I. Introduction

Richard Pierce’s “Recession Profit Secrets” Guide offers a strategic approach to generating income during economic downturns. This guide provides individuals with valuable information and techniques to navigate through the challenges of a recession. The aim of this article is to analyze the benefits and concerns associated with using Pierce’s guide. This article will explore the advantages of applying the methods outlined in the guide, as well as the potential drawbacks or ethical considerations that users should be aware of.

A. Explanation of Richard Pierce’s “Recession Profit Secrets” Guide

In his guide titled “Recession Profit Secrets”, Richard Pierce provides a comprehensive explanation of strategies individuals can adopt during an economic recession. Pierce outlines various techniques to not only survive but also thrive amidst adverse financial conditions. His guide offers valuable insights on identifying and capitalizing on emerging business opportunities, minimizing expenditure, and optimizing financial resources. Moreover, Pierce emphasizes the importance of adapting to the changing market dynamics and continuously upgrading one’s skillset to remain competitive. Overall, “Recession Profit Secrets” serves as a valuable resource for individuals seeking practical advice to navigate through economic downturns.

B. Step by Step – discussing the benefits and concerns of using the guide

As mentioned earlier, the purpose of this article is to delve into the benefits and concerns of utilizing Richard Pierce’s “Recession Profit Secrets” guide. By examining the advantages, such as gaining insight into recession-proof strategies, identifying potential profitable opportunities, and developing effective financial management skills, individuals can enhance their ability to navigate uncertain economic times. However, it is imperative to address the concerns surrounding the guide, including the potential for overreliance on the strategies provided and the ethical considerations associated with profiting from a recession.

One major benefit of using Richard Pierce’s “Recession Profit Secrets” guide is its practical approach to navigating the challenges presented by economic downturns. The guide provides step-by-step instructions and strategies for individuals and businesses to not only survive but thrive during recessions. Additionally, it offers insights into profitable industries and markets that tend to thrive during these times. However, some concerns arise from the potential for overly optimistic promises and the lack of a guarantee for success, as every situation is unique and influenced by various factors.

II. Benefits of Using Pierce’s “Recession Profit Secrets” Guide

Additionally, one of the significant benefits of utilizing Richard Pierce’s guide, “Recession Profit Secrets,” is the emphasis on practical strategies that can be easily implemented by individuals. Pierce’s guide provides step-by-step instructions and actionable advice that can be utilized by anyone, regardless of their financial expertise or educational background. This accessibility is particularly advantageous for college students who may be looking for innovative and effective ways to generate income during challenging economic times. By simplifying complex concepts and offering straightforward solutions, Pierce’s guide proves to be an invaluable resource for those seeking financial stability and success.

