The stock options give the holder the right, but not the obligation, to buy (or sell) 100 shares on or before the options expiration date.

By Guy Avtalyon

Stock options are financial instruments. That can provide the investor with the flexibility need in almost any investment situation.

Stock options are contracts that convey to its holder the right, but not the obligation, to buy or sell shares of the underlying security at a specified price on or before a given date. After this specified date, the option stops to exist. The seller of an option is, in turn, obligated to sell (or buy) the shares to the buyer of the option at the specified price upon the buyer’s request.

The stock options give the holder the right, but not the obligation, to purchase (or sell) 100 shares of a particular underlying stock at a specified strike price on or before the option’s expiration date. The seller of the option is one who grants this right.

You can recognize two kinds of stock options: American and European. American options are different from European options. The European options permit the holder to exercise the option only on the date of expiry.

How do stock options work?

All options are derivative instruments. That means that their prices are derived from the price of another security. More precisely, the underlying stock price will determine the options price, it is derived from the stock price.

As an example, let’s say you purchase a call option on shares of Intel (Nasdaq: INTC) with a strike price of $40 and an expiration date of April 16. This option gives you the right to purchase 100 shares of Intel at a price of $40 on or before April 16th. Of course, the right to do this will only be valuable if Intel is trading above $40 per share at that point in time.

Every stock option represents a contract between a buyer and a seller. The seller has the obligation to either buy or sell stock to the buyer. Of course, at a specified price by a specified date. The buyer, on the other hand, has the right but not the obligation, to execute the transaction. On or before a specified date. If it isn’t in the best interest of the buyer to exercise the option when it expires, the buyer has no further obligations. The buyer has bought the option to execute a transaction in the future. Hence the name – option.

What is underlying security?

The particular stock on which an option contract is based is usually known as the underlying security. Stock options are categorized as derivative securities because their value is derived in part from the value and characteristics of the underlying security. A stock option contract’s unit of trade represents the number of shares of underlying stock which are covered by that option. The stock options unit of trade is 100 shares. This indicates that one option contract signifies the right to buy or sell 100 shares of the underlying asset.

What is the strike price?

The strike price, or exercise price, of stock options, is the specified share price at which the shares of stock can be bought or sold by the holder, or buyer, of the option contract. To exercise your option is to exercise your right to buy or sell the underlying shares at the specified strike price of the option.

The strike price for an option is initially set at a price that is reasonably close to the current share price of the underlying security.

What is the stock options contract?

A stock options contract is defined by the following elements: type (put or call), style (American, European and Capped), underlying security, a unit of trade (number of shares), strike price, and expiration date. All stock options contracts that are of the same type and style and cover the same underlying security are referred to as a class of options. All stock options of the same class are referred to as an option series. They have the same unit of trade at the same strike price and expiration date

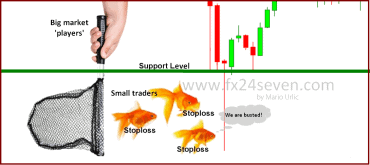

Stock vs stock options

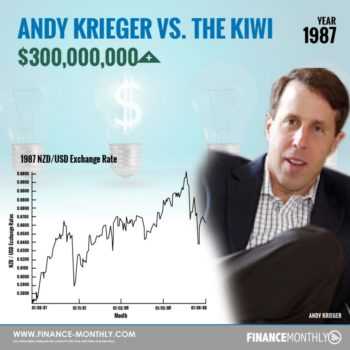

The difference between stocks and stock options is that stocks give you a small piece of ownership in the company, while stock options are contracts that give you the right to buy or sell the stock at a definite price by a particular date. There are always two sides to every option transaction: a buyer and a seller. For every call or put option bought, there is always someone else who is selling it. Many traders think of a position in stock options as a stock surrogate that has a higher leverage and less required capital. They can be used to bet on the direction of a stock’s price, just like the stock itself. But stock options have different characteristics than stocks. And there is a lot of terminologies that options traders must learn.

What are Put and Call?

A call is the option to buy the underlying stock at a predetermined price by a predetermined date. The buyer has the right I explained above. The seller of the call who is also known as the call “writer” is the one who has the obligation. If the call buyer decides to buy, the call writer is obliged to sell shares to the call buyer at the strike price. A call option contract grants its holder the right to buy a certain but specified number of shares of the underlying stock. That right has to be executed at the settled strike price on or before the date of the expiry of the contract.

For example, you bought a call option on ABC company with a strike price of $40, expiring in two months. That call buyer has the right to exercise that option, paying $40 per share, and receiving the shares. The writer of the call would have the obligation to deliver those shares and receive $40 for them.

Put options are the options to sell the underlying stock at a predetermined strike price. Until a fixed expiry date. That put buyer has the right to sell shares at the strike price. And the put writer is obliged to buy at that price.

Calls and puts, individual, or in combination, can provide different levels of leverage or protection to a portfolio.

What are employee stock options?

Many companies issue them for their employees. When used appropriately, these options can be worth a lot of money for you. With an employee stock options plan, you are offered the right to buy a specific number of shares of company stock.

All employees’ options have a vesting date and the expiration date. It’s impossible to exercise these options before the vesting date or after the expiration date.

You’ll recognize two types of stock options companies issue to employees:

NQs – Non-Qualified Stock Options

ISOs – Incentive Stock Options

With a non-qualified type, taxes are taken from your gains after you exercise the options. However, keeping too much company stock is considered risky. For example, if the company has financial problems, your future financial security could be in danger.

When long-term investors want to invest in a stock, they usually buy the stock at the current market price and pay full price for the stock. An alternative is to use stock options. Buying them allows you to leverage your purchases. Far more than is possible in even a margined stock purchase. In several investment situations, it might make sense to invest in stock options. Hence, rather than the underlying stock. Note, the basic fact of stock options trading. You are highly leveraging your investment. And it means your investment risk is also substantially increased.