5 min read

This is a story about surviving, great success and philanthropy.

George Soros was born as Gyorgy Schwartz in Budapest, Hungary, on August 12, 1930.

His parents were Tividar and Erzebat Schwartz.

With increasing anti-Semitism, the danger for Jewish arose. To avoid Nazi persecution, George’s father changed the family

name to Soros. George was just a teenage boy in 1944 when survived Nazi aggression and occupation of Hungary.

History would never be the same if he didn’t.

The different danger shaped their lives after the end of WWII. Communist domination in Hungary managing by the Soviet Union (USSR). Having the fact that they were cruel with their own citizens, made Hungarians frightened for their lives.

George Soros decided to emigrate.

In 1947 he went to England and began to study philosophy at the London School of Economics under Karl Popper.

Today we can say that Karl Popper’s “The Open Society and Its Enemies” had a great influence on him. In this philosophical masterpiece, Popper criticizes totalitarianism.

The basic idea is that no ideology controls the truth and society can grow only when it is free and open. The main lesson is that respect for individual rights can maintain such a society. Soros was attracted by Popper’s biography and the fact that this book was written during WWII.

Popper was not only a philosopher but also a journalist. While working as a war reporter he started thinking how could Adolf Hitler and national-socialism happen at all.

Popper started writing Open society in order to analyze the history of political ideas and to find an answer to the question above. The whole book was written before the end of WWII.

But Soros never became a philosopher. Actually, he is the greatest philosopher among investors or the greatest investor among philosophers.

Instead, he entered the London merchant bank Singer & Friedlander.

Soros’s first investment

Soros graduated in 1952. Four years later he bought a ticket and sailed to America. He got a job at Wall Street brokerage “F.M. Mayer”.

At first, he worked as an analyst of European securities. Soros, being excellent educated and intelligent, rapidly made success.

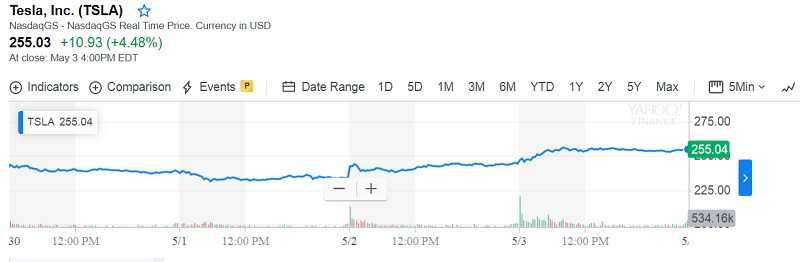

He changed firms in the following years and finally decided to start his own business. In 1970 Soros founded his own hedge fund with $12 from investors. The first name was the Soros Fund Management but later he changed at Quantum Fund and the Quantum Fund Endowment.

The rest is history. George Soros became one of the most successful investors in the history of the US.

But we will give you more details because he is an extraordinary man.

He is one of the rare individuals whose example is worth to follow.

The man who broke the bank of England

George Soros grew to one of the most recognized currency traders, thanks to his brilliant bet placed against the Bank of England in 1992. He entered history.

That event is well-known as Black Wednesday.

His bet was that the British Pound price would fall in value.

But let’s start from the very beginning.

In that time, the early 1990s.

It’s essential to explain the political background of Europe at that time. Europe was in the middle of preparation for something today known as the European Union. Their first aim was to set a unique monetary system and monetary stability. They wanted to put Euro on the stage later. The money which will be unique to all member countries.

But, at that time Europe has a combination of different currencies inside the ERM (European Exchange Rate Mechanism). The monetary union was one of the first steps which led to the European Union.

Not all would like this. Some of the countries that geographically belongs to Europe never entered the Union because of domestic coins. They were assured that such a movement would have consequences for their countries economy.

There were a lot of debates inside their parliaments about that issue.

The British government wasn’t an exception.

George Soros was a big investor in that time. He had a lot of experience and success too.

Of course, he was well informed about all the news in the market and politics.

And what Soros did?

The economic conditions assure him that the best move on the market to build a short position on Pound Sterling. He was working on it up to September of 1992.

At that time the UK government noticed that the value of Pound Sterling is climbing down and they decided to reverse it from the ERM in order to keep their national currency value.

And that was a fantastic opportunity for investors like Soros. The great advantage.

Thanks to his short position in the currency trading Soros short sold more than $10 billion calculated in pounds.

Taking this move alone brought billions of dollars to Soros.

More details

The UK agreed to connect the British Pound to German Deutschmark.

The value of 2.78-pound sterling was equal to 3.13 Deutschmarks. But the UK was kicked by the economic recession.

The normal reaction would be to lower interest rates in order to support the national economy. But there is the trick.

Lower interest rates have a negative influence on the currency value, so they wouldn’t be able to maintain pound’s value against the Deutschmark.

The biggest dilemma was: should the UK government try to recover domestic economic growth or enter the ERM. They choose ERM.

The Bank of England made such a big mistake, it raised interest rates. At the same time, they started to use foreign currency reserves to buy the Pound.

That gesture opened the space for short selling. Investors, Soros first of all, recognized that the UK is in the middle of economic depression.

Over two years period, the U.K. proceeded to defend its currency. Those cost billions. They were building a house of cards actually.

In August 1992 the German Bundesbank got the idea that currencies in the ERM could be revalued.

The president of Bundesbank at that time was Helmut Schlesinger.

He was prepared to make a big move. He was ready for a devaluation.

The Bundesbank explored the possibility to set a new lower fixed rate with respect to a foreign reference currency.

That totally changed the risk/reward to a short Pound position.

The Pound would be weaker in any possible scenario. If pound didn’t devalue or if it did. Of course, if it declines it would be by large volume.

At that very moment, Soros told his top trader, “Go for the jugular.”

Soros’s fund, which was building several months, sold $10 billion

Soros’ fund sold $10 billion value of Pounds short.

The pressure on the Bank of England came from other investors. Everyone wanted to sell the pound.

Then the Bank of England made new mistakes.

First, they tried to raise interest rates by 2%. On first glance, it is a logical reaction that should lead to currencies appreciation. But this decision didn’t generate the Pound’s rally. Then they raised interest rates by 3% more on the same day. Well, they hit further selling Pounds.

Nothing helped. At the evening of the same day, about 7:30 the Bank of England stated that Britain would leave the ERM. That meant that the currency on the market. It was their last attempt to save the Pound.

But Pound promptly fell 15% against the Deutschmark and 25% against USD.

And the star was born. Soros become a trading legend. In the next five years, his net worth was $23 billion thanks a lot to this short selling.

The UK decision made Soros richer by more than a billion pounds.

And won the name “The man who broke the Bank of England”.

Black Wednesday is universally known as the day that George Soros broke the Bank of England and made over $1 billion.

George Soros and Philanthropy

George Soros began his philanthropic activity in 1979, and he established the Open Society Foundations in 1984.

“When I had made more money than I needed for myself and my family, I set up a foundation to promote the values and principles of a free and open society. ”

The scholarships given to black South Africans under apartheid 1979, was the beginning of Soros philanthropy.

During the 1980s, he supported the development of the open exchange of ideas in Communist Hungary. Soros was financing educational visits to the West and supporting other actions.

He founded the Central European University to encourage critical thinking after the Berlin Wall fell.

When the Cold War was over, he constantly spread his philanthropy to the United States, Africa, Latin America, and Asia.

“George Soros is the only American who rivals the great philanthropists of the 1890s, John D. Rockefeller, Andrew Carnegie, and Julius Rosenwald,” said Nelson Aldrich Jr., editor of The American Benefactor, in a 1996 New York Times profile of Soros.

He supported efforts to create more responsible, open, and democratic countries.

He criticized the war on drugs as “arguably more harmful than the drug problem itself,” and also, helped to start America’s medical marijuana movement.

Soros is a supporter of same-sex marriage efforts. The Open Society Foundations are against discrimination lesbian, gay, bisexual, transgender, and intersex communities. It promotes and defends human rights.

Soros supports autonomous groups and organizations such as Global Witness, the International Crisis Group, the Institute for New Economic Thinking, the European Council on Foreign Relations.

Since 1984 Soros gave to the different humanitarian organizations and through his foundations more than $30 billion of his fortune.

We have to say that thanks to Soros’s engagement, personal and through his organizations, many very important issues on the field of human rights are not only opened, but they are also solved or close to be. Whenever.

“I’m not doing my philanthropic work, out of any kind of guilt, or any need to create good public relations. I’m doing it because I can afford to do it, and I believe in it. ” – said, George Soros.

Don’t waste your money!

risk disclosure

There is no such thing – worst investors. Yes? No? Read to the end.

There is no such thing – worst investors. Yes? No? Read to the end.

by Gorica Gligorijevic

by Gorica Gligorijevic

Who was John Bogle?

Who was John Bogle?

Traders-Paradise presents you the best money apps that we examined, and use.

Traders-Paradise presents you the best money apps that we examined, and use.