Passive investing is the way to force your money to work for you.

By Guy Avtalyon

Passive investing has become a significant part of the market. Finally! The low-cost index funds or exchange-traded funds are popular. However, there are still a lot of investors who are trying to achieve an excellent return through active investing. The question is why they are doing that when passive investing provides a better alternative.

What is passive investing?

It is investing your assets in funds that mimic a market. The main task of fund managers is to purchase the security in the precise proportion of a particular index to copy it. It is a passive investment. Sometimes you will hear the term “indexed investing.” It is the same.

Let’s consider a bit more the act of active and passive investing strategies. Three years ago, the S&P500 had a total return of 9.54%. What did every passive investor make? Precisely 9.54%. On the other hand, an active investor gained 12,5%, but the other made just a 1,9%, or some made losses of -27%.

How is that possible?

The passive portion returned 9.54% and the total market returned 9.54%. But returns before the cost is not what should be counted. You should count what you actually earn. And what is that? The returns after cost and after-tax.

So, where is the catch?

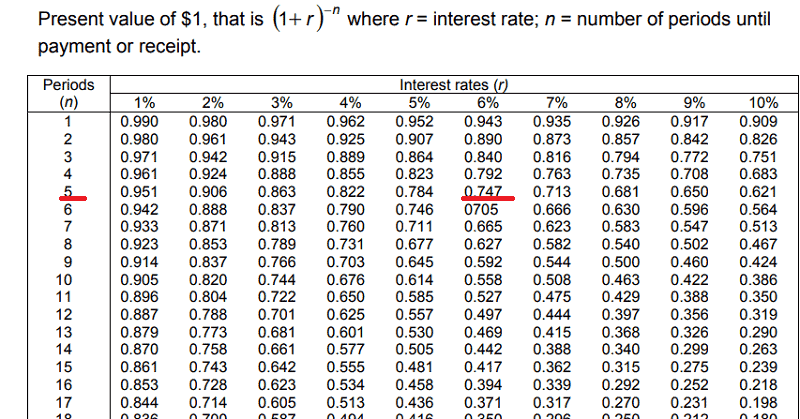

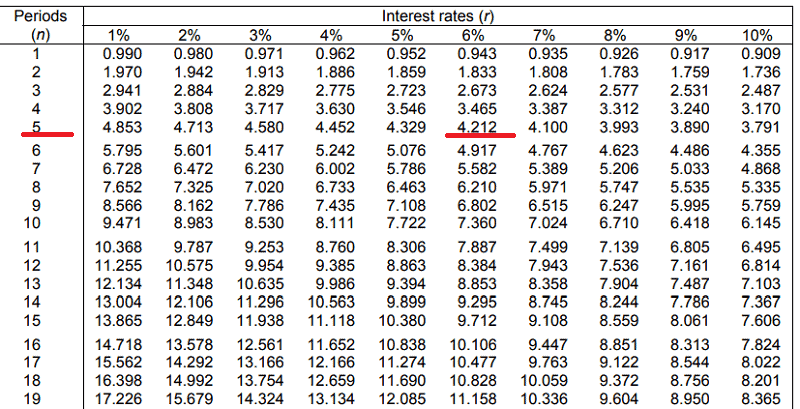

Passive management is cheaper than active. Active management is more costly. If you know that the cost of managing an index fund is between 0,15% and 0,50% rely on the market replicates, you will find that an active investing will have a minimum of 1% higher costs than passive investing.

That 1% is 100 basis points and may not sound a lot.

But let’s consider the following situation.

Let’s say you put your money in the bank account instead of buying stocks because you don’t want to pay that 1% of costs. You are short immediately 5-6%. Your wealth is worthless. Actually, if you invest that amount in stocks there is a chance to gain more. With putting money in the bank account you will lose 15-16% of your net profit from potential investments in the stock market. In only one year. Over time this difference could considerably decrease your wealth. It will surely lower your standard when retirement.

The costs of active investing are not only fees. The activity by nature adds more costs. The active trades create capital gains more often than passive investing. So, why wouldn’t you avoid them entirely? It is simple math. If you want active investing you would pay more. Just take into account the taxes and costs.

So, we have to say, index funds and passive investing can be a better option than actively managed funds.

Passive investing in index funds has changed the investment world.

In 1975, Jack Bogle, the father of passive investing, introduced the index fund. His radical idea showed the financial sector regularly cheated the individual investor with the unknown and opposed fees.

This doesn’t mean that everyone should be indexed. Of course not. Active managers’ choices hold prices closer to values. That allows indexing to operate. Index investing means to leverage their trade without paying the costs. The majority of investors decide to index part of their money, some do it with all of them. But the others want to explore the less-priced securities.

Let’s consult the statistic, in 2017, the percentage of securities owned by passive fund portfolios was about 5% of the total in the global market. The biggest part it took in the US where it was 15 %.

When it comes to investing, you can choose between active and passive investing.

Picking the right is crucial to your investing profit. If you make a mistake, you can end up with money loss. With the right one, you are the winner and you can make a big success in the stock market.

How to find the right passive investing opportunity?

Passive management requires buying investments that track an underlying index or making asset allocation and holding to it for the long term.

One form of passive investing is the mutual fund investment because the mutual fund’s purpose is to return what the S&P 500 returns every year. The advantages of passive investing are numerous.

Passive funds don’t require you to make trades and adjust holdings daily. The management fees are much cheaper, which is a benefit in the long run. You will always get the same percentage as the market returns. Good or bad, but the same.

Passive investing is easy. You just have to pick some investments and that’s all. There is no need to monitor the market every second and make changes or to try to catch price swings. But passive investing is not for investors who want to beat the market. Yes, you can do it from time to time, but all the time. So, probably, if you are not a professional you will make big losses.

Passive investing is more than set up your portfolio and don’t touch it anymore. You have to monitor your portfolio and make corrections as the market moves. You have to rebalance.

Say the stocks increase in price, bonds are falling. If you have a 60% stock and 40% bond in your portfolio, this price movement requires an adjustment to 70% stock and30% bond in the portfolio. In case you never make these changes in your portfolio you will take on too much or too little risk. You will not achieve your targets. So, some monitoring has to be done. In the first place, you have to think about your money. The money is not just a piece of paper. Having money means that you are free and safe.

You have to force your money to work for you. Passive investing is for sure a good way.

If you’re afraid to start trading stocks, here are some sure ways on how to do that

If you’re afraid to start trading stocks, here are some sure ways on how to do that

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.