How to read this report

Every report will start with a short “Market News” section. In this section, we scraped the latest financial news regarding the financial markets. This is a more macro vision of the market. Interest rates, unemployment reports, inflation, oil and energy, earning season, etc.

After the news report section we head to the trading idea section. Every idea is divided into 4 important parts:

-

-

-

- The company and its sector and description

- Recent news about the company

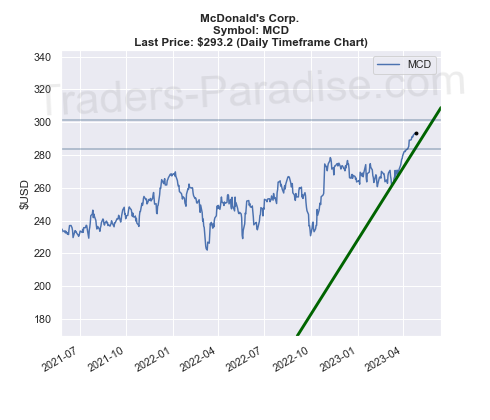

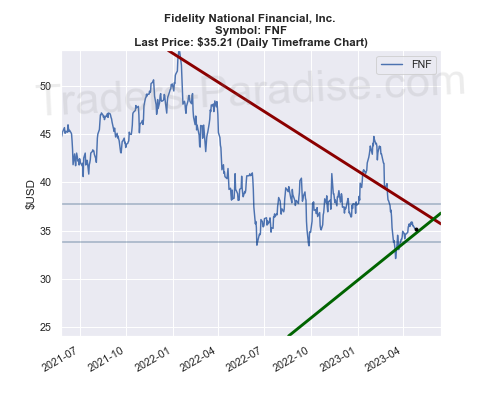

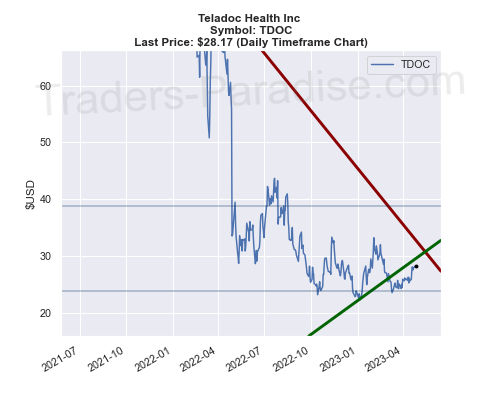

- Chart and its boundary lines

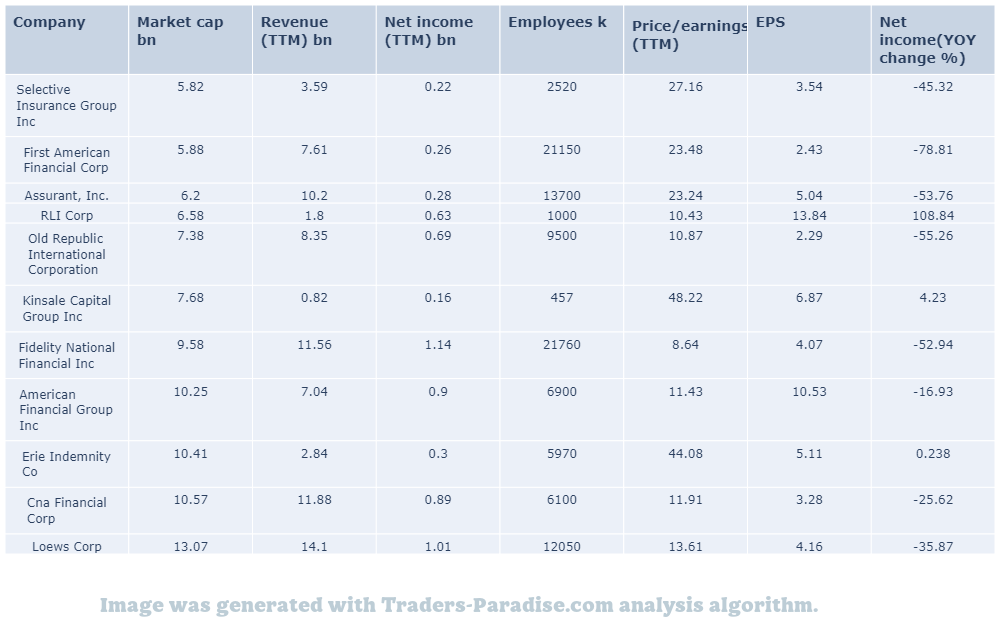

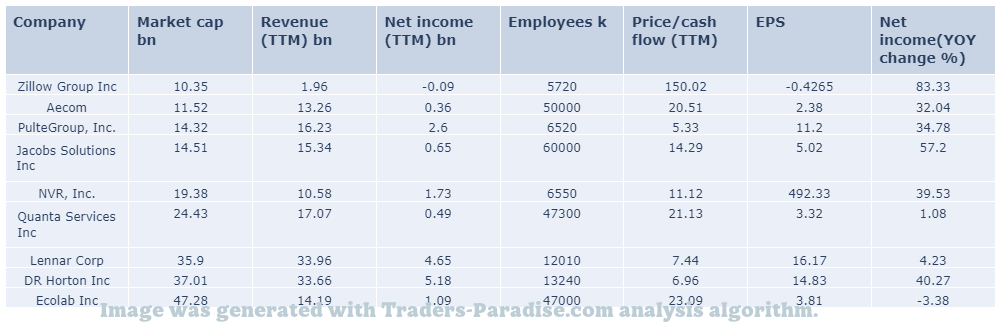

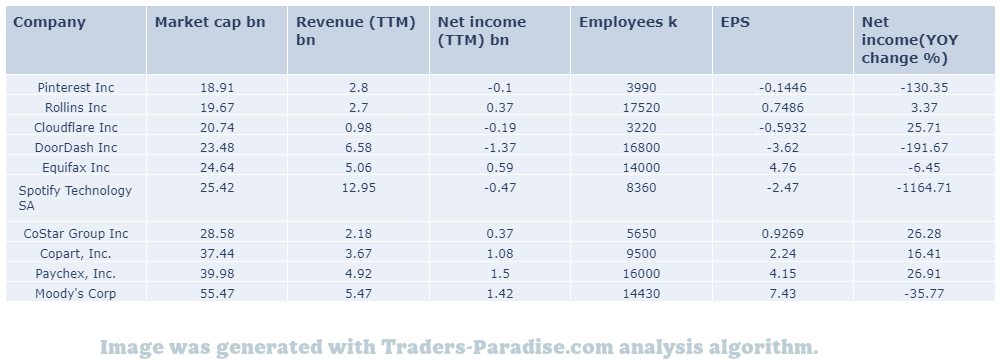

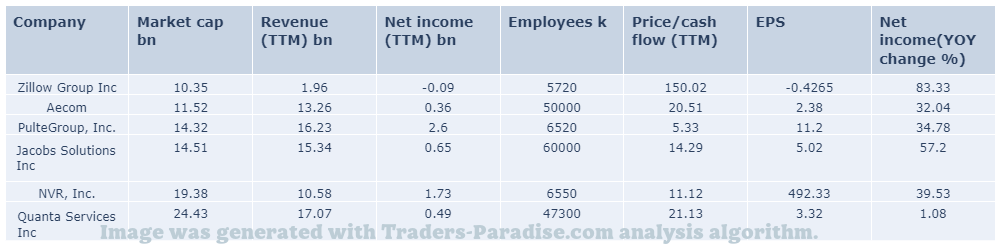

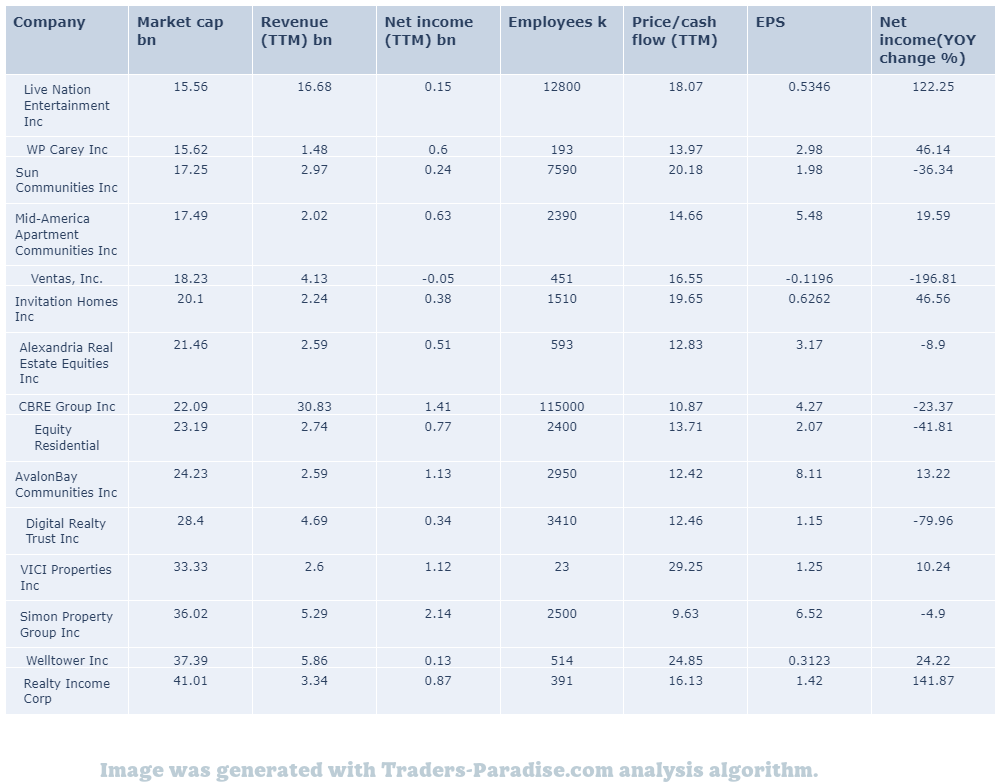

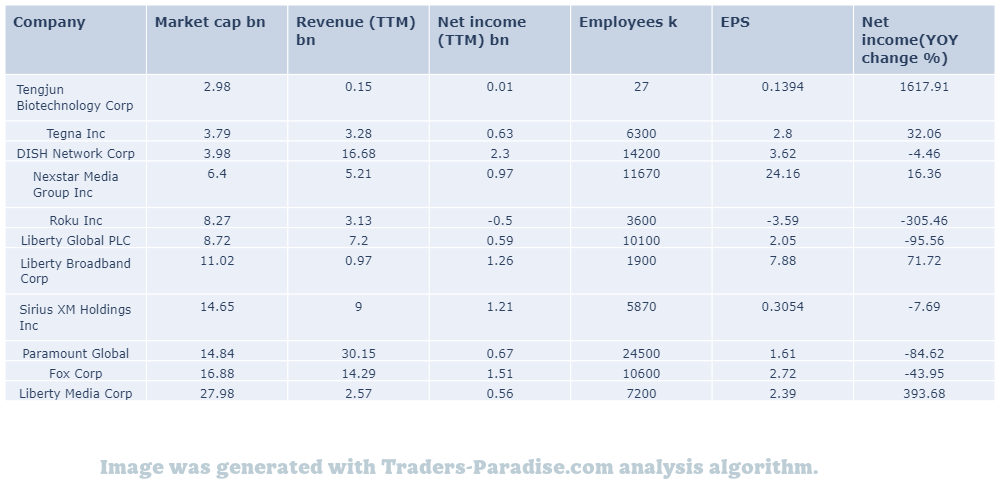

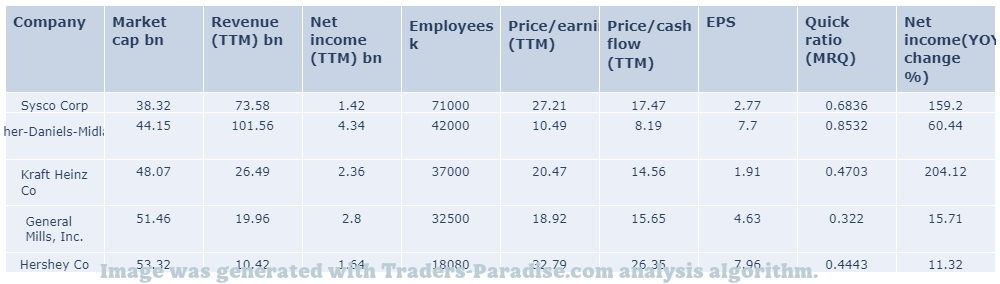

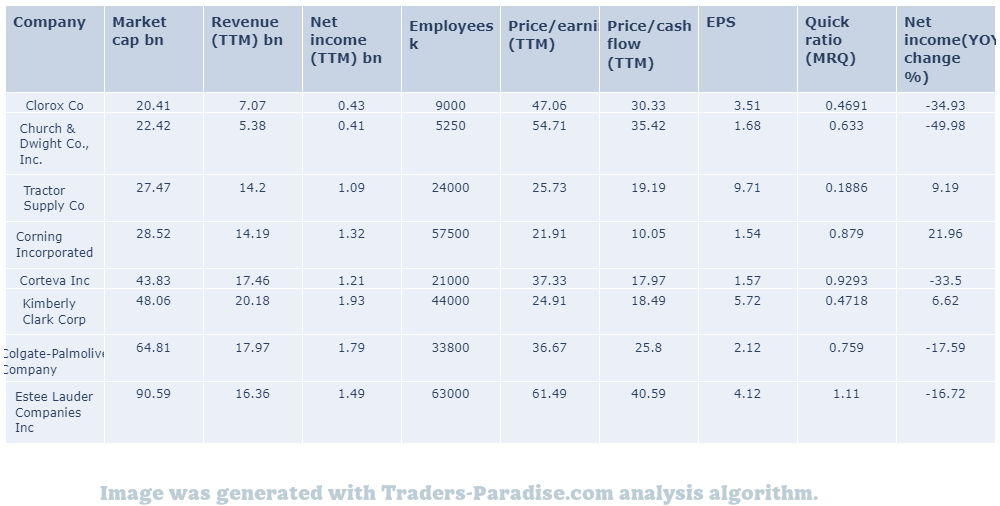

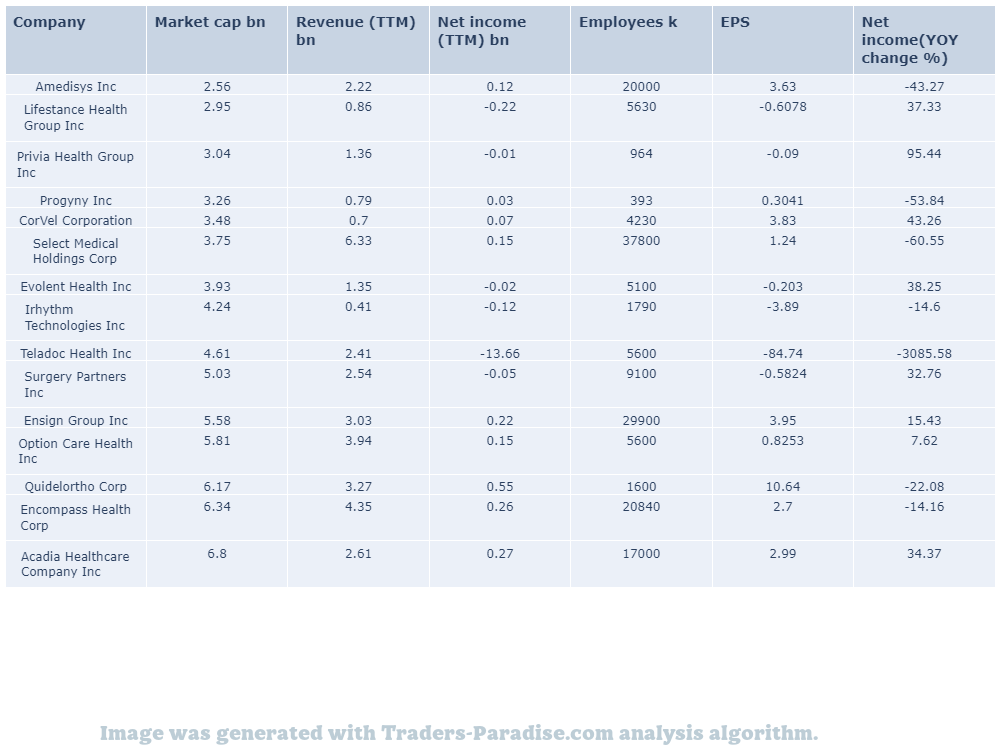

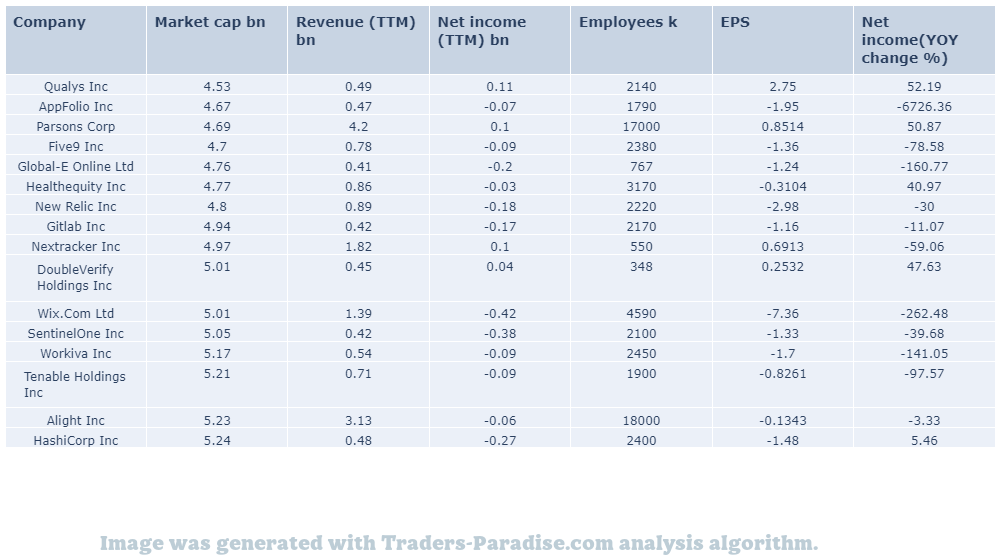

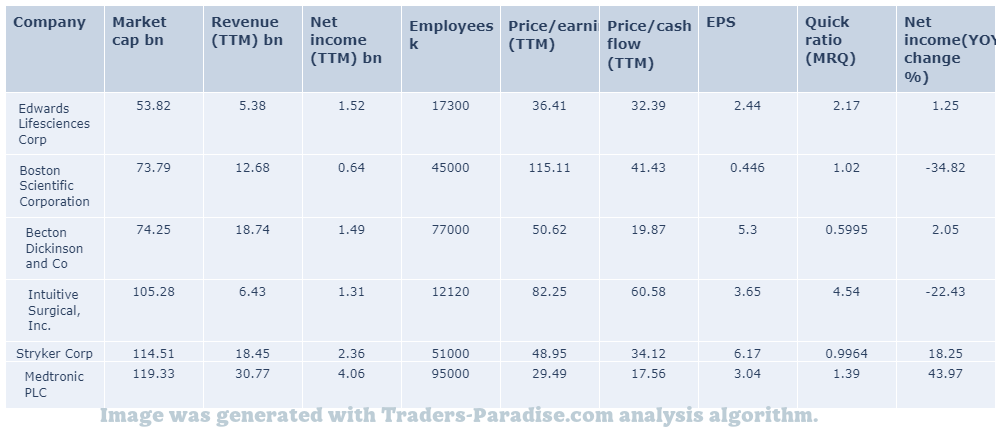

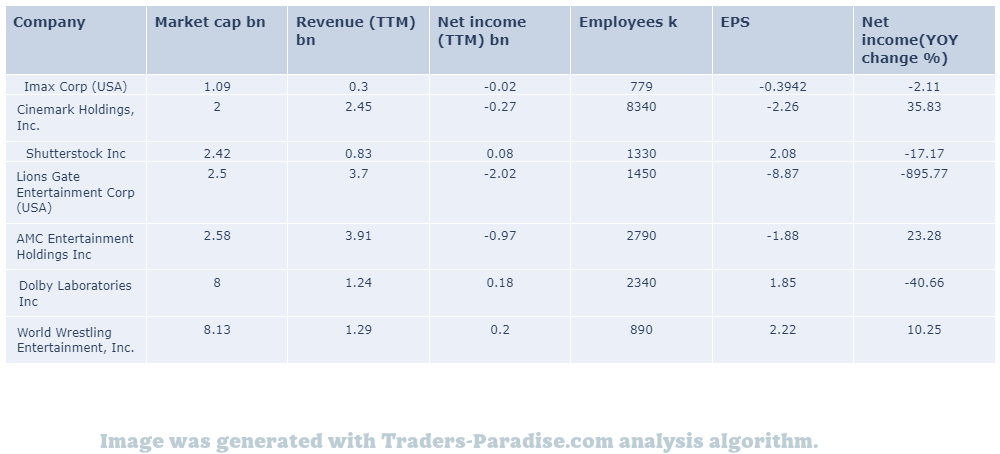

- A table with the company peers and competitors, including their financial and fundamentals.

-

-

A new report will be generated on a daily basis.

Does it work?

In short, yes.

you can read here how we use these methods for our real life trades.

Short declaimer

This report, including all content, is made for educational purposes only. Use on your own risk!

Most recent news about the financial markets

- Equal weight ETF has been an impressive performer.

the Invesco S&P 500 Equal Weight ETF has been an impressive performer when taking bull and bear market cycles into account. It can lower risk and still beat the market overall. It’s a twist on a traditional S&p 500 stock fund.

- Investors should be prepared for another correction.

The market is up so far in 2023, but investors should be prepared in case we see another correction. Where to invest $10,000 in a Bear Market is where to find the best place to do it. For more information, go to: www.cnn.com/investor.

- Check out these 8 stocks that look like bargains for long-term investors.

8 value stocks that look like bargains for long-term investors. Their current valuations are compared with historical averages and they appear to be on sale when compared with their historical averages. They are: Apple (AAPL), Facebook (FB), Microsoft (MSFT), Google (GOOG) and Samsung (SSW).

- Report on Schwab 1000 Index ETF (SCHK)

SCHK is an exchange traded fund. Schwab 1000 Index Exchange-Traded Fund is a style box exchange-traded fund based on Schwab’s stock market index. It has a market cap of $1.2 billion.

- Report on Invesco Russell 1000 Equal Weight ETF (EQAL).

Invesco Russell 1000 Equal Weight ETF (EQAL) should be on your investing radar. Invesco has a Style Box ETF report for EQAL. It’s available on the website. For more information, see the website’s Style Box report.

- GUSA is a passively managed equity ETF.

Goldman Sachs MarketBeta U.S. 1000 Equity ETF (GUSA) should be on your Investing Radar? Style Box ETF report for GUSA is available on the website of the Goldman Sachs Market Beta US 1000 Equity Fund. It is a style box exchange-traded fund.

- Mike Wilson sees near-term threat to stock prices. S&P 500, Nasdaq have rallied since March lows

Morgan Stanley’s chief U.S. equity strategist and chief investment officer Mike Wilson warns that U.s. equities are likely to witness a short-term blow due to the risks of further Federal Reserve rate hikes and declining corporate earnings. The S&P 500 index has rallied 7% since mid-March, while the tech-heavy Nasdaq 100 has risen nearly 10%.

#1 Trading idea on MCD

Company Name: McDonald’s Corp.

Symbol: MCD

Sector: Services

Company Description: Richard and Maurice McDonald started a hamburger stand in San Bernardino, California in 1940. They later turned the business into a franchise. The Golden Arches logo was introduced in 1953 at a location in Phoenix, Arizona. McDonald’s Corporation is an American fast food company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MCD — Fund managers have held Microsoft stock since it was $5 a share.

