Most recent news about the financial markets

- Consumer price index rose 5% year-over-year in March. Core CPI rose 5.6% year-over-year in March

The Labor Department reported a 5% year-over-year increase in the consumer price index (CPI) for March. On a monthly basis, the CPI was up 0.1%, which was also lower than the estimates of 0.2%. Core CPI, which excludes volatile food and energy prices, rose 5.6% on a year-on-year basis.

- Report on Vanguard Large-Cap ETF (VV)

Vanguard Large-Cap ETF (VV) should be on your investing radar? Style Box ETF report for VV has been published. It’s available on the iReport.com website. For more information, see the report’s style box and the link below.

- VanEck Wide Moat ETF (MOAT) is a strong ETF to own.

VanEck Morningstar Wide Moat ETF (MOAT) is a strong ETF right now. Smart Beta ETF report for MOAT is available on VanEck’s Smart Beta website here. It is based on Morningstar’s Wide Moats Smart Beta Index.

- S&P 500 ETF report for the first quarter of 2017.

SPY should be on your investing radar, according to the Style Box report for SPY. The report is titled Should SPDR S&P 500 ETF (SPY) Be on Your Investing Radar? and it is available on the website: http://www.stylebox.com/index.html.

- Invesco S&P 500 Equal Weight ETF (RSP) should be on your radar?

Invesco S&P 500 Equal Weight ETF (RSP) should be on your investing radar? Style Box ETF report for RSP is available on Invesco’s website. It’s based on an exchange traded fund (ETF) with a market value of $1,500.

- Head of equity strategy at Wells Fargo reportedly expects S&P 500 to fall 10%.

Wells Fargo Securities’ Chris Harvey expects the S&P 500 to correct 10% in the next 3-6 months. The decline will be driven by worsening economic conditions, aggressive monetary policy, potential capital/liquidity issues, and a consumer that is increasingly reliant upon credit.

- Former Pimco chief economist sees ‘Table-Pounding Declaration’. Says street ‘not convinced,’ but ‘we’re having a lively

Paul McCulley believes the Federal Reserve is likely to hold its rate hike cycle during its upcoming policy meet in May. He disagrees with where the Fed funds futures are priced. He also points out that the rate hike is unlikely to be successful.

- Goolsbee says fight against inflation should no longer be priority.

The right monetary policy during financial stress is to maintain caution, watchfulness and prudence, according to Chicago Fed President Austan Goolsbee. Financial issues should dominate monetary policy concerns when they conflict, he believes. Goolsbees believes the fight against inflation should not be prioritized just because markets got upset.

- Inflation, quality of labor, and cost of labor all remain elevated.

Inflation, quality of labor, and cost of labor are the most pressing issues facing small businesses. Inflation concerns are easing, but labor costs remain elevated, which is still a problem for small businesses, however. .

#1 Trading idea on FHN

Company Name: First Horizon National Corporation

Symbol: FHN

Sector: Financial

Company Description: First Horizon Corporation is the banking holding company for First Horizon Bank providing various financial services. The company is headquartered in Memphis, Tennessee and is the bank’s parent company. It is a publicly traded company with a market capitalization of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FHN — Traders have taken $3.7 billion of bets against the stock.

TD Bank is now the most shorted bank stock. Traders have taken $3.7 billion worth of bets against the large Canadian bank stock, which is a concern for investors. The stock is down 2.5%. in value.

- News story for FHN — IVOV is a mid-cap value ETF.

Vanguard S&P Mid-Cap 400 Value ETF (IVOV) should be on your investing radar? Style Box ETF report for IVOV is available on the website of Vanguard’s investment advisor, who recommends IVOV as a suitable investment for investors.

- News story for FHN — KRE is a strong ETF for regional banking.

SPDR S&P Regional Banking ETF (KRE) is a strong ETF right now. Smart Beta ETF report for KRE has been published. It is based on the Smart Beta report for the KRE’s Smart Beta exchange traded fund (ETF).

