High-frequency trading algorithms or algos are rigidly secured by their owners.

High-frequency trading algorithms or algos are rigidly secured by their owners.

By Guy Avtalyon

High-frequency trading algorithms can be amazingly easy to use. And beneficial too. Where is the catch?

By their nature, because they are so fast, those algos know the future price, they don’t even have an attempt to predict them. The slower shareholders need to predict prices, algos don’t. High-frequency trading algorithms use arbitrage, traditional technical analysis, and everything that works. Their purpose is to implement and modify well-known strategies while running with their extraordinary speedy setup.

The High-frequency trading algorithms main advantage is getting price quotes earlier and placing orders faster than the bulk of other traders.

Of course, the profit may depend on the software’s latency. Or it can be some lag between the price quote and following order execution. Latency is the most important part of an HFT algorithm.

High-frequency traders can optimize latency in two ways: if you minimize the time to reach the exchange or if you maximize the speed of your trading system.

Traders use algorithms for trading to reach higher performance to markets.

Algorithmic trading is like traditional trading.

You want to buy or sell the security. The whole process is based on the predefined collection of rules examined on past data.

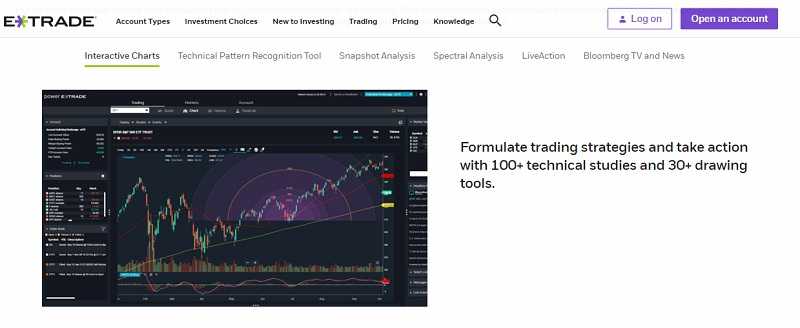

That means every HFT algorithm use indicators, charts, technical analysis, etc.

HFT firms decrease latency by fastening direct market access.

As an HFT trader, you can get data from the market nonstop, and without third-party. The direct market access gives you the capability to enter market orders straight into the market’s order book. This is an important feature of a low latency trading platform.

That guarantees that you will receive data before then other traders that are not using direct market access. So, you will be able to participate in the marketplace before the competitors.

HFT methods gain an advantage via ultra-low latency

It is possible through the establishment of two important inputs:

Automated trading algorithms

It is known as “black box” trading systems. Actually, it employs multiple algorithms based on various market variables. It provides a trader to get trading signals and identify a possible trading chance. That signal is traded automatically by installed trading software.

Collocated servers

These servers are given to the trader and connected to the market or exchange. They are actually placed at the exchange or market. The advantage of collocated servers is that they give you direct market access with hugely decreased latency. That’s why they are better than remote servers.

The main task of a good HFT algorithm is to reduce the time of traders’ access to the market.

The use of the HF trading algorithm altogether with collocated servers guarantees an exact and up-to-date synergy with the market. Complex algorithms identify and execute trades build on strategies. These strategies are known as order anticipation, arbitrage opportunities, momentum.

So, is it possible to compete with algorithmic trading?

Well, we have to say it isn’t. Don’t try to beat a High-Frequency trader! You will lose that match. The HFT has plentiful supplies and is be able to keep the algo running 24/7. Can you keep alert all that time? Can you be functional and reliably?

HFT includes multiple sub-disciplines.

They are quantitative techniques with short time holdings.

It is established on technical and fundamental analysis. Yes, they use traditional patterns to make trades. They are a very fast variant of what traders have done for a long time before. Also, HFT includes algorithms to prognosticate hudge buying or selling patterns. They use high-speed connections and co-located servers or in-house exchanges. And in a millisecond places trades based on those forecasts. They know what the next will happen!

The simplest algorithm is based on technological and geographic recognition.

Remember, the length of the optical connections is very important. The HFT algorithms can evaluate the order attributes, and discover if it is an indicator that related orders will go to other markets.

And what will happen? The High-frequency trading algorithms will place the order to buy at the offer price at the other exchanges.

High-frequency trading algorithms will always take advantage of the speed of execution.

HFT knows how to force the price to a higher level. It will buy all the stocks first and push the price to grow. And?

So, if some trader places the order with the limit order on that or higher price the algo will be the winner. It will use the spread.

Because of its dominance in the rapidity of execution.on technical and fundamental analysis. Yes, they use traditional patterns to make trades. They are a very fast variant of what traders have done for a long time before. Also, HFT includes algorithms to prognosticate hudge buying or selling patterns. They use high-speed connections and co-located servers or in-house exchanges. And in a millisecond places trades based on those forecasts. They know what the next will happen!

The simplest algorithm is based on technological and geographic recognition.

Remember, the length of the optical connections is very important. The HFT algorithms can evaluate the order attributes, and discover if it is an indicator that related orders will go to other markets.

And what will happen? The High-frequency trading algorithms will place the order to buy at the offer price at the other exchanges.

HFT algorithm will always take advantage of the speed of execution.

HFT knows how to force the price to a higher level. It will buy all the stocks first and push the price to grow. And?

So, if some trader places the order with the limit order on that or higher price the algo will be the winner. It will use the spread.

Because of its dominance in the rapidity of execution.

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

Here are Traders-Paradise’s suggestions for the automated trading software we examined.

Here are Traders-Paradise’s suggestions for the automated trading software we examined.