Buffalo Growth Fund’s co-managers have held Microsoft stock since it was $5 a share. They explain to MarketWatch their longstanding faith in some of tech’s biggest names and offer a couple of new stock ideas for their portfolio. They also share some of their lesser-known tech picks.

- News story for MCD — Investors remain cautious ahead of earnings season.

U.S. stock futures dip as investors eye big-tech earnings. Investors are cautious ahead of a batch of company earnings and looming economic data that may color the Federal Reserve’s thinking. The market is also awaiting the release of the next round of economic data, which is due in two weeks.

- News story for MCD — First Republic reported better-than-expected results, but loan growth continues to slow.

First Republic had a -40.8% deposit loss in Q1. Whirlpool performed better than First Republic. First Republic’s issues are not affecting the entire banking industry. Â iReport.com: First Republic Beats on Deposits.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#2 Trading idea on FNF

Company Name: Fidelity National Financial, Inc.

Symbol: FNF

Sector: Financial

Company Description: Fidelity National Financial offers various insurance products in the United States. The company is headquartered in Jacksonville, Florida and offers insurance products. It offers different types of insurance products, including life insurance and annuities. It’s a private company with a primary focus on Florida.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FNF — SEC chief wants retail orders to be auctioned off. Questions remain on ultimate impact of reforms

Gensler’s meme-stock reforms are meant to help retail traders, but some investor protection advocates aren’t so sure. SEC chief wants retail stock orders to be auctioned off to market makers and exchanges, but questions remain as to the ultimate impact of these reforms.

- News story for FNF — Financial stocks with RSI near or below 30 are considered oversold.

The most oversold stocks in the financial sector presents an opportunity to buy into undervalued companies. First Guaranty Bancshares Inc (NASDAQ: FGBI) is one of the most undervalued stocks in this sector with an RSI near or below 30.

- News story for FNF — Q4 earnings miss on title volume decline, higher average fee per file.

Fidelity National’s Q4 results reflect significant decline in volume, partially offset by a higher average fee per file. FNF missed Q4 earnings expectations. The company reported a decline in title volume, but a rise in the average fee for files.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#3 Trading idea on ECL

Company Name: Ecolab Inc.

Symbol: ECL

Sector: Consumer Goods

Company Description: Ecolab is an American corporation that develops and offers services, technology and systems that specialize in water treatment, purification, cleaning and hygiene in a wide variety of applications. It helps organizations both private market and public treat their water, not only for drinking directly, but also for use in food, healthcare, hospitality related safety and industry.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ECL — Report on Invesco Water Resources ETF.

The Invesco Water Resources ETF (PHO) is a sector-based exchange-traded fund (ETF) that tracks the water resources sector. It’s available on the iShares Select Water Resources Select Sector Exchange-Traded Fund (NYSE:PHO).

- News story for ECL — First Trust Water ETF (FIW) is a sector ETF in the S&P 500.

First Trust Water ETF (FIW) is a sector exchange traded fund (ETF) that tracks the First Trust Water Index. The index is based on a sector report for water exchange traded funds (ETFs) and has a market value of $1.1 billion.

- News story for ECL — 7 analysts have a positive view on the stock.

7 analysts have an average price target of $169.86 for Ecolab (NYSE:ECL). The current share price is $163.27. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#4 Trading idea on ARE

Company Name: Alexandria Real Estate Equities, Inc.

Symbol: ARE

Sector: Financial

Company Description: Alexandria Real Estate Equities, Inc. is an American real estate investment trust. It invests in office buildings and laboratories leased to tenants in the life science and technology industries. It is based in Washington, D.C. It has a market value of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ARE — FFO and revenue beat analysts’ expectations.

