The Shiller P/E or the cyclically-adjusted price-to-earnings (CAPE) ratio of a stock market is a market valuation metric that eliminates change of the ratio caused by the difference of profit margins during business cycles. It is the regular metric for evaluating whether a market is overvalued, undervalued, or fairly valued.

Shiller CAPE ratio or the cyclically-adjusted price-to-earnings ratio of a stock market is one of the regular metrics if you want to evaluate whether a market is overvalued, undervalued, or fairly valued.

Shiller CAPE ratio, developed by Robert Shiller, professor of Yale University and Nobel Prize Laureate in economics. This ratio usage increased during the Dotcom Bubble when he claimed the equities were extremely overvalued. And he was right, we know that now. Shiller P/E is actually a modification of the standard P/E ratio of a stock.

Investors use this Shiller CAPE ratio mostly for the S&P 500 index but it is suitable for any. What is so interesting about the Shiller CAPE ratio? First of all, it is one of several full metrics for the market valuation able to show investors how much of their portfolios should wisely be invested into equities.

The ratio is based on the current relationship among the price of equities you pay and the profit you get in return as your earnings.

For example, if the CAPE ratio is high it could indicate lower returns across the following couple of decades. And opposite, a lower CAPE ratio might be a sign of higher returns across the next couple of decades, as the ratio reverts back to the average.

Investors use it as a valuation metric to forecast future returns. The metric has become a popular method to get long-term stock market valuations. To be more precise, the Shiller CAPE ratio is the ratio of the S&P 500’s (or some other index) current price divided by the 10-year moving average of earnings adjusted for inflation.

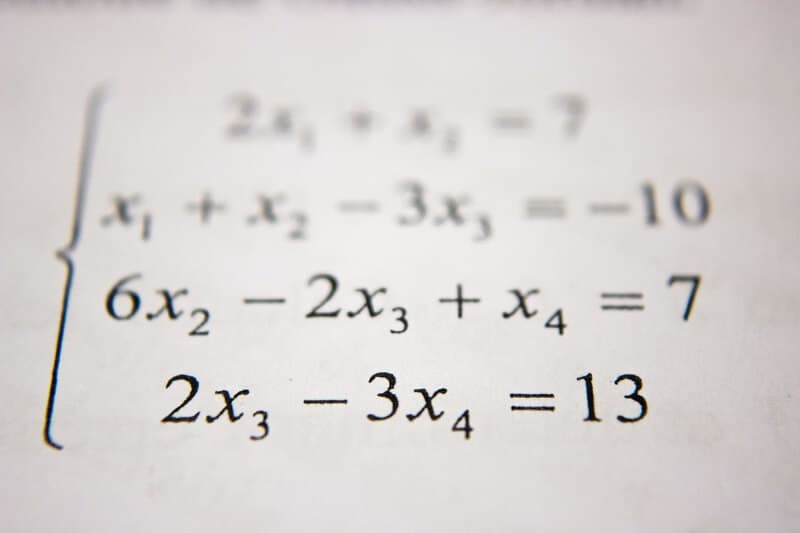

The formula is:

CAPE ratio = share price / average earnings over 10 years, adjusted for inflation

That was the formula but let us explain a bit more how to calculate the Shiller CAPE or also called Shiller’s P/E ratio.

What you have to do is to use the annual earnings of the company in the last 10 years. Further, adjust the past earnings for inflation.

How the Shiller CAPE ratio works

As an investor, you know that the price is the amount you have to pay, and the value is the amount you get. That’s clear. We have to compare the price to the value and that’s why we have many metrics to do so. One of them is the P/E ratio, read more HERE.

It is legal that everyone wants to buy a healthy company when the shares are trading at a low P/E ratio. This means you can get lots of earnings for the price you paid. This is valuable for index too. Just take an aggregate price of the shares of the company from, for example, the S&P 500 index for one year and divide that number by the aggregate company’s earnings for that year. You will get an average P/E for the index.

But it isn’t quite true. For example, during the recession. At the time of the recession stock prices will fall as well as companies’ earnings (okay, they may fall significantly sharper). The problem is that the P/E ratio can rise temporarily. The investors want to buy when this ratio is low but temporary high P/E can send them a fake signal that the market is overpriced. And what is the consequence? Investors wouldn’t buy at the time when it is the best solution.

So, here is the Shiller CAPE ratio to fix that. Shiller invented a special version of the cyclically-adjusted price-to-earnings ratio to help fix this simple calculation. If we use his CAPE ratio we’ll have a more accurate understanding of the ratio between current price and earnings. This ratio employs the average earnings over the past business cycle, not just one year that may have bad or good earnings.

The importance of the ratio

Shiller himself explained this the best. He used 130 years of data and noticed that the returns of the S&P 500 over the next 20 years are fully inversely connected with the CAPE ratio at any observed period. How should we understand this? Well, when the CAPE ratio of the market is high, that means the stocks are overvalued. So, the returns in the next 20 years will be lower. Hence, if the CAPE ratio is low, we can be sure the next 20 years the returns will be satisfying.

This is natural and logical. Cheap stocks can increase in price no matter if it is from a growing company’s earnings or a rising P/E ratio. Contrarily, when stocks are expensive and have a high P/E ratio, they don’t have too much space to grow. It is more likely they have more chances to drop when market correction or recession comes.

How to use the Shiller CAPE ratio

Shiller warned against using CAPE in short-term trades. The CAPE is more helpful in predicting long-term returns. Siller said in an interview: “It’s not a timing mechanism, it doesn’t tell you – and I had the same mistake in my mind, to some extent — wait until it goes all the way down to a P/E of 7, or something.”

But really, you have to combine CAPE with a market diversification algo or some other tool for that. Maybe the most important part is that you never get fully in or fully out of stocks. As the CAPE is getting lower and lower, you are moving more and more in. We think the CAPE ratio for March this year is 21.12. Check the Shiller P/E ratio HERE

So, it isn’t super high. We, at Traders-Paradise, think the stocks should be an important part of your portfolio. Don’t get out of the stocks and go in cash because the CAPE is at 21. It is smarter to buy less and expect poorer returns in the next several years. Some experts noted that markets are most vulnerable when the Shiller P/E is above 26 like it was in February this year. Some stats show that investors respecting Shiller’s ratio are doing better.

Bottom line

Since Shiller showed that lower ratios signify higher returns for investors over time, his CAPE ratio becomes an important metric for predicting future earnings.

There are criticisms about the use of the CAPE ratio in predicting earnings. The main matter is that the ratio doesn’t take into account changes in the calculation of earnings. These kinds of changes may turn the ratio and give a negative view of future earnings.

The CAPE ratio was proved as important for identifying potential bubbles and market crashes. The average of the ratio for the S&P 500 Index was between 15 -16. The highest levels of the ratio have exceeded 31( February 2020). For now, the Shiller CAPE ratio announced market crashes three times during history: Great Depression in 1929, Dotcom crash in 1990, and Financial Crisis 2007 – 2008.

Opponents of the CAPE ratio claim that it is not quite helpful since it is essentially backward-looking, more than it is forward-looking. Another problem is that the ratio relies on GAAP earnings, which have been changed in recent years.

The proponents claim the Shiller P/E ratio is good guidance for investors in determining their investment strategies at various market valuations.

Historical data show that when the market is fair or overvalued, it is good to be defensive. When the market is cheap, companies with strong balance sheets can produce great returns in the long run.