Investors should pay attention to several issues when adding alternatives to their investment strategy.

By Guy Avtalyon

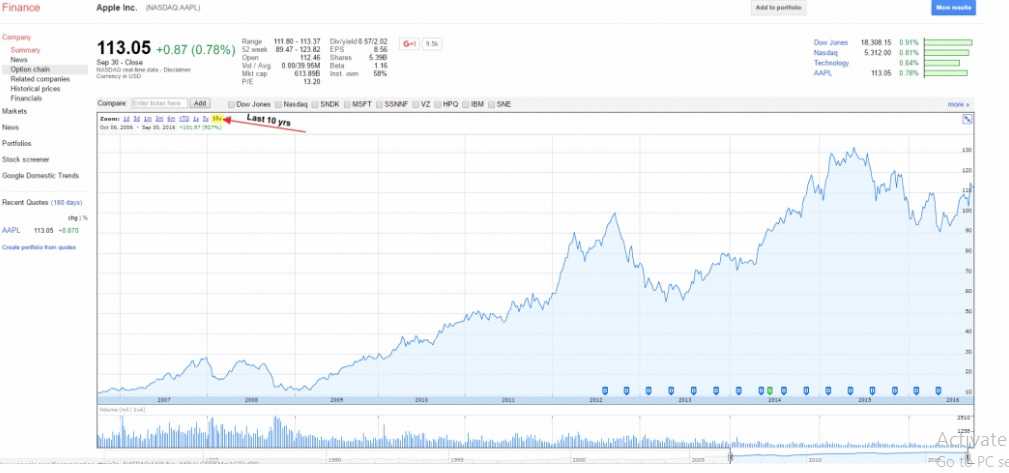

Alternative investments, which have been used by large institutions and foundations for quite some time, have become more mainstream in the last years. They are more popular among individual investors. Also, there are more available products, which makes investing in alternatives possible for an increasing number of investors.

Alternative investments are a non-traditional approach to investing. They give the ability to invest in sectors and access to assets that traditional investments cannot provide. Investors should understand alternative investments as the potential to improve the overall risk-return ratio of your portfolio. Even a small allocation to alternatives may be reasonable and profitable now for more investors. Previously it wasn’t the case.

However, the non-traditional approach and structure of these investments bring with them unique risks of which investors must be aware of.

Alternative investments have a different approach

Alternative investments use a different approach to investing than do traditional equity or fixed-income investments.

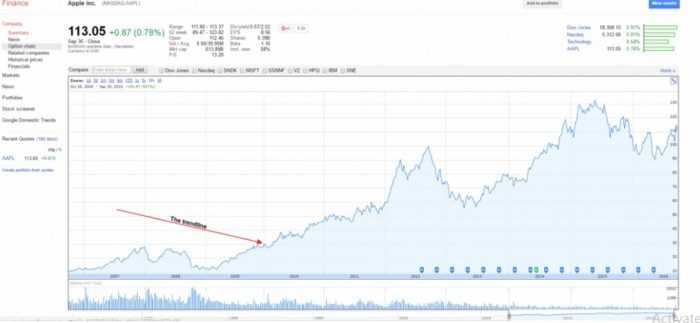

This approach may require holding both long and short positions in securities. Also, it may require to hold private securities instead of publicly-traded investments. And there may be derivatives or hedging strategies as well. Also, investors that use alternatives have a goal to achieve a distinct level of total return. The other investors’ goal is the opposite, they usually pay more attention to relative performance versus an index.

Alternative investments have the potential to magnify the risk but also returns of an investment portfolio. They can possibly improve diversification and reduce risk. This approach is more flexible, investors have a chance to invest in a more extensive set of investments, so the possibility of enhancing returns is obvious.

Different risk

Alternative investments have risks different from traditional investments. They are less liquid, especially in periods of high pressure in the markets. Also, they are more complex and less transparent. These characteristics make it difficult for inexperienced investors to understand and they are more subject to investment manager failure.

The successful implementation of an alternative investment strategy relies largely on the investment manager’s experience and skill because of the wide range of investment opportunities.

Satellite asset classes as Alternative Investments

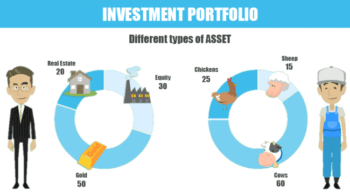

Satelite asset classes are very suitable for portfolio diversification. They cover everything that traditional investors and funds managers don’t even think about. They are more interested and specialized in asset classes such as real estate, commodities, any that can give high-yield fixed income. Satellites are non-traditional and have a low correlation with traditional assets. But their performances are driven by exposure which represents the similarity with traditional investments.

Types of Alternative Investments

We highlight several types of alternative investments but this list is more illustrative than exhaustive because new approaches are constantly being developed.

Private equity

Private equity is an investment strategy. Its goal is to take part in the growth of the private company. Hence, this strategy is long-term investments all in private securities generally and globally.

Private equity investment strategy covers illiquid asset classes with potentially greater long-term capital appreciation. The diversification doesn’t include public markets.

Only to higher-net-worth individuals use this strategy because it requires more investment experience, hence they are often accredited investor at high minimums and often has liquidity restrictions.

Hedge funds

The hedge funds are an alternative investment. They are designed to protect investment portfolios from market changes, so they will generate positive returns no matter if the markets are up or down.

They could protect the investment from market risk by adding alternative investments to the portfolios to decrease loss and protect capital.

The term “absolute return” is broadly used in connection with hedge funds. This explains how investment strategies are created to generate returns in any market condition. Actually, these funds are “hedging” the markets.

Managed Futures

An investment strategy that seeks to participate in trends in a large variety of global futures markets. Strategies include the use of the stock index, interest rate, currency, energy, and commodity futures. Many managed futures traders apply sophisticated software designed to invest in a disciplined, unemotional fashion, which often results in a lower correlation with traditional assets.

Alternative investments – mutual funds

These funds are not forced by traditional portfolio management systems. They have varying approaches, ranging from the absolute return, long/short equity, a broad mandate, or “go-anywhere” funds, and hedge fund-like strategies. Many of these funds also have a total return or an absolute return objective. They provide access to non-traditional investment. But they also provide investors daily liquidity at fair investment minimum.

Alternative investments can be useful tools to improve the risk-return of an investment portfolio. They can increase diversification and reduce volatility, given low correlations to more traditional investments.

Risks of Alternative Investments

- Higher fees. – Alternative investments can have higher fees. They may also charge additional management fees. While higher than traditional investments, these fees may or may not be excused when comparing returns net of fees.

- More complicated. – Alternative managers invest in a broad variety of investments, such as derivatives, and can use short selling. Understanding that can be difficult for many investors.

- Less transparent. – There can be limited to the underlying holdings of these investments. They use many tools that are not always the best choice for alternative investments. That makes a manager’s investment ability more difficult to assess. Also, some alternative investments are largely unregulated.

- Less liquid. – This is due to holding illiquid investments that can restrict the investor’s ability to offset money invested. For example, some hedge funds do not allow redemptions over the first year of investing. Most of them will allow annual or quarterly redemptions. Moreover, private equity may not allow redemptions for more than seven years. Here is also exposure to a notable lack of liquidity in some trading environments.

- Less tax-friendly. – Most alternative investment strategies aren’t focused on minimizing taxes.

- May disappoint in strong up markets. – They use short sellings to generate absolute returns. That may deter some investors.

- May not diversify risk in extreme down markets. – During the dislocation, the relationships of many different types of investments may increase notably. Investors hold that the more profits of alternatives is connected to the added risk.

Is this suitable for every investor?

Alternative investments can potentially magnify the overall risk-return of an investment portfolio. There are benefits but also risks in these non-traditional investment strategies. The most important is that investors have to be comfortable with alternatives when adding them to their investment strategy.

It is important also to discuss alternative investments with a respectable financial advisor. If you choose this strategy you’ll first need to determine how suitable it is in relation to your current investment approach.