A. Financial strategies during a recession

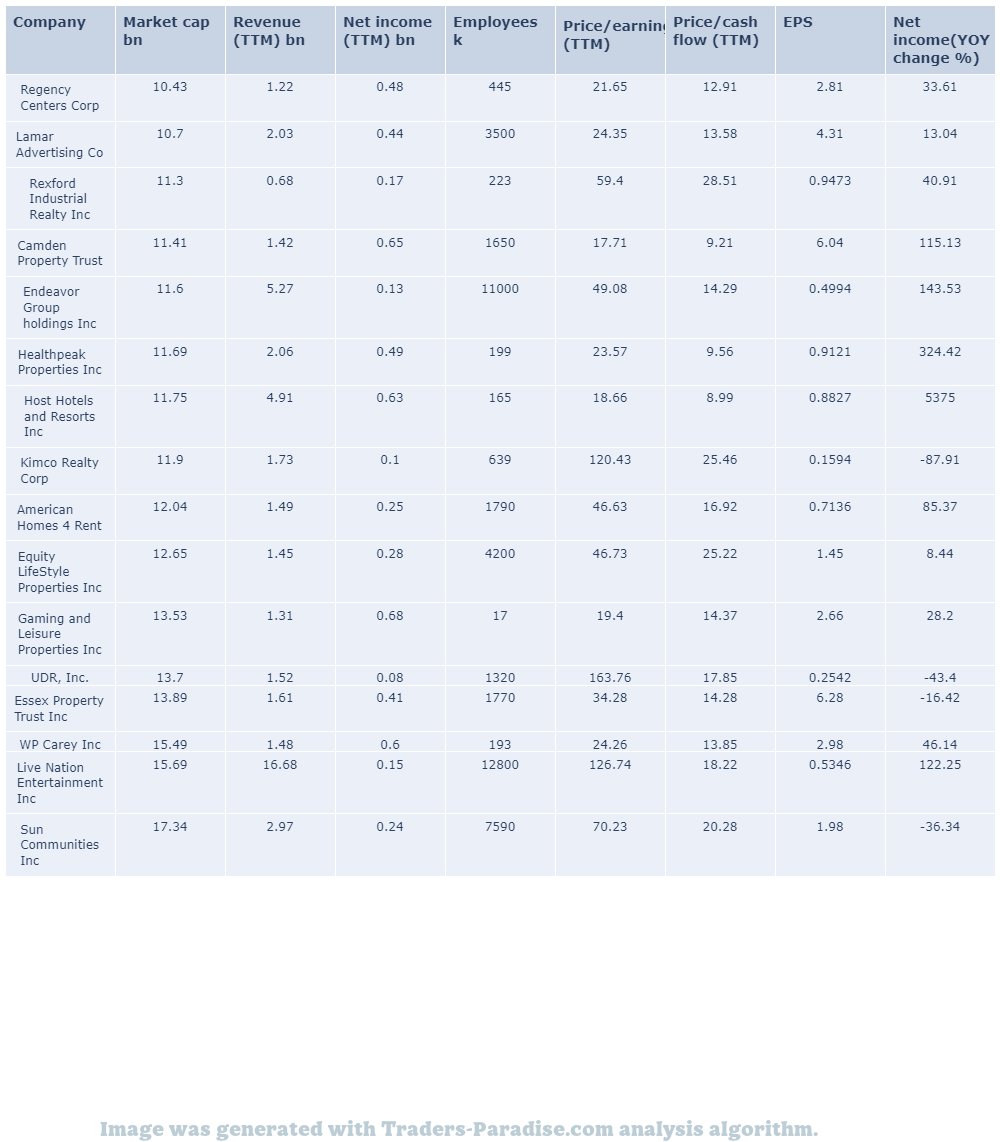

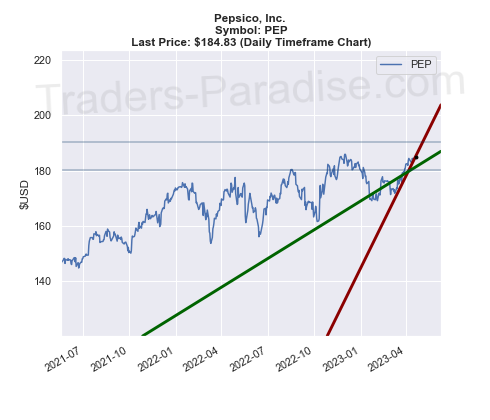

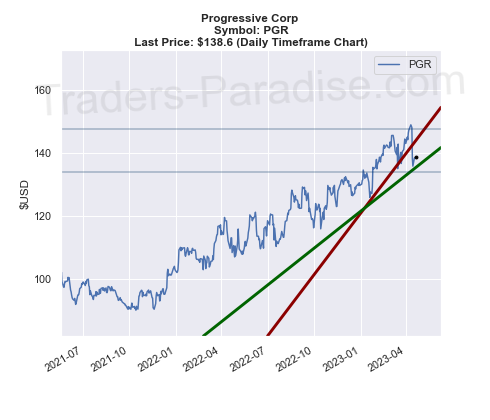

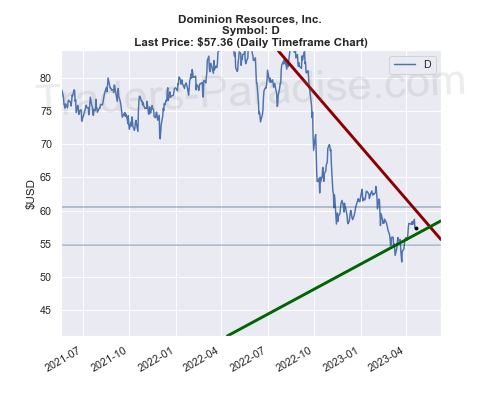

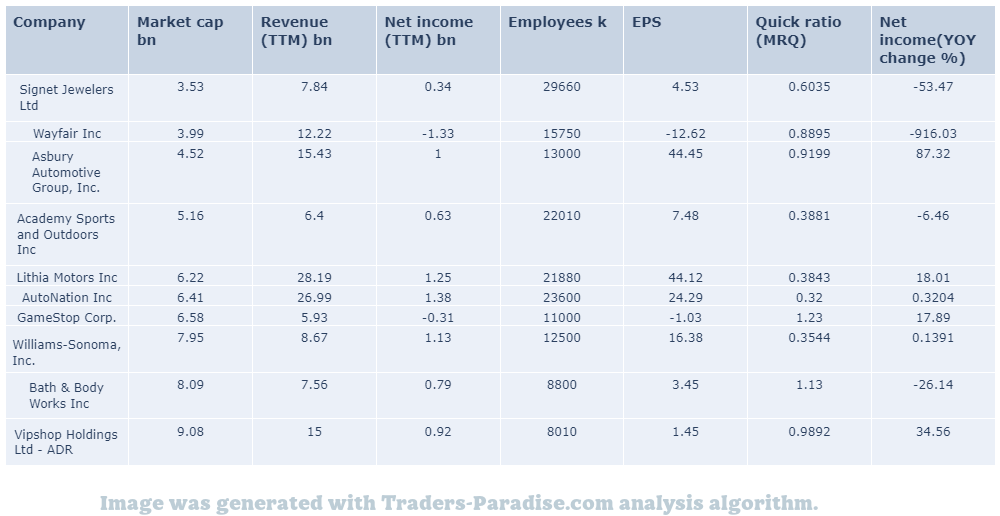

The “Recession Profit Secrets” guide by Richard Pierce provides valuable insights into financial strategies during a recession. Pierce emphasizes the importance of diversification and maintaining a balanced portfolio to navigate the uncertain economic times. He also suggests exploring alternative investment options, such as real estate or commodities, to mitigate the potential losses in traditional markets. Additionally, Pierce advises individuals to be cautious with debt and to strive for consistent savings to build a financial safety net. These strategies can empower individuals to make informed decisions and find opportunities for financial growth even during a recession.

1. Techniques to protect personal finances during economic downturns

One technique highlighted in Richard Pierce’s “Recession Profit Secrets” guide to protect personal finances during economic downturns is to prioritize and cut unnecessary expenses. This involves analyzing one’s spending habits and identifying