If you are interested in trading GPN stock and have identified what you believe to be a trading opportunity, it’s important to examine the sentiment and news to determine if your assessment is accurate.

In this article, we’ll examine several sources to help you make an informed decision.

Firstly, let’s take a look at the sentiment for GPN. A recent article on Yahoo Finance suggests that GPN received a lot of attention from a substantial price movement on the NYSE over the last few months, increasing to $127.86 at one point, and dropping [1]. However, an article on Entrepreneur.com suggests that the stock is currently trading below its 50-day and 200-day moving averages of $140.99 and $160.91, respectively, indicating a downtrend, in sync with [2]. It’s worth noting that past performance is not a guarantee of future results, and you should always conduct your own analysis before making any trading decisions.

In addition to examining the sentiment, it’s important to check the news for any recent developments that could affect the stock price. A search for GPN on financial news websites such as MarketWatch or Benzinga can provide insights into recent events or announcements. For example, a recent article on Seeking Alpha highlights that GPN has grown by an average of ~18.6% a year in the last two decades, which by itself is very impressive, but the growth is actually accelerating. Solely valuing it on its growth of [5]. This is a positive sign for investors who are bullish on GPN’s prospects.

Next, it’s important to conduct your own analysis of GPN before making any trading decisions. A five-step test on Investopedia provides some guidelines for evaluating potential trades. This involves understanding your strategy and plan, identifying opportunities to know your entry and exit targets, and knowing when to abandon a bad trade. [3] It’s also important to check the volume to make sure the stock has high liquidity, which allows you to get in and out of a day trade quickly. Additionally, you may want to look at moving averages, such as a 30-day moving average, to confirm that the stock is a potential trade. You can also look at the chart to see if there is a chart pattern you use in your trading strategy. [4]

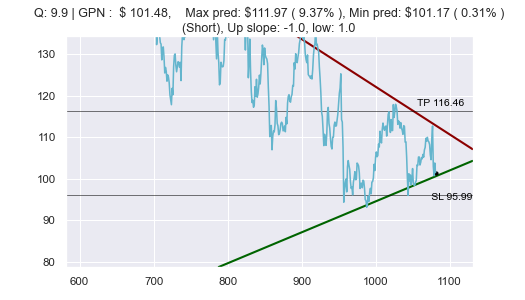

GPN Chart Analysis:

In conclusion, trading GPN requires careful consideration of the sentiment, news, and your own analysis. While recent news suggests that GPN has experienced substantial price movements, the stock is currently trading below its 50-day and 200-day moving averages. It’s important to conduct your own analysis and follow a strategy that aligns with your trading plan. Using the five-step test on Investopedia and checking the stock’s volume and moving averages can help you make an informed trading decision. Ultimately, it’s up to you to weigh the risks and rewards of trading GPN and decide if it’s a good opportunity for you.

Leave a Reply