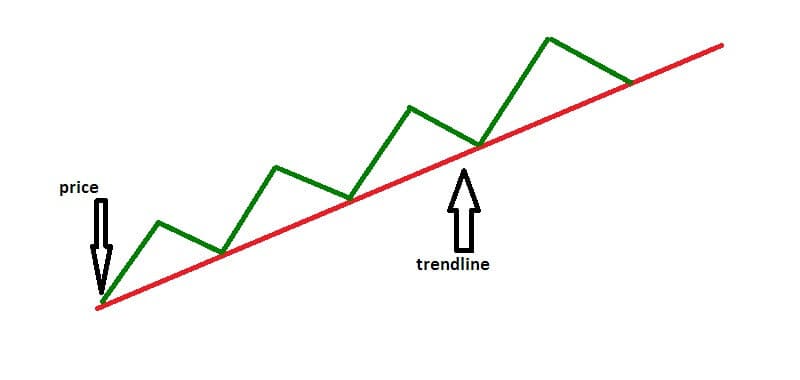

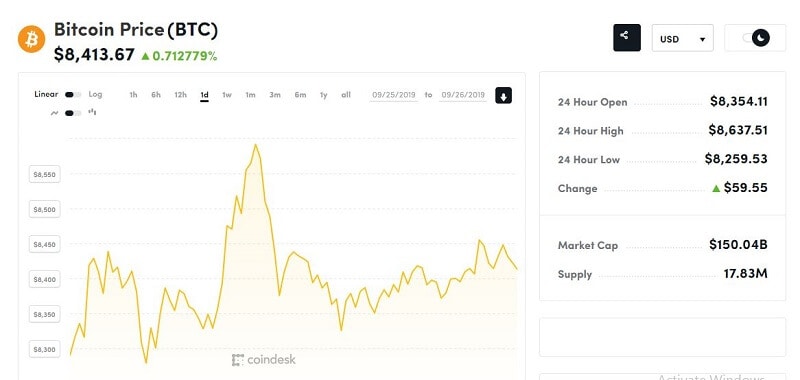

A stock bull market means that investment’s price rises over a long period. Investors’ faith in stock prices lead the prices themselves in a self-fulfilling prediction. A bull market means profits for investors who own stocks.

What exactly is a bull market? If you are like me several years ago, you are confused with all these terms, conditions, maths, evaluations, or estimations of the stock market.

May I be honest with you?

The truth is that I know nothing about the stock market when I entered. I was foolish, I know. But my desire to earn, to be investor was something I never have had before. It was like this…

A personal story

A friend of mine had a grandfather. Extremely interesting figure. He came from Italy to the US as a kid. OMG, he was just 12 when he bought a ticket and came with nothing except dreams about fortune. To shorten this story, after several years of struggling he made his first success. He became a clerk in the office of some broker. Step by step, that wonderful man became very rich. People, listen. Very rich!

I wanted the same. ASAP! I asked him for the recipe. Oh, how I would like I never did such a thing! The first lesson was: You know nothing, have to learn a lot. C’mon, man! Give me something else to start. I thought I know everything. I have just finished university. With a diploma in the hands, I thought I know everything possible about anything. Of course, I was wrong.

That blessed man told me I had to learn. How to, where to go? I spoke with some friends. No help. So, I decided to start. I found a broker, put some money (not a lot) on my trading account, and started to find a stock. That was a nightmare! My first trade was totally a disaster! I placed another trade. The result was the same. In two trades I lost everything.

Ok, at least I tried. Then I went back to my friend’s grandfather and asked him to teach me.

“You get your first lesson, my son.”

OK, I understand. I have to go for basic. And I started to learn. You must learn to have a chance to earn.

The bull market was the point where I started. I can’t explain why, but I felt I needed to know what it is.

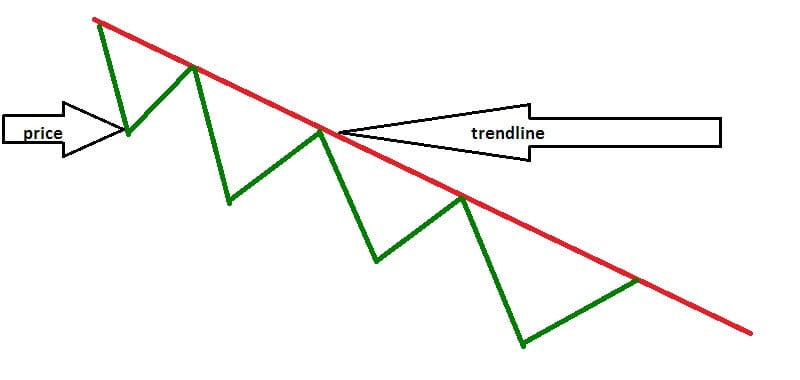

The term “bull market” indicates a stock market is rising. Of course, every single investor supposes the market to rise. Better say, has a hope it will rise. But having only hope means to stand in the mud. You can slide in a moment and fall. Having my previous experience in the mind, I needed more facts.

Nice from this zoological term

So, I learned that the bull market occurs when the prices rise for 20% or more.

Further, I learned that a bull market systematically produces higher highs and higher lows. A stock bull market happens in a strong economy. Nice again, thanks bulls. But what can drive a stock bull market, that I wanted to know?

And I found (with a little help from my friend) that great revenue, profit, and P/E ratio are the most important.

The revenue should be in line with the economy, meaning revenue should grow by the speed of economic growth. Here is some interesting part. As consumers spend more on goods and services rise the economy will rise. Super!

And I came to the companies profit.

The revenue must generate profit.

But some knowledge defeated me. I thought that great profit is a wonderful thing and it is good when the company can generate more profit from the same revenue money. But it is not so simple.

And the P/E ratio! The stock price is just the amount of money it will cost to buy a share of a company. But stock prices can vary. If the demand for the stock rise, its price will rise too. The P/E ratio estimates the relationship between a stock price and its earnings per share.

I was confused just as you are now, I believe.

In a bull market

In a bull market, you’ll notice powerful demand and limited supply for securities. This means that more investors want to buy securities and less want to sell. What will happen? The stock price will rise, right. Let’s go further! Let’s observe investors’ psychology.

In the stock bull market condition, investors have the hope of earning a profit. They are positive and optimistic. Oh, how I wanted to have that experience. Instead, I was scared to death. I needed more knowledge to sure what I am doing. My first trade was so stressful and, by the way, I wanted to show my older friend that I can learn.

In the periods of the bull market, people have more money.

And they are spending. In turn, it stimulates the economy to grow. My old friend told me something important and let me share that with you.

When it is the bull market, you should buy stocks in the early stage, while they are not too expensive. As the price goes up, just wait for its peaks and sell your stocks. And don’t worry if there are some losses in price. It is temporary. Just invest in more stocks with a higher chance of getting a bigger return.

I am grateful to him for this lesson. But there was one piece of advice that sounded the most important to me: “Play the market like toreador plays his wonderful performance in the arena. Peaceful, with confidence, elegant. Tickling the bull. You have to know where the limits are, don’t get surprised.”

I’ll not. Thank you, my dear mentor.