areas where costs can be reduced. Additionally, Pierce suggests building an emergency fund to provide a financial cushion during tough times. Diversifying investments is another strategy he emphasizes, as it helps to spread the risk and minimize the potential impact of market downturns. By implementing these techniques, individuals can safeguard their personal finances in times of economic turbulence.

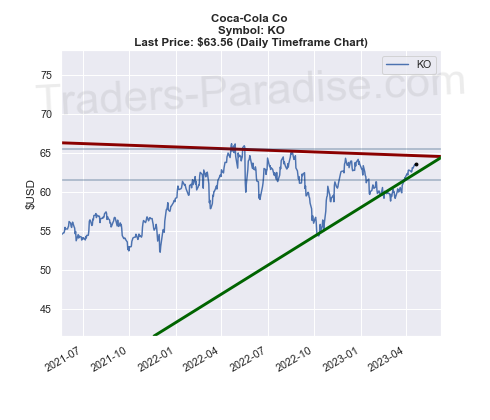

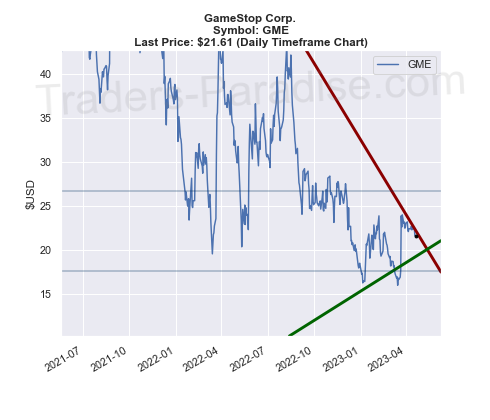

2. Identifying profitable investment opportunities during a recession

In conclusion, Richard Pierce’s “Recession Profit Secrets” guide has proven to be a valuable resource for identifying profitable investment opportunities during a recession. By providing a comprehensive understanding of the economic climate and offering practical strategies, this guide enables investors to make well-informed decisions to maximize their profits. However, it is important to acknowledge the concerns surrounding the accuracy of the information provided and its applicability in different recession scenarios. While the guide offers potential benefits, investors should exercise caution and conduct their own research before implementing any investment strategies.