TECHNICAL ANALYSIS

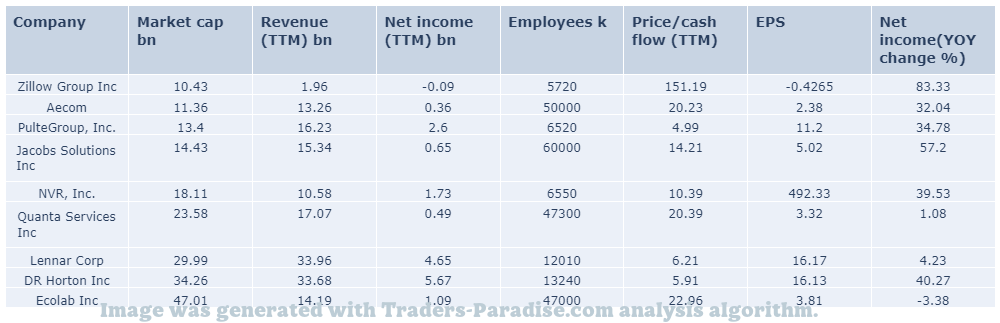

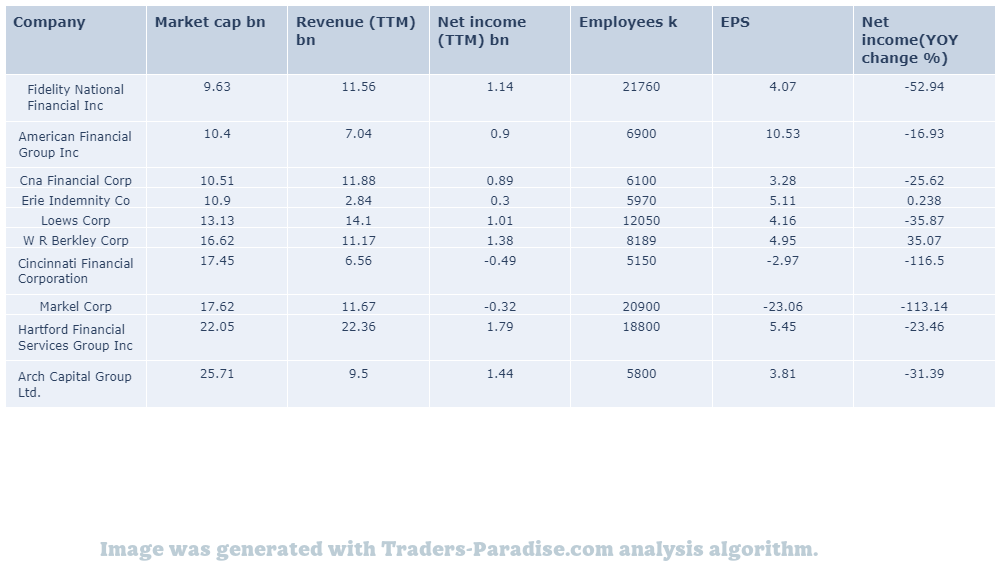

PEERS AND FUNDAMENTALS

#2 Trading idea on FNF

Company Name: Fidelity National Financial, Inc.

Symbol: FNF

Sector: Financial

Company Description: Fidelity National Financial offers various insurance products in the United States. The company is headquartered in Jacksonville, Florida and offers insurance products. It offers different types of insurance products, including life insurance and annuities. It’s a private company with a primary focus on Florida.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FNF — SEC chief wants retail orders to be auctioned off. Questions remain on ultimate impact of reforms

Gensler’s meme-stock reforms are meant to help retail traders, but some investor protection advocates aren’t so sure. SEC chief wants retail stock orders to be auctioned off to market makers and exchanges, but questions remain as to the ultimate impact of these reforms.

- News story for FNF — Financial stocks with RSI near or below 30 are considered oversold.

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies. First Guaranty Bancshares Inc (NASDAQ: FGBI) is one of the most undervalued stocks in this sector with an RSI near or below 30.

- News story for FNF — Q4 earnings miss on title volume decline, higher average fee per file.

Fidelity National’s Q4 results reflect significant decline in volume, partially offset by a higher average fee per file. FNF missed Q4 earnings expectations. The company reported a decline in title volume, but a rise in the average fee for files.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#3 Trading idea on ECL

Company Name: Ecolab Inc.

Symbol: ECL

Sector: Consumer Goods

Company Description: Ecolab is an American corporation that develops and offers services, technology and systems that specialize in water treatment, purification, cleaning and hygiene in a wide variety of applications. It helps organizations both private market and public treat their water, not only for drinking directly, but also for use in food, healthcare, hospitality related safety and industry.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ECL — Investors continue to be optimistic about Ecolab

Investors are optimistic about Ecolab (ECLc) owing to its strong business. ECL has 3 reasons to keep the stock in your portfolio. ELCL has a good chance to grow due to its good business prospects.

- News story for ECL — Passive income grew by 22.63% in February and 46.87% in March.

Nicholas Ward’s passive income stream grew by 22.63% in February and by 46.87% in March. Read more as I review my February and March results in this piece. Nicholas Ward’s Dividend Growth Portfolio: Special Fixed Income Edition.

- News story for ECL — Price-to-Sales (P/S) ratio is a misleading indicator.

U.S. Wide-Moat Stocks On Sale – The April 2023 Heat Map. We believe that the most widely used valuation multiples are terribly flawed. Click here to read a complete analysis of the heat map and the analysis of U.S wide-moat stocks on sale.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#4 Trading idea on HZNP

Company Name: Horizon Pharma, Inc.

Symbol: HZNP

Sector: Healthcare

Company Description: Horizon Therapeutics Public Limited Company is a biotechnology company focused on the discovery, development and commercialization of drugs that address the critical needs of people affected by rare, autoimmune and serious inflammatory diseases. The company is headquartered in Dublin, Ireland with additional offices in Deerfield, Illinois, Chicago, South San Francisco, California, Washington, D.C., Gaithersburg, Maryland, Rockville, Maryland and Mannheim, Germany.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HZNP — Top-line data support expanded use of Tepezza for adults with chronic/low clinical activity scores.

Horizon Therapeutics’ Tepezza met the goals of the TED Expanded Use Study. The study will be expanded to include adult patients with chronic/low clinical activity scores, which meets the company’s goals for the study, and it will be approved for use in adult patients.

- News story for HZNP — These 3 stocks are smart buys with yields of 3.1%, 3.4%, and 14.3%.

3 Stocks With Yields of 3.1%, 3.4%, and 14.3% are Smart Buys right now. They are hard to pass up right now with yields of 3, 3, 4 and 14%. They are available to buy now.