Alexandria Real Estate Equities delivered FFO and revenue surprises of 1.86% and 3.08%, respectively, for the quarter ended March 2023, beating the estimates. The company is expected to report positive results for the next three months.

- News story for ARE — Analysts are typically employed by large Wall Street banks and tasked with understanding a company’s business.

6 Wall Street analysts have published their opinion on Alexandria Real Estate (NYSE:ARE) stock in the last 3 months. The average price target of the 6 analysts is $166.67 with a high of $180.00 and a low of $144.00.

- News story for ARE — Why did you stop buying rental properties?

I Stopped Buying Rental Properties To Buy REITs instead and now I’m looking for opportunities to invest in REIT shares. . “I stopped buying rental properties to buy REIT’s instead” i

TECHNICAL ANALYSIS

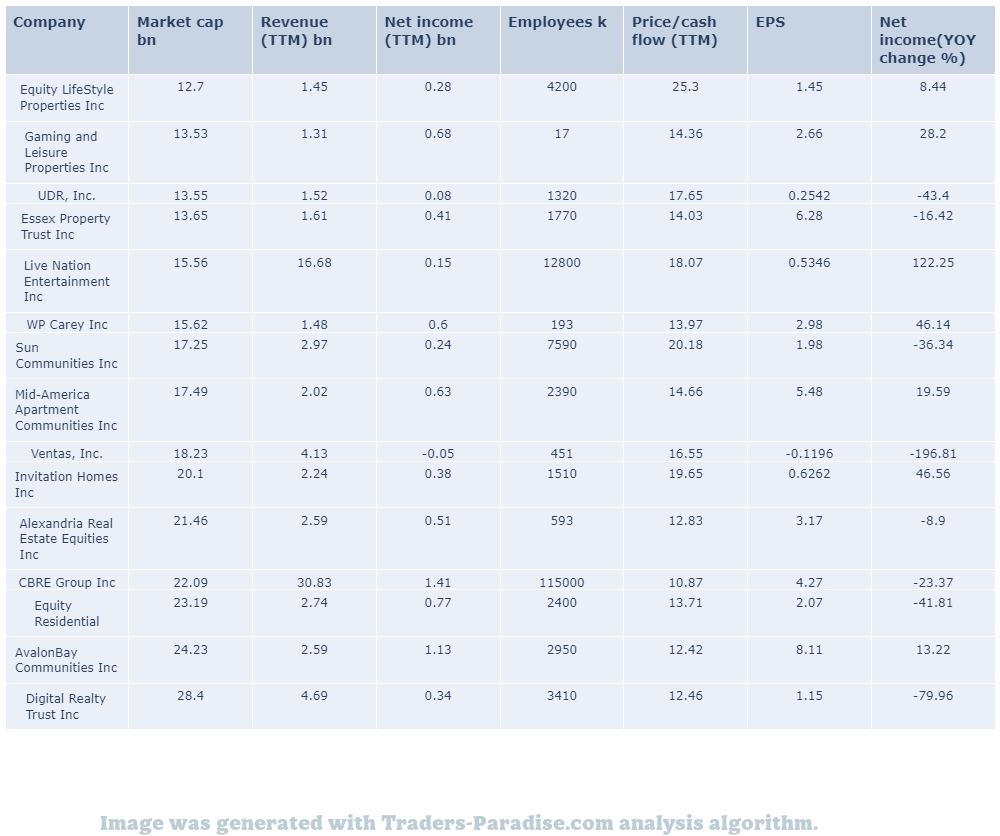

PEERS AND FUNDAMENTALS

#5 Trading idea on WMT

Company Name: Wal-Mart Stores Inc.

Symbol: WMT

Sector: Services

Company Description: Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores from the United States. It also owns and operates Sam’s Club retail warehouses. It is headquartered in Bentonville, Arkansas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WMT — Companies across the retail spectrum could benefit from the retailer’s demise.

Bed Bath & Beyond is going bankrupt. A number of companies could benefit from the demise of the retail giant, including Amazon, Walmart, and Gap, among other companies. i.e. they could be able to benefit from its demise.

- News story for WMT — Weekly take on mergers and acquisitions in the technology sector.

Walmart, Chevron, Danaher, Intel and Lowe’s are included in the Analyst Blog. The Blog highlights the highlights of Walmart, Chevron and Danaher and highlights the company’s financial performance. The blog is available on the Zacks Analyst Blog site.

- News story for WMT — Costco and Target trading at attractive valuations.

Costco (COST) and Target (TGT) are retail powerhouses trading at attractive long-term entry points as tech gets a bit overheated. The two stocks we dig into today are Costco and Target. They are retail stocks to buy for the upside as the Tech Rally Slows.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

#6 Trading idea on GPN

Company Name: Global Payments Inc.

Symbol: GPN

Sector: Services

Company Description: Global Payments Inc. is an American company providing financial technology services globally headquartered in Atlanta, Georgia. Global Payments is a provider of payment technology services. . for more information, visit globalpaymentsinc.com or call 1-800-273-8255.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GPN — Expected growth in revenue, cost of goods sold to drive earnings.

Global Payments’ earnings are expected to grow next week. Global Payments doesn’t possess the right combination of the two key ingredients for a likely earnings beat. Get prepared with the key expectations ahead of the release. Â .

TECHNICAL ANALYSIS

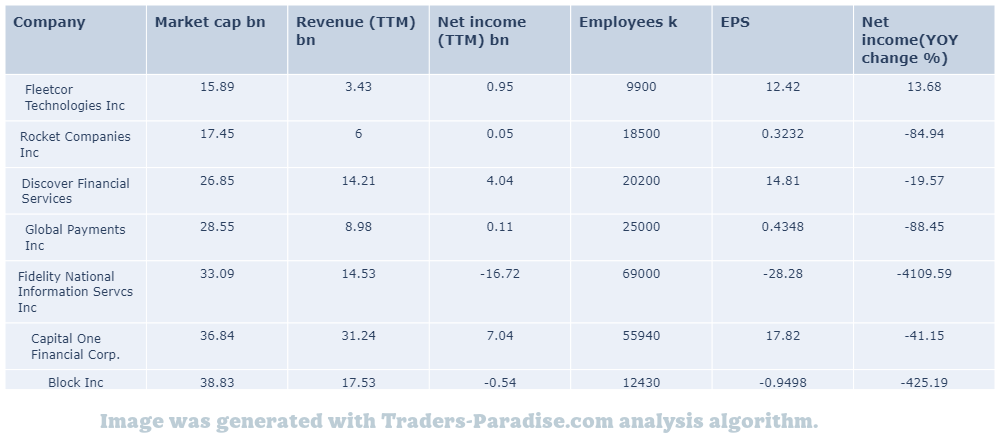

PEERS AND FUNDAMENTALS

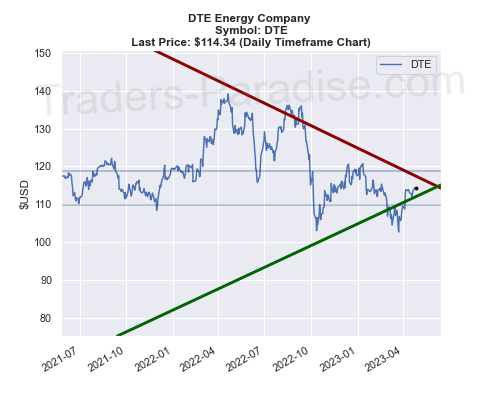

#7 Trading idea on DTE

Company Name: DTE Energy Company

Symbol: DTE

Sector: Utilities

Company Description: DTE Energy is a diversified energy company based in Detroit. It was formerly known as Detroit Edison until 1996. It is involved in the development and management of energy-related businesses and services in the U.S. and Canada. DTE Energy has operations in the following countries:

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DTE — DTE Energy has an impressive earnings surprise history.

DTE Energy (DTE) has an impressive earnings surprise history. DTE Energy possesses the right combination of the two key ingredients for a likely beat in its next quarterly report. Dte Energy is expected to beat earnings estimates again. for the quarter ending March 31st.

- News story for DTE — Utility giant DTE Energy is set to report its first-quarter results on Oct. 26.

DTE Energy (DTE) is expected to beat earnings estimates. DTE Energy possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for DTE’s upcoming report and follow this link for more information.

- News story for DTE — First quarter 2023 earnings release, conference call scheduled for Thursday, April 27, 2023.

DTE Energy schedules first quarter 2023 earnings release and conference call for April 13, 2023. The company will announce before the market opens on Thursday, April 27th 2023 and release the results before the public on April 13th, 20th.

TECHNICAL ANALYSIS

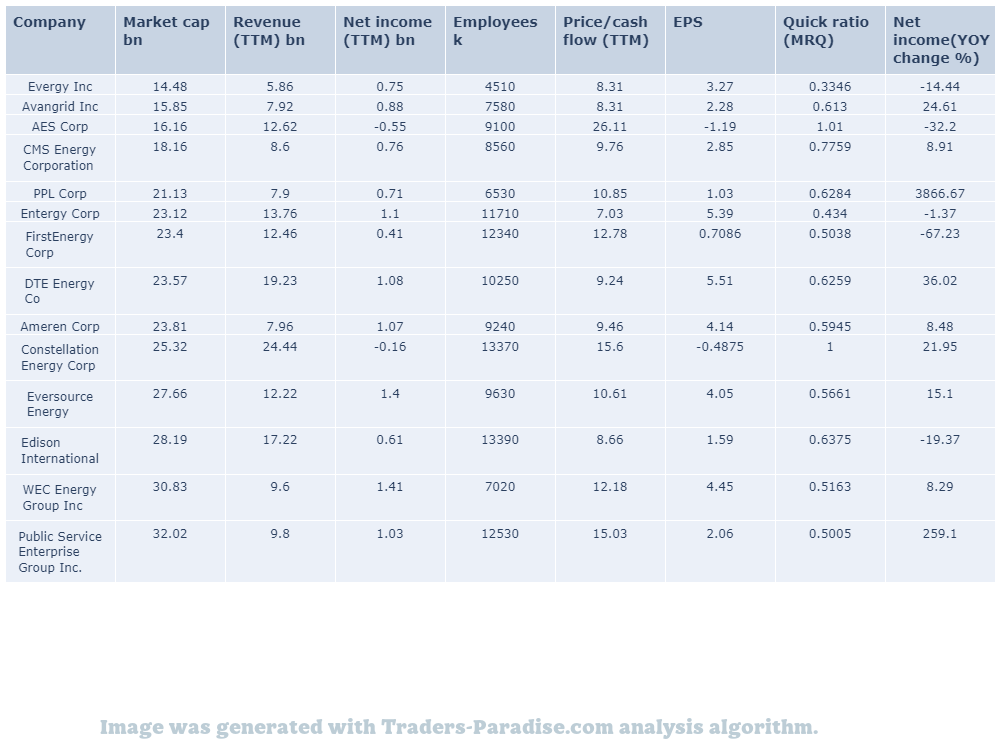

PEERS AND FUNDAMENTALS

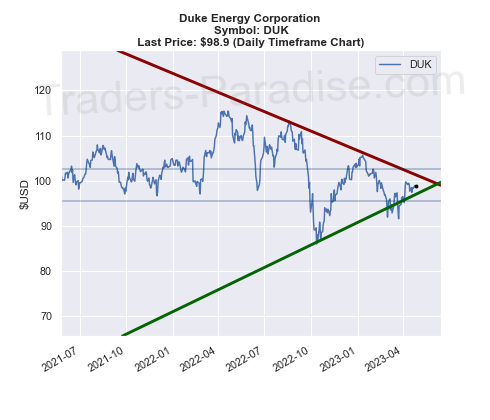

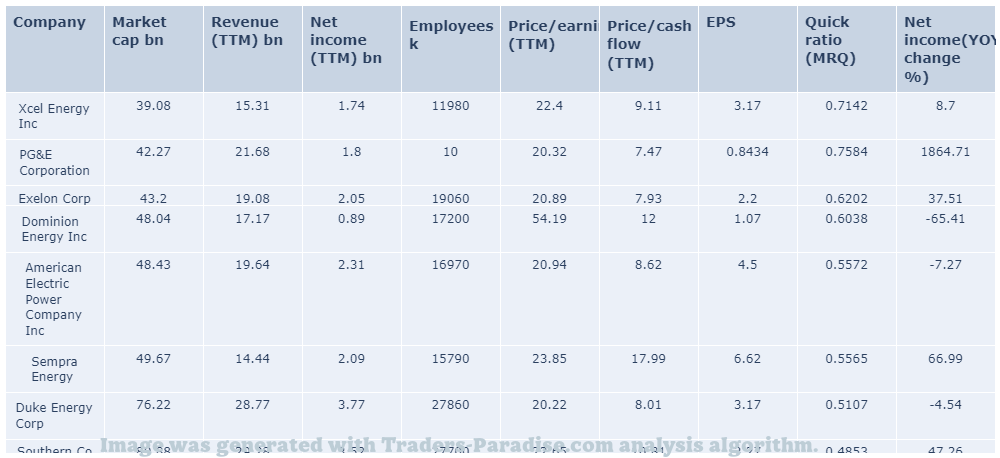

#8 Trading idea on DUK

Company Name: Duke Energy Corporation

Symbol: DUK

Sector: Utilities

Company Description: Duke Energy Corporation is an American electric power and natural gas holding company headquartered in Charlotte, North Carolina. It owns the Duke Energy and Carolina Power and Light Company. It also owns the Carolina Natural Gas Company. Its stock is trading on the New York Stock Exchange.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DUK — Fidelity MSCI Utilities Index ETF (FUTY) is a passively managed fund.

The Fidelity MSCI Utilities Index ETF (FUTY) is a sector-based exchange-traded fund (ETF) that tracks a sector index. FUTY’s sector index is the FTSE Nifty-Fifty Utilities Index.

