This is another in a series of lazy portfolios and one of the most popular. There is no single “coffeehouse portfolio” and an investor can adjust the basic version to own needs and investing goals.

This lazy portfolio, Coffeehouse portfolio, that financial advisor Bill Schultheis made famous in his book “The Coffeehouse Investor” is so simple.

The Coffeehouse portfolio is built of 7 funds. The basic version starts with the composition of 60/40 stock/bonds. The fixed income part is put into a bond fund (you have to choose). The 60% in stocks is divided equally between six index funds. That index funds are a large-cap value fund, a small-cap fund, a small-cap value fund, a foreign fund, a REIT fund, and a large-cap fund.

“Investing should be dull,” said Nobel economist Paul Samuelson. Yes, some would say the same. But we have to be honest. This kind of portfolio maybe isn’t suitable for some Millennials experienced in investing. The Coffeehouse portfolio is too much dull. On the other hand, it is good. All you have to do is to set it up and live your lives.

And this discovery is amazing.

You can hear investors saying the same thing again and again: You need some simple but well-diversified portfolio. You don’t need more than several funds (4, 5, 9 whatever), but pay attention, as you are a novice, they have to be low-cost and able to create winners during both bear and bull markets.

That’s the point with lazy portfolios. There is no active trading, no market timing, and of course, no commissions. Moreover, they are simple. Well, someone may ask what happens with assets absent from such a portfolio. Forget it! You don’t care!

How to structure Coffeehouse portfolio

It is quite simple, as we said and here is one example:

10% Vanguard 500 Index

10% Vanguard Value Index

10% Vanguard Small-Cap Index

10% Vanguard Small-Cap Value Index

10% Vanguard REIT Index

10% Vanguard Total International Index

40% Vanguard Total Bond Market Index

Or

10% Large-Cap Stocks

10% Small-Cap Stocks

10% Large Value Stocks

10% Small Value Stocks

10% REITs

10% Total International Stocks

40% Bonds

As you can see in this portfolio, it is massive on the REITs, is slight on international stocks, and misses diversity on the fixed income side.

Roll the dice

Basically it is a “slice and dice” portfolio. So we can say it isn’t a “total market” example of the portfolio. A total-market portfolio consists of 1/3 equal parts of a total bond market index, total stock market index, and total international stock market index. But this “slice and dice” portfolio seeks to benefit from the higher returns. There is a higher risk when investing in value stocks and small stocks. And, as you can see, this portfolio has a massive collection of both small, and value stocks.

The 60% piece of the Coffeehouse portfolio represents 6 different funds that cover a different part of the market. That is a really good part of this portfolio since it is adding to the diversity.

The rest of the 40% of the portfolio is a total bond fund that includes the whole of the bond market.

It is recommended to rebalance the Coffeehouse portfolio every year. That secures that the asset allocation percentages are held at the accurate amounts. But it can be an individual decision for every investor, there are no rules what is the accurate amount.

Modifications of this lazy portfolio

As you can see this portfolio holds more bonds. It is more than some average investors would like to hold, especially if you are young. To make a comparison, the target-date funds, for instance, for Vanguard hold 10% bonds until investors are 45. We found some of the Trinity University studies and one shows that even investors in retirement should own 50/50 portfolios or even more aggressive.

Honestly, the Coffeehouse portfolio favors small-cap and value stocks. And do it with reason. Historically they have had higher returns and which means higher volatility too. But you can tweak the portfolio.

How to adjust the Coffeehouse portfolio

One method is to reduce your exposure to bonds (for example you could hold 10% of them) and split the rest of the portfolio equally into six funds. In this way, you’ll have a much more aggressive portfolio if you like that. But keep in mind, that is riskier at the same time and you must know how much risk you are able to handle.

Why not invest in the Coffeehouse portfolio

Firstly, for some investors, this portfolio hasn’t enough international exposure. It holds only 10% of Total International Stocks. Secondly, the 40% bond allocation will reduce your returns, you can be sure. Also, rebalancing can be expensive. There are too many funds to set them up.

For young investors, it isn’t so easy to just buy and hold. What if the prices are going up and down frequently? How to stay calm and do nothing? That’s the tricky part of any lazy portfolio.

Also, as we said above, the Coffeehouse portfolio can be too conservative for some investors. Where has the excitement of investing gone? Yes, you can adjust the portfolio as we described but still. Hence, to be honest, the one size that suits all methods sometimes don’t work for everyone. Especially if you prefer to be a more aggressive investor.

Why invest in this portfolio

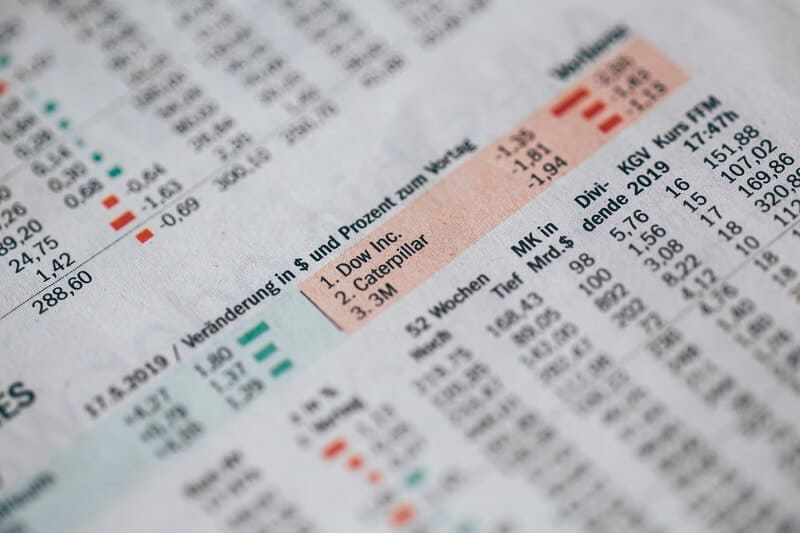

Allocation on the value stocks is an advantage. The value stocks have outperformed growth stocks for 20%, according to historical data. Also, since this portfolio holds 20% small-cap stocks, it is good because they have outperformed large caps. Historically speaking, of course. By being a lazy portfolio and holds 40% in bonds, the Coffeehouse portfolio is less risky.

Bottom line

A creator of this portfolio is Bill Schultheis. He wrote a book about dullness investing. He had found that when you simplify your investment decisions, you end up with better returns.

His book “The Coffeehouse Investor” explains why investors should stop holding top-level stocks or mutual funds, and stop attempting to beat the stock market. Instead, keep stick to three clever principles:

1) There is no free lunch

2) Never put all eggs in just one basket

3) Save for rainy days

Sure, there is one more. Don’t pay too much attention to daily ups and downs in the stock market. It can ruin your life. But with investing in the principle buy-and-hold, with an annual rebalancing of your portfolio, it is more likely that you will build your wealth. There’s nothing wrong with adjusting the CoffeeHouse portfolio. It’s more important that you stick with your plan. The weighting of your allocations is less important but has to be reasonable. And a note for newbies, sometimes it is smarter to be a bit conservative especially in the stock market.

And here is a bit of statistics. Behavioral finance professors Brad Barber and Terry Odean discovered: “The more you trade the less you earn.” Buy-and-hold investors are doing better than traders. Active traders can lose a lot of money paying transaction costs and taxes.

The truth is that active traders can turn their portfolios over for more than 250% per year, but their returns can be just like 11% after paying tax. Opposite, buy-and-hold investors can turn their portfolios over a bit around 2%, making around 18% returns.

Finally, this is just one of the numerous approaches to investing. You are the one who has to choose. It’s all up to you.