3 min read

Freedom or utopia, what is Bitcoin?

Freedom or utopia, fraud or bubble, you could hear that so many times.

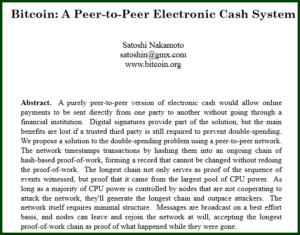

It was one of the worst months for stock markets. In one of its articles, CNN called that month “Red October”. The global economic crisis was in full swing. Right at the end of that month, October 31, 2008, a document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” appeared on the internet, which on the eight sides briefly describes an entirely new type of money – Bitcoin.

The origin of this document is covered with a veil of mystery. Some think that its creator deliberately waited for the existing financial system to fall into a deep crisis so that people would be more open to the alternative offered by him. Others think that the phenomenon of appearance is just in the midst of a financial crisis is just a coincidence.

The only man who could solve this mystery, his creator, is himself quite mysterious. It is represented as Satoshi Nakamoto, but his real identity, as well as his location, stayed unknown, despite many attempts to discover who is behind the Bitcoin. Irrelevant. “Behind it” is only open and accessible to all program code.

The only man who could solve this mystery, his creator, is himself quite mysterious. It is represented as Satoshi Nakamoto, but his real identity, as well as his location, stayed unknown, despite many attempts to discover who is behind the Bitcoin. Irrelevant. “Behind it” is only open and accessible to all program code.

Bitcoin is a recipe, an idea, an algorithm. Freedom, not utopia.

Freedom or utopia? It’s not a legal entity. So many qualifications, worse after a bad one. Is it important who actually was Pythagoras? Francis Bacon? William Shakespeare?

The currency was created on January 2009, but in the first 16 months of its existence, nothing was actually paid with Bitcoins. Only on May 22, 2010, for the first time, something tangible was paid by Bitcoin. Specifically, Mr. Laslo paid 10,000 bucks for two pizzas that day.

Since then, the Bitcoin community has been celebrating May 22 as “Bitcoin’s Pizza Day“. The big question is how much Laslo himself is for celebrating. He became part of the battle of history, but this entry in history cost him a lot. Those 10,000 Bitcoins at the time of writing this article worth more than $65 millions!

After 9 years we are speaking about the social and political importance of Bitcoin.

As a form of money, Bitcoin should be viewed in the context of changes in the global monetary landscape of Bretton Woods in the early 1970s. Since then, it has been increasingly difficult to manage national currencies, given the incredible growth of financial instruments produced by banks and other complex financial institutions operating in a global environment.

These are the events Susan Strange spoke about in books, such as Casino Capitalism (1986), and Mad Money: When Markets Outgrow Governments (1998). She warned that the states, as a rule through central banks, were increasingly unable to control the circulation of funds by instruments that were specifically developed to deal with the risks that arose when the same countries abandoned the exchange rate control.

Money, which she viewed through the classic definition of Georg Simmel as a “social deal”, was endangered by a series of sophisticated financial instruments designed to control global risks. It seems that many of these new instruments, such as derivatives, act in their own way as forms of money. In the revolutionary book Capitalism With Derivatives, Dick Bryan and Michael Rafferty later argued that derivatives were “a new type of money that now becomes an anchor to the global financial system.“

One cryptocurrency, such as Bitcoin, offers answers to many types of reviews of the monetary system as it is now configured – although the answers do not go in the same direction as criticism. Knowing all reasons that support Bitcoin, there are intriguing and obvious opposite political and ideological alliances around the cryptocurrency in general. That’s where the question Freedom or Utopia arise.

IT BECOME TOO EXPENSIVE. ONLY RICH CAN AFFORD.

Money with two decimals is only a historical consequence. It’s not a natural law that money must have only two decimals. Bitcoin is split into a hundred million parts. You can buy, for example, a thousand pieces of coin for 15 euros or dollars. Less than 1% of people on the planet can have more than one Bitcoin.

AND THEN WHAT? WAITING FOR IT TO GROW, THEN TO SELL?

Not. You have a chance that your old man did not have. To save something that no single dictator can deny you, a taxpayer or a perpetrator will be seized, the banking officer will refuse, forward it. Every day there is an ever-increasing and widespread payment facility. Wait till we’re exchanging parts of bitcoins at a local flea market.

THIS IS A BUBBLE!

Then pop it!

Bitcoin has had 4 bubbles so far.

The first was July 2010, when he jumped from $ 0.008 to $ 0.08.

The other was the “Big Bubble 2011”, from $ 0.06 to $ 31, then dropped to $ 5.

The third was in April 2013, from $ 20 to $ 280, when Cypriot banks rescued floating client deposits.

The fourth was a major crisis of the MtGox Stock Exchange in November 2013 when it jumped from $ 70 to $ 1,200, and a few months later it fell to $ 200.

Bitcoin is, of course, now in the bubble, which is called the only freely unregulated market in the world. The multi-year trend of growth of Bitcoin values follows Metcalfe’s law on the value of the network. But on a small scale, this value is very volatile, as networks grow in bouts, and on each of them there is a struggle of fear and greed and a new disclosure of a fair price. Do not forget Keynes’s investment advice: “The market can remain irrational longer than you can remain solvent“.

COUNTRIES WILL NOT ALLOW THIS GAME TO PLAY

This argument more testifies to the inferiority of the one who pronounces it than about the power of governments. Here is a list of some state bans so far: the printing press, free elections, power-sharing, stripes, alcohol, sucrose, gramophone, gold, homosexuality, marijuana, pornography.

So, will we really need to talk about Freedom or Utopia? Now, after all?

Only the governments and the banking cartel can try to morally outline the idea in the hope that most of us will believe: terrorism, pedophilia and, of course, the favorite oppressive law, the successor to Socrates‘ defect of youth, his predicate highness: money laundering.

But, without most of us, these are just paper dragons. Don’t forget the first lesson about an enlightened man from the Renaissance period: You are not the object of history, you are the subject that changes it.

When in 2000, Lars Ulrich ( Metallica) was tearful in front of the Senate Board for his intellectual property in the Napster case, a coder called as an expert, warned the US government: “Forbid Napster, and something more horrible will appear.”

They turned it off.

And that same month, they received a BitTorrent protocol, which today is, among other things, an inevitable part of the Bitcoin protocol.

For, as Victor Hugo said, “No army can stop an idea whose time has come.”

For, as Victor Hugo said, “No army can stop an idea whose time has come.”

Attempting to ban Bitcoin is just as an attempt to ban swearing or a word for dots.

Bitcoin isn’t utopia, it is freedom.

Do you agree?