- News story for HZNP — Top 5 Medical stocks to buy for 2023 and beyond.

The top and bottom-line growth make these Zacks Medical stocks very attractive. 5 Diverse Medical Stocks to Buy for 2023 and Beyond are listed here. They are all Zacks Rank #1 or #2 stocks with positive outlooks for the future.

TECHNICAL ANALYSIS

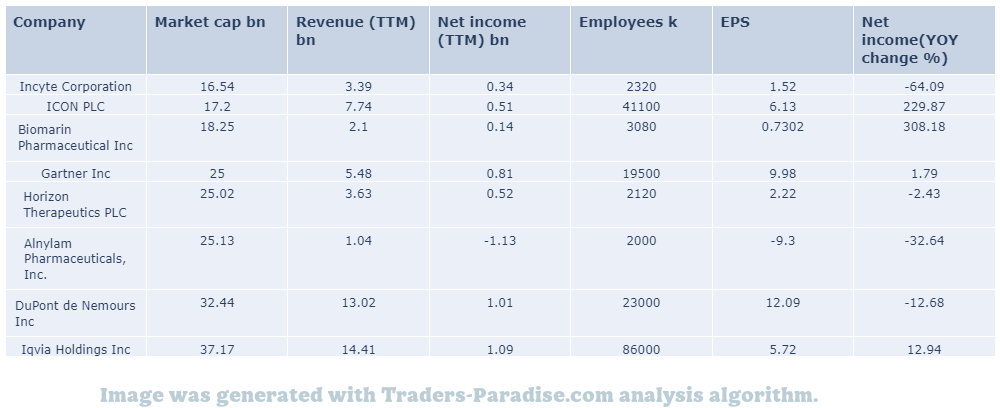

PEERS AND FUNDAMENTALS

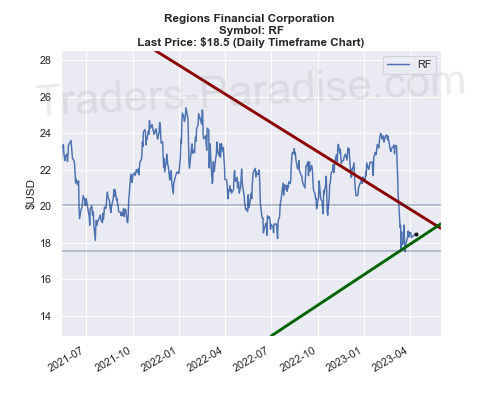

#5 Trading idea on RF

Company Name: Regions Financial Corporation

Symbol: RF

Sector: Financial

Company Description: Regions Financial Corporation is a bank holding company headquartered in Birmingham, Alabama. It provides retail banking and commercial banking, trust, stockbrokerage, and mortgage services. It’s a bank with headquarters in the Regions Center in Birmingham. Its products include retail banking, commercial banking and trust.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RF — Implied Volatility Surging for Regions Financial (RF) Stock Options

Regions Financial (RF) stock options are increasing implied volatility. Investors need to pay close attention to RF’s stock based on the movements in the options market lately. RF’s share price has risen on the back of the rise in implied volatility in options market.

- News story for RF — JPMorgan sees megabanks facing litany of concerns.

JPMorgan analyst sees a litany of concerns for megabanks, from a recession to impacts on credit creation and loan growth to inflation and regional-bank woes. The outlook for the big banks is not good, because of low loan growth and lower margins.

