Investing in stocks can be the best move during inflation. What are the best stocks for such an environment?

By Guy Avtalyon

So, stock markets aren’t going away anytime soon. But let see how stocks act in the period of inflation. They remain a driving economic force in every country in the world. Analysts aren’t quite sure what the future holds for the stock market.

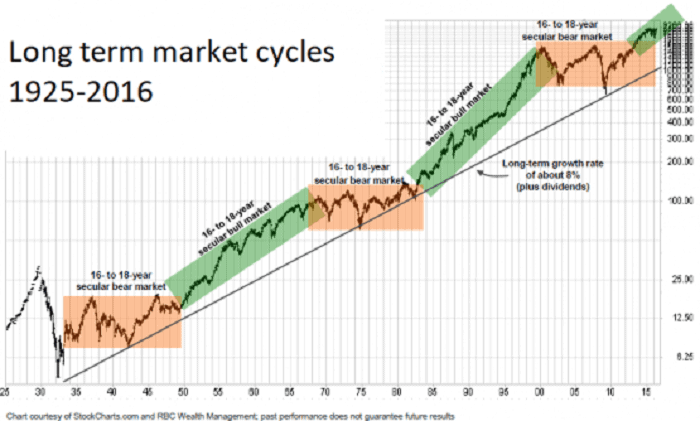

We will likely see stock markets continue to merge over the coming years. Some have even thought that we’ll see a single global stock market. This appears to be unlikely. Frankly, stocks are not good short-term protection against rapidly increasing inflation, but bonds are worse. But for long-term investors, stocks can be an excellent hedge against rising prices.

Inflation has been creeping up on the world economy. It isn’t the first time. During the history, we had so many inflations.

Inflation tracks the rise in the price of goods and services, which in turn shrinks the money’s purchasing power. When inflation rises, people can buy fewer goods, input prices go up, and revenues and profits go down. The result is, the economy slows down.

But the good news is that you can make money on the market by investing in stocks. Earnings come even in times of inflation.

How?

Well, the truth is that too much money chasing too few goods is one classic definition of inflation. Many studies have looked at the impact of inflation on stock returns. Most studies conclude that inflation can positively or negatively impact stocks. That depends on the investor’s ability to hedge. Also, it depends on the government’s monetary policy.

The most important is knowing how to invest in that environment.

Should you be concerned about inflation and your investments? If you have a substantial portion of your portfolio in fixed income securities, the answer is a definite yes.

Inflation erodes your purchasing power, and retirees on fixed incomes suffer when they can buy less each passing year. This is why financial advisers caution even retirees to keep some percentage of their assets in the stock market as a hedge against inflation.

The consumers will not hold cash because their value over time decreases with inflation. For investors, this can cause confusion.

High inflation can be good, as it can stimulate some job growth.

What can you do in periods of inflation? You can stay invested and not pay attention to the short-term fluctuations. Sometimes this can be hard.

One common misconception about a buy-and-hold strategy is that holding a stock for 20 years is what will make you money. Long-term investing still requires homework because markets are driven by corporate fundamentals. If you find a company with a strong balance sheet and consistent earnings, the short-term fluctuations won’t affect the long-term value of the company.

In fact, periods of volatility could be a great time to buy if you believe a company is good for the long-term.

Companies that raise their prices in line with inflation tend to fare better than others when the cost of living is increasing.

Energy companies, for example, may perform well in an inflationary environment as they can raise their prices in line with inflation. Infrastructure companies such as those responsible for toll roads, or hospitals, may also do well. They often have long-term government contracts in place with payments linked to inflation, which encourages private-sector investment.

Generally speaking, cash would be the worst asset class to hold in a high inflationary environment. However, stocks would be a better choice. This is because a company’s revenue and earnings should grow at the same time as inflation. Companies usually pass rising costs to the consumer to maintain their profit margin.

The concern of rising inflation has recently surfaced as strong employment numbers have caused fears of wage growth. In January, the average hourly pay, for example, in the US jumped 2.9 percent in a year. This is the largest jump in 8 years.