B. Entrepreneurial guidance

The entrepreneurial guidance provided by Richard Pierce’s “Recession Profit Secrets” guide offers valuable insights and strategies for individuals seeking to navigate the challenges of starting a business during an economic downturn. Pierce emphasizes the importance of adaptability and innovation, encouraging entrepreneurs to reevaluate traditional business models and explore new opportunities in the market. By providing practical tips and resources, such as identifying niche markets and leveraging digital platforms, Pierce’s guide equips aspiring entrepreneurs with the tools necessary to thrive in uncertain times.

1. Tips and tricks for starting and growing a business during hard times

In conclusion, Richard Pierce’s “Recession Profit Secrets” guide offers valuable tips and tricks for starting and growing a business during hard times. The guide emphasizes the importance of adaptability and creativity in identifying and capitalizing on new opportunities. It also provides practical strategies for managing finances and ensuring sustainability. While some concerns may arise regarding the feasibility of certain techniques or the reliance on one individual’s expertise, the guide still serves as a valuable resource for entrepreneurs navigating challenging economic conditions.

2. Development of a recession-proof business model

In addition to outlining the various strategies and techniques to navigate a recession successfully, Richard Pierce’s “Recession Profit Secrets” guide also emphasizes the importance of developing a recession-proof business model. This entails establishing a resilient and adaptable framework that can withstand economic downturns and sustain profitability. By diversifying revenue streams, investing in innovation and digital transformation, and carefully managing costs, businesses can enhance their resilience and seize opportunities even during challenging economic times. Furthermore, the guide provides valuable insights into market analysis, risk assessment, and customer behavior, assisting entrepreneurs in creating a business model that can thrive regardless of economic fluctuations.

C. Personal development and mindset shift

In addition to the practical strategies aimed at generating income during economic downturns, Richard Pierce’s “Recession Profit Secrets” guide emphasizes the significance of personal development and mindset shift. Pierce recognizes that navigating through challenging times requires not only financial expertise but also a resilient and adaptable mindset. By encouraging individuals to cultivate a growth-oriented mentality, the guide empowers them to persevere in the face of adversity and develop the necessary skills and traits for long-term success in any economic climate. This focus on personal development complements the guide’s practical recommendations, offering a holistic approach to thriving during recessions.

1. Encouraging a positive and proactive attitude toward financial challenges

Another benefit of using Richard Pierce’s “Recession Profit Secrets” guide is that it encourages a positive and proactive attitude toward financial challenges. Pierce emphasizes the importance of taking control of one’s financial situation and implementing strategies to overcome obstacles. By fostering a mindset of optimism and action, individuals are more likely to find creative solutions to financial difficulties. This proactive approach can lead to increased confidence and a greater sense of empowerment when addressing financial challenges. Additionally, adopting a positive attitude can improve overall mental well-being and resilience in the face of economic uncertainty.

2. Motivational advice to adapt and thrive in a recession

In conclusion, Richard Pierce’s “Recession Profit Secrets” guide offers valuable motivational advice for individuals seeking to adapt and thrive in a recession. Pierce emphasizes the importance of staying positive and maintaining a proactive mindset, as well as the need to identify new opportunities in the market. By encouraging individuals to embrace change and constantly learn, this guide provides crucial strategies for navigating the challenges of a recession and ultimately achieving success. However, it is important to approach the guide with a critical mindset and consider individual circumstances before implementing any suggestions.

In conclusion, Richard Pierce’s “Recession Profit Secrets” guide offers numerous benefits but also raises certain concerns. The guide effectively provides practical strategies for individuals to navigate and profit during a recessionary economy. It offers valuable insights on how to minimize financial risks and maximize opportunities, empowering readers to secure their financial future. However, some concerns revolve around the potential for unethical practices and the lack of extensive empirical evidence supporting the efficacy of these strategies. Despite these concerns, the guide remains a valuable resource for individuals seeking innovative approaches to financial success during economic downturns.