- News story for DUK — Analysts have a mean recommendation of 1.83 on the stock.

7 analysts have published their opinion on Duke Energy (NYSE:DUK) stock over the past 3 months. According to 7 analyst offering 12-month price targets in the last 3 months, Duke Energy has an average price target of $106.86 with a high of $113.00 and a low of $111.00.

- News story for DUK — Duke Energy (DUK)

. Duke Energy (DUK) closed at $98.40 in the latest trading session, marking a +1.02% move from the prior day. for the market dips. for Duke Energy. For the market dips.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

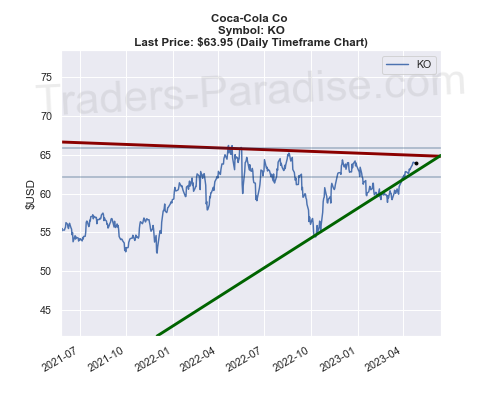

#9 Trading idea on KO

Company Name: Coca-Cola Co

Symbol: KO

Sector: Industrial Goods

Company Description: The Coca-Cola Company is an American multinational beverage corporation incorporated under Delaware’s General Corporation Law and headquartered in Atlanta, Georgia. It has interests in the manufacturing, retailing, and marketing of nonalcoholic beverage concentrates and syrups, and in the production of sodas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KO — Coca-Cola sees FY23 organic revenue growth of 7%-8%, comparable currency neutral EPS growth.

Coca-Cola reported first-quarter FY23 sales growth of 5% year-on-year to $10.98 billion. Adjusted EPS of $0.68 beat the analyst consensus of $ 0.64. Coca-Cola continues to see FY23 organic revenue growth of 7%-8%, comparable currency neutral EPS growth.

- News story for KO — Pricing jump, volume growth return to growth.

Coca-Cola beats earnings forecast as pricing jumps 11% and volume grows again. The company’s stock rose on Monday after the results were announced. It beat expectations as pricing jumped 11%, and unit-case volume returned to growth. The stock rose 1.5%.

- News story for KO — Warren Buffett’s investment company could be worth $1 trillion.

Warren Buffett’s Berkshire could join Apple, Microsoft, Alphabet, and Amazon in the $1 Trillion Club. . for Warren Buffett’s investment company, Berkshire Hathaway, is marching his investment company into the stock market’s most exclusive club.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

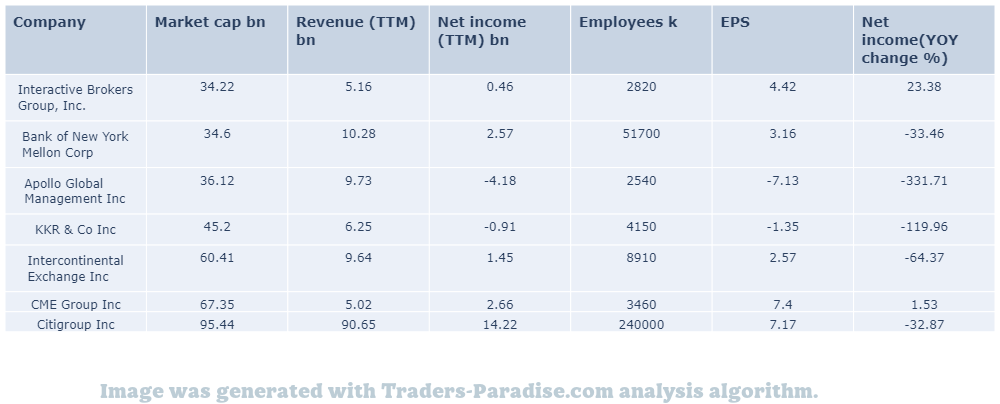

#10 Trading idea on CME

Company Name: CME Group Inc.

Symbol: CME

Sector: Financial

Company Description: CME Group Inc. is an American global markets company. It is the world’s largest financial derivatives exchange. It trades in asset classes that include agricultural products, currencies, energy, interest rates, metals, stock indexes and cryptocurrencies futures. It also operates Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantil Exchange and The Commodity Exchange.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CME — Earnings are likely to have been aided by improved clearing, transaction fees and other revenues.

CME Group’s (CME) Q1 earnings are likely to have been aided by improved clearing, transaction fees and other revenues, and market data and information services. CME Group is expected to report its Q1 results on May 9th.

- News story for CME — Shares of ICICI Bank, HDFC, State Bank of India have shown relative strength.

Finance-related stocks have come under pressure following banking concerns. However, all three of these have displayed relative strength and are still relevant. – The Relative Strength of These 3 Finance Stocks is important to keep a close eye on them.

- News story for CME — Shares of CME Group have more than doubled in 10 years.

A $1000 investment in CME Group 10 years ago would be worth $1000 today. Investing in certain stocks can pay off in the long run if you hold on for a decade or more. CME is one of the most valuable stocks in the world today.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#11 Trading idea on AKAM

Company Name: Akamai Technologies, Inc.

Symbol: AKAM

Sector: Technology

Company Description: Akamai Technologies, Inc. is a global content delivery network (CDN), cybersecurity, and cloud service company. It provides web and Internet security services. It’s a provider of CDN, Cybersecurity, and Cloud Service. It is headquartered in San Francisco.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AKAM — Directors have been buying shares recently.

Insiders bought 5,000 shares of Delta Air Lines, Inc. (NYSE: DAL) on Tuesday at an average price of $24.50. For more information on Benzinga’s insider transactions platform, check out the platform.

- News story for AKAM — Cloud stocks are in the spotlight as Amazon dominates.

Amazon is the king of the cloud, but its way isn’t the only way. There are two cloud stocks that are challenging Amazon’s dominance. They are: Amazon.com and CloudMe.com. iReport: Share your thoughts on these cloud stocks.

- News story for AKAM — Akamai Techs has an average price target of $88.0.

Akamai Techs (NASDAQ:AKAM) has observed the following analyst ratings within the last quarter: “Bullish”, “Somewhat Bullish,” “Indifferent” and “Bearish”. 6 analysts have an average price target of $88.0 versus the current price of $79.39.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

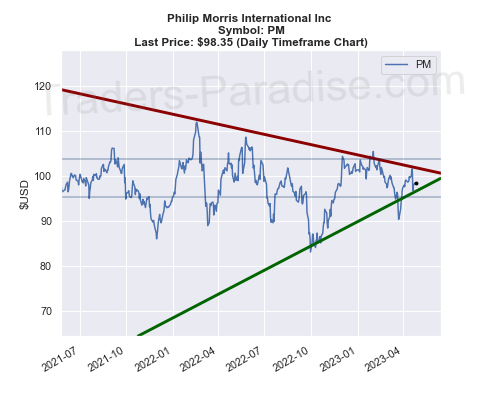

#12 Trading idea on PM

Company Name: Philip Morris International Inc

Symbol: PM

Sector: Industrial Goods

Company Description: Philip Morris International Inc. is a Swiss-American multinational cigarette and tobacco manufacturing company with products sold in over 180 countries. The most recognized and best selling product of the company is Marlboro. PMI’s products are sold in all the world’s major markets.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PM — Analysts expect strong performance from Packaged Beverages.

Pepperidge’s (KDP) Q1 earnings. Packaged Beverages and strong in-market performances are likely to have aided Keurig Dr Pepper’s Q1 performance. Inflation has been concerning. In general, the company’s performance has been good.

- News story for PM — Here is what you need to know about the company.

Philip Morris International Inc. (PM) has received a lot of attention from Zacks users lately. It is wise to be aware of the facts that can impact the stock’s prospects, as well as the risks associated with the company’s business. Zacks recommends investors to look for Philip Morris on the market.

- News story for PM — Wall Street’s most accurate analysts rate these stocks.

The most accurate Wall Street analysts recommend Altria Group, Inc. (NYSE:MO) and Philip Morris International (NYSEMKT:PM) as high-yielding stocks in the consumer staples sector with over 3% dividend yields. Benzinga readers can review the latest analyst takes on their favorite stocks.

TECHNICAL ANALYSIS

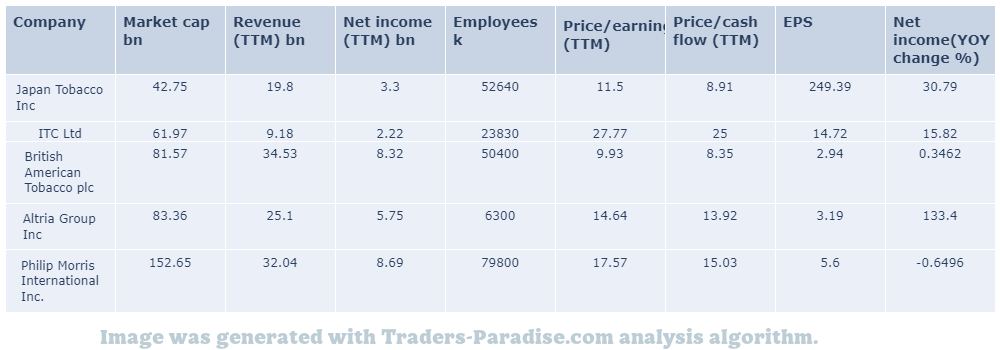

PEERS AND FUNDAMENTALS

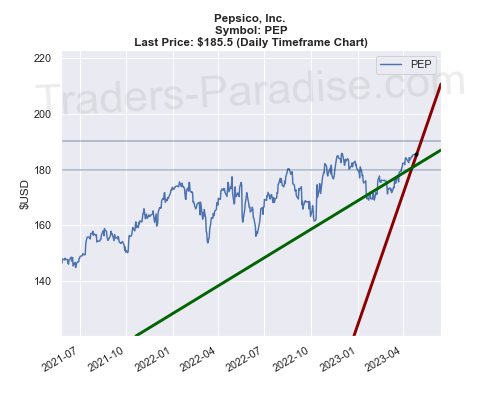

#13 Trading idea on PEP

Company Name: Pepsico, Inc.

Symbol: PEP

Sector: Consumer Goods

Company Description: PepsiCo, Inc. is an American based multinational food, snack, and beverage corporation headquartered in Harrison, New York, in the hamlet of Purchase. It oversees the manufacturing, distribution, and marketing of its products. Its business encompasses all aspects of the food and beverage market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PEP — PepsiCo has an average analyst price target of $191.9.

In the last 3 months, 10 analysts have offered 12-month price targets for PepsiCo. The company has an average price target of $191.9 with a high of $205.00 and a low of $180.00. Expert Ratings for Pepsico are as follows: Bullish, Somewhat Bullish and Bearish.

- News story for PEP — Investors remain cautious ahead of earnings season.

U.S. stock futures dip as investors eye big-tech earnings. Investors are cautious ahead of a batch of company earnings and looming economic data that may color the Federal Reserve’s thinking. The market is also awaiting the release of the next round of economic data, which is due in two weeks.

- News story for PEP — First Republic reported better-than-expected results, but loan growth continues to slow.

First Republic had a -40.8% deposit loss in Q1. Whirlpool performed better than First Republic. First Republic’s issues are not affecting the entire banking industry. Â iReport.com: First Republic Beats on Deposits.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

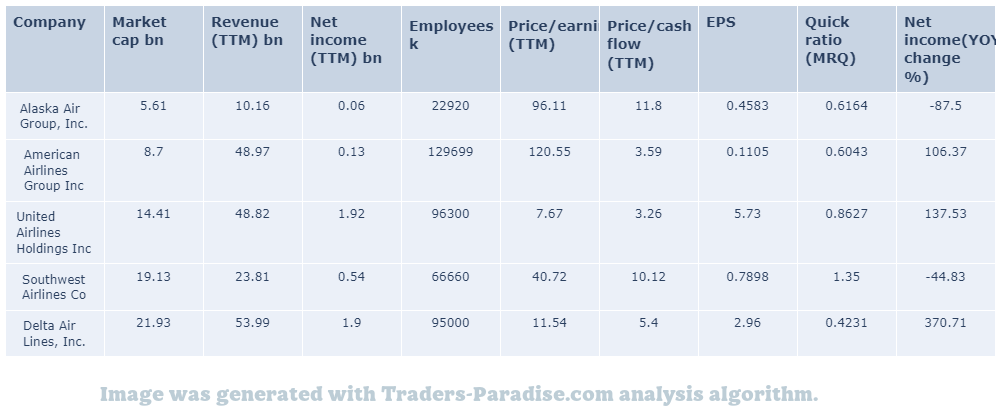

#14 Trading idea on LUV

Company Name: Southwest Airlines Co.

Symbol: LUV

Sector: Services

Company Description: Southwest Airlines is one of the major airlines of the United States and the world’s largest low-cost carrier airline. It is headquartered in Dallas, Texas. It’s also known as Southwest Airlines Co., typically referred to as Southwest Airline Co., or simply Southwest.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for LUV — Airbnb, T. Rowe Price among stocks to watch this week.

Airbnb and T. Rowe Price are two stocks worth watching. Wall Street Headlines and a Closer Look at the Business of Movies are also included in the list of topics discussed today on CNN.com’s “This is What’s Up With That?” show.

- News story for LUV — First-quarter 2023 revenues are expected to have benefited from growth in air-travel demand. Rising expenses are likely to have weighed on the bottom line

Rising expenses are likely to have weighed on the bottom line for Southwest Airlines (LUV) in Q1 Earnings. First-quarter 2023 revenues are expected to have benefited from growth in air-travel demand, while expenses will have been higher.

