3 min read

The quick ratio is a liquidity ratio that estimates the strength of a company to pay its current obligations when they come due with only quick assets. It is also called an acid test ratio.

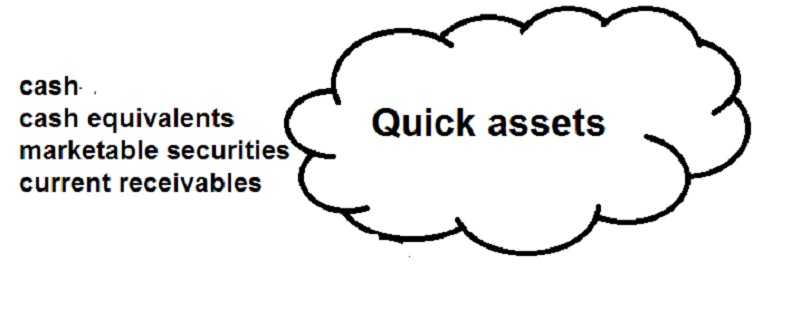

Quick assets are current assets that you can change to currencies within 90 days or in the short-term.

In other words, the quick ratio is a measure of how well a company can meet its short-term financial liabilities.

It is liquidity metric and can be calculated as follows:

(Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

The quick ratio can be calculated for quick assets only.

Let’s explain why sometimes the quick ratio is known as an acid ratio?

That comes due to the historical use of acid to examine metals for gold. The early miners used it.

If the metal passes the test, they know it is pure gold. But if the result was opposite and metal was rusting, the gold miners knew there is no value.

The acid test of investment determines is a company able to instantly change its assets into cash within 90 days.

So, the acid test ratio is a more traditional variant. The other liquidity metric is a modern one – the current ratio.

They are pretty similar but the acid test ratio gives a more precise estimation.

How is that?

The acid test includes only the most liquid assets to study.

It will never examine inventory because it is almost impossible to change inventory into the cash in a short time frame. The company often sell inventory on credit.

Yes, there are some analysts that add inventory in the ratio, but if it is more liquid than some receivables.

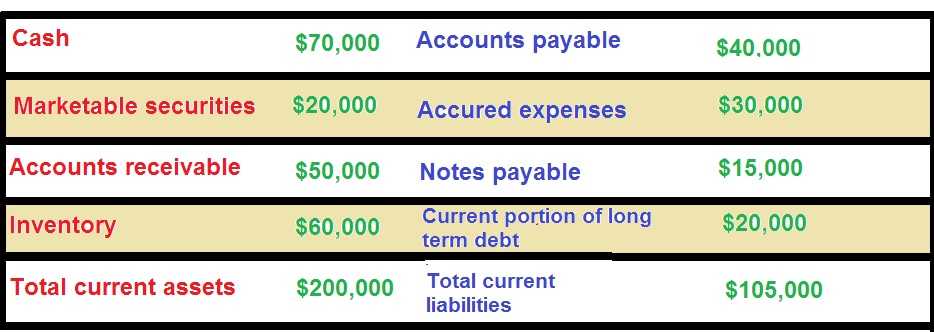

To show you, let’s assume this information was in the balance sheet of our hypothetical firm:

Let’s apply the first quick ratio formula and the data above. So, we can figure this company acid test ratio:

($70,000+$20,000+$50,000) / $105,000 = 1,33

This means that for every dollar of this company’s current liabilities, it has $1.33 of very liquid assets to satisfy urgent obligations.

We will not take inventory into consideration. As we said, the company may require months or years to sell inventory.

Why it matters?

It is important that a company have sufficient cash to pay accounts, interests when they come to be paid. The higher ratio shows that the company is more financially secure in the short term. The companies with a quick ratio greater than 1.0 are enough capable to meet their short-term obligations.

Low or decreasing acid- test ratios usually shows that a company is fighting to keep or increase sales.

Maybe it is paying bills immediately or getting receivables too slowly. Hence, a high or increasing acid-test ratio means that a company has solid growth.

It is quickly turning receivables into cash and regularly covers its financial obligations. Such a company regularly has active inventory turnover and cash exchange periods.

However, the acid-test ratio has its possible disadvantages.

To begin, it provides no data about the level and timing of cash flows. And it is very important because it really defines a company’s ability to pay liabilities to the arranged date.

Also, the formula assumes that a company would sell its current assets to pay current obligations. That is not always pragmatic.

But this analysis can give you a solid and quick view of some company’s financial status.

It is crucial for investors to know if some company are ready to pay its bills and credits.

Some firms use their long-term assets to produce earnings. But, selling off resources will damage the company. Also, it is a signal to investors that current plans aren’t making enough profits.

Higher quick ratios are more welcome for the company.

It confirms there are more quick assets than current liabilities.

A company with a quick ratio of 1 indicates that quick assets are equal to current assets. This also shows that the company could pay off its current debts and not to sell any long-term assets.

An acid ratio of 2 indicates that the company has twice more quick assets than current liabilities.

And you can see how does it work. When the ratio increases, the liquidity of the company increases too.

This is a good sign for investors. Well, this is an even better sign for creditors. You know, creditors want to know they will be paid back on time.

One example more.

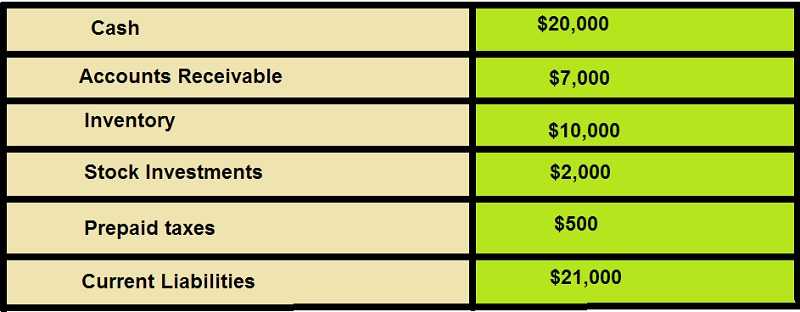

Let’s assume some company is asking for a loan. The bank asks a complete balance sheet so it can calculate the quick ratio. Company’s balance sheet carries the following accounts:

The bank can count quick ratio like this.

($20,000+$7,000+$2,000) / $21,000 = 1,38

As you can see the company’s quick ratio is 1.38. This means that the company can pay off all of the current contracts with quick assets. And moreover, it will have some quick assets left over.

For investors, it’s good news, too.

Don’t waste your money!

risk disclosure

Economic experts and academics agree that there is a real possibility of the US facing a recession by the end of 2020, but how well is the US prepared for it?

Economic experts and academics agree that there is a real possibility of the US facing a recession by the end of 2020, but how well is the US prepared for it?

by Gorica Gligorijevic

by Gorica Gligorijevic