A bond is a loan that the bondholder gives to the bond issuer. Governments, corporations, and municipalities issue bonds when they need cash.

Trading bonds may seem unusual and difficult. But it isn’t. Actually, the whole process can be quite simple. Anyone interested in trading bonds shouldn’t have a problem getting started. You can find plenty of opportunities in trading bonds and the bond markets. But some things are special for trading bonds and bond markets. If you are not familiar with them, trading bonds might be very confusing. Honestly, it is important to trade bonds so let’s see how to do that.

First of all, bond markets are much bigger than, for example, stock markets. One of the most important differences between bonds and stocks is that there is no exchange for trading bonds; it is done on the “over-the-counter” market but some kinds of bonds can be traded on exchanges. For example, convertible bonds are possible to trade on exchanges. Actually, trading bonds can happen anywhere where the buyers and sellers can make a deal.

Trading Bonds: The participants in trading

There are two types of participants in trading bonds: bond dealers and bond traders.

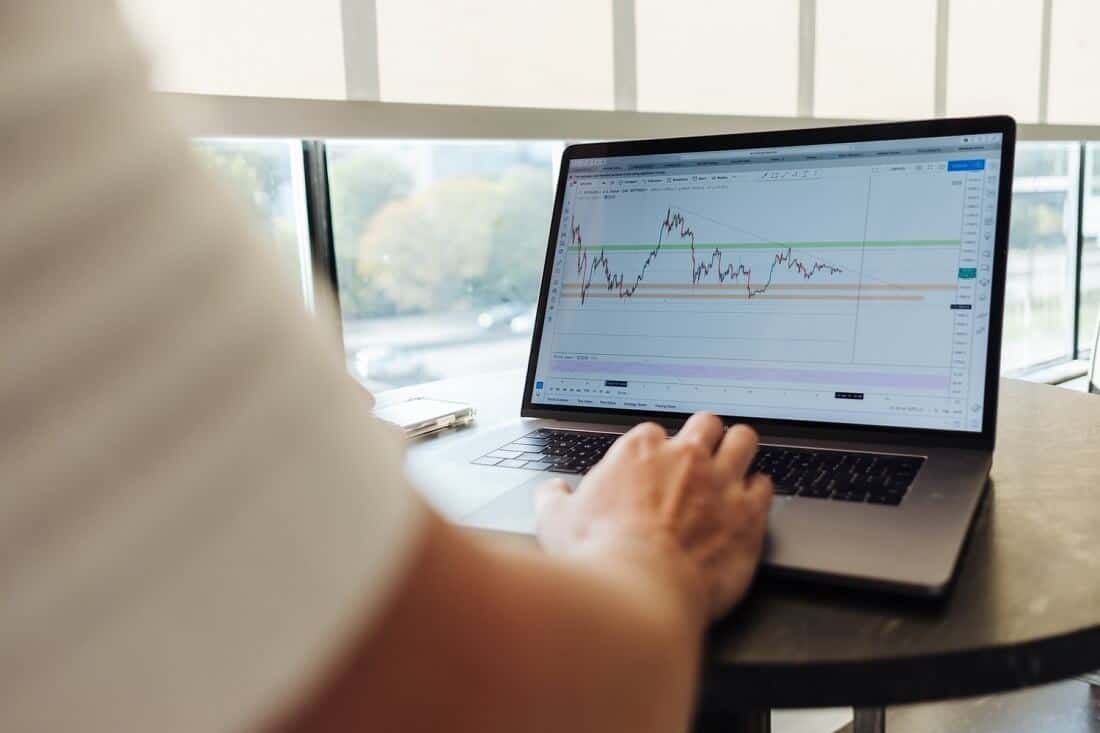

Traders can trade bonds among themselves, but trading is customarily done through bond dealers. Well, to be more precise, these places where you can trade bonds are dealers’ bond trading desks. Bond dealers are kind of intersection points. They have all types of connections available. Phones, computers are on their desks. But also, they are connected with some traders whose job is to gather all information about bonds, they are quoting prices for buying or selling bonds. To make the story short, these traders are responsible for creating the market for bonds.

Dealers and traders

Dealers’ job is to provide liquidity for bond traders and make it easier to buy and sell bonds with a limited concession on the price. But they have some other possibilities to take part in trading bonds. Dealers can also trade bonds between each other. Sometimes they do so through bond brokers, meaning anonymously. Dealers make money from the spread between the bonds buying and selling price. This also the way how they can lose money.

Bond trading can be very lucrative. That’s the reason why pension and mutual funds, financial organizations, and also governments are involved in trading bonds. When you have such powerful players in the market, it isn’t surprising that $1 million worth of bonds is small initial capital. The bond markets don’t have any size limit, trades may worth over $1 billion but also $100 million. That isn’t the rule for the institutional markets, there are no size limits for individual traders, also. Their trades are ordinarily below $1 million.

Trading bonds strategies

Trading bonds can be passive or active. Both approaches are legit and can produce you the gains.

You can make money from bonds in two ways. You can invest in them and hold and receive interest payments after the maturity date. It is usually twice per year. That is a passive way of trading bonds.

