Generally, trading is unquestionably one of the most difficult things but it is maybe the best opportunity to make money.

By Gorica Gligorijevic

I’ve been examining for some time now how to trade stocks during recession. Don’t doubt we are in a recession now because we are. Well, this recession isn’t like we know from our previous experiences. The one we are talking about is caused by a pandemic.

I know that many experts will argue that the recession would come anyway. That might be true but this one came due to the coronavirus pandemic and thus, it’s somehow different but speaking about how to trade stocks, the principle could be the same. That’s my opinion.

First of all, let’s make clear one important thing. We all know that the most important market gains occur during short periods of time. What does it mean? It means the market profits aren’t equally spread throughout time.

How should traders trade stocks during recession?

Stock trading in a recession could be very different since there are several opposing schools of thought. Some experts would suggest traders should go short. That is true due to the fact that some companies’ profits could be hurt and lower share prices.

Yet, there is another group that deems the recession is a “lagging indicator” thus their opinion is contrarian.

The first school advises traders to be cautious in these circumstances. This means traders should take little or no trading activities. In general, they suggest traders stay away until the end of the recession.

Is a recession time to buy?

Yes, I know that many people have lost a lot but, on the other hand, many profited. So, I concluded that loss and profits during the recession depend on the strategy you use and the assets you trade.

Take the risk and go short

This could be a possible best way to earn a lot of money during the recession when the market downturns. Well, if a downturn never comes you’ll not make money.

In a recession, traders usually go short. They short their stocks, some will sell their call options or buy puts.

These trading activities show that traders expect the price will go down. If that happens traders will increase their gains. The most important for every trader is to set a stop-loss level and take profit level. That will trigger your risk management rules if the price changes direction and goes against your position. These settings will provide you to close the position in small losses.

In fact, gains from short positions happen faster.

Short your stocks if you feel you have an advantage and if you want more direct exposure. Stocks with high beta could be the worst players during recession. These companies have weak balance sheets and the lowest earnings. Such companies could easily be from the tech or biotech sector, but always they are small-caps.

They are dropping faster due to traders’ expectations they will no longer exist.

What else can you do?

You can go long volatility if you buy a volatility ETF such as VXX. It showed great results in 2018 and in 2019 with sell-offs. If you chose this strategy to trade stocks during recession, keep in mind that you shouldn’t go long volatility for a long time. That could lead you to “decay”.

Go long volatility for a short time, for example, it could be a month or two but no longer.

Also, go long gold because it has tendencies to perform very well during recession. Well, gold cannot give you dividends or generate earning but it is a tradable commodity. In the dire economic circumstances, this asset always becomes more valuable. With some gold ETF, you could earn a lot.

How to make money during recession?

You couldn’t be more wrong if you think it’s impossible. Pay attention to how long you’re shorting the market. Bear in mind, when you’re buying volatility in the market it can last just one week. On the other hand, if you’re shorting index funds such as the S&P 500, you can do that for up to two years.

The point is to have discipline and short for a short time. Otherwise, you’re more likely to lose your money due to your faulty timing. To be honest, the simplest way to make money during a recession is to go long cash or cash equivalents. For example, some low-risk investments could be the right choice.

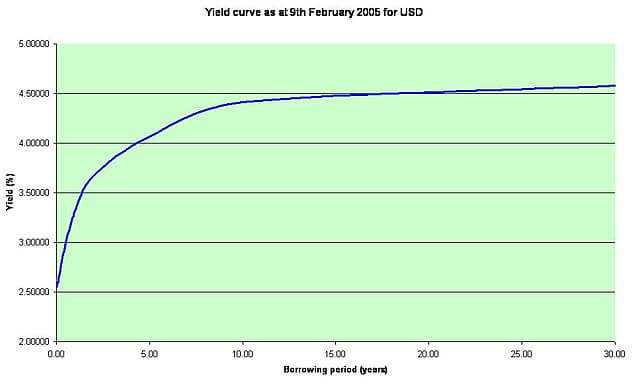

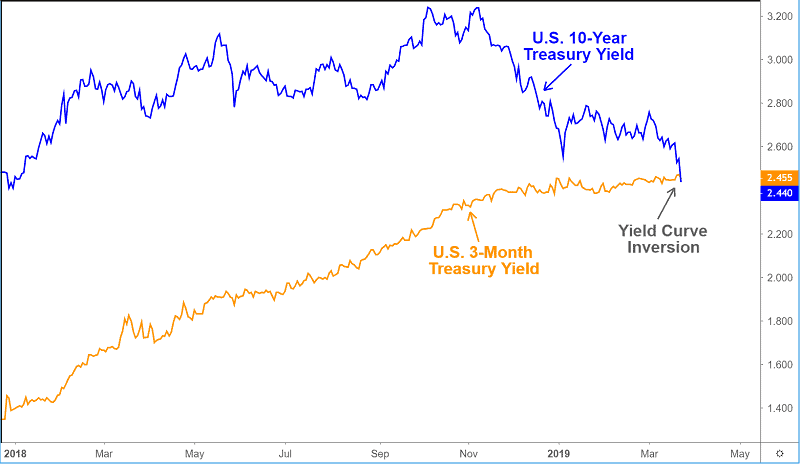

Interest rates are currently ultra-low right. You can invest in treasury notes, treasury bills, bonds, money market mutual funds, fixed annuities, preferred stocks, common stocks that pay dividends, or index funds.

Always have cash reserves. Remember, the latest mentioned are investing opportunities. If you want your money to earn a higher return on, you do have different options. Don’t be afraid to day trade, it can generate a lot of money right now.

What’s the best strategy to trade stocks during a recession?

Learning to trade is unquestionably one of the most difficult things. It can be terrifying and frustrating in the beginning. I want to say to new traders that attempt to enter this field, never try to figure out everything at once. You’ll be overwhelmed by the information and that can only confuse you. Make small progress every day, trade a little each day, and learn.

Remember, it is 100 percent sure that it is possible to make a lot of money during recession. The thing needed for trading is here – the price fluctuation. So, it is almost the same when there are no recessions or downturns. For stock trading price fluctuation is essential.

You must have a strong risk management strategy, and not more than two trading strategies. Never be impatient, just wait for A+ setups. You must have a trading plan, it’s impossible to just jump in a trade.

Trade smart!

Analysts have black predictions for the coming year. The crisis is knocking the door.

Analysts have black predictions for the coming year. The crisis is knocking the door.