3 min read

One share of stock – Is there any benefit to buying one? Is it better to have a bunch of shares or not? A dozen? 100? 150? 200? The answer is typically less than the number of fingers on the hand. A ruling principle of stock investing is to spread your portfolio throughout several companies.

But, what if you don’t? What if something bad happens to your single investment? You will have practically no way to cushion the disaster. The misconception in managing a portfolio is that should contain numerous stocks.

Why is this opinion a mistake?

Yes, your exposure to risk in individual stocks is smaller. But, at the same time, you are also reducing the chance to make large profits in the big winners. There is a simple reason behind this: You won’t have enough shares to enjoy the gains. But there is a disadvantage of an over-diversified portfolio is that it takes a lot of commitment to watch over many companies, follow their rise, reports, and other progress.

If you have a smaller number of shares, it’s easier to follow the companies you own.

Yes, truth is, investing all of your money in the stock of only one company is very risky. You can suddenly lose most of your money. But it also has the potential for huge returns. There are numberless stories about investors getting into a company that went onto great things.

For example, if someone was able to buy Apple in its early days, such has made a lot of money nowadays. Moreover, one share of stock was good enough.

But, there are a lot of risks here.

Very often, those stories don’t include the fact that the investor made a lot of investments that failed before the big success happened. If you make 25 investments and they’re all average and suddenly make one that earns a big return, your overall return is not that big. The stocks can sometimes increase value, but companies can often totally fail. In that case, their stock is worthless.

In fact, entire business areas can become insignificant over time. Some companies were probably good investments several decades ago.

For example, producers of VHS cassettes or floppy disks. What we want to say is, you can invest in a big company to reduce the risk of losing, but that also drastically reduces the chance of big success, too. Some companies can be as steady as a rock, but still, it’s not likely to quickly double your money, either.

Is buying one share of stock worth It?

It is not about how many shares of a stock you buy or sell in one transaction.

Stock brokerage firms usually charge the same commission. For smaller transactions, the fees represent a higher percentage of what you’re paying for the stock itself.

Buying under 100 shares can still be worthwhile if you think you’re going to make sufficient money on the investment to cover the fees. To decide for yourself if a small trade is worth it, you’ll want to look at your brokerage’s commission and the actual stock price.

Buying 50 shares of Berkshire Hathaway could cost $15 million since one class of stock in the company has traded above $300,000 a share, for example. But, other companies’ stock trades for as little as a penny, so buying 50 shares would cost you 50 cents. A commission of $5 dollars on a 50-cent purchase has a much different effect on the total cost than a $5 commission on a $15 million purchase. Don’t you think? It is important to evaluate whether or not the commission fees charged to you will still make the investment profitable.

One share of stock – Fewer is better

For a beginner portfolio of about $3,000, just two stocks are enough. But for a portfolio of $5,000 to $20,000, three stocks can be an easy load. Hence, for portfolios up to $200,000, four or five stocks are enough. Also, those who have more than a million dollars to invest should restrict themselves to six or seven stocks. To have success with some of the stocks, you have to make the right selection. This doesn’t mean you have to make excellent choices.

All you need is a careful process of selecting companies with superior profit and sales growth. Deduct the stocks lacking good chart profiles, and you end up with a shorter list of potential investments.

How to evaluate

Watch at the current share price, calculate the price at which you would sell that stock, and determine the difference. Now, calculate that price by the number of shares you plan to trade to see how much your profit would be. It is without commissions. Then, deduct the commissions you’d pay to both buy and sell the stock. And you will find if the transactions seem worth it.

Remember, you have to consider the risk involved. The stock might not play as well as you suppose.

Lower share price means less expensive

That’s where most people start. But it is wrong. The price per share of any company you want to buy should be almost trivial to you. You should think in terms of your overall money invested. That’s how you should allocate. Don’t even think of what a stock’s price is, or how many shares you get.

You have to be sure that you are buying solid companies that you feel it is good for you. Your portfolio should reflect your idea of the company’s future. The share price is meaningless. For example, Google is $700 per share, Apple is $100 per share, that doesn’t say anything about either company or whether or not one is a better investment over the other.

Why the price of a share doesn’t matter?

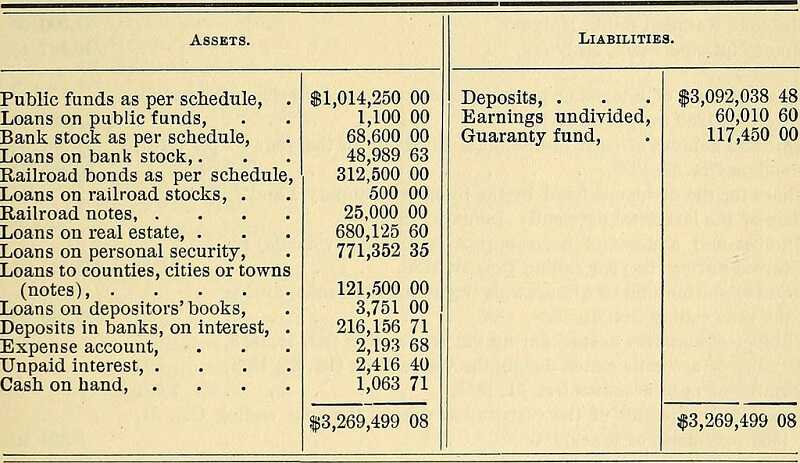

You should not make an investment decision based on the price of a share. Look at the books to decide if the company is worth owning, then decide if it’s worth owning at its current price. The price of the stock is made by how many shares were issued and how much people think the company is worth and will be worth it. The first factor can change in a stock split and without the others changing.

What you really need to look at is what you think the future of that company looks like. But as most important, what that might do to the stock price and to the dividends it pays to stock owners.

One share of stock can be good

Honestly, there is no difference between more shares of a cheaper stock and fewer shares of more expensive stock. When you invest in a stock, the increase in the share price results in gains. This is a major concept of investing.

Trading real money can be difficult without a sharp understanding of the principles involved. Investing your money without good knowledge will be stressful. It could have a discouraging effect if it doesn’t go properly.

The bottom line

There is no minimum order limit on the purchase of a publicly-traded company’s stock. It’s prudent to buy portions of stock with a minimum value of $500 to $1,000. As you already know, there are commissions on the trade. Whether you own 10 shares at $200 or 200 shares at $10, you still own $2,000 of a company. If that company’s market value grows by 10%, you earn $200 in any case.

It is easy to find online discount brokers that allow you to buy fractions of shares of higher-priced stocks. So, if you don’t have enough to buy a full share it shouldn’t stop you. Also, if a company you want to own but you don’t have enough saved to buy a share, keep saving. Simple as that. It doesn’t matter if you buy now or a few months from now.

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

How to Forex investing? It isn’t a get-rich-quick scheme but it is full of potential to become wealthy

How can we apply artificial intelligence to the financial markets

How can we apply artificial intelligence to the financial markets