- News story for LUV — 1 Stock to Buy, 1 Stock to Sell This Week: McDonald’s, Intel

McDonald’s and Intel are the stocks to buy and sell this week. McDonald’’s is the one stock to buy. Intel is the stock to sell. Â . For confidential support call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch or click here.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

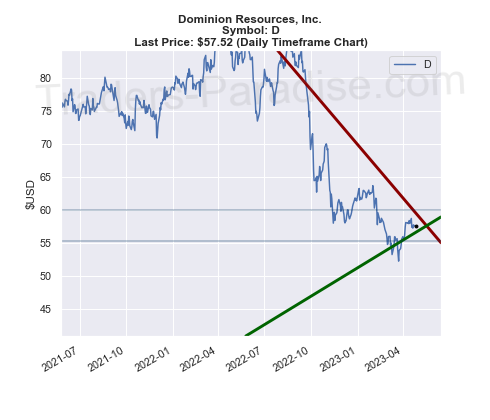

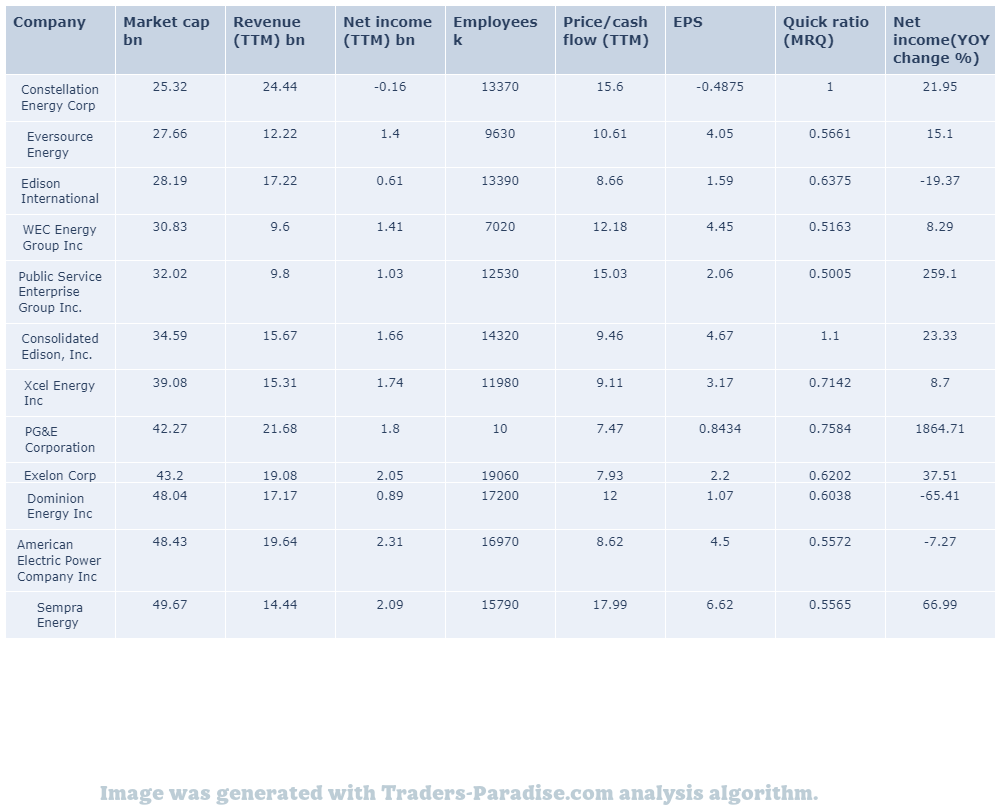

#15 Trading idea on D

Company Name: Dominion Resources, Inc.

Symbol: D

Sector: Utilities

Company Description: Dominion Energy supplies electricity in Virginia, North Carolina, and South Carolina and natural gas to parts of Utah, West Virginia, Ohio, Pennsylvania and North Carolina. Dominion also has generation facilities in Indiana, Illinois, Connecticut and Rhode Island. Dominion Energy is headquartered in Richmond, Virginia.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for D — Shares of Dominion Energy closed at $57.43 in recent trading session

the previous day. Dominion Energy (D) closed at $57.43, marking a +0.12% move from the previous trading session, and +1.3% gain from previous day, and -1.5% gain on previous trading day.

- News story for D — Wall Street’s most accurate analysts rate these stocks.

Dominion Energy, Dominion Energy and Dominion Resources are high-yielding utilities stocks with over 4% dividend yields. The most accurate Wall Street analysts recommend them to investors. Benzinga readers can review the latest analyst takes on their favorite stocks by visiting the Analyst Stock Ratings page.

- News story for D — 14 analysts have a positive view on the stock.

14 analysts have an average price target of $63.07 for Dominion Energy. The current price of Dominion Energy is $57.905. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the upside potential of the stock.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

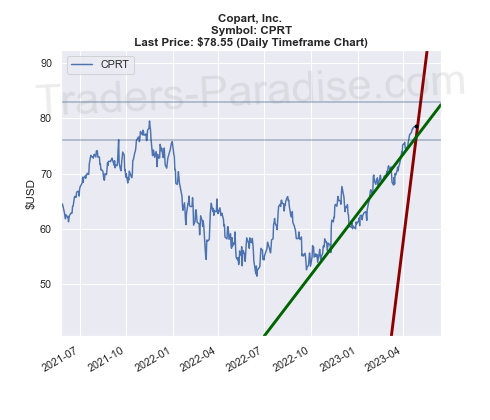

#16 Trading idea on CPRT

Company Name: Copart, Inc.

Symbol: CPRT

Sector: Services

Company Description: Copart is a global provider of online vehicle auction and remarketing services to automotive resellers. Copart offers its services in 11 countries: the US, Canada, the UK, Germany, Ireland, Brazil, Spain, Dubai, Bahrain, Oman and Finland.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CPRT — Fund managers have held Microsoft stock since it was $5 a share.

Buffalo Growth Fund’s co-managers have held Microsoft stock since it was $5 a share. They explain to MarketWatch their longstanding faith in some of tech’s biggest names and offer a couple of new stock ideas for their portfolio. They also share some of their lesser-known tech picks.

- News story for CPRT — Copart, Inc. (CPRT) has performed in similar fashion to the Business Services sector

Copart, Inc. (CPRT) and Duolingo, Inc (DUOL) have performed compared to their sector so far this year. Business Services Stocks Are Lagging Copart and duolingo this year, according to Barron’s.

- News story for CPRT — Earnings surprise history shows that stocks with better-than-expected earnings tend to outperform.

Copart, Inc. (CPRT) reported earnings 30 days ago. The stock is up 3.1% since the last report. The company is expected to report earnings on July 25th. The market is expecting a positive report.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

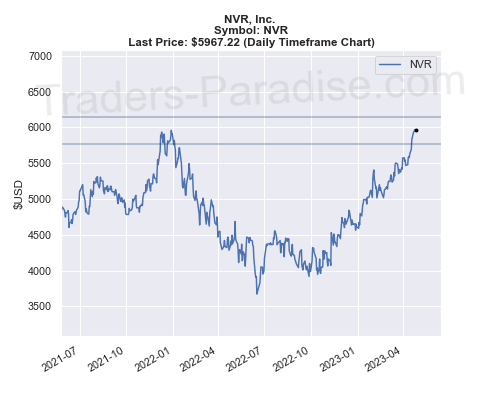

#17 Trading idea on NVR

Company Name: NVR, Inc.

Symbol: NVR

Sector: Industrial Goods

Company Description: NVR, Inc. is engaged in home construction and mortgage banking and title services. The company operates on the East Coast of the United States. It is mainly based in New York City and has offices in New Jersey and Boston.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for NVR — S&P 500 is up more than 4% this week, outperforming the FTSE 100.

NVR is going to report Q1 earnings soon. The company is benefiting from a solid business model. However, moderate housing demand is concerning, as NVR reports. NVR will report its earnings on April 25th. Â

- News story for NVR — ToL or: Which Is the Better Value Stock Right Now?

TOL vs. NVR is a question about which is the better value stock right now. TOL and NVR are discussing it here. For more information, go to: http://www.tol.com/news/investors/tol-and-nvr-question-about-the-better-value-stock.

- News story for NVR — Earnings and revenue beat estimates on higher sales.

D.R. Horton beat Q2 earnings and revenue estimates by 43.68% and 21.58%, respectively for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock? Shareholders should keep an eye on the news.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#18 Trading idea on DLR

Company Name: Digital Realty Trust Inc.

Symbol: DLR

Sector: Financial

Company Description: Digital Realty Trust, Inc. is a real estate investment trust that invests in carrier-neutral data centers and provides colocation and peering services. It is based in New York City. It has a portfolio of real estate investments in data centers, colocation centers, and data centers.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DLR — Oplysningerne fremgr af vedhftede fil.

DLR Kredit A/S corrected Ydelsesrækker (CK94) pr. 31.03.2023. Oplysningerne fremgår af vedhæftede fil for the replacement of previous correction.

- News story for DLR — Solid data-center demand amid enterprises’ growing reliance on technology.

Digital Realty’s (DLR’s) Q1 earnings might have been better than expected. Data-center demand and acceleration in digital transformation strategies might have helped the company’s Q1 results. Digital Realty is a real estate investment trust that focuses on data centers.

- News story for DLR — Data center owners should be prepared for the rise of artificial intelligence.

AI uses a lot of data, which bodes well for data center owners. AI is going to increase the need for this real estate business. Â i.e. it’s going to make it easier to sell real estate.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#19 Trading idea on PCAR

Company Name: PACCAR Inc.

Symbol: PCAR

Sector: Consumer Goods

Company Description: PACCAR is an American Fortune 500 company. It designs, manufactures and supports light-, medium- and heavy-duty trucks under the Kenworth, Peterbilt, Leyland Trucks, and DAF nameplates. It also designs and manufactures powertrains, provides financial services and information technology, and distributes truck parts related to its principal business.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PCAR — Shares of Paccar closed at $73.15 in recent trading session

Paccar (PCAR) closed the most recent trading day at $73.15, moving +0.79% from the previous trading session. Paccar Outpaces Stock Market Gains: What You Should Know. Paccars shares are up 0.79%.

- News story for PCAR — Paccar has beaten estimates in each of the last four quarters.

Paccar (PCAR) has an impressive earnings surprise history. PCAR is expected to beat estimates again in its next quarterly report. Paccar currently possesses the right combination of the two key ingredients for a likely beat in the next quarter report.

- News story for PCAR — Shares of Modine and Paccar are down this year.

Modine Manufacturing (MOD) and Paccar (PCAR) have performed better than other auto-tires-trucks stocks this year compared to their sector so far this year. Modine Manufacturing is a manufacturer of tires and trucks. PCAR is a supplier of trucks.

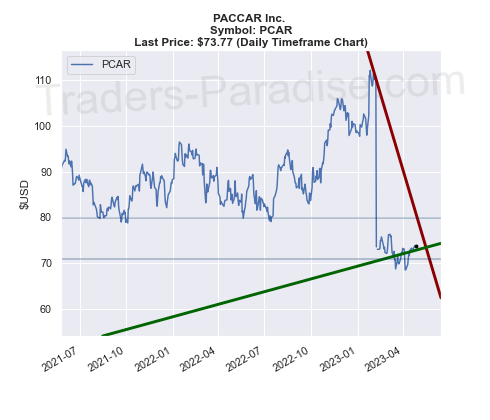

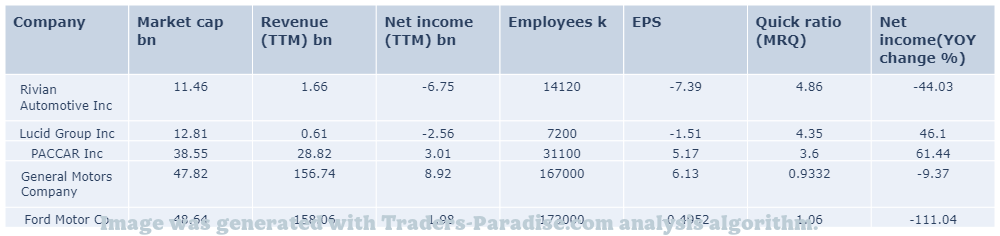

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#20 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Invesco Dynamic Food & Beverage ETF (PBJ) is a passively managed ETF.

Invesco Dynamic Food & Beverage ETF (PBJ) is an exchange-traded fund (ETF) that invests in the food and beverage sector. It tracks Invesco’s Dynamic Food and Beverage Select Sector SPDR (PJ).

- News story for HSY — First-quarter earnings are likely to reflect gains from strategic buyouts. However, impact of global cost inflation and supply chain issues are a concern

Mondelez’s first-quarter 2023 earnings will likely reflect gains from strategic buyouts. However, global cost inflation and supply chain issues are a concern for the company’s future profits. for Mondelez’s Q1 2018 earnings.

- News story for HSY — First-quarter earnings to reflect gains from strategic pricing actions, prudent buyouts.

Hershey’s first-quarter 2023 earnings will reflect gains from strategic pricing actions and prudent buyouts, as well as gains from prudent investments in new products. For confidential support call the Samaritans on 08457 90 90 90 or visit a local Samaritans branch or click here.