The other way to make money from bonds is by trading them. You can sell your bonds at a higher price than you bought them. For instance, you bought bonds at a nominal value of $20.000. After some time, their market value increases by 20% and you can sell them at $24.000. You’ll earn $4.000.

Bond laddering is also one of the more active strategies and very convenient to start trading if you hold bonds with different maturity dates. You can use the profit from bonds with shorter maturity dates to buy bonds with longer maturity dates. This is named “income stream” and you don’t need a lot of money to use this strategy. It is pretty much economical and cheap.

Bond swapping is another active approach to trading bonds and very attractive for skilled traders. Where is the catch? Let’s say one of your bonds isn’t a good player and it is more likely a losing one, it’s not going to recover. Traders usually are selling these bonds to get a tax write-off for the loss. The money gained from the selling bond they reinvest in high-yielding bonds. That helps them to build a firm portfolio.

The differences between the trading bonds and investing

In trading bonds you are actually speculating on the price changes during a short period in time. You are buying bonds only when you believe they will increase in price. And vice versa, you are selling them only when you believe their prices will drop. So, your profit is coming from the bonds’ price movements. Trading bonds is also when you use the advantage of leverage. To be honest, that might magnify your profits but also, you may be faced with great losses.

Investing in bonds means that you are holding bonds for a long time. You decided to hold them whatever is happening and you are taking the risk to lose your money if bonds prices decrease. When investing in bonds the profit will come from interest payments. Further, on the maturity date, you will put down the total value of your position.

Should you trade stocks or bonds?

Bonds and stocks are the most traded assets but in different separated markets. When trading stocks, you are actually buying ownership in some companies. When the company or companies are doing well, the value of your shares will grow.

When trade bonds, you are actually lending money to the issuer of the bonds for a fixed period of time. For that you’ll charge interest. Bonds are often seen as safer than stocks. People use them as saving for retirement, for example.

So, trading bonds is an investment strategy. You can use them as we mentioned above, but also, bonds are very useful if you want to diversify your portfolio.

What to look out

Buying bonds can be a difficult path when you aren’t purchasing them right from the underwriter or you are buying used bonds. What to look out, how to know you’re making a good deal?

Look out for the credit rating. It is important to know if the company can pay its bond. Standard and Poor’s and Fitch use a rating system that ranks bonds, the best quality is marked as AAA and the worst as D. Between these two marks you’ll find, in range of quality from good to less good, AA, A, BBB, BB, B, CCC, CC, C bonds.

Further, you’ll need to know the bond duration. That is an indicator of how unstable the bond can be in terms of changes in interest rates. If the duration is longer, that means a higher fluctuation when interest rates shift. The problem is in the nature of the bonds. If interest rates increase, the price of a bond decreases. Also, be careful when buying bonds through the brokerages. They will charge you the fees. Check it before any bond-buying. Use publicly available data on the pricing of bonds, or bonds with equal maturities, interest rates, and credit ratings.

Why trade bonds?

Trading bonds can boost the yield on your portfolio. The yield represents the total return you’ll receive if you keep a bond to its maturity, but you’ll want to maximize it. The point is to sell bonds with lower yield and buying bonds with better. You are selling bonds with low yield and buying another to earn from the spread. For example, you hold a bond that yields 4,75% and you noticed a similar bond but it yields 5,25%. That is 0,50% more. So, you can sell your bond and buy this better yielding one and you’ll have a spread gain – yield pickup of 0.50%.

Credit-upgrade trade is used when a trader assumes that a particular debt problem will be upgraded soon. When an upgrade happens on a bond issuer, the price of the bond will rise and the yield will decline. A credit-upgrade means that the company is marked as less risky. Traders want to catch this expected price increase and buy the bond before the credit upgrade. For this type of trade you’ll need some skills for credit analysis.

You might like to take credit-defense trade.

It is very popular. When uncertainty in the economy and the markets increase, some sectors are weaker to fulfill their debt obligations. If you hold this kind of bond, just take a more defensive position. Pull your money out of that sector, don’t hesitate to get out.

Also, you can trade your bonds to adjust a yield curve and change the duration of the bond portfolio you are holding. In this way, you’ll get an increase or decrease in sensitivity to interest rates, whatever you prefer. Keep in mind that the price of the bond is inversely correlated to the interest rate.

The reason for trade bonds might be the sector-rotation. For example, you want to reallocate your capital to bonds from the sector that is supposed to outperform the industry or some other sector. If you are trading bonds in the same sector, one strategy could be to switch bonds form cyclical to the non-cyclical sector or vice versa.

Bottom line

To trade bonds, you’ll need an account. Choose your bond, when trading bonds, you can buy or sell assets from all over the world.

Now, decide when you would like to open the position. Timing the opening and closing of trades plays the greatest role in how you are successful in the markets.

Open your position by using some online trading platform. Determine how much you want to put on the position and do you want to go short or long. Add stops and limits orders.

If your trade isn’t closed automatically by stops or limits, close it yourself to take profits or cut the losses. To calculate your profit or loss, subtract the opening price of your position from the closing price.

Simple as that.