Take advantage of owning these stocks, they are paying guaranteed dividends, but the owner doesn’t have the voting rights

By Guy Avtalyon

Preferred stock signifies an ownership stake in some companies. It is like a share of common stock but less volatile.

But there are more advantages to hold preferred stocks. For example, they are prioritized when it comes to dividends or bankruptcy. But by owning this stock you will not have the same voting rights as owner of common stock. Actually, you will not have them.

Preferred stock is similar to bonds. See, with preferred shares, you will have a fixed dividend in continuity. And you can easily calculate the dividend yield. All you have to do is to divide an amount of dividend in the currency by the current price of the stock. Yield is the effective interest rate you earn when you buy a share of the preferred stock.

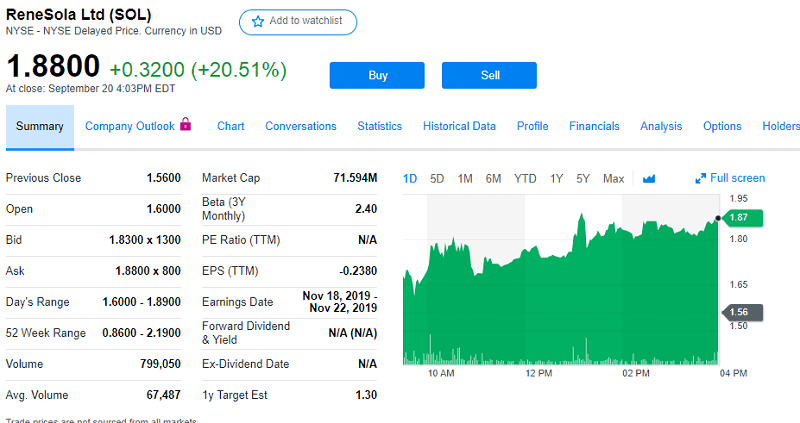

Let’s do some math.

Assume a preferred stock has an annual dividend of $6 per share and is trading at $120 per share. So, the yield is $6 divided by $120 which is 0.05. Multiply by 100 to turn to the percentage. The yield is 5%.

6/120 = 0.05

0.05 x 100 = 5

This is regularly based on the standard value ere a preferred stock is sold. It’s generally determined as a percentage of the current market price after the trade starts. This is a difference from a common stock. Common stock has variable dividends that are published by the board of directors and it is never guaranteed. Moreover, a lot of companies don’t pay out to common stocks.

The added difference is that this kind of stock has a par value. It is in correlation with the interest rate. If the interest rate increases, the value of preferred stock drops. Also, when the interest rate decreases, the value of this stock will grow. You will not find a similar situation with common stock since its value is determined by supply and demand in the market.

Why buy preferred stock?

Investors frequently buy preferred stock for the income the dividends give. The dividends for them are higher than those issued for common stock. And the other benefit is notable. If the company has to miss out on a dividend it collects, it still must pay preferred stock dividends before any common stock dividends come to the schedule. That is why they carry less risk than common stock. Preferred stock owners must be paid before common stockholders if the company failed or in case of bankruptcy.

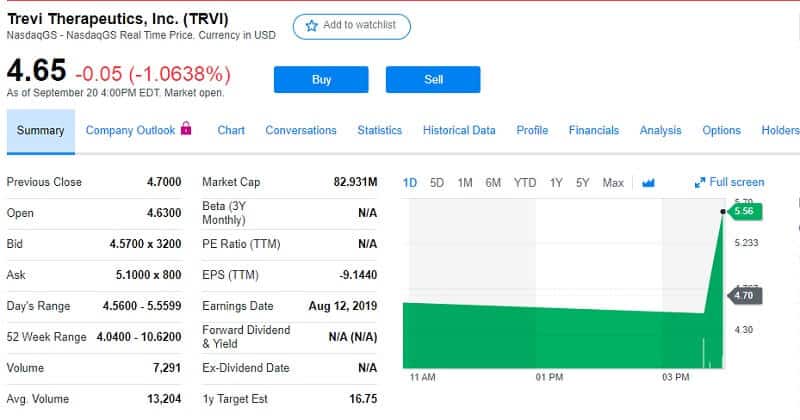

When evaluating the investment potential of preferred stock, it is most important to compare the dividend yield to the yields of the company’s bonds. You will find that preferred stocks often work similarly to bonds.

Preferred stock is a good choice for investors who don’t want to take a big risk. Moreover, it is less volatile than common stock and provides a better flow of dividends.

How to buy preferred stock?

The process is the same as you buy any stock. You can use a broker’s service, doesn’t really matter if it is a discount broker or full-service broker. The main point is that the company has to be publicly-traded, of course. But before you start finding a preferred stock to buy, you must know why should you do that. Why don’t you buy that company’s common stock?

When buying common stock, you’re actually buying a part of ownership in the company. You’ll have voting right as one of the co-owners. On the other hand, if you buy a preferred stock you’ll almost never get voting right.

They have regular dividends payments

When you buy preferred stock, you’ll get regular dividends payments. That is opposite from the owner of common stock that doesn’t have guaranteed dividends. Even a case that the company stops to pay dividends, your unpaid dividends are still yours and once, when the company decides to continue these payments, you’ll receive them.

The other advantage of buying preferred stocks is that your investment will be repaid in full even if the company goes bankrupt.

The owner of common stocks will get nothing instead.

One thing more is present here.

Those stocks give more options to investors. Let’s explain this. Numerous preferred shares are callable. This means the issuer can purchase them at any time. Investors have a true chance for these shares to be called back at a redemption rate. It can be a notable bonus over their purchase price. The market for preferred shares usually assumes callbacks and prices may be bid up respectively.

And we must point out one disadvantage again. Its shareholders regularly do not have voting rights as the owners of common stock. It may be a problem for some investors.