What rules every investor should follow if want to be successful? Read to the end.

What rules every investor should follow if want to be successful? Read to the end.

By Guy Avtalyon

Every field has golden rules, so this one has too.

Fast money and easy earnings are mostly what young people want to succeed in the business world.

They are attracted by exchanges, money is invested in shares.

WOW!

However, there are many curves, curvatures, spirals, and twists that, and if you don’t know how to avoid them, your trip to the stock market can be very short-lived.

What are the golden rules for investing in the stock market, which should be known primarily to beginners in this business, but also to more experienced stock traders?

Create a portfolio one of the golden rules

You can do this in a simple way. There are many free portfolio managers on the Internet, so use some of them to make a free account.

Create a fictitious portfolio in which you would potentially invest and monitor the situation for a while, a minimum of one month. This will give you the best insight into market volatility.

Before you take the first step, the goal is to create a profitable fictitious portfolio as an investor on the stock market. This is really the golden rule.

Among other Golden rules: Read business magazines

In order to successfully start investing in the stock market, you need to be aware of the world’s stock market. Also, what are the social events that affect the rise or fall of the price of shares?

There are many respectable business magazines dealing with this topic (Forbes, The Economist, Kiplinger’s are some of the most famous ones).

Follow the events in the global economy and finance and you will be able to swim more easily in the very turbulent waters of the stock market.

Buy stock from a field you know well

Before investing money into something, you should understand the business the company is dealing with.

The first stock you will buy on the stock market should be from the sector you understand and it is familiar to you.

For example, if you know the banking sector, try to explore the market and find a bank whose stocks are good and worth investing.

Never invest in the action itself, but in the company. This is one of the best golden rules I ever got.

Have realistic expectations

There may be a problem if your financial goals are based on unrealistic presumption. Try to be realistic in your ambitions and goals. This will the most important golden rule for novices.

In this way, there are fewer chances to lose money or be disappointed in your stock market business.

Do your own research one of the most important golden rules

You will hear from people who are dealing with the stock exchange that they have bought some stocks. Just because the same was done by their friend or family member who understands this business.

Accept everything with reserve. Before buying a stock, do research. If some stocks brought in earnings in the past doesn’t necessarily mean that this trend will continue.

Always believe more to yourself than other people’s estimation.

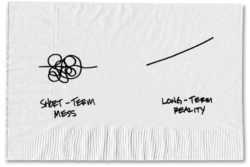

The stock exchange is NOT a money-making machine

This is one of the Golden rules. Most of those who want to participate stock market, have an unrealistic desire to double or triple investment in the short time frame.

If you are one of them, then that’s not a job for you. For those who want to invest, 10 to 12% of the earnings for a long period is quite a good investment.

You need to realize that you are just a small fish in a big lake and that your success depends on many factors. Some traders became really successful when they realized this golden rule.

Follow the clues and make conclusions.

3 or 4 good stocks are enough

Don’t overplay is truly a golden rule. Especially because you are a beginner in this business. More than 10 stocks are a good portfolio, but for investment funds.

It is true that they make more profit. But if you make a smart and wise decision you will earn enough money. Golden rules should be known to beginners in this business.

Don’t try to predict the stock price

Not even the biggest billionaires and owners of the largest multinational companies in the world are doing this. No one is able to predict, at least for a longer period, several stock market cycles.

Ability to guess the moment when the stock will have the highest value is still a myth. Even for those who have an insight into the business of some companies. Therefore, for successful business and investing in the stock market, you need to acquire certain knowledge and skills.

According to many kinds of research, the risk of investing in the stock exchange is most often taken over by young people who have just finished college.

But, like in every other business, the experience you get, will help you to be wiser in making decisions in the future.

That’s how it works!