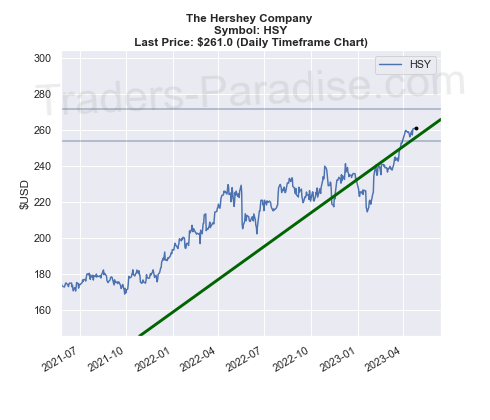

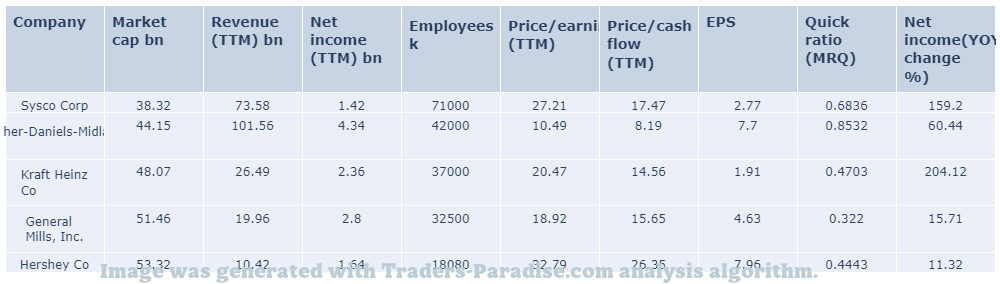

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

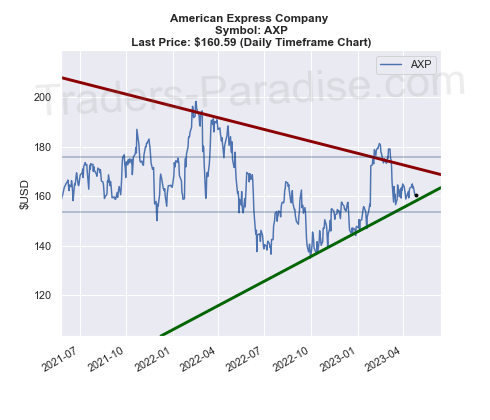

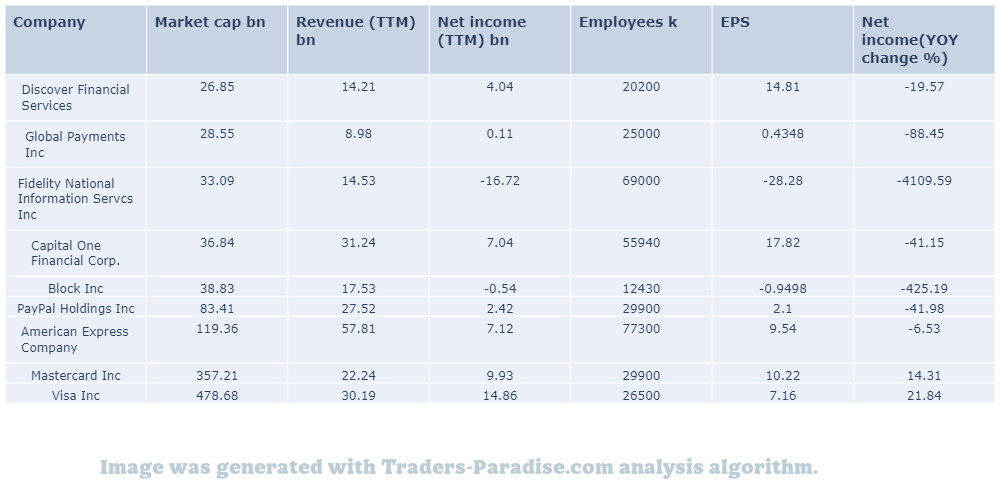

#21 Trading idea on AXP

Company Name: American Express Company

Symbol: AXP

Sector: Financial

Company Description: The American Express Company is a multinational financial services corporation headquartered at 200 Vesey Street in the Battery Park City neighborhood of Lower Manhattan in New York City. It’s a company that provides a range of financial services to its customers. It is one of the world’s biggest banks.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AXP — Warren Buffett’s investment company could be worth $1 trillion.

Warren Buffett’s Berkshire could join Apple, Microsoft, Alphabet, and Amazon in the $1 Trillion Club. . for Warren Buffett’s investment company, Berkshire Hathaway, is marching his investment company into the stock market’s most exclusive club.

- News story for AXP — Warren Buffett’s company reports better-than-expected earnings.

An excellent quarter could still be a harbinger of some negative trends on the way for Buffett’s favorite stock. – Warren Buffett’s company had a very good quarter. – The Warren Buffett Company had a good quarter, but negative trends may be on their way.

- News story for AXP — Card giant American Express reported better-than-expected earnings.

The state of the consumer looks solid based on the card giant’s latest financials. American Express’ revenue grew by 7.5% in the last quarter. The company is a Warren Buffett’s favorite stock. It’s time to buy American Express stock.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

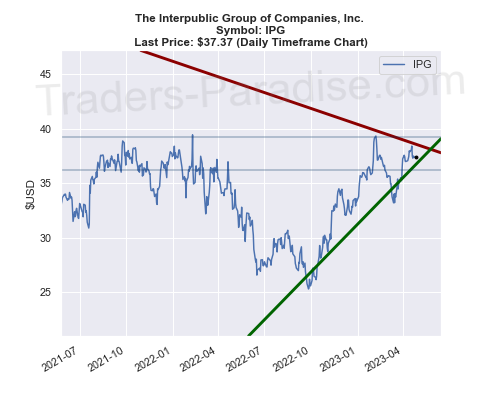

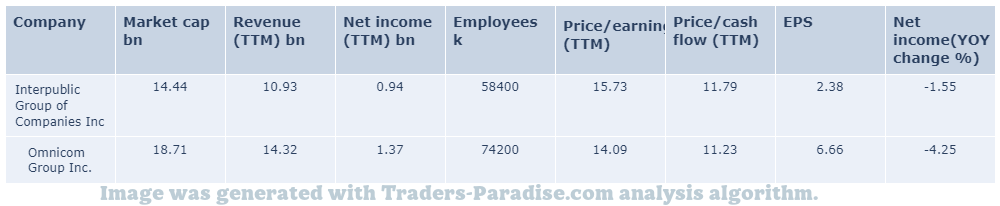

#22 Trading idea on IPG

Company Name: The Interpublic Group of Companies, Inc.

Symbol: IPG

Sector: Services

Company Description: The Interpublic Group of Companies, Inc. is an American publicly traded advertising company. The company consists of five major networks: FCB, IPG Mediabrands, McCann Worldgroup, MullenLowe Group, and Marketing Specialists. It also consists of independent specialty agencies in the areas of public relations, sports marketing, talent representation, and healthcare.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for IPG — Interpublic Group (IPG)

Interpublic Group (IPG) closed at $37.50 in the latest trading session, marking a +0.54% move from the prior day. The stock market gains outpaced the IPG’s share price. for the day.

- News story for IPG — Agency giant to report first-quarter earnings on Tuesday, 1 April.

IPG’s investments and acquisitions are likely to have structured the company’s performance in the first quarter of 2023. Here’s what to expect from Interpublic Group’s (IPG) Q1 Earnings. iptg.com.

- News story for IPG — Analysts expect Interpublic to report a decline in earnings.

Interpublic Group (IPG) is expected to report a decline in earnings. The company doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for the company’s upcoming earnings report.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#23 Trading idea on KMX

Company Name: Carmax Inc

Symbol: KMX

Sector: Consumer Discretionary

Company Description: CarMax is a used vehicle retailer based in the United States. It operates two business segments: CarMax Sales Operations and CarMax Auto Finance. It has a fleet of more than 100,000 vehicles in its fleet. It sells vehicles through its own stores and online.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KMX — CarMax, Lithia Motors, AutoNation among big gainers this week.

Used car prices have finally started to ease since the outbreak of COVID-19, raising hopes that a bubble is starting to wane. Investors keep tabs on well-known used vehicle stocks, including CarMax, Lithia Motors, AutoNation, and Carvana.

- News story for KMX — Deutsche Bank cuts the price target for Autoliv, while Loop Capital increases the target.

Deutsche Bank cut the price target for Autoliv from $113 to $110. Wedbush raised the target for CarMax from $55 to $70. Loop Capital increased the price for HCA Healthcare from $285 to $320. Raymond James raised the price of Graphic Packaging Holding Company from $27 to $27.

- News story for KMX — CarMax, Ford, Blink Charging and XPeng are part of top Analyst Blog.

CarMax, Ford, Blink Charging and XPeng are part of the Zacks top Analyst Blog. Zacks Analyst Blog highlights CarMax and Ford as well as XPeng on the Analyst Blog’s list of high-ranked companies. Â

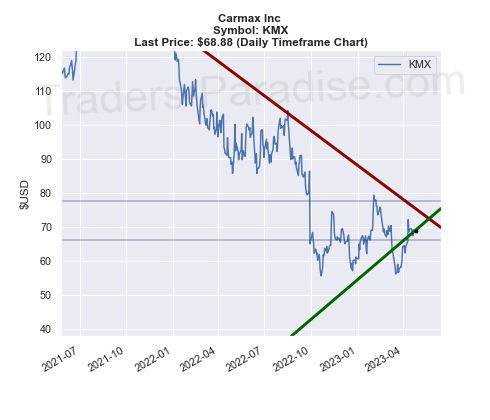

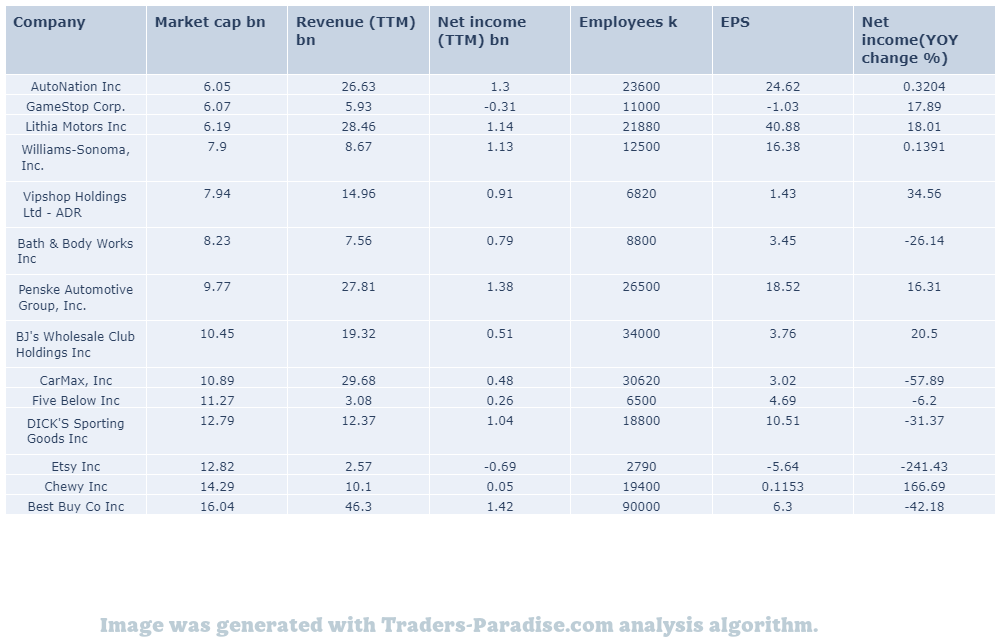

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#24 Trading idea on COF

Company Name: Capital One Financial Corporation

Symbol: COF

Sector: Financial

Company Description: Capital One Financial Corporation is an American bank holding company with operations in the United States. It offers credit cards, auto loans, banking, and savings accounts. It is headquartered in McLean, Virginia. It has operations primarily in the U.S. and has a presence in several countries.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for COF — Higher Credit Acceptance to report first-quarter earnings on May 2.

Credit Acceptance (CACC) is expected to beat earnings estimates. The company has the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for CACC’s upcoming report and follow the company’s progress here.

- News story for COF — Capital One to report first-quarter earnings on Wednesday, April 18.

Capital One (COF) is expected to beat earnings estimates for the first quarter of this year. Get prepared with the key expectations ahead of Capital One’s Q1 earnings release on April 25th, and follow the links below to learn more about the company’s business.

- News story for COF — Earnings season for regional banks gets under way this week.

The recent banking turmoil affected regional financial institutions. Investors should watch regional bank earnings to see how they are affected by it. – The Wall Street Journal. – Wall St. Journal, April 25, 2013. Regional bank earnings are due.

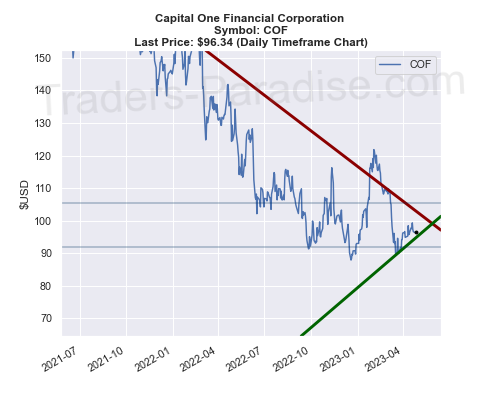

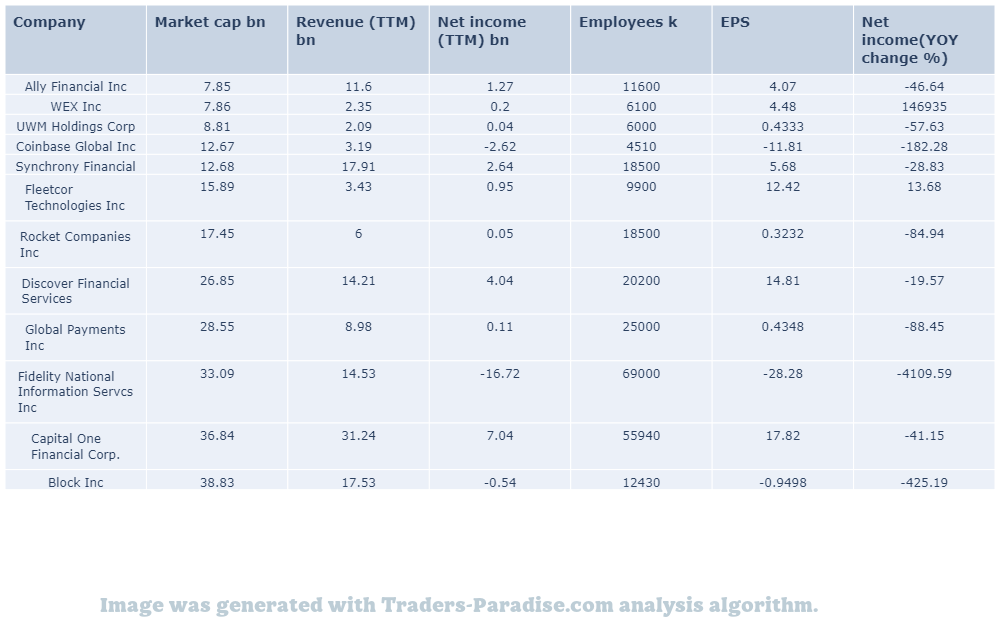

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#25 Trading idea on PARA

Company Name: Paramount Global

Symbol: PARA

Sector: Technology

Company Description: Paramount Global is a global media and entertainment company. It is headquartered in New York, New York and has a global network of offices. It has more than 100,000 employees. It’s one of the world’s biggest media companies, with a turnover of over $20 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PARA — Shares of Paramount Pictures have slumped in recent months.

Paramount’s investors have several ways to profit from the entertainment company’s stock right now. A Bull Market Is Coming: 3 Reasons to Buy Paramount Stock Right Now is one of the reasons. – Paramount’s stock is up 7% this year.

- News story for PARA — Following are 3 stocks that can 888-282-0476 888-282-0476 888-282-0476 888-282-0476 888-282-0476 888-282-0476 888-282-0476 888-282-0476 888-282-0476 888-282-0476?

3 Unstoppable Stocks That Can Safely Turn $325,000 Into $1 million by 2033. These surefire stocks have the tools and intangibles needed to more than triple your initial investment over the next decade. They are surefire to do it.

- News story for PARA — Airbnb, T. Rowe Price among stocks to watch this week.

Airbnb and T. Rowe Price are two stocks worth watching. Wall Street Headlines and a Closer Look at the Business of Movies are also included in the list of topics discussed today on CNN.com’s “This is What’s Up With That?” show.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

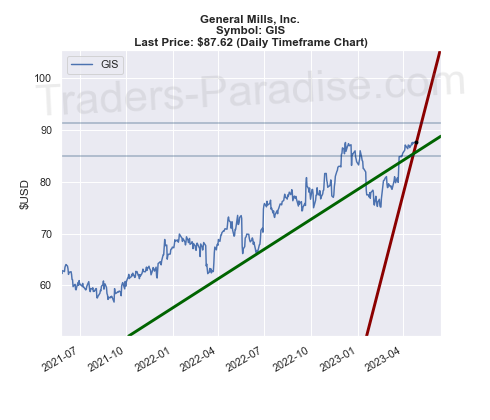

#26 Trading idea on GIS

Company Name: General Mills, Inc.

Symbol: GIS

Sector: Consumer Goods

Company Description: General Mills, Inc. is an American multinational manufacturer and marketer of branded consumer foods sold through retail stores. It is headquartered in Golden Valley, Minnesota, a suburb of Minneapolis, and it sells its products in stores there. Â

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GIS — Invesco Dynamic Food & Beverage ETF (PBJ) is a passively managed ETF.

Invesco Dynamic Food & Beverage ETF (PBJ) is an exchange-traded fund (ETF) that invests in the food and beverage sector. It tracks Invesco’s Dynamic Food and Beverage Select Sector SPDR (PJ).

- News story for GIS — The Estee Lauder Companies’ (EL) Emerging Market Presence Solid.

Estee Lauder Companies derives significant revenues from emerging markets. The company makes distributional, digital and marketing investments in emerging markets to grow its presence. Â e.lauder.com has a report on Estee Lauder’s (EL’s) emerging market presence.

- News story for GIS — Management raises top and bottom-line view for 2023.

Inter Parfums’ (IPAR) sales increase year over year in first-quarter 2023. Management raises its top-and bottom-line view for 2023 and increases its guidance for the year 2023 as a result of the increase in sales.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

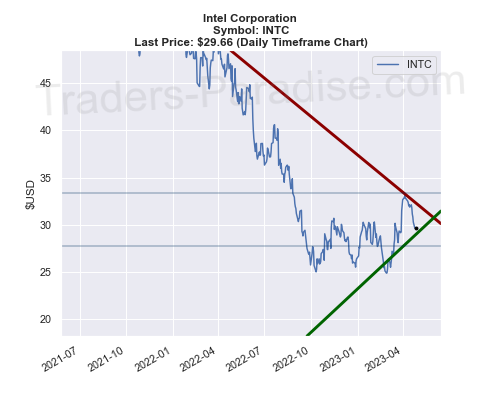

#27 Trading idea on INTC

Company Name: Intel Corporation

Symbol: INTC

Sector: Technology

Company Description: Intel is the world’s largest semiconductor chip manufacturer by revenue. It is the developer of the x86 series of microprocessors, the processors found in most personal computers (PCs). It is headquartered in Santa Clara, California, in Silicon Valley.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for INTC — Wall Street still bets on tech rebound in second half of year.

Wall Street is betting on a second-half rebound for tech, but there is little concrete evidence that it will happen. After a $2 trillion stock rebound, Big Tech wades into a sea of uncertainty now. – The trajectory for tech remains worrisome.

- News story for INTC — Weekly take on mergers and acquisitions in the technology sector.

Walmart, Chevron, Danaher, Intel and Lowe’s are included in the Analyst Blog. The Blog highlights the highlights of Walmart, Chevron and Danaher and highlights the company’s financial performance. The blog is available on the Zacks Analyst Blog site.

- News story for INTC — Analyst suggests AMD share normalized in 1Q following Intel order pull-ins.

Susquehanna analyst Christopher Rolland maintains a Positive rating for Advanced Micro Devices Inc (NASDAQ: AMD) and raises the price target from $112 to $115. Ronald generally expects in-line 1Q results but is more uncertain about the guide. PC ODM builds have significantly improved for February and March. AMD share normalized in laptops and desktops during 1Q following Intel’s order pull-ins ahead of their price hikes into 4Q. For Data Center, he expects a slower Genoa ramp.

TECHNICAL ANALYSIS

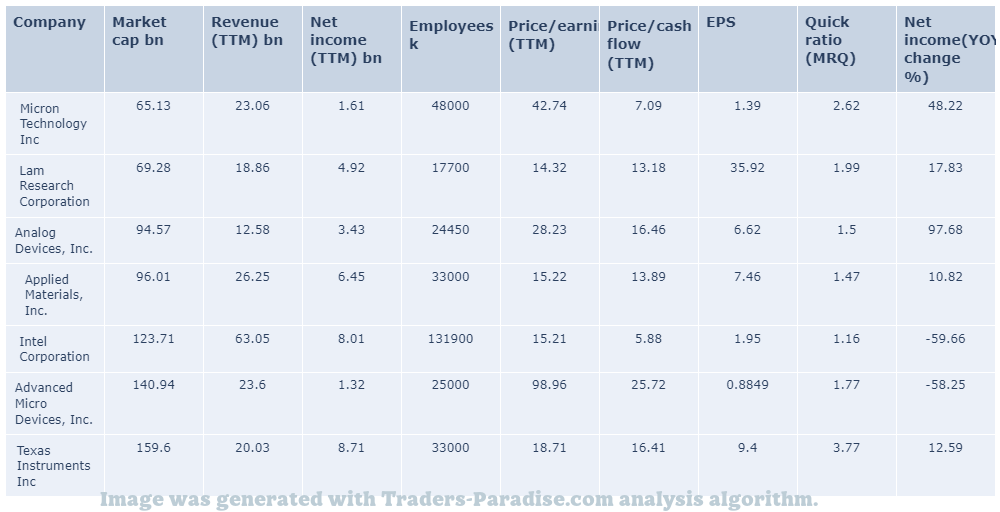

PEERS AND FUNDAMENTALS

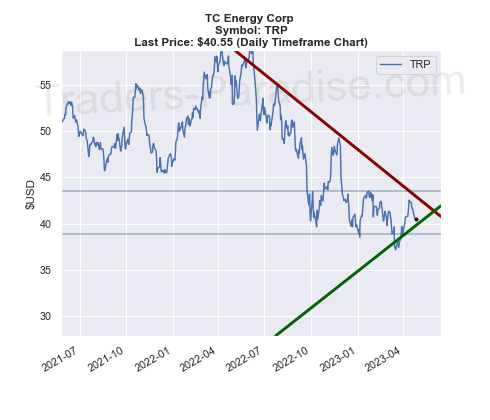

#28 Trading idea on TRP

Company Name: TC Energy Corp

Symbol: TRP

Sector: Energy & Transportation

Company Description: TC Energy Corporation is an energy infrastructure company in North America. The company is headquartered in Calgary, Canada, and it’s a subsidiary of TC Energy Inc. (TCE). TCE is a publicly traded company with a market capitalization of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TRP — Utility is expected to report better-than-expected earnings.

Ameresco (AMRC) is expected to beat earnings estimates. The company has the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for AMRC’s upcoming report and decide if you want to buy.

- News story for TRP — Analysts expect TC Energy to report a decline in earnings.

TC Energy (TRP) doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for TRP’s upcoming report and stay on top of the company’s key developments.

TECHNICAL ANALYSIS

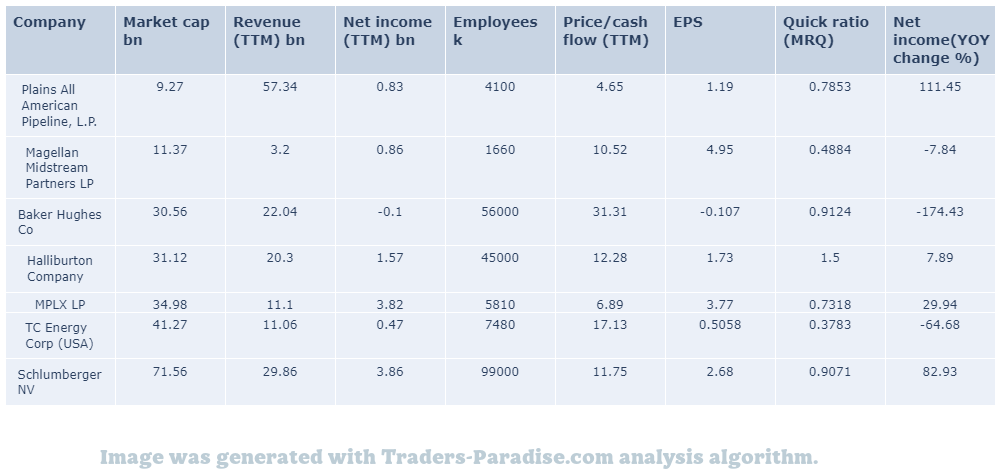

PEERS AND FUNDAMENTALS

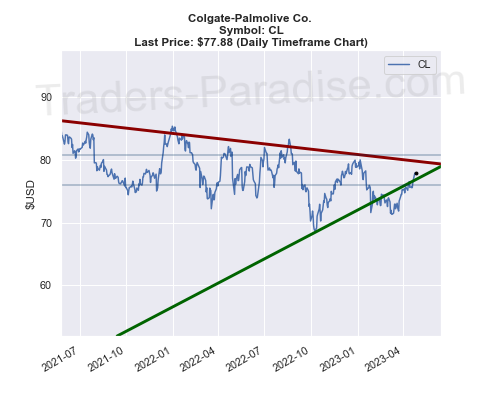

#29 Trading idea on CL

Company Name: Colgate-Palmolive Co.

Symbol: CL

Sector: Consumer Goods

Company Description: Colgate-Palmolive Company is an American multinational consumer products company headquartered on Park Avenue in Midtown Manhattan, New York City. It specializes in the production, distribution and provision of household, health care, personal care and veterinary products. It is a subsidiary of Colgate-Plimolive Corporation.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CL — Internet domain name firm to report first-quarter results.

‘s first-quarter performance is expected to have benefited from growing Internet consumption. However, ongoing weakness in global macroeconomic conditions might have been a concern for VeriSign’s performance in the first quarter of this year. Verisign’s performance. in Q1.

- News story for CL — Analysts expect strong performance from Packaged Beverages.

Pepperidge’s (KDP) Q1 earnings. Packaged Beverages and strong in-market performances are likely to have aided Keurig Dr Pepper’s Q1 performance. Inflation has been concerning. In general, the company’s performance has been good.

- News story for CL — Consumer goods giant to report strong demand for its products.

of Church & Dwight’s first-quarter 2023 results. It is likely to reflect benefits from strong pricing action incurred to counter inflation. It’s expected to reflect profit from strong consumer demand. It will reflect profits from strong price increases to counterinflation.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#30 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — Top healthcare stocks to watch in the coming months.

There are 3 healthcare stocks that could help make you a Fortune. These companies are top players in their fields. They are listed on the NYSE and the NASDAQ. Â in terms of market capitalization and share price.

- News story for TDOC — Analysts expect Teladoc to report strong revenue growth.

Teladoc Health’s (TDOC) first-quarter results are likely to reflect growth in Access Fees revenues and total visits. Teladoc’s expenses are expected to rise slightly. – TDOC’s Q1 results will be released on April 25th.

- News story for TDOC — Is Teladoc a Buy Now?

