(Updated October 2021)

In some scenarios, bonds are riskier than stocks. The main problem is how to run your investments stable but not cutting the growth stocks have to give.

Do you think the stocks are riskier than bonds? Well, stock prices are more volatile than bonds, that’s the truth. Also, bonds are paying fixed income. What else is on the bond side? Well, not much. Maybe these two is all since bonds could be riskier than stocks. The whole truth is that bonds are very risky for the companies, but at the same time, less risky for investors. Speaking about stocks, they are less risky for the companies but for investors, they can be extremely risky.

So, why do so many people think that bonds are less risky? We have to solve this dilemma: what is riskier, bonds or stocks.

The most and least risky investments

There are so many factors that have an influence on how some investment will perform. Honestly, all investments carry some level of risk. Speaking about bonds, they are under the great influence of inflation while stock investors may not feel it so much. Stocks have some other kind of risks, for example, liquidity risk. Such a problem bond investments don’t have.

Firstly, stocks are the riskiest investments, but they also give excellent potential for high returns. Stocks or equity investments cover stocks and stock mutual funds.

Bonds or Fixed Income Investments cover bonds and bond mutual funds. They’re less risky than stocks but generate lower returns than stocks.

The third-place belongs to cash or certificates of deposit, money market funds, Treasury bills, and similar investments. They are giving lower returns than stocks or bonds but carry a little risk also.

What are stocks and bonds?

To understand what is riskier, bonds or stocks we have to make clear what each of them is. There are two main concepts of how companies can raise money to finance their businesses. One is to issue stocks and the other is to issue the bonds.

Stocks and equity are the same. Both define ownership in a company and can be traded on the stock exchanges. Equity defines ownership of assets after the debt is paid off, so it is a bit broader term. Stock relates to traded equity. Equity also means stocks or shares.

In the stock market tongue, equity and stocks are the same.

Stocks

Stocks will give you an ownership stake in the profits of the business, but without the promise of payment. That’s why stocks are riskier. The companies may decide to pay dividends but nothing else is an obligation. While holding the stocks the value of your investment will vary related to the company’s profit. Stocks are also dependent on investors’ sentiment and confidence. Anyway, stocks are safer for companies since they are a sure way to raise the money needed to maintain business. For investors, stocks are riskier since the companies don’t have any obligation to provide any kind of return. If the company is growing and rising profit, investors will obtain capital gains.

Bonds

Bonds are parts of debt issued by companies and transformed into assets to be able to trade in the market. Bonds give fixed interest rates also called coupons to bondholders. The companies have to pay the interest rate before any dividend to stockholders. Otherwise, the bonds go into default. Also, bonds are conversely related to interest rates, meaning, when rates go up, bond prices drop.

Can you see now? How to answer the question of what is riskier, bonds or stocks? For investors, stocks are a riskier investment, for the companies, the bonds are riskier.

Bonds vs Stocks

The majority of investments can be classified as bond investments or stock investments. In stock investment, you are buying an asset and your profit depends on the performance of that asset. If you buy a y a thousand shares of Tesla, your profit is based upon the stock dividend which Tesla pays (if any) and upon the fluctuation of the value of Tesla shares.

In a bond investment, you actually loan money to a company or a government. With a bond investment, your profit is not related to the performance of the company. If you buy a $2,000 bond from Tesla, for example, and the company earns a record profit, your profit will be the same as if Tesla didn’t make a profit at all. But here is the risk involved with the bond investment. What if the company is unable to pay back the debt? You can lose all your investment.

Stock investment is recognized as a higher risk. But risk makes a profit, therefore you will earn a higher return over the long term.

So, what is riskier, bonds or stocks?

Risks and rewards of stocks investments

Stock investments offer higher risks but greater rewards. A lot of things influence that. An increased sales, for example, or market share, or any improvement or development of the company’s business, literally anything can shift the stock price and skyrocket it. So, investors can earn by selling them or by receiving the dividends.

Any company can succeed or stumble. That’s the reason why nobody should invest in just one company. Do you know the saying: Never put all eggs into one basket? But if you hold stocks from several companies you will ensure high returns over the long term.

But, so many investors couldn’t watch the unfortunate events without selling their stocks at a loss.

Well, if you don’t have a stomach for that just stay away from the market or, which is a better choice, diversify your investment portfolio. Add some bonds-based investments, that will help you when the stock market gets rough. Moreover, a well-diversified portfolio will give you a bumper by providing lower volatility and calm play. So, you will not be forced to sell your investments and feel stress while making decisions.

Bottom line

So, do you have the answer what is riskier, bonds or stocks?

Yes, stock prices fluctuate more than the prices of bonds but that doesn’t necessarily mean more risk for the investor. There are a lot of cases when bonds are riskier than stocks.

For example, over a high inflationary period when inflation is surging quickly, the bond price can be damaged, decreased. The inflation will decrease the value of payments, and the bonds will mature less valuable.

On the contrary, stocks can boost their prices during inflation. The companies could raise prices of their products and increase their profits. That would raise the value of their stock, even higher than the inflation rate.

Can you see how the bonds might be riskier investments than stocks?

During the regular economic conditions, stocks could be much riskier than bonds.

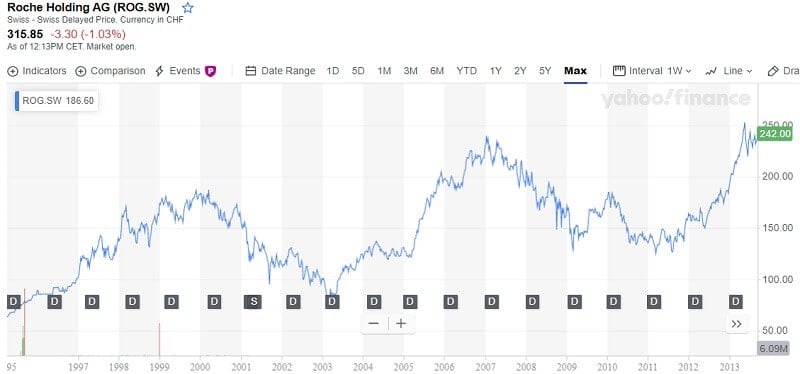

Stock prices could sink sharply. Hold! Don’t sell! Wait for a while, wait for a stock to bounce back in price. And you know what, when the stock prices are falling, there is no better moment to buy them and hold. Just pick a well-established company.

The point is that bonds are not always the safest asset. They can be very risky. In some scenarios, stocks can be a much safer choice.

Savvy investors will buy both to diversify portfolios. Of course, how many of each you will hold isn’t set in stone. You can change it over your lifetime as many times as you want to reach your goals and earn a profit.