Trading stocks isn’t rocket science but it is helpful when you know some secrets about it

By Guy Avtalyon

I’ll reveal all secrets about trading stocks. Yes, that’s exactly what I’m going to do. First of all, you must understand, trading is a younger cousin of investment. As a newcomer, you can be overwhelmed by the quantity of the data available in the stock market.

When you simply sign up at one of these online brokerage companies and dump your life savings into the market, you are ready to start.

The most important decisions you’re going to have to make in your road to becoming a successful trader of the financial markets is, what your trading style is going to be. Different trading strategies have their own collection of benefits and drawbacks. If you’re new to the trading scene and might not understand the differences of each trading style, you may be confused.

Damn, what I have to do?

You have a choice to simply buy and hold positions in any market for long periods of time, for years or even decades. Or you can complete your trades within one 24-hour period which is easy but the most challenging and fraught with the highest levels of risk, though it can bring big rewards.

If you choose long-term trading and buy-and-hold trading, offer is a lessened risk in exchange for fewer opportunities for reward.

”And now, what is the next I have to do?”

Well, you have to pick your trading days. Research has shown that the third week of the month is the best time to buy stocks.

According to researching, the best of the best is the period between 18. and 22. of the month.

Why is that? The prices tend to hit their lowest monthly points at that time because cash flows from dividend reinvestment and pension funds are likely to be at their lowest as well in that period.

That means the best time to sell stocks is closer to the beginning and end of the month when cash flowing into the system is at its highest.

Speaking about of period of the whole year, April and May are the most successful time to sell your stocks, while buying new stocks in September and October is going to get you the best price (in that time the market tends to bottom out).

Do you want to become a day trader?

If you want to be a day trader, there’s a right time for you as well.

The best time of day to trade stocks, if you are from Europe, is between 9:30 to 10:30 AM. This time frame is offering the biggest moves in the shortest amount of time (a great and efficient combination). You can extend it out to 11:30 AM EST if you want another hour of trading. The best time for a US-based day trader will typically be in the late afternoon Eastern Time. Corporate earnings reports and statistical reports from the federal government usually released in the morning, waiting until around 1:30 pm to 2:00 pm.

Secrets about trading that make you successful

I was waiting for you here!

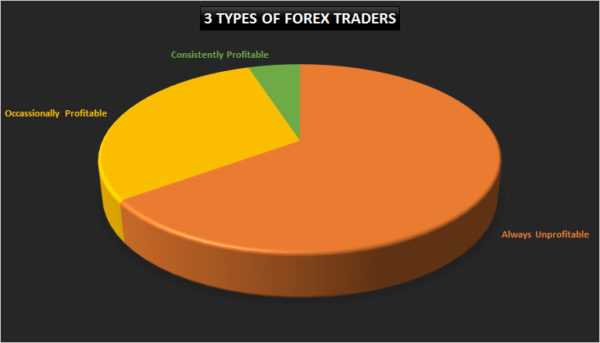

There are no instant solutions. Unless you are idiot, you have to understand that you can’t find a secret formula or secrets about trading. If there is any secret or key, it is this: keep it simple, be systematic, and get educated.

If you had enough capital to open a trading account, this doesn’t mean that you’re going to be successful right out of the gate.

But, let’s assume are a beginner and if you’ve never spent a day in your life in trading before. So you may think you’ll be able to dive without educating yourself because trading stocks isn’t rocket science. Really? Well, you’re likely to end up learning the hard way. You will watch how all your investment capital disappears into the ether in exchange for a handful of stocks that end up not worth much. Even worse, not worth anything at all.

Keep in mind: trading is not gambling. But there are some tips and secrets about trading.

One secret you should know: everyone is selling the stock or vice versa. But it’s obvious that someone has to be buying the stock also.

The ultimate secrets about trading are this, learn to identify and trade with Smart Money!

Secrets about trading stocks

- Focusing on odds trading and risk/reward vs. hunches and feelings can lay the foundation for a very long and successful career.

- The stock market does not care about your feelings or wants. These major principles are the biggest contributors to the losses realized in the stock market.

- Know your risk tolerance, and trade the consistent strategies. If you stay focus on these 2 things you can be sure you will be trading longer than 1 year, even longer.

- Don’t be risk-averse, learn to evaluate risk, and learn to understand yourself.

- Trade up to the point you can bear the loss, don’t ever cross your limits it’s better to wait for your time.

Final words: Always have a plan, consolidate your portfolio, stay away from all the mumbo jumbo, only invest in the coins that will turn over a profit, find others that you trust to keep you properly informed, use the tools of the pros.

Good luck!

If you find that this article may interest someone else, feel free to share. If you have personal experience, share it with me.