The doubts due to Facebook “Project Libra” are understandable because it looks Libra won’t be decentralized as a regular cryptocurrency.

Facebook’s Libra could be the new digital currency. Facebook finally announced its cryptocurrency plans. “Project Libra,” a new variety of digital money created for Facebook’s apps and social network users. That means we would be able to make purchasing and send the currency Libra on Instagram, WhatsApp, and Messenger. Also, MasterCard, Uber, and Spotify should give such a possibility.

Some other merchants are involved too.

But, Libra isn’t as decentralized as a regular cryptocurrency. Hence we can talk about trust in new crypto. We all know that crypto is all about trust.

Satoshi Nakamoto wrote about the Bitcoin system. “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

The basic sense of using crypto is that we don’t trust financial authority.

Libra is a totally Facebook project. Facebook experts created the blockchain and selected the associates that will handle it. Libra wallets will be installed in Facebook apps.

What does it mean?

The trust in Facebook’s Libra

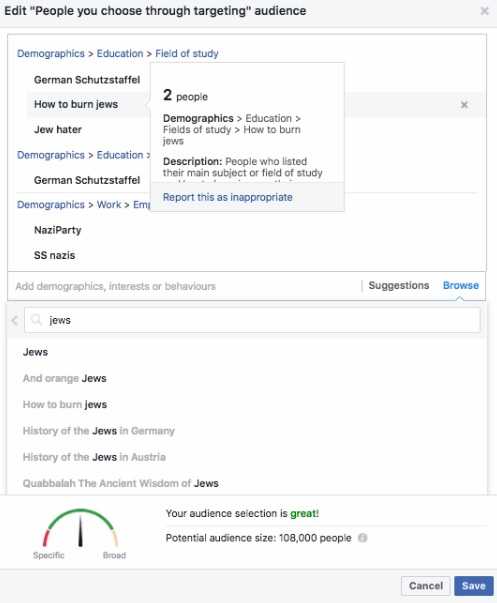

After all, we experienced it? Don’t we? Facebook has a lot of problems with trust. But let’s stay with Libra.

Libra is announced as crypto, which should mean full decentralization. That is the power of cryptocurrencies. But Libra will be under Facebook’s control, under the control of one of the most powerful companies in the world. Can we still talk about the essence of crypto nature if Libra scores success in the future? From our point of view, it may be the end of one of the most important characteristics of cryptocurrencies – decentralization.

Further, this new crypto operates via licensed blockchain which will cause that the right to mine Libra will have only companies included in Libra Association. So, what we have there? Libra Association as a central bank? The developers tried to explain that as an intention to avoid Libra to use so much power needed for bitcoin mining. The nice intention, but at the same time, it will provide the Libra Association in controlling the currency’s stability supported by a reserve of bonds and liquid money.

The implementation of blockchain technology has sense. It will provide clear transactions fast.

But, here is the point where the matter of trust in Facebook’s Libra arises.

If you don’t trust your local central banks, why should you trust Mastercard?

Libra will change its nature. It will not be permissioned forever, says the separated document, where the further plans are revealed. Libra Association will be open to more members. After five years, Libra would switch to the permissionless mode. That would happen after some problems with scalability have been solved. Can you point any example that blockchain has ever gone from permissioned to permissionless? This explanation looks more like buying time to solve the problem in the hope that the future will bring new solutions in technical improvements. That promise seems like a trick. Why?

When you start using the centrally managed blockchain you must face that users will not trust you.

This promise is actually selling the fog

Why? Unlike Bitcoin and other public blockchains, only foundation members will be permitted to run a node.

Facebook’s ambitious plan to bring cryptocurrency to the masses is recognized, and we don’t have a problem with that. But we have plenty of reasons to be skeptical. Why they are launching this crypto knowing that the problem of trust will arise? On what they are counting? Yes, they promise that the problem with centralized crypto will be solved later. So, if they are aware of it and know how to solve, why this rush? Guys, fix it, you already have a trustworthy model, just implement it.

Facebook did not present specifics regarding when and how users will get ahold of the currency. All we have is the executive’s confirmation it will first be shared on Messenger and WhatsApp in 2020.

The company also said something about a new digital wallet called Calibra. The digital wallet will be managed by Facebook as a separate subsidiary. It will have the possibility for users to store and spend Libra.

Calibra won’t be accessible to the people for months

Moreover, this digital wallet will not show you the value in Libra currency, the value will be displayed in your local fiat. The design will be similar to Venmo.

According to David Marcus, who is on the head of Project Libra for Facebook, one of the main goals is to approach to 1.7 billion people globally who don’t have access to the banking system.

“It’s an anomaly that the Internet has no protocol for money,” Marcus said.

“You’ll see banks on this between now and next year, because if we bring on another billion people, they’ll need savings accounts, loans, and things banks are very good at,” Marcus says. Facebook also plans to reduce money transfer fees and transaction fees through Calibra.

As a conclusion, it is very questionable if the Libra is cryptocurrency at all. It will have a very strong connection with the fiat. Moreover, it is backed by a reserve of low-risk assets to avoid volatility, as Facebook’s representatives explained. These “low-risk assets” are actually fiat: dollar, euro, Swiss coin.

The point is that we can transfer our dollars or whatever to Libra, but the amount will ever be shown in given fiat, never in Libra. So we couldn’t talk about true crypto. It is digital money only because it is not tangible.

And there is a wallet named Calibra where the Libra is supposed to be stored.

Behind this, according to some experts, this system could provide Facebook access to extremely large financial information. Having Facebook’s reputation on our mind, can we trust that such information will not be misused? With very strong reason we have some doubts.

On the other hand, we are dealing with the most powerful company in the world.

Is it worth to take part?

Libra can be useful for purchasing via FB apps and associates. We all can expect some discounts or something similar for users in order to promote the new digital money. And the other powerful participants are in play, as we mentioned above. So, for short term or periodical used, Libra is useful. As a long-term investment, we are not sure. But we are very sure that Facebook’s Libra is a manifestation of banks’ blemishes.

Images Credit: Libra Association official website

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.