Companies may increase the prices for goods and services in order to pay for these increased salaries. This element is causing concern for investors. Higher salaries for some can bring a higher cost of living.

So, what can you do, where to invest, which stock to buy in the period of inflations?

Oil Stocks

There is a positive connection between the price of oil and inflation. The consumer price index helps measure inflation in the economy by tracking a basket of goods and services by households. Energy costs in households are part of the consumer price index. When the oil prices increase, it directly affects the energy costs spent by consumers. This leads to an increase in the CPI index and then inflation. Oil stocks always do well in high inflation environments.

Utilities

Utilities are defensive stocks. People will need utilities even in a high inflation environment. When operating costs rise for energy companies, in the final instance the consumers will pay them.

So, the companies will maintain their profit margin. Consumers will have no choice. They have to pay for the newly inflated cost if they want to receive electricity, for example. Demand in utility companies will still be strong even in high inflation periods.

Healthcare as best stocks

Healthcare is also a defensive stock. They are considered safer investments as people will always need healthcare. Even when consumer budgets are poor. During the inflationary period, investors will sell out high-risk stocks. They will prefer to buy into low-risk stocks because these are considered safer. People will always need medicine and medical treatment. They will give priority in spending on healthcare as opposed to less crucial goods and services.

Gold Stocks

When investors notice high inflation in the economy they want to turn to safe-haven investments such as gold stocks.

Gold traditionally is an investment held during the economic instability. High inflation causes investors to want to safeguard their investments by buying gold stocks.

Of course, holding cash in bank accounts is a bad idea in a high inflation environment. Because the purchasing power of cash is eroded by inflation.

Basic goods/consumer staples

For instance, companies with higher energy costs from increased transportation costs or higher operating costs will pass these costs to the consumer. Good and services will become more expensive. Consumers will become more selectable when purchasing goods and services because they have less buying power. But, basic goods or consumer staples will still be in demand in a high inflation environment. Even if the costs increase, people will still buy bread and milk. Even if such companies increase the price of their goods, consumers will need to buy it. Consumers will not buy non-essential goods and services such as a new car or furniture. They will only spend what is necessary. That kind of company is a good opportunity.

During the period of inflation never invest in discretionary stocks.

Material Stocks

Basic materials companies are involved in the exploration, development, and processing of raw materials. Hence, many times target specific resources, such as gold, silver, and crude oil. This sector also includes companies that run refineries and plants to develop refined materials. The dividend yields within this sector are above average in comparison to the wider market.

If you’re looking to invest in dividend-paying basic materials stocks, you may also be interested in dividend-paying basic materials exchange-traded funds (ETFs). These funds offer a diversified dividend payment based on a basket of basic materials stock holdings.

What we want to show is that there is no solution to inflation, but there’s the reason for hope. And for profits and returns of course.

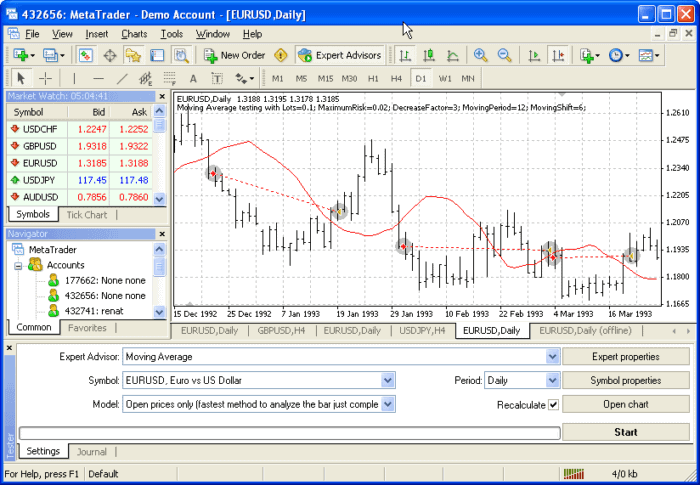

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy