Forex Educational Series – Part 2

6 min read

by Hans Stam, A Forex trader

The terminology of trading Forex

When I first started showing interest in trading, I might have been where you are now, so I will go back a long way to put myself in that place again and try to help you.

The first obvious attempt was going for stock trading and I didn’t have a clue what I was looking at.

After I had done a course on stock trading I soon got stuck on terminology.

Also, I figured out very quickly, stock trading was not for me.

At the end of the course I was getting really good grades, but in real life that didn’t do much for me as I simply did not have the money to buy stocks in masses and get something of real value back. Back then I had to go to the bank and buy stocks, but the commissions were very high and it wasn’t really worth the effort.

The other problem I had was I did not understand the language traders used, so in my writing, I will try to explain every step so you can follow this series with ease.

First, I will try to explain trading to you, before going to set up an account and trading platform, as that is a totally different story.

Options vs Forex

When I figured out stock trading was not for me simply because I did not have the money, I soon found out about trading options.

The big plus of trading options was that you didn’t actually buy the stocks, but you bought a contract to buy these stocks at a certain price.

Think of it as getting an option to buy a house, it simply means the house is being taken off the market for a while because there is a potential buyer.

Now I was able to trade at leverage. Instead of buying 100.000 shares hoping they would go up to sell them again against a profit, I could buy a contract to buy at current price and keep that option for say 3 months, if the price went up I could still buy these shares at the previous price and make an instant profit.

Instead of actually buying and selling these stocks or commodities like oil etc. the put and call options that were being traded.

The contracts were much cheaper than buying the actual stocks or commodities, but the negative to me was that if the stock went against the option, the option was worthless.

Why would anyone buy a contract that would allow them to buy a stock at a higher price than they could at the current price? If that happened, the money to buy the option was gone.

So back to Forex. Again, forex trading is being done using leverage. But this time, although you may lose some of your money, it’s always worth something.

Closing out your position (your trade) will still have some value even if the other currency went down. That’s when I knew, Forex will be the area to focus on.

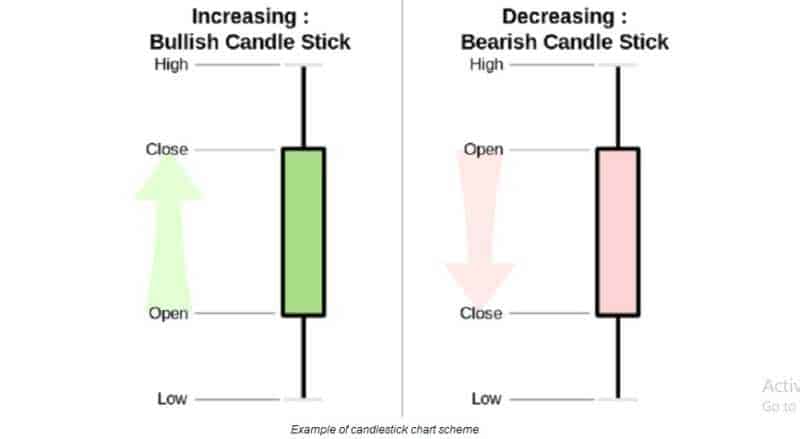

Bull and Bear Market

You might have seen this before, and you probably have.

Think of the bull of Wall Street, or the phrase bullish or bearish markets.

Maybe it seems irrelevant to write about this, but once you are looking at a chart, it’s good to see of the Pairs go up or down.

When the market is heading upwards, we call that a bullish market. When it’s heading down, it’s called a bearish market.

The way to see this clearly, think of it like a bull that takes you on his horns and throws you up in the air, as where the claw of a bear crashes you down.

Explaining Pairs

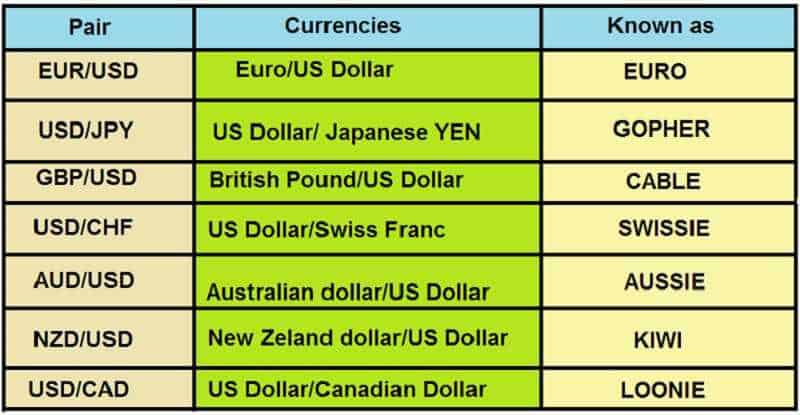

In our previous example, I used the pair EUR/USD.

But how about Base and counter currency?

In this example, it’s simple to understand you can buy the Euro against the Dollar.

But what if I want to buy the Dollar against the Euro, I don’t see that pair anywhere?

That’s correct, so instead of buying the Dollar, you will now Sell the Base currency, the Euro.

That also explains the next bit of terminology, Buying the Euro (EUR/USD) now becomes going LONG, and buying the Dollar now becomes going SHORT on the pair EUR/USD.

Simply put, Long is buying, and Short is selling the Euro against the Dollar pair (Where in fact you are buying the Dollar as the counter Currency of the pair)

Analyzing the market

As you may have read in the previous article, there is a difference between trading and gambling.

So what makes the difference? And why are traders not agreeing with each other on where prices will go?

The final judge is the market itself, and sometimes you are right and sometimes you’re wrong.

To make sure you are more right than wrong, you would want to try to analyze what the market is going to do based upon what other people think.

Although, there are analyses of the market, even so, if everyone would disagree with the projections and still went another way, the market as the judge would rule that the price would head towards supply and demand.

Unfortunately, that doesn’t happen often in real life. If you’re interested in reading more about this, Google George Soros and see what he did.

The majority of traders will try to analyze based upon two different types of analyses, Fundamental or Technical.

Knowing that other traders have the same information, they will very likely try to figure out what most others decide to do based on the presented information and go along with the flow.

Fundamental vs Technical in Forex

Fundamental analyses, in a nutshell, are more or less analyzing where the market will go based upon the news and events that happen around the world.

It’s possible the influence of these analyses are very high, high enough to even close the markets temporarily. Think of an event like 9-11 or a war for example.

More common in this type of analyses are reports that are presented publicly like unemployment rates or elections etc.

Whatever the news is, usually this is affecting the market greatly and prices will go up or down rapidly, sometimes in seconds.

Once the move happens, you probably are too late already because of the speed, so many will preset orders in case the market goes up or down fast, others will already have the trade open based upon their expectations of what will happen with certain rates like unemployment.

Technical trading Forex

…is something completely different.

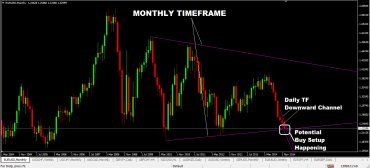

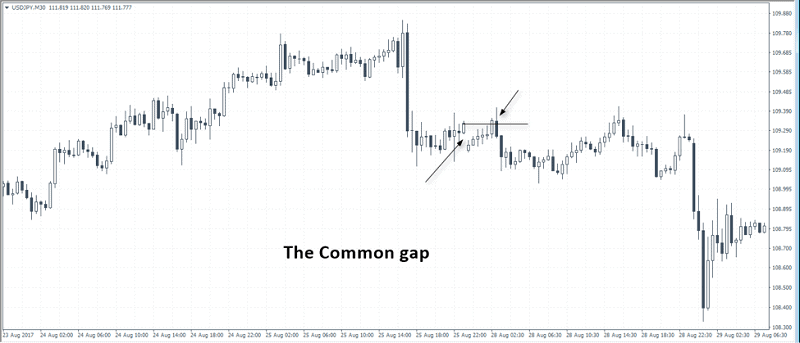

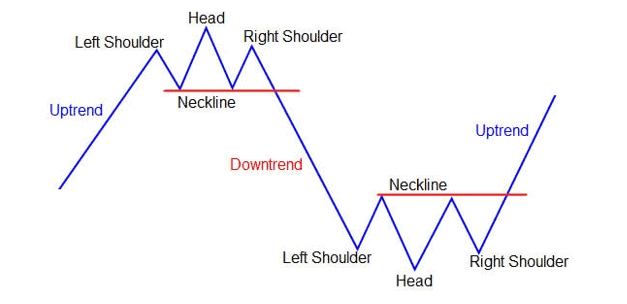

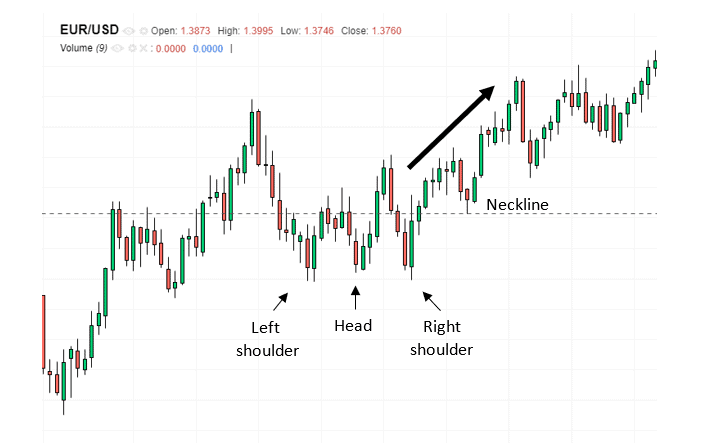

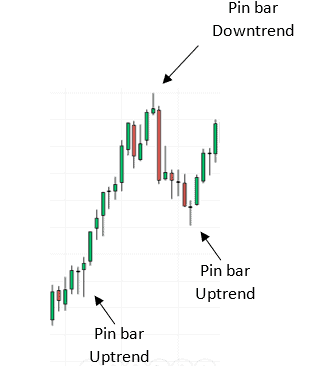

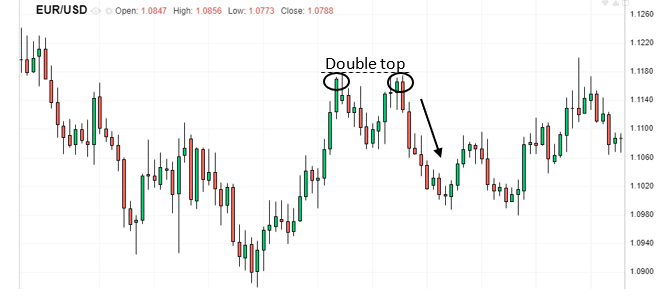

When trading based upon technical indicators, many will look for patterns in all kinds of shapes and sizes.

There are many tools to use, think of moving average price waves based on the last X numbers of price values.

Others are Elliott waves or Fibonacci for example.

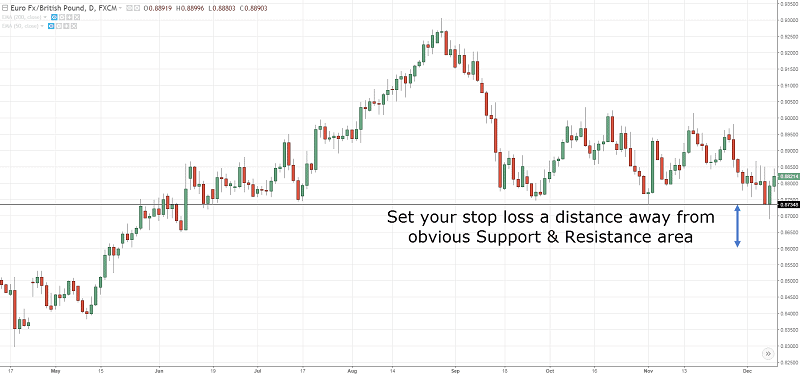

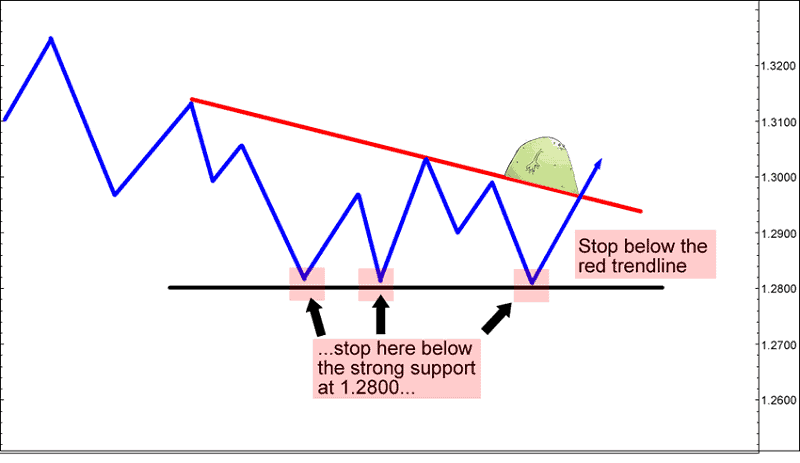

Also, support and resistance levels are used a lot. When a price is trying to go upwards, it often happens it will try to break a ceiling, bounce back, and have another attempt to breakthrough. Once that happens often, a resistance level is forming. Other traders will see that too, and will most likely trigger a lot of buying orders once that level is broken which is a self-fulfilling prophecy as it will go up because others will buy in that direction which supports the move.

The support level works the same, the difference here is that it supports the lower side of a move.

So the difference between Gambling and Trading basically is that you can try to analyze what most traders will do and go along with that direction.

If you made it this far, you really seem dedicated to learning! Well done!

When you need mentorship, please contact me by clicking here.

Is there another way?

In short, Yes.

We’ve been over Emotions, we’ve been over Analyses. So basically I need to be a robot?

No, you don’t, you can be a vibrant human being and still get very good results.

In fact, it doesn’t have to be difficult at all, but it does require a bit of money to do it right.

I’ll say it out loud, it will take between $5.000 – $10.000 to get started, so a few hundred doesn’t really get you very far with this option.

If you want to know more about this option, please contact me here and I’ll set it up for you.

What is PIP?

For consumers, the best-known decimal is in cents.

For example, if the rate EUR/USD is 1,12 it means that 1 Euro is worth 1,12 Dollar.

It would be very difficult to trade on that decimal.

So in trading, we add a few numbers behind the comma and start trading in PIPs.

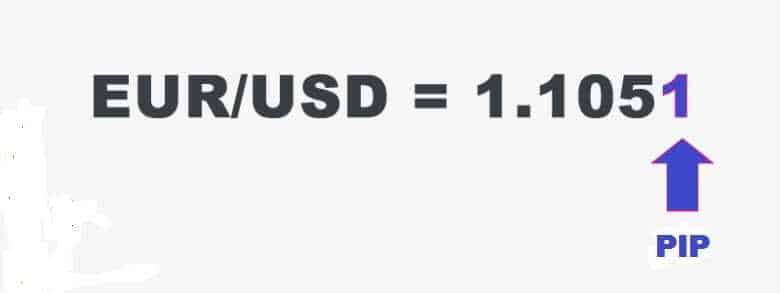

PIP (Price Interest Point) Although some have other versions, it’s the point on the market.

1 PIP equals 1/100 cent on the dollar.

Example:

1.1200 to 1.1300 equals a price change of 100 PIP’s and that equals 1 cen

1.1200 to 1.1201 equals a price change of 1 PIP…

But wait, there are more digits when I’m trading?

Correct…

When you see 1.12000 to 1.12001 that’s 1/10 PIP So we call that a Pipette.

Hopefully, this is a simple way to understand how that works.

Demo Trading

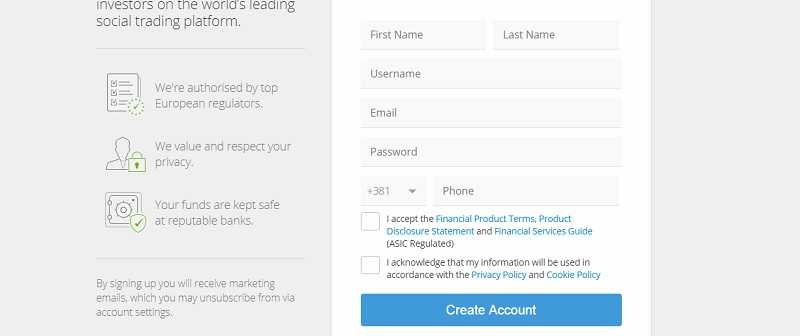

The best way to start learning is to open an account and start demo trading. You can do that by clicking here.

Those account with real live numbers are FREE to use, and most will be temporarily but on request, most brokers will extend the trial period.

It might be overwhelming at first, but the good part is, you can get to learn how it works, and you can see directly if you make or lose money.

By the time you are ready, you can open a live account, and start trading for real.

Be aware, going live is really different!

The main difference is, you can refresh your demo, where on a real account your money is gone when you lose.

I have seen people trade on a demo and all seemed reasonable, but when they switched to a real account their balance went south.

The most common difference I noticed was the demos were being traded without much stress in comparison to live-accounts.

It didn’t really matter if this was about thousands of dollars or a few dollars; the tension was just making traders fail a lot quicker on the live account.

Most common mistakes were taking profits way too early, and experiencing fear of loss which totally ruined their trades.

Although some brokers do have their tricks, it’s usually something you can figure out and workaround, but the human factor makes trading more difficult than you may think for most people.

Many also think it will not affect them until they realize they too are human.

Artificial Intelligence (A.I.)

Many of us are aware of Alexa, Siri, and other A.I. which to a lot of us is very intriguing.

For us Forex Traders this is the future.

If you want to experience A.I. which checks your trading and gives you advice on where to focus, you can try that out for free by clicking here.

What you will need is a Free demo account or set up a live-account by clicking here.

This A.I. does not give you strategies, but it makes you aware of the risks you are taking, and if you are doing well or where you need to improve.

If you are struggling to get a good score, and need to perfect your strategy, wait until upcoming articles where I will explain how to create a strategy of your own.

This is not like the trading robots you may have heard about, as I believe you always will have to keep a close eye on your trading instead of letting whatever robot take your decision from you because to a robot it doesn’t matter if it is blowing your money away or not. And of course, we don’t want that to happen.

We will go through more valuable information coming very soon!

Hopefully, you appreciate the value offered to you on this website, stay tuned!

Best Regards,

by Gorica Gligorijevic

by Gorica Gligorijevic