Ways to use call options trading to make money

By Guy Avtalyon

Call options represent a deal between a buyer and a seller to buy a stock at an accepted and agreed price. This agreement lasts up until a fixed expiration date. The buyer has the right, there is no obligation, to exercise the call and purchase the stock. The seller is obliged to deliver the stock if the option is exercised.

What are call options in stocks?

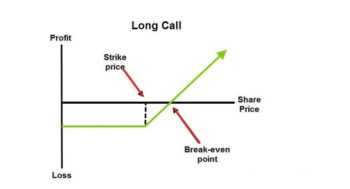

A trader would choose to buy a call option if expects the stock is going to rise in the near future. Some traders buy options rather than to buy a particular share because the options are cheaper than stocks.

Call options are limited by time, of course. They have an expiration date associated with them. The same comes with all options.

What are the main characteristics of call options?

No matter if the options is “call” or “put” the characteristics are the same. Both have three essential characteristics: exercise price, expiration date, and time to expiration.

Call options are a kind of a derivatives contract that gives the buyer the right to buy a stock at a specific price known as the strike price of the option and has to exercise it within a defined time frame. The seller has an obligation to sell the stocks to the buyer if the buyer chooses to exercise the option to make a purchase. There is one requirement that the buyer must fulfill – such has to exercise the option at any time but prior to a named expiration date. The expiration date depends on buyers and seller agreement and may vary from three months to even one year.

The seller will receive the buying price for the option, but the amount depends on how close the option strike price is to the price of the stock at the time the option is bought. Also, on how long is a period of time to the option’s expiry date.

To put a long story short, the options price will vary depending on how possible or not possible is for the buyer to profitably exercise the option before the expiry date.

What is the exercise price of stock options?

The exercise price is the price at which stock can be bought or sold when trading a call or put options.

For example, you own call options for ABC company with an exercise price of $50. The underlying stock is trading at $60. It indicates the call options are trading in the money by $10. So, the exercise price is lower than the current stock.

The call options will give you the right to buy the stock at $50 even it is trading at $60. That allows you to make $10 per share if exercise the option. Your profit would be $10 reduced by the premium or cost you paid to the seller for the option.

But if ABS company is trading at $60, and the strike price of your call option is $65, the situation is quite different. Your option is out of the money. You will not profit if exercise that option because why would you like to pay $65 by using the option if you can buy the stock at a lower price for $60.

How many options contracts you can buy?

Each option contract holds 100 shares of the underlying stock. Buying 2 call options contracts, for example, grants the owner the right, but not the obligation, to buy 200 shares (2 x 100 = 300).

Suppose you think ABC Company stock is going to rise over a specific period of time. You may consider buying as many call options as your budget allows you. In other words, consider the trade amount that your account can support. This means to decide the maximum amount of money you want to use to buy call options.

What is the expiration date?

Options do not last forever. They have an expiration date.

But if the stock closes below the strike price and a call option has not been exercised by the expiration date, it expires worthless. And the trader no longer has the right to buy the underlying asset and the trader loses the premium paid for the option. Most stocks have options contracts that last up to nine months. Traditional options contracts typically expire on the third Friday of each month.

What do we pay when trading the options?

When you buy the stock for the stock price, you buy options for what’s known as the premium.

Premium is the price to buy options. In 100 XY call options example, the premium might be $4 per contract. It means the total cost of buying one XY 100 call option contract would be $400 ($4 premium per contract x 100 shares that the options control x 1 contract = $400). If the premium were $6 per contract, instead of $4, the total cost of buying 2 contracts would be $1,200 ($6 per contract x 100 shares that the options control x 2 total contracts = $1,200).

What orders to use when trading options?

Options prices are constantly changing, like stocks.

So, you may choose the type of trading order with which to purchase some options contract. There are several types of orders, including market, limit, stop-loss, stop-limit, trailing-stop-loss, and trailing-stop-limit.

Writing or selling a call option

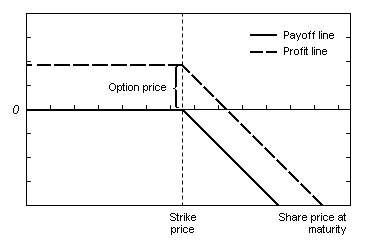

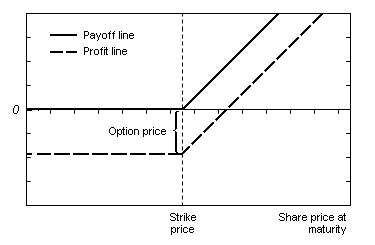

Writing or selling a call option P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid