Forex is short for foreign exchange, but the actual asset class we are referring to is currencies.

By Guy Avtalyon

If you want to be a profitable forex trader and have profitable forex trading, you have to follow some rules. You have to either win more often than you lose. The must is to win more on each trade than you lose.

Or better yet; do both.

Doing both is truly the hallmark of a professional trader. It can be very tricky though. As you are a new trader, it is probably best to focus on one approach. See where you can go from there.

I want to show you the ins and outs of each approach and help you decide which method suits you the best.

What is the relationship between the win rate and reward ratio in forex trading?

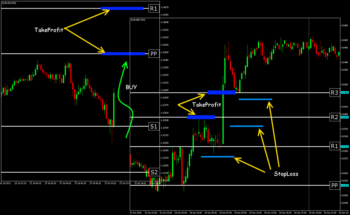

Before everything, you have to understand the relationship between a trader’s win rate, their reward ratio, and profitability. Assuming a trader risks an average of 10 pips on a trade to make 10 pips of profit. They will need to get 50% of their trades right in order to breakeven. Only if they win more than 50% of their trades, then we can speak about profitable forex trading.

What happens if you risk 10 pips to make 20?

You are trader forex trading with a positive reward ratio and therefore you will not have to win as many trades to breakeven or turn a profit. The opposite is true for a trader who trades with a negative reward ratio e.g. risks 10 pips to make 5. Such a trader will have to win more than 50% of their trades to breakeven and even more to turn a profit. There is an inverse relationship between a trader’s win rate and reward ratio. The larger your reward ratio, the fewer trades you have to win, and the more trades you win, the less you need to win on each trade.

What is profitable forex trading?

Forex trading with a positive reward ratio is a good place to start as a beginner. Why?

Because chances are if you are just starting out, you don’t quite yet have a talent for accurately predicting markets. Say your goal is to make twice as much as you are risking on a winning trade. We have to do some math. If you have such a goal, then your breakeven rate drops all the way down from 50% to 33% and any wins above 33% are pure profit.

If you aim for 3 units of risk (3R) on a profitable trade, your breakeven requirement drops even further to 25%.

This advice is offered by market makers with educational background. This advice is reliable, but what they ignore to tell new traders is that it’s actually harder to make 2 x risk (2R) than it is to make 1 x risk (1R). Anyway, this approach is still a great place to start as a new trader, we just believe in an open and honest approach to forex education.

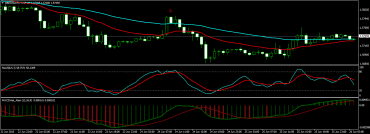

What is forex trading with a positive win rate?

Trying to score profitability via a positive win rate isn’t the best idea for new traders, because you are not yet experienced enough to get the market right more than half the time. Aiming for one unit of risk in profit has a higher chance of success than aiming for two. The other option is trading with a negative reward ratio, such as aiming for less than a single unit of risk on a profitable trade.

But there is the problem with trading forex with a negative reward ratio: the more your reward ratio drops, the more trades you need to win to turn a profit. If for example, you only aim for half a unit of risk on a winning trade, your breakeven rate rises from 50% all the way up to 66.67%. Then again, there is a higher probability of profitable forex trading and success on trades with negative reward ratios.

Automated systems and forex signals

When looking at automated systems and forex signals, you often see systems that appear great because they are forex trading with extreme negative reward ratios. These systems will risk a hundred pips or more in order to make 5-10 pips. This can work for a long time, but eventually, volatility picks up and the stop losses start getting hit. Every stop-loss that triggers wipes out a bunch of winning trades and you start seeing sharp declines in the system’s equity curve. The characteristic of these systems is win rates above 90%. If you see a system with a win rate that high, look a little deeper. You’ll like to examine how exactly this unbelievable win rate happens.

Currency is known as an “active trader” opportunity. This type of opportunity suits brokers. That means they earn more due to the agility that accompanies active trading but it is also promoted as leveraged trading. Hence it is easier for a forex trader to open an account with a little money than it is required for trading stocks.

How to use forex trading as a hedge

You can use currency trading to hedge your stock portfolio too.

For instance, if some trader builds a stock portfolio in a country where there is potential for the stock to increase in value. But there is a downside risk in terms of the currency. For example, you might own the stock portfolio and short the dollar against another currency such as the Swiss franc or euro.

This means, the portfolio value will increase, and the negative effect of the declining dollar will be neutralized. This is good for those investors outside the U.S. who will eventually repatriate profits back to their own currencies.

With this profile in mind, this suits the best day trading or swing trading.

The other strategy of trading currencies is to understand the fundamentals and long-term benefits.

It is useful to a trader when a currency is trending in a specific direction. That means it offers a positive interest differential. Hence, it provides a return on the investment plus an appreciation in currency value.

This forex trading strategy is a “carry trade.”

Good timing is the essence of profitable trading. In both cases, as in all other trading activities, the trader must know their own personal attributes. In order not to violate good trading habits with bad and impulsive behavior patterns.