Many say the strategy is to “buy a dip”, but can it really lead to success? There are so many opposing opinions.

By Guy Avtalyon

Don’t buy stocks on the dip says UBS Group AG. It is a Swiss multinational investment bank. While analysts at Goldman Sachs Securities Division advised: “Buy bitcoin on the dip” for stocks it is a straight way to a loss.

“Buy the dip” was a good plan for the bull market, but analysts at UBS addressed to stock investors:

“A world where leading indicators are accelerating is generally one where a correction in equities is an opportunity for investors and ‘buying the dip’ gets rewarded. In contrast, today’s backdrop with PMIs (purchasing managers indexes) in the low 50s and rates arguing for further declines often results in buying the dip being a losing proposition,” addressed strategists Francois Trahan and Samuel Blackman, in a Tuesday.

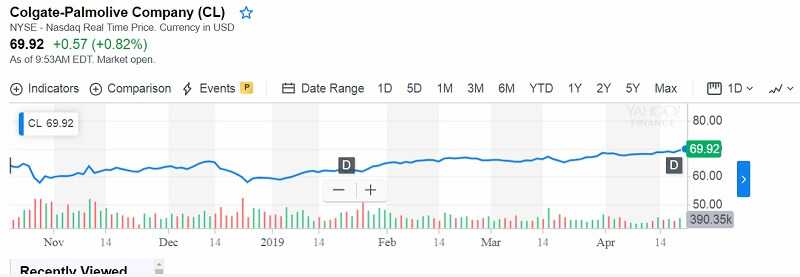

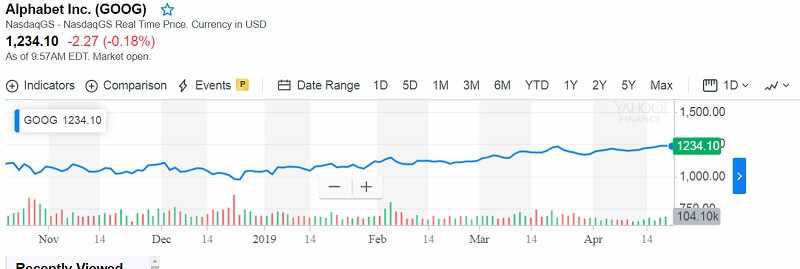

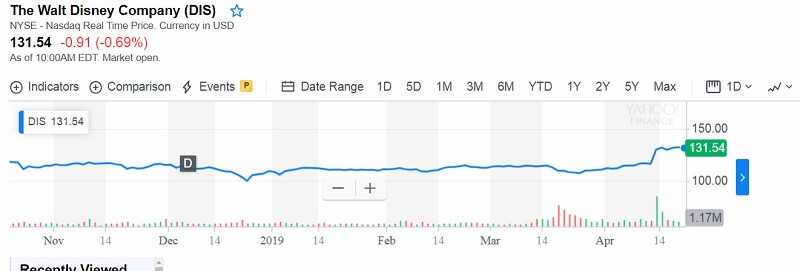

This announcement is quite strange because dip buyers are still making a profit.

The Dow Jones Industrial Average DJIA, +1.44% increased more above 370 points Tuesday. This increment came after the U.S. said it would pause imposing tariffs on some imports from China.

The S&P 500 SPX, +1.48% climbed 1.5%. The Dow is depressed 2.2% for the month, and the S&P 500 is 1.8% below in comparison to the previous month.

Trahan and Blackman have a different interpretation of the current market conditions.

What is buying on a dip

It is a losing proposition.

They said the historical records covering the last nine economic cycles, reveals that buy-the-dip works the best when leading economic indicators, like PMIs (private mortgage insurance), are accelerating.

The analysts said that buying-the-dip had a virtually excellent history. They call it the “risk-on” period. However, it is followed by the “risk-off” period. When PMIs fell under 50, labeled the “risk-aversion” period, dip-buying has poor benefits, they said.

Don’t buy stocks on a dip the analysts said

They said that defining the period of the cycle is just one piece of a three-item checklist. They also explained the perfect risk-reward scenario. It happens when the “risk-on” period is followed by interest rates, that carries an increase in the price/earnings ratio, so the earnings opportunity is promising.

Today, the potential dip buyers are 0-for-3, they explained. In other words, we are witnesses of the “risk-off” period, but the companies earnings opportunity has declined.

They also estimated interest rates.

They were looking at yields with an 18-month lag.

Their conclusion is: “the path laid by interest rates 18 months prior to today shows that there is now tightening in the pipeline, and it’s more likely we experience multiple contractions than expansion in the months ahead.”

Multiple expansion points the readiness of investors to pay more for a dollar of earnings. And they pointed out that the risk/reward for buying the dip “extremely poor”.

As you can see, analysts from Investment bank Goldman Sachs has advised investors to capitalize on the new dip and buy bitcoin.

The bank stated that its short-term target for bitcoin is $13,971. It also suggested to investors to buy Bitcoin on any dips in the current situation. But, don’t buy stocks on the dip, says UBS Group AG.

There is a difference.

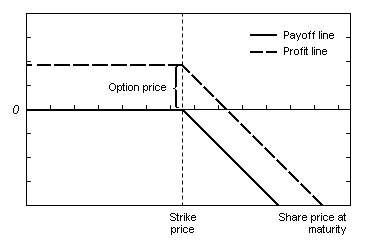

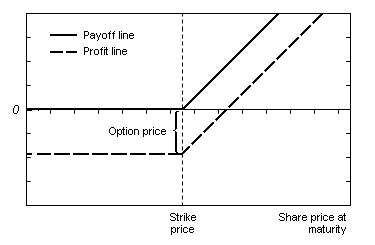

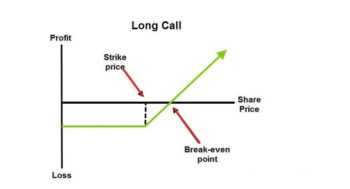

Writing or selling a call option

Writing or selling a call option P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid