4 min read

Would like to know where to invest in the second half of this year? What stocks to buy to the end of 2019? Yes, we know that the market circumstances are not so good. Uncertainty comes from trading war, this bull market has lasted almost eleven years and the matter of moment when the disturbing calculation will arise.

What we, in Traders-Paradise, want is to offer you a closer insight into some stocks to buy to the end of this year.

We have several suggestions about the stocks to buy to the end of 2019. We picked some that are paying a dividend, some utilities, but you will see. The main criteria were to find low-rates because these stocks are able to produce profits when rates climb.