Last year Teladoc stock performance was a bit of a horror show for the company, but it’s better now than it was last year. It’s a good time to buy it now, as it’s cheaper now than in the previous year.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#31 Trading idea on WIX

Company Name: Wix.Com Ltd

Symbol: WIX

Sector: Technology

Company Description: Wix.com Ltd develops and markets a cloud-based platform that enables anyone to create a website or web application in North America, Europe, Latin America, Asia, and internationally. The company is headquartered in Tel Aviv, Israel and is available in English and Spanish.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WIX — WIX extends its integration with Square to improve online ordering.

WIX extends its integration with Square to improve online ordering and reduce customer wait time for restaurant owners. – WIX Extends Integration With Square to Aid Restaurant Owners. – Square and WIX will work together to improve customer service.

- News story for WIX — 3D printing solution provider Stratasys has been the subject of takeover speculation.

Stratasys (SSYS) is likely to be a lucrative takeover target. The Minnesota-based 3D printing solution provider has solid prospects and attractive valuations. Stratasys’ fundamentals and prospects make it a strong takeover target for a number of reasons.

- News story for WIX — Falcon Complete XDR platform is designed to help organizations address the cybersecurity skill gap.

CrowdStrike’s recently launched MXDR service, the Falcon Complete XDR platform, is designed to help organizations address the cybersecurity skill gap. CrowdStrike (CRWD) Extends MDR Capabilities With MXDR Launch. Crowdstrike CRWD

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

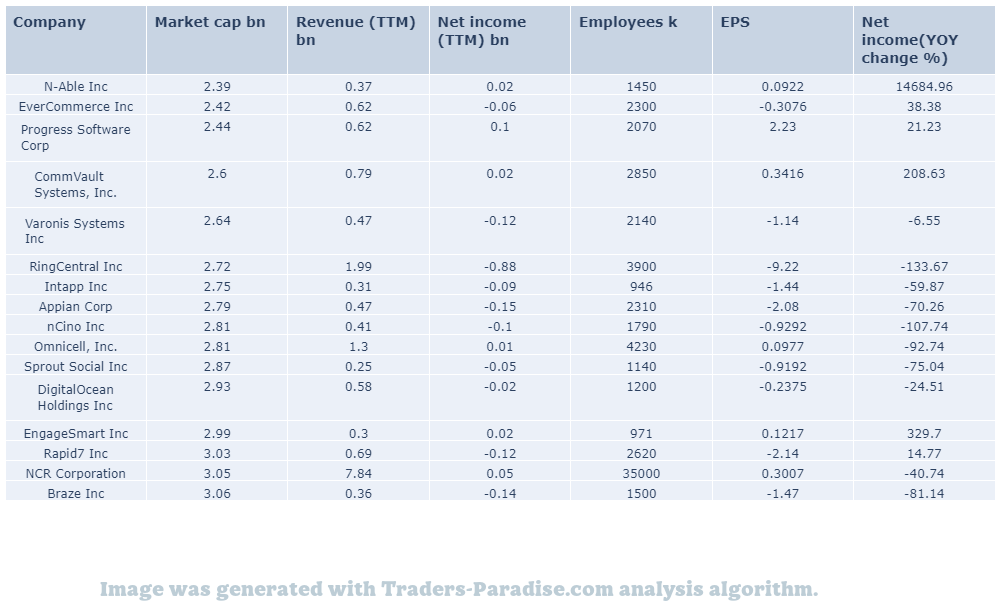

#32 Trading idea on RNG

Company Name: RingCentral Inc

Symbol: RNG

Sector: Technology

Company Description: RingCentral, Inc. offers software-as-a-service solutions that enable businesses to communicate, collaborate and connect in North America. The company is headquartered in Belmont, California and offers its services in English and in Spanish. for more information, visit ringcentral.com.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RNG — Bullish Somewhat Bullish Indifferent Somewhat Bearish Total Ratings 5 2 3 0 0 Last 30D 1 0 0 0 1M Ago 1 0 0

In the last 3 months, 10 analysts have offered 12-month price targets for RingCentral. The company has an average price target of $46.9 with a high of $62.00 and a low of $35.00. The greater the number of bullish ratings, the more positive analysts are on the stock.

- News story for RNG — RNG has posted better-than-expected results in three of the last four quarters.

RingCentral (RNGR) has an impressive earnings surprise history. RingCentral’s next quarterly report is expected to beat estimates again. RNGR currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly earnings report.

- News story for RNG — Surge in AI hiring is a ‘beacon of light’ for tech world.

AI has been a ‘beacon of light for the tech world’ after months of layoffs, high interest rates and the collapse of Silicon Valley Bank, says one tech exec. Startups are hiring for the next big thing and AI is a good fit.

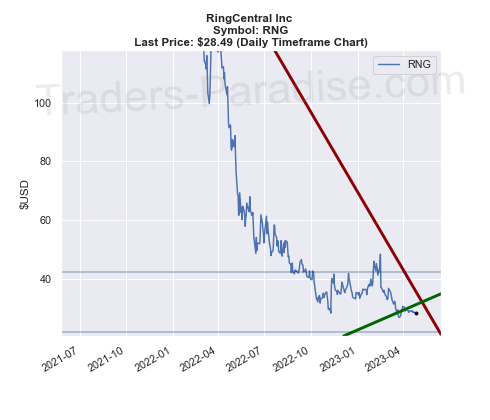

TECHNICAL ANALYSIS

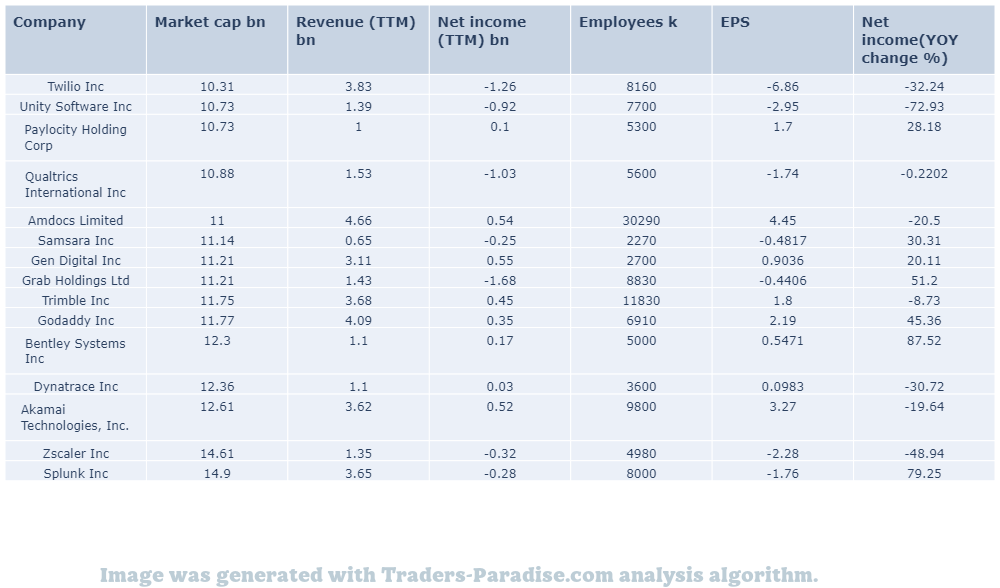

PEERS AND FUNDAMENTALS

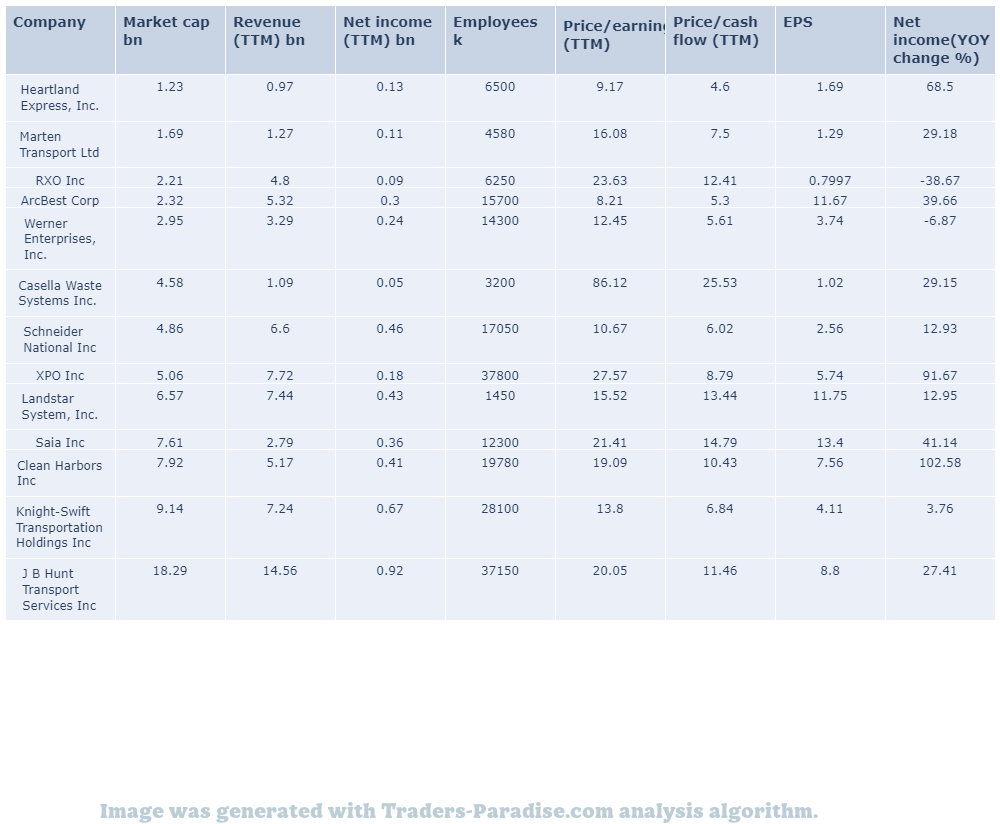

#33 Trading idea on XPO, might be reaching some kind of top

Company Name: XPO Logistics, Inc.

Symbol: XPO

Sector: Services

Company Description: XPO Logistics, Inc. provides supply chain solutions in the United States, the rest of North America, France, the United Kingdom, and rest of Europe. The company is headquartered in Greenwich, Connecticut and provides services in the U.S., France, UK and internationally.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for XPO — Shares in XPO tumble as rivals step up hiring.

from Old Dominion boosted XPO stock this week. Old Dominion has a new hire from XPO this week, which boosted the stock. . in this week’s trading. in the past week, the stock has risen by about 10%.

- News story for XPO — XPO shares are up nearly 20% this year, outperforming the S&P 500.

Wall Street is excited about the trucking firm’s new chief operating officer. XPO stock is accelerating again today. in favor of the company’s new CEO, who is also a former COO. The company’s stock is up 7% this year.

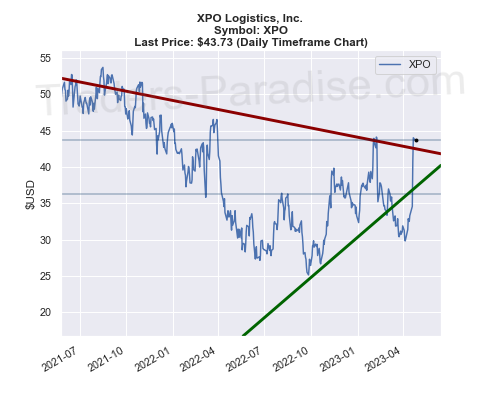

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#34 Trading idea on ISRG, might be reaching some kind of top

Company Name: Intuitive Surgical, Inc.

Symbol: ISRG

Sector: Healthcare

Company Description: Intuitive Surgical, Inc. is an American corporation that develops, manufactures, and markets robotic products designed to improve clinical outcomes of patients through minimally invasive surgery. The da Vinci Surgical System is a robotic system developed by Intuitive Surgic.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ISRG — Stocks to buy no matter what the market is doing

The long-term picture for these stocks remains bright, so buy them no matter what the market does or doesn’t do in the short-term. – The list includes 3 winning stocks to buy no matter how the market is doing, including these three.

- News story for ISRG — Investment Ideas feature highlights: Nasdaq 100 ETF, Dexcom, Merck, Intuitive Surgical.

Nasdaq 100 ETF, Dexcom, Merck, Intuitive Surgical, and SPDR S&P Regional Bank ETF have been highlighted in this Investment Ideas article. Zacks Investment Ideas feature highlights are: Nasdaq 100, Dexcom Merck and

- News story for ISRG — A look at what’s going on in the world ofcryptocurrencies.

The “Motley Fool Money” crew looks at what’s going on with Netflix. They also cover Wall Street Headlines, International Investing, and Stocks to Watch. “The Motley Fool” crew kicks things off with a look at Netflix.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#35 Trading idea on AMC, might be reaching some kind of top

Company Name: AMC Entertainment Holdings Inc

Symbol: AMC

Sector: Consumer Discretionary

Company Description: AMC Entertainment Holdings, Inc. is involved in the theatrical business. The company is headquartered in Leawood, Kansas and has a film production division. “The Dark Knight Rises” is scheduled to be released on October 25th.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AMC — Fund managers have held Microsoft stock since it was $5 a share.

Buffalo Growth Fund’s co-managers have held Microsoft stock since it was $5 a share. They explain to MarketWatch their longstanding faith in some of tech’s biggest names and offer a couple of new stock ideas for their portfolio. They also share some of their lesser-known tech picks.

- News story for AMC — Strategist says stocks need to drop 15% to recover.

Even without an earnings apocalypse, stocks still need to drop 15% this week, according to strategist. – MarketWatch.com’s call of the day is that investors will not be out of the woods even if earnings news is not a disaster this week.

- News story for AMC — AMC to expand its branded popcorn sales to 2,600 Walmart stores.

AMC is set to expand its branded popcorn sales to 2,600 Walmart stores. The company kicked off its Walmart popcorn partnership earlier this year. . “AMC” is a division of AMC Networks. “Ammar” is the parent company of “The Walking Dead”.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.