A digital currency similar to bitcoin called crypto-asset could be a good pick to trade

By Guy Avtalyon

If you missed getting bitcoin, this is the best time to consider and add this crypto asset to your portfolio. This crypto asset has a powerful recovery in 2019: Bitcoin. We can see on the BTC charts and from the market, bitcoin is now one of the best assets since it recovered at $10,000 again in 2019. It happened last month and it looks like it will stay there or climb more.

Bitcoin grows approx 163% this year. Most importantly, this time the basics are different.

Can you see that frenetic fight among banks, technology, and financial companies? Everyone wants to develop the blockchain.

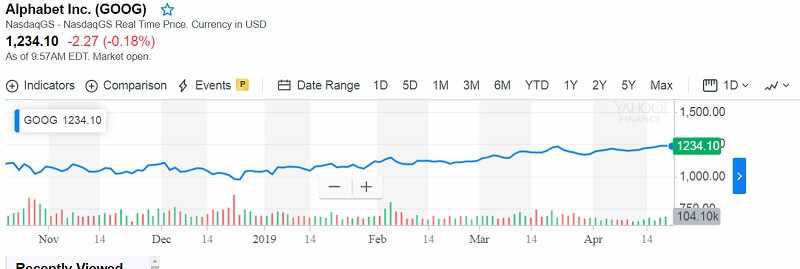

We already wrote about Facebook, but there are more. Google, Square, Goldman Sacha are also the companies that invested in projects to provide a mass adoption of blockchain.

Bitcoin’s new rally could be more powerful than ever. How is that possible? The crypto traders and investors already know what creating of own crypto may cause on the market. Twitter is on its way to include bitcoin and other cryptos into its payment, Square. It is the question of the moment. We will not wait so long to see that.

Facebook announced its plans to introduce its own cryptocurrency, Libra.

Fidelity already offers to its traders to trade BTC. Amazon is very close to offering the same possibility but at the same time, they are developing their own crypt asset.

Moreover, crypto asset-backed ETFs are preparing to enter the market. That will be a really new investment class.

What is crypto-asset?

It is a digital currency similar to bitcoin and based on blockchain technology. How things look now, it will enter a bull market. This new asset is getting strong popularity!

This hype can be compared with the time of Internet adoption.

In the beginning, it was treated as a fancy freak. Do you remember that time? Okay, someone can, but someone hadn’t been born in that time. The point is that the introduction of the Internet gave a chance to many companies to be created. For example, Google or Amazon, and many others came later. The mentioned companies are among the top market listed firms.

And now, we are witnesses of the creation of the new crypto-assets based on blockchain technology.

Maybe this is a chance for you to add crypto assets in your investment portfolio. Yes, the crypto market is volatile. But it is a chance for traders to make a profit.

Bitcoin is a volatile investment, that the truth. From $20,000 in December 2017, it dropped at a bit above $3,500 next year. It was almost a $17,000 decrease. But this year Bitcoin is doing well. It recorded (and still do) steady climbing in value. Now it is traded around $10,000. Who didn’t sell bitcoin at $3,700 can make a nice profit now.

How can you as ordinary investors get in on this the most profitable odds? How can you enter the crypto asset market?

If this is an unknown field for you, you should find some guidance, you have to find some trusted expert to guide you through the market volatility to the possibilities.

Why is this so important?

Let’s say, you don’t have a lot of knowledge about crypto assets. So, how could you profit from them without that? You can find more than 2,000 assets in the market whose total value is about $250 billion.

Which crypto asset to trade? How to pick?

Wild value fluctuations happen and you may stay confused where to invest. Don’t worry, everything will be more clear very soon.

The best part is that even the investors with most suspicious can see now that crypto is here to stay. It will not go anywhere or totally disappear. The technology behind digital assets is even more firm.

Traders-Paradise wants to give a few examples of the crypto assets which you should buy.

On the top is Bitcoin. BTC should be a central asset in your portfolio. If you still don’t hold it, it is the time to include this asset to generate really high profits because the prices will grow. So, the time to buy is NOW.

You have to pick the most future proof coin. Some will tell you it is Binance Coin, issued by Binance exchange. The price of BNB tokens will be a good test. Stay informed about it.

Some others will suggest it is NEO. It will finally expand to add other cryptos and fiat. It can be one of the most interesting and hopeful purchases. Or Stellar! The guarantee plus is a connection to IBM. Further, Ethereum. You will never go wrong with Ethereum. And also, there are Litecoin, Dash, Ripple, Monero, Bitcoin cash, etc.

Bottom line

If they sound like investments you would like to have in your portfolio, what are you waiting for?

Never mind.

You have to know that some of the biggest world companies are establishing blockchain. But the most important is that the number of companies is increasing. The power of crypto assets to make money is unquestionable.

Take your place on time.