What investors should do when the market is down

The global uncertainty due to the coronavirus outbreak forces investors to a smart allocation. Avoid companies with high debt, stay focused on the sustainability of earnings.

By Guy Avtalyon

How to survive the market downturn? We heard so many investors asking this. Boosting the concerns were profit warnings from the companies in Europe, the US, and all over the world. Everyone is talking that a key earnings target would take longer to meet. The reason is the coronavirus outbreak adds uncertainty in the main markets. Many well-known large companies plunged and had to mute growth for this year due to the COVID-19 outbreak. We are sure you are following what’s going one with that and also, we hope you are following WHO’s advice to protect yourselves.

Our concern is how to survive the market downturn, what investors have to do now when the markets are down.

Financial pandemic

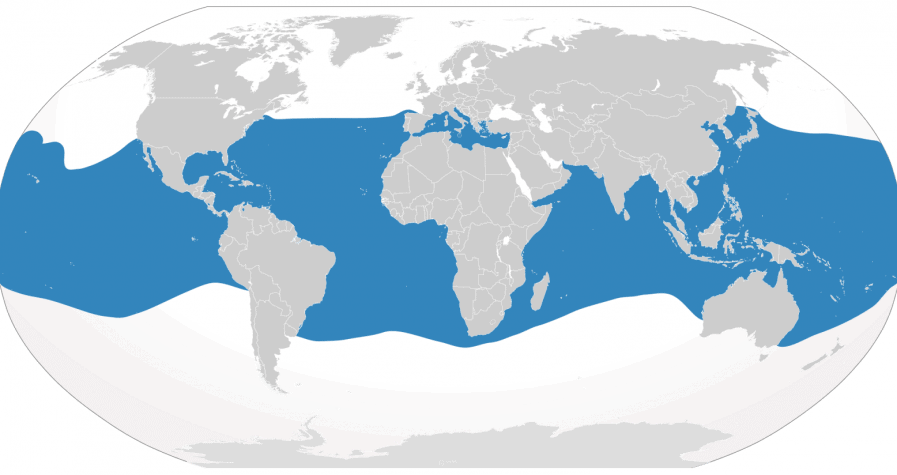

Asia Pacific markets dropped today (February, 28) due to fears about the coronavirus. These fears continue to urge a global sell-off.

Japan’s Nikkei 225 dropped more than 3% in today’s morning trading. South Korea’s Kospi and Australia’s S&P/ASX 200 fell more than 2% each.

Hong Kong’s Hang Seng fell 2.7%, while the Shanghai Composite fell 3.4%.

Also, we have a historic plunge in the markets in the US. Three major US indexes slipped into correction territory on Thursday. The S&P 500 had the worst day since 2011. The Dow sank 1,191 points, which is a drop of 4.4%. This was the worst one-day point drop in its history.

Coronavirus appears as a ‘financial pandemic’. The global oil benchmarks, US crude, and Brent crude fell Thursday lower by 3.4% and 2.3%.

Even China search giant Baidu warned that revenue could fall as much as 13% in the first quarter and its core business could fall by 18% compared to the same time last year.

How to survive the market downturn?

So, the coronavirus has continued to spread, the stock market has started to feel the uncertainty. No one knows how this situation could affect companies over the world. Or investors. This epidemic like any other came suddenly and caused a shock to the global economy. As always, this situation lead (and it did) to great changes in the stock markets. Investors’ fears became a truth. And also, this led to panic selling.

What a great mistake!

Why do we think it is a great mistake? Okay, we all want our wealth to grow, not to vanish. These stock market ups and downs are hard to look at for all of us. That’s why it is so easy to be caught in emotions.

Investors are frightened and worried and that can lead to panic. And panic can lead to quick and imprudent sellings. We want to help you to avoid this mistake that may cost you very much.

Let’s take a look at an example that may help you to learn how to keep your hands off your investments. Especially now with a major market slide. Let’s say you entered this year with $100.000 in your investments. But it is the end of February and the stock market is dropping (You have the last data above) and let’s say, you already lost $10.000. Can you afford to lose an extra $10.000 if the market continues to fall? So, how to survive the market downturn? If you want to survive this storm your first thought might be to sell off, for example, mutual funds and move into the money market. That’s a mistake, that’s wrong. Don’t do that! The stock market can rebound. Yes, it will take a few months till then, at least two, but when it does that you’ll be able to recover your losses and gain more. So, don’t keep your money on the sidelines. Investors that did such a thing extremely regretted it.

Try to separate your emotions from the investment decisions. One day, very soon, whatever looks like a disaster now, can be just a twinkle in your investing history.

How to survive the market downturn by keeping fears under control?

Do you know a saying on Wall Street? It is something like: The Dow climbs a wall of worry. What does this saying want to tell us? Dow Jones will continue to rise despite economic downturns, pandemics, natural disasters, or any other catastrophes. That’s why we have to keep our emotions under control, our fears in check. This market correction just looks like a massive disaster but it is just one short period in the market’s cycle.

Well, how to tell you this? When some economic slowdown appears it is so normal for the stock market to go negative. For long-term investors that means nothing. They bought their shares at a low price when the market was down. So, consider if there is a buying opportunity. Always keep in mind the old maxim “buy low and sell high”.

Reexamine your portfolio and your investment strategy instead of panic. Choose to be strategic with actions.

What are the benefits of a declining stock market?

The market is down, so what? Will it be a market correction? No one knows. What do we have to do? To stick to our investment plan and goals. Don’t damage your portfolio.

Investors turn into stocks when the market approaches new highs. When the market drops they are running away. So, what are they doing? Buying high, selling low? The consequence is that they have poor returns. Can you see the problem? It doesn’t have to be like that. Some investors know how to benefit from the market drop, how to survive the market downturn.

Ways to survive the market downturn

Firstly, they know how to recognize the problem, meaning they understand the essence of investing. With that knowledge, it is more possible to avoid unfavorable investment performance. So, learn!

If we sell out of fear when the market is down, we are actually generating minimal returns. At least, we should think about this before executing a trade on such occasions. The next step is to change our mentality, the way we think. For example, we all like when the price of electricity goes down, right? But we are not excited when the stock price is going down. Here is the catch!

How can money go further?

It can be achieved if we buy more shares since the prices are lower. We can buy more shares even if the amount of money we planned for that stays the same. So, our money will go extra. Further, we can reinvest dividends. That can be a notable portion of our returns. We found some studies that show the dividends added 5 percentage points of the entire 7.9% returns of stocks. These studies cover the period from 1802 to 2002. So, if we want better returns we need to reinvest dividends.

One of the benefits of a declining market is a chance to sell high and buy low but through rebalancing. This means we have to sell winning assets, the assets that increased in value, and provide money to buy assets at a lower price but with a good future perspective.

Typically, bonds are better players in everyone’s portfolios, so sell them and go into stock funds. Analysts revealed that this only step in rebalancing can increase risk-adjusted returns, even up by 21%.

Is the dropping market a good experience?

A dropping market provides us priceless experience. Don’t underestimate this. That new knowledge will give us a valuable answer on how to survive the market downturn in the future. At least, we’ll be able to understand how we manage our emotions. That can be the core of our future investment goals. If we feel uncertainty about every small change in stock price, we should go into a safer investment. Maybe stocks are not for us. But if we enter the fight and end up with more winners, only the sky’s the limit.

We don’t like to guess if this will be a market correction or not. No one can do that, whoever tells that can predict the next stock market move, lies. We don’t know. All we know is that the best way is to stay in your investment plan. This is smart trading!