What is a stock market bubble? How a stock market bubble is created? What is the definition?

We are talking about a stock market bubble when the prices of stocks rise fast and a lot over the short period and suddenly start to drop also quickly. Usually, they are falling below the fair value.

A stock market bubble influences the market as a whole or a particular sector. A bubble happens when investors overvalue stocks. Investors can overestimate the value of the companies or trade without reasonable estimation of the value.

How does this thing work?

Let’s say investors are massively buying some particular stock. They become overly eager to buy. How does that affect the stock price? The stock price is going up. The traders notice the growing potential and believe that the stock price will rise more and they are also buying that stock with an aim to sell it at a higher price.

This trading cycle has nothing with the usual criteria related to trade. When this cycle lasts long enough it can extremely overvalue the stock or some other asset, generating a stock market bubble that will burst.

Because a stock market bubble is a cycle defined as speedy increase, followed by a decrease.

We would like to explain this in more detail. When more and more traders enter the market, believing that they also can profit and perhaps go on the double, but we have a limited supply of some stock, it isn’t unlimited. So, on one side we have an enormous number of traders willing to buy a stock, and on the other side is a limited number of particular stock they are interested in. The consequence is that the stock price will rocket. That sky-high price isn’t supported by the underlying value of the company or stock.

Finally, some traders realize that the growing trend is unsustainable and start selling off. Other investors start to follow that and catch on and start draining their stocks, in hopes to recover their investments. And here we come to the main point.

The declining market isn’t investors’ darling. The stock prices are dropping, traders who enter the market too late have losses, the stock market bubble bursts or in a better scenario, deflates.

Actually, we can easily say that behind the stock market bubbles lies a sort of herd mentality. Everyone wants a piece of high returns, it’s logical, right? Well, it continues with a downward run.

What causes it?

When eager investors are pushing the value of the stock, much over its proper value, we can say that we have a bubble. For example, the stock proper value is, let’s say $50 but investors boost it at $150. You can be sure the price will go back to its proper value, soon and extremely fast. The bubble will pop.

A good example is the dot-com bubble of 1999/2000. The markets were cut from reality. Investors accumulated dot-com stocks so wildly. How was it possible when they knew that a lot of these companies were worthless? They didn’t care.

That pushed the NASDAQ to over 5.000 points in a short period. That was the bubble and everything got apart very fast and painful.

One of the most famous market bubbles took place in the Netherlands (former Holland) during the early 1600s. It is the Dutch tulip bulb market bubble or ‘tulipmania’.

What happened?

The speculators pushed the value of tulip bulbs sky-high. The rarest tulip bulbs were worth six times more than the average yearly salary. Today, tulipmania is in use as a synonym for the traps due to extreme greed.

That can happen when someone follows some investor and notices how good it is and suddenly that one decides to do the same. But such copycats are not single individuals in the stock market. There are millions doing exactly the same thing. In a short time, everyone is plunging the money and the market reacts respectively by inflating prices. And eventually, the bubble will burst.

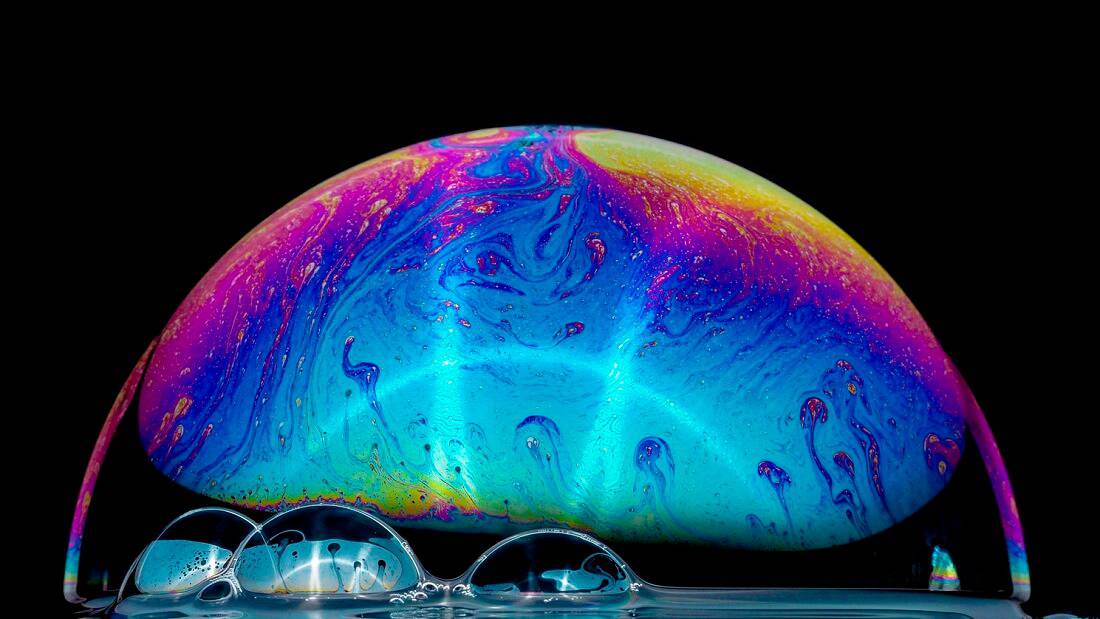

A stock market bubble as positive and negative feedback loops

Whatever has begun to shift stock prices up to become self-sustaining is a positive feedback loop. For example, investors hunting higher growth. When prices increase, investors are selling stocks. The others are buying them to profit on the growth. Someone will ask what is wrong with that. Well, new purchasings are driving the prices up higher and more investors are seeking those profits. The cycle is starting. And it is good but only when this positive feedback loop, as economists call this, comes as a reflection of reality. But when the feedback loop is based on fake data or questionable ideas it can be very dangerous. A great example is the Stock Market Crash of 1929. That was a time of blooming speculators in the markets. Speculators are trading stocks with borrowed money. The loan is paid from profit. When speculators have good trades they can make a fortune. In a different scenario, when they try to limit losses on debt, they can lose the shirt.

The stock prices will go down, the other investors will quickly sell with the same hopes to mitigate losses. The prices will go down further and create a “negative feedback loop” and poor market conditions will bloom. This is exactly what happens when the stock market bubble bursts. The stock prices are going down further as investors try to sell their stocks to cut losses.

Bottom line

As you can see, a stock market bubble happens when investors are buying stocks neglecting the value of the underlying asset. It is caused by a kind of optimism, almost irrationally, despite the rule of thumb: avoid impulsive trading.

The crucial nature of a stock market bubble is that trading can go in a direction that is not in your favor. Optimism can fade. Investors seeking higher profits easily can see their own disaster when the growth starts to slip. Why should they stay in positions any longer? They will not, of course. It is opposite, the selling off will start and the stock market bubble bursts. And it can do it for random reasons. Be careful, you can recognize a stock market bubble when everything is done. Only rare investors are able to anticipate it is coming. Well, that’s why they are successful and rich.