TECHNICAL ANALYSIS

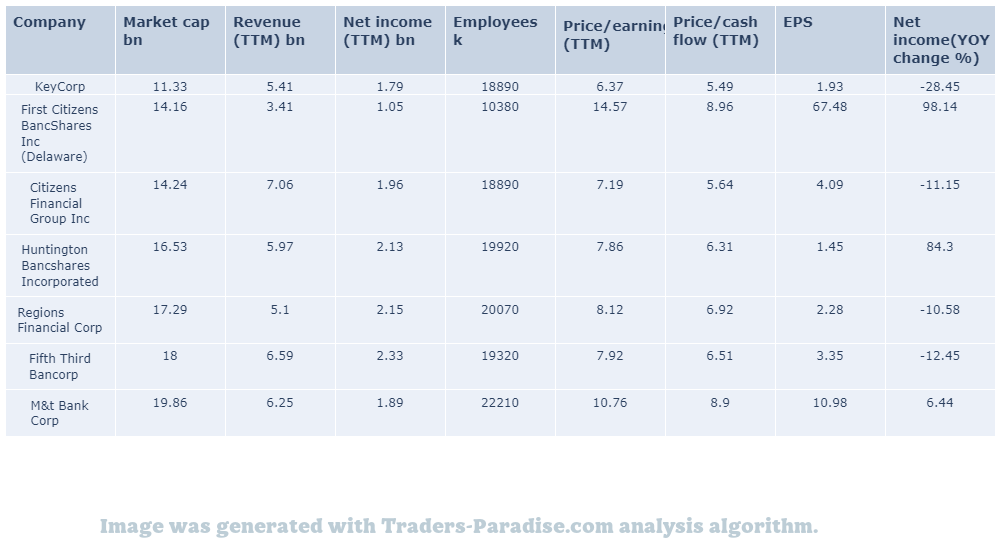

PEERS AND FUNDAMENTALS

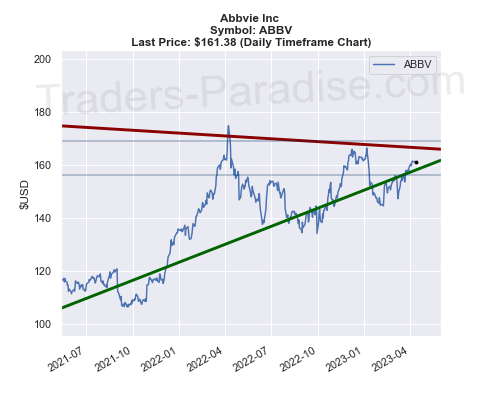

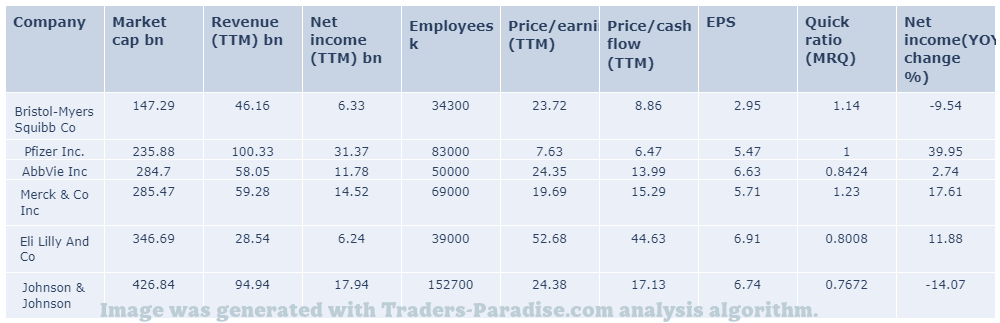

#6 Trading idea on ABBV

Company Name: Abbvie Inc

Symbol: ABBV

Sector: Healthcare

Company Description: AbbVie is an American publicly traded biopharmaceutical company. It originated as a spin-off of Abbott Laboratories. It was founded in 2013. It’s a publicly traded company that was created as a result of a merger between Abbott and Abbvie.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ABBV — Investors should buy the stock despite headwinds, says analyst.

2023 Could Be a Tough Year for AbbVie Stock. Should you buy the stock despite its headwinds? Â . in this situation, you should consider buying the stock, despite the headwindS.

- News story for ABBV — AbbVie (ABBV)

AbbVie’s stock closed the most recent trading day at $161.38. The stock moved +0.06% from the previous trading session. Abbvie is a subsidiary of Abbvi, a publicly traded company based in Switzerland.

- News story for ABBV — Top 2 stocks to buy no matter what the market is doing.

The two top stocks are trading at reasonable prices right now. They are the 2 Forever Stocks to Buy No Matter What the Market Is Doing. – The list is based on their market value and the current share price. The stock prices are based on the current market value.

TECHNICAL ANALYSIS

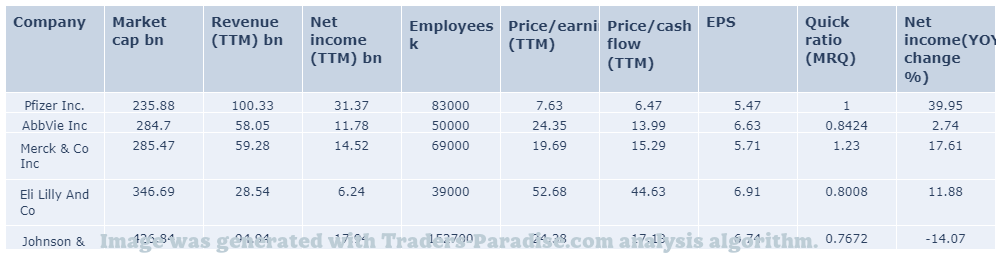

PEERS AND FUNDAMENTALS

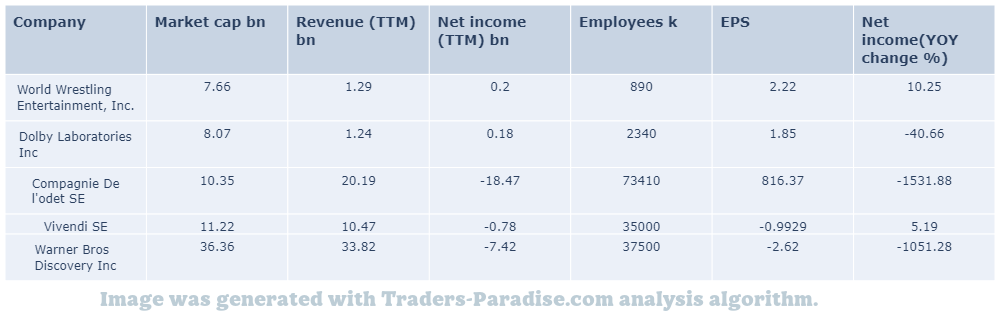

#7 Trading idea on WBD

Company Name: Warner Bros Discovery Inc

Symbol: WBD

Sector: Technology

Company Description: Warner Bros. is headquartered in New York, New York and is owned by Warner Bros. Pictures. The company is a division of Warner Bros., which is based in Los Angeles. It’s worth $2.5 billion in annual revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WBD — Shares of Warner Bros. are down more than 20% this year.

Warner Bros. Discovery has some strong strategies, but it’s loaded with debt. The stock market has been on a sell-off. Warner Bros Discovery is not a good buy at this time. . for now.

- News story for WBD — Netflix releases new episodes of The Nutty Boy.

Netflix (NFLX) releases new episodes of The Nutty Boy as a part of its family entertainment portfolio. Nutty, Julieta and Bocao are played by Tom Hanks and Julia Roberts. Netflix is boosting its content portfolio with new episodes.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

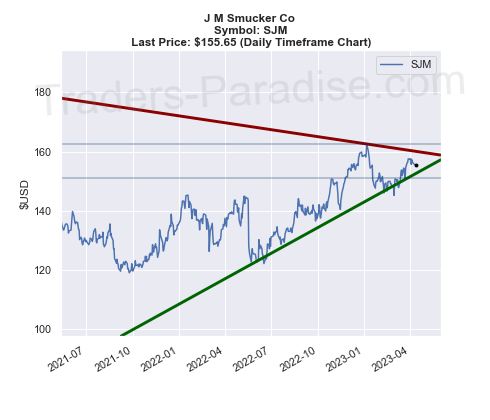

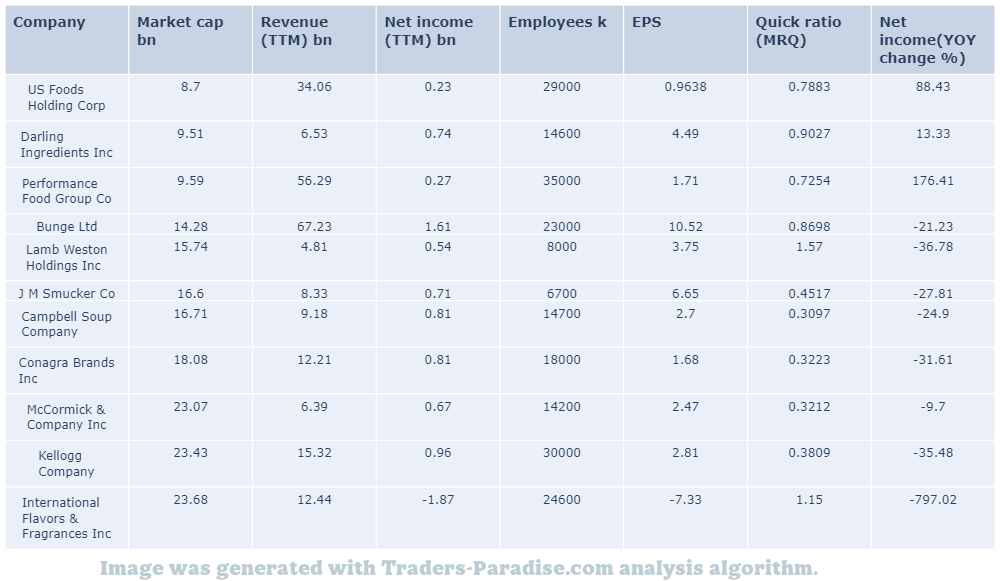

#8 Trading idea on SJM

Company Name: J M Smucker Co

Symbol: SJM

Sector: Industrial Goods

Company Description: The J. M. Smucker Company is an American manufacturer of jam, peanut butter, jelly, fruit syrups, beverages, shortening, ice cream toppings, and other products in North America. Its headquarters are located in Orrville, Ohio.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SJM — Negative net price realization seen in pet food, pet food segments.

The J. M. Smucker (SJM) benefits from its positive net price realization across all segments. The company is also progressing well by focusing on its core strategies. It is focusing on Pricing Efforts & Strategies. It’s also focusing on core business strategies.

- News story for SJM — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

- News story for SJM — McCormick’s P/E ratio is higher than most of its peers

stock soared on Tuesday. McCormick stock doesn’t have a high P/E ratio, but it’s not a reason to avoid the stock either. i in the share price on Tuesday soared by 10% to $8.50.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

