Even if you’re a less aggressive investor, you should rebalance your portfolio at least once a year.

By Guy Avtalyon

You invested your hard-earned money for the long term, you added your lovely stocks, bonds, whatever, and thought everything is done and suddenly somebody told you’ll need investment portfolio rebalancing. What? Should you find an accountant? What you have to do? How to perform that investment portfolio rebalancing? What does it mean, at all?

That is the main key, the fundamentals of investing. You have to do two main things: building it and investment portfolio rebalancing.

The investment portfolio is a collection of your investments. You hold stocks, bonds, mutual funds, commodities. The allocation of the assets you own has to be done based on your risk tolerance and your financial goals. But nothing is finished with the moment you bought your lovely assets. It is just a beginning. After a few years or sooner you’ll notice that different assets generate different returns and losses as well. Some stocks may have nice and high returns, so they become a large part of your portfolio. Much bigger than you wanted.

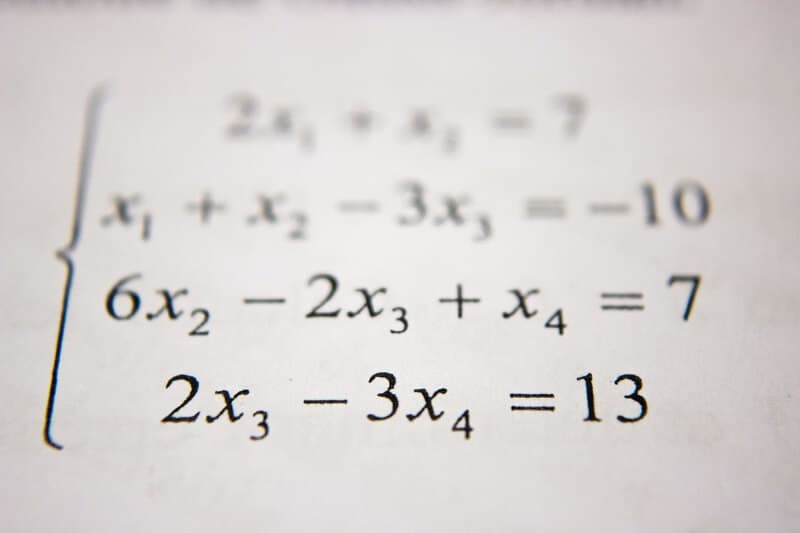

Assume you built up a 60/40 portfolio where 60% were in stocks. But after some time, you found that the value of those stocks represents over 80% of your portfolio’s overall value. What you have to do? Honestly, it is the right time for investment portfolio rebalancing.

Investment portfolio rebalancing means that you have to adjust your investments, you have to change the asset allocation of the portfolio to obtain your desired portfolio outlook.

Why is investment portfolio rebalancing important?

It will help you to keep your desired target asset allocation. In other words, to keep the percentage of assets you want to hold adjusted to your risk tolerance and to earn the returns you need to reach your investment goals. If you hold more in stocks, you’re taking on more risks since your portfolio will be more volatile. That might have a bad influence on your portfolio because the value will change with changes in the market.

But stocks look like a better investment than bonds due to their ability to outperform bonds as a long-term investment. That is the reason to hold more stocks than bonds in your portfolio but as a reasonable portion to avoid additional risk.

In periods when the stock market performs well, the portfolio’s money value that’s come from stocks will grow along with stock price rise. We already mentioned this possible scenario when your 60% of holdings in stocks rise to over 80%. This means your portfolio can become riskier. So, you’ll need investment portfolio rebalancing. How to do that? Simply sell stocks until you manage them to represent 60% of your portfolio. For the money received from that selling, you can buy some less volatile assets such as bonds, for example.

The drawbacks of investment portfolio rebalancing

However, there are some problems if you rebalance your portfolio during the time when the markets are doing well. Even more, it can be hard to sell stocks that are doing well, they are your winners and their prices might go even higher. What if you miss huge returns?

But consider this. What if they drop and you lose an important amount of money? Are you okay with that?

Remember, every time you sell any asset that is an excellent player, you are actually locking in gains. That’s real money and you can use it to obtain some stocks that are not such a good player but you’ll buy them at a bargain. Do you understand what you actually did? You sold high and bought low. You’re every single investor’s dream. You made it happen!

The real-life example

Our example of rising to 80% is rather drastically than a realistic one. Investment portfolio rebalancing ordinarily means selling 5% to 10% of your portfolio. We are pretty sure you are able to choose 5% of your winners and to buy some current losers but in the long run also winners. Investors usually buy bonds instead of stocks when rebalancing their portfolios.

Investment portfolio rebalancing is important because it provides you balanced asset allocation and, what is also important, in this way you’ll avoid additional volatility of your portfolio. If you’re the risk-averse type of investor this added risk might produce bad investment decisions. For example, you might sell stocks at a loss.

Investment portfolio rebalancing is the best way to follow your financial plan and obtain the best returns adjusted to your risk tolerance. Anyway, you don’t need to be overweight in stocks because the markets are cyclical, and it could be a matter of time when the next reverse will come.

Why rebalancing your investment portfolio?

Let us ask you. Are you having a car? Do you change the oil or broken parts from time to time? The same is with your investment portfolio even if it is the best created. As we said, the markets are cyclical and some parts of your portfolio might not play well in every circumstance. Why should you want to hold a stock that isn’t able to meet your investing goals or you bought it by mistake?

It isn’t hard to rebalance your portfolio, at least once per year. In short, that is investment portfolio rebalancing. If you think your investment portfolio is well-diversified among asset classes, just think again. Maybe it is diversified among asset classes but is it diversified within each asset class?

For example, why would you like to hold only Swiss biotech stocks? There is no reason. Moreover, it can be dangerous. It can hurt your investment portfolio a lot. It is better and safer if you hold a mix of different stocks, domestic and foreign from different sectors.

What if some of the investments grow in value while others decline?

In the short term, it is good. In the long run, it can be a disaster. That is the reason to rebalance your portfolio promptly and properly. Otherwise, your portfolio will be hurt as well as your overall returns.

For example, you own 50% in stocks and 50% in bonds. Sometime later, your stocks performed unsuccessfully and their value is lower now, but bonds performed outstandingly. So, what do we have here? Bad performers – stocks at lower value and bonds as excellent players at a higher value. Would you think to change the proportion in your portfolio? Of course, you would. So, what do you need to achieve that?

Let’s examine a different mix. For example, you may rebalance your portfolio and now it will be 40% in stocks and 60% in bonds. But what is the consequence if you don’t rebalance your portfolio and stay with your initial mix? You will not have enough capital invested in stocks to profit when stocks come growing back. Your returns will be below expected.

What if stocks were growing in value while bonds did unsuccessfully? Or, what if your portfolio turned into a collection of 60% stocks and 40% bonds, and quickly the stock market dropped? You’ll have greater losses, much bigger than it is possible with rebalanced the 50/50 mix. In short, you had more money in stocks. Your long-term gains are in danger.

To make a long story short, when rebalancing, you have to cut the over-performing stocks and buy more underperforming assets. The point is to sell overvalued stocks and buy less expensive but with good prospects. Do you understand this? We came up again to the winning recipe: buy low, sell high.

How often should you do that?

The answer is short, once or twice per 12 months mostly. Markets are cyclical and unpredictable. However, if you rebalance at an uncertain period of the year you’ll put your money at risk. Never avoid rebalancing your portfolio after significant market moves. Follow a 5-percent rule. Your investments should be within 5% of where they were when you build your portfolio. For example, if your initial portfolio was with 60% in stocks (you were smart to buy good players) and after several months they changed to 65% or over, it’s time to rebalance. In case you weren’t so smart and you bought poor performers and they changed to 55% or below, it is also time to rebalance. You have to prevent your portfolio from fluctuating more than 5%.

That’s the whole wisdom.

Even without a product and with big risk, this stock could generate a large reward.

Even without a product and with big risk, this stock could generate a large reward.

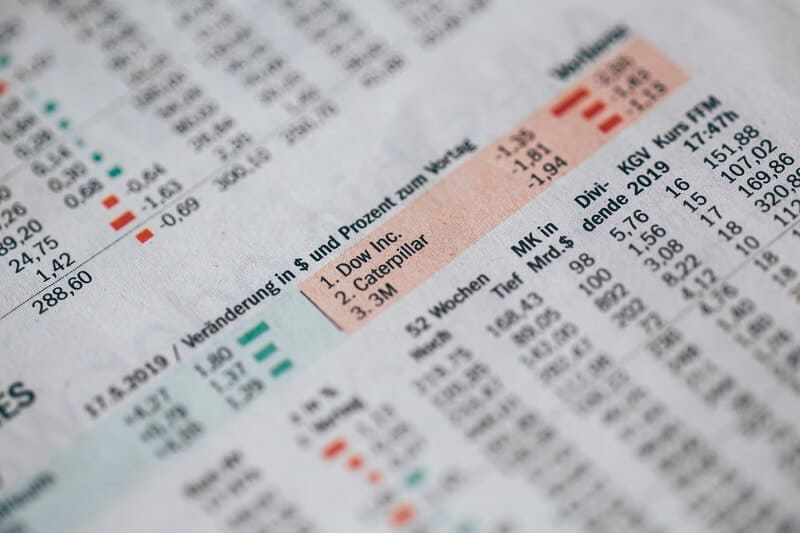

Investors’ demand drove Saudi Aramco market value to $2 trillion on the first 2 days of trade in Riyadh

Investors’ demand drove Saudi Aramco market value to $2 trillion on the first 2 days of trade in Riyadh