III. Concerns Regarding Pierce’s “Recession Profit Secrets” Guide

Despite the numerous benefits discussed in the previous sections, there are several concerns that arise when considering Richard Pierce’s “Recession Profit Secrets” guide. Firstly, the lack of empirical evidence supporting the effectiveness of his strategies raises doubts about the validity of his claims. Additionally, the potential risk associated with financial investments or entrepreneurial endeavors may not be adequately addressed, leaving users vulnerable to unfortunate losses. Finally, the guide’s emphasis on individual success and profit maximization without considering broader societal implications may neglect ethical considerations. These concerns should be carefully considered before utilizing Pierce’s guide.

A. Lack of credibility and expertise

One major concern regarding Richard Pierce’s “Recession Profit Secrets” Guide is the lack of credibility and expertise displayed in his work. While Pierce claims to have been successful during previous economic downturns, there is a dearth of evidence and testimonials to support his assertions. Additionally, his guide fails to provide any substantial research or primary sources to back up his claims. This raises questions about the reliability of the information provided in the guide, making it difficult to trust its authenticity.

1. Assessing the author’s background and qualifications in financial matters

In order to effectively analyze the merits and potential limitations of Richard Pierce’s “Recession Profit Secrets” Guide, it is crucial to assess the author’s background and qualifications in financial matters. With a bachelor’s degree in finance and an impressive career spanning over two decades as a financial advisor, Pierce has acquired a comprehensive understanding of the intricacies of the economic landscape. Moreover, his previous publications and interviews in prominent financial magazines further demonstrate his expertise and credibility in the field. By evaluating his credentials, readers can better gauge the reliability and trustworthiness of the information presented in his guide.

2. Critiquing potential biases or conflicts of interest

Another concern when using Richard Pierce’s “Recession Profit Secrets” guide is the need to critique potential biases or conflicts of interest. As with any investment or financial advice, it is crucial to evaluate the source’s credibility and ascertain if they have any hidden motives influencing their recommendations. In this case, it is important to examine whether Richard Pierce stands to gain personally or financially from the purchase or implementation of his guide, as this could potentially compromise the objectivity and reliability of the information presented. Therefore, individuals should exercise caution and conduct thorough research before making any decisions based solely on this guide.

B. General applicability of the advice

A significant benefit of Richard Pierce’s “Recession Profit Secrets” guide is its general applicability. The advice provided can be applied to a wide range of industries and businesses, making it relevant and useful to a diverse audience. The strategies and tips offered in the guide can be implemented by small, medium, or large-scale enterprises, allowing them to navigate and thrive during economic downturns. This general applicability increases the accessibility and value of the guide for entrepreneurs and business professionals seeking to maximize their profits during recessionary periods.

1. Considering the guide’s relevance to different economic contexts

The guide’s relevance to different economic contexts is an essential aspect to consider. Richard Pierce’s “Recession Profit Secrets” guide provides strategies and advice that can be applied in various economic circumstances. The guide offers insights into how to navigate and thrive during recessions, making it particularly valuable during times of financial uncertainty. Whether it be a global economic downturn or a localized recession, the guide’s principles can be adapted and utilized to maximize profitability and minimize potential risks, proving its significance in different economic contexts.

2. Evaluating the adaptability of the strategies to varying personal financial situations

Another concern worth evaluating is the adaptability of the strategies proposed in Richard Pierce’s “Recession Profit Secrets” guide to individuals with different personal financial situations. While the guide claims to provide actionable methods for financial success during a recession, it may overlook the fact that people have diverse financial circumstances, such as varying levels of income, debt, and expenses. Therefore, it is crucial to assess whether these strategies can be feasibly implemented by individuals with contrasting financial situations, ensuring their effectiveness remains unbiased.

C. Ethical considerations

Ethical considerations must be taken into account when discussing the utilization of Richard Pierce’s “Recession Profit Secrets” guide. One concern is the potential for exploiting vulnerable individuals who may be desperate for financial stability during times of economic uncertainty. Additionally, there is a moral question surrounding the idea of profiting from the misfortune of others. It is crucial to ensure that ethical guidelines are followed and that individuals are not taken advantage of for personal gain.