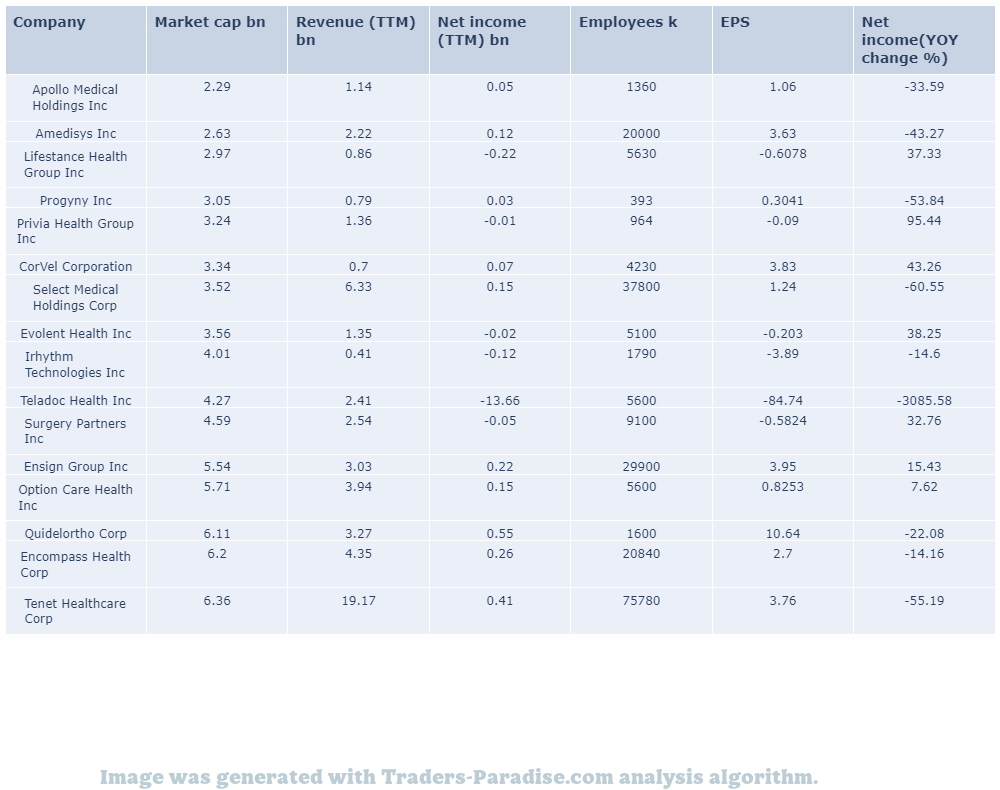

#9 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — Analysts have been giving Teladoc Health a positive view over the past 3 months.

12 analysts have published their opinion on Teladoc Health (NYSE:TDOC) over the past 3 months. They are employed by large Wall Street banks and tasked with understanding a company’s business to predict how a stock will trade over the upcoming year. The 12 analysts have an average price target of $30.83. The current price is $26.27.

- News story for TDOC — Company to host conference call at 4:30 p.m. E.T. on the same day

Teladoc Health, Inc. will release first quarter 2023 financial results on Wednesday, April 26, 2023 after the market closes. The company will host a conference call to review results at 4:30 p.m. E.T. on the same day.

- News story for TDOC — Shares of the health care company are down 60% this year.

Teladoc Health stock is down 60%. The stock hasn’t been trading this low since well before the pandemic. Teladoc’s stock is trading at its lowest level since the beginning of the financial crisis in 2008. Telodoc shares are down 60% since the start of 2008.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

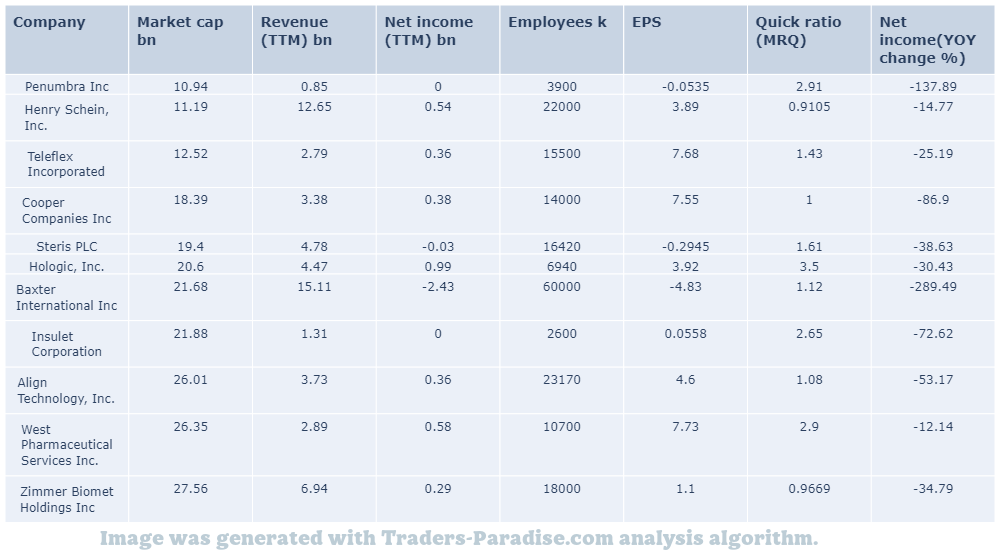

#10 Trading idea on HOLX, might be reaching some kind of top

Company Name: Hologic Inc.

Symbol: HOLX

Sector: Healthcare

Company Description: Hologic sells medical devices for diagnostics, surgery and medical imaging. It is a medical technology company focused on women’s health. It was founded in 1983 and is based in San Francisco. It has a market value of $1.3 billion. It sells products for medical imaging and diagnostics.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HOLX — The company has seen three earnings estimate revision in the past 30 days.

Shockwave Medical (SWAV) moved 10.6% higher last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term, as it’s been recently revised down.

- News story for HOLX — Investors are optimistic about robust growth in Bio-Rad

Investors are optimistic about Bio-Rad (BIO) on robust growth in Life Science and Clinical Diagnostics arms. Here’s why investors should buy Bio-Rad stock now. BIO is a biopharmaceutical company with a focus on life science and clinical diagnostics.

- News story for HOLX — The The expansion will create up to 100 new jobs

Thermo Fisher’s expansion in Bourgoin is built on the company’s investments in small molecule solutions. TMO is expanding to boost commercial manufacturing in Bourgogne as well as in other parts of France and abroad. for confidential information, please visit: http://www.tmo.com/.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

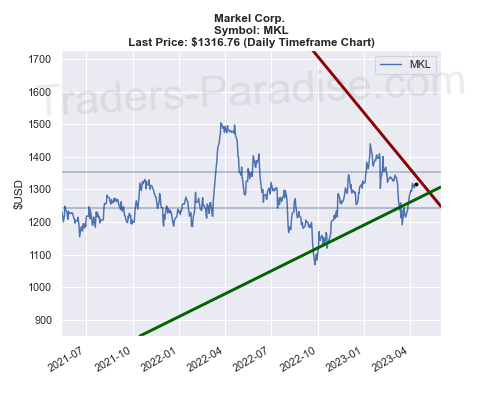

#11 Trading idea on MKL, might be reaching some kind of top

Company Name: Markel Corp.

Symbol: MKL

Sector: Financial

Company Description: Markel Corporation markets and underwrites specialty insurance products in the United States, Bermuda, the United Kingdom, rest of Europe, Canada, Latin America, Asia Pacific and the Middle East. The company is headquartered in Glen Allen, Virginia and is a diverse financial holding company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MKL — Warren Buffett owns more of Apple, Bank of America, and Chevron.

Warren Buffett owns more of Apple, Bank of America, and Chevron than you might think. Berkshire Hathaway’s regulatory filings don’t reveal the full story, as it’s revealed by the company’s filings. The company owns more shares of Apple than you’d think.

- News story for MKL — Here’s Why Hold is an Apt Strategy for Markel

Markel (MKL) is well poised to gain from growth across all its product lines, higher earned premiums, solid cash position and favorable growth estimates. Here’s why Hold is an Apt Strategy for Markel ( MKL) and why it’s a good investment strategy.

- News story for MKL — Mid-cap growth stocks could deliver returns in 2023.

Mid-cap growth stocks could deliver market-beating returns in 2023 and beyond. These are the 3 growth stocks to buy right now and why they’re worth a look now. i.e. these are the mid-sized growth stocks that are worth buying now.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#12 Trading idea on MOH, might be reaching some kind of top

Company Name: Molina Healthcare, Inc.

Symbol: MOH

Sector: Healthcare

Company Description: Molina Healthcare, Inc. provides managed care services to low-income individuals and families under the Medicaid and Medicare programs and through the state insurance marketplaces. The company is headquartered in Long Beach, California and provides care to people on Medicaid and through state insurance markets.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MOH — inorganic growth activities, cost-cutting initiatives

Molina’s inorganic growth activities, financial flexibility and cost-cutting initiatives position it well for growth. Here’s why you should retain Molina in your portfolio. . Â moh-investors.com.

- News story for MOH — Health insurer and flooring retailer each have growth potential.

A health insurer and a hard-surface flooring retailer have market-beating potential. They are growth stocks with potential to grow and create wealth for the long-term. They can be bought and tuck away to grow their wealth.

- News story for MOH — 8 analysts have a positive view on the stock.

8 analysts have an average price target of $344.25 for Molina Healthcare. The current price of the stock is $265.12. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

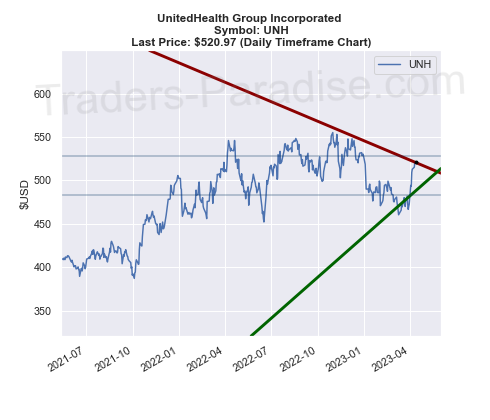

#13 Trading idea on UNH, might be reaching some kind of top

Company Name: UnitedHealth Group Incorporated

Symbol: UNH

Sector: Healthcare

Company Description: UnitedHealth Group Incorporated is an American for-profit multinational managed healthcare and insurance company based in Minnetonka, Minnesota. In 2020, it was the second-largest healthcare company (behind CVS Health) by revenue with $257.1 billion and the largest insurance company by net premiums. UnitedHealthcare revenues comprise 80% of the Group’s overall revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for UNH — Vanguard Dividend Appreciation ETF (VIG) is a strong ETF.

Vanguard Dividend Appreciation ETF (VIG) is a strong ETF right now. Smart Beta ETF report for VIG has been updated. vig is an exchange traded fund with a market capitalization of $1.2 billion. It offers investors a variety of investment options.

- News story for UNH — Top healthcare companies in the U.S. are set to hit $1 trillion market cap.

These businesses show promise and should get much bigger in the future. Which Healthcare Company Will Be the First to Get to a $1 Trillion Market Cap? Let us know in the comment section below. Â. Â y

- News story for UNH — Q1 2023 earnings season could be a repeat of Q4 2022

Q4 2022 earnings season was better than feared. Q1 2023 cycle is just around the corner. There are three quarterly reports that investors should pay close attention to this week. The most important one is the quarterly report from CITI, which will be released on Monday.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

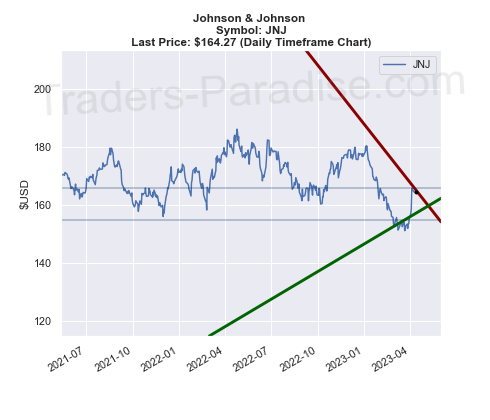

#14 Trading idea on JNJ, might be reaching some kind of top

Company Name: Johnson & Johnson

Symbol: JNJ

Sector: Healthcare

Company Description: Johnson & Johnson was founded in 1886. Its common stock is a component of the Dow Jones Industrial Average. The company is ranked No. 36 on the 2021 Fortune 500 list of the largest U.S. corporations by total revenue. J&J has a prime credit rating of AAA.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JNJ — Vanguard Dividend Appreciation ETF (VIG) is a strong ETF.

Vanguard Dividend Appreciation ETF (VIG) is a strong ETF right now. Smart Beta ETF report for VIG has been updated. vig is an exchange traded fund with a market capitalization of $1.2 billion. It offers investors a variety of investment options.

- News story for JNJ — Top healthcare companies in the U.S. are set to hit $1 trillion market cap.

These businesses show promise and should get much bigger in the future. Which Healthcare Company Will Be the First to Get to a $1 Trillion Market Cap? Let us know in the comment section below. Â. Â y

- News story for JNJ — Check out the latest Portfolio update for your investments.

The DivHut Portfolio Update is scheduled for March 2023. The portfolio update is due on March 20th, 2017. Â “DivHut” is a portfolio management company. It offers portfolio management services.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

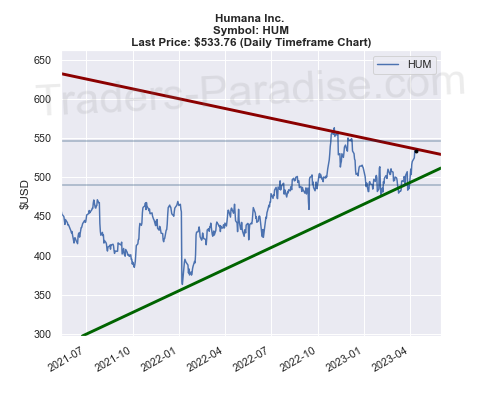

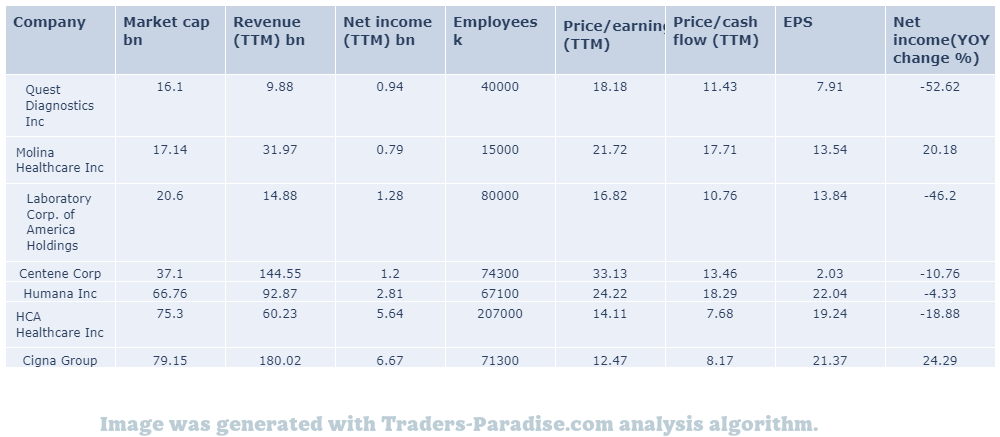

#15 Trading idea on HUM, might be reaching some kind of top

Company Name: Humana Inc.

Symbol: HUM

Sector: Healthcare

Company Description: Humana Inc. is a for-profit American health insurance company based in Louisville, Kentucky. It offers a range of health care insurance plans. It’s one of the largest insurance companies in the United States. It has a market value of $50 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HUM — Humana is up 7.11% in one week, is a top momentum stock

Humana (HUM) is up 7.11% in one week. Humana could be a top stock pick for momentum investors, as it’s up 7% in a week. It’s up to you to decide if Humana is a good investment for you.

- News story for HUM — Companies featured in this week’s Screen of the Week include Marcus, GameStop, AssetMark Financial, Humana and ICF International.

Marcus, GameStop, AssetMark Financial, Humana and ICF International are part of the Zacks Screen of the Week article. Zacks.com featured highlights include Marcus, Gamestop, Asset Mark Financial and Humana as well as ICf International.

- News story for HUM — Shares of Humana closed at $524.56 in recent trading session

of Humana (HUM) closed at $524.56, marking a +0.88% move from the previous day. Humana’s stock market gains (Humana) outpaced stock market gains (Hummans stock market gain).

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.