1. Analyzing potential ethical dilemmas related to exploiting a recession for personal gain

In analyzing potential ethical dilemmas related to exploiting a recession for personal gain, it is important to consider the moral implications of such actions. While Richard Pierce’s “Recession Profit Secrets” guide may offer strategies for financial success during economic downturns, one must critically evaluate the ethical consequences of taking advantage of others’ misfortune. Exploiting a recession for personal gain may result in exacerbated inequalities and socioeconomic disparities, ultimately undermining the principles of fairness and justice that underlie ethical decision-making. Therefore, thoughtful reflection and consideration of the moral implications is crucial when employing strategies outlined in Pierce’s guide.

2. Assessing the social implications of the strategies promoted in the guide

Assessing the social implications of the strategies promoted in the guide is essential to understanding the full extent of its impact. While the guide aims to provide individuals with the knowledge and skills to navigate and profit from a recession, it is important to consider the potential consequences for society as a whole. By encouraging a focus on personal gain and financial success during difficult economic times, the guide may inadvertently contribute to a societal mindset that prioritizes individualism over collective well-being. Additionally, the strategies recommended in the guide may further exacerbate existing inequalities and divisions in society, as those with the means to invest and capitalize on the recession may benefit more than those who are already disadvantaged.

Furthermore, another benefit of using Richard Pierce’s “Recession Profit Secrets” guide is its emphasis on investing in gold and silver. In times of recession, these precious metals have proven to be a safe haven for wealth preservation. Pierce provides valuable insights and strategies on how individuals can navigate the ever-changing market and take advantage of the potential profit opportunities that arise during economic downturns. However, it is important to acknowledge that investing in these commodities also comes with risks, such as price volatility and potential scams. Therefore, caution and thorough research are paramount when following Pierce’s guide.

IV. Conclusion to Pierce’s “Recession Profit Secrets” Guide

In conclusion, it is evident that Richard Pierce’s “Recession Profit Secrets” guide offers several benefits for individuals seeking to navigate the challenges of a recession. His comprehensive approach incorporates various strategies to optimize financial resources and diversify income streams. Additionally, the guide provides valuable insights into identifying emerging market opportunities and staying ahead of economic trends. However, despite these advantages, it is crucial to remain cautious and thoroughly evaluate the risks associated with implementing the techniques discussed in the guide. Overall, Pierce’s guide can be a valuable resource for those willing to approach the recession with a proactive mindset.

A. Recap of the benefits of using Pierce’s “Recession Profit Secrets” Guide

In conclusion, the benefits of using Richard Pierce’s Guide, “Recession Profit Secrets,” are numerous. Firstly, the guide provides practical and actionable strategies for generating income during economic downturns. Secondly, it offers a comprehensive understanding of market trends and investment opportunities. Thirdly, it equips individuals with the necessary knowledge and skills to navigate the complexities of the business world successfully. Lastly, it empowers readers to adapt and thrive during challenging times, ultimately helping them secure their financial stability and future. Overall, Richard Pierce’s Guide provides valuable insights and guidance for individuals seeking to profit during a recession.

B. Acknowledgment of concerns regarding credibility, applicability, and ethics

Furthermore, it is crucial to acknowledge and address concerns regarding the credibility, applicability, and ethics of Richard Pierce’s “Recession Profit Secrets” guide. While the author claims expertise in navigating economic downturns, it is essential to scrutinize the sources and evidence supporting his strategies. Additionally, the guide’s applicability may vary depending on individual circumstances and market conditions. Furthermore, the ethical nature of some tactics advocated in the guide, such as exploiting vulnerable populations or engaging in deceptive marketing practices, raises ethical questions that must be carefully considered.

C. Personal reflection on the overall value and potential risks involved in using the guide.

In personal reflection, the overall value of Richard Pierce’s “Recession Profit Secrets” Guide cannot be denied. The comprehensive approach in exploring various strategies and techniques to thrive during an economic recession provides valuable insights for individuals and businesses alike. However, it is important to acknowledge the potential risks involved. Depending solely on a guide, without understanding the unique market conditions and individual circumstances, may lead to unfavorable outcomes. Therefore, it is crucial to exercise caution and adapt these strategies to specific situations to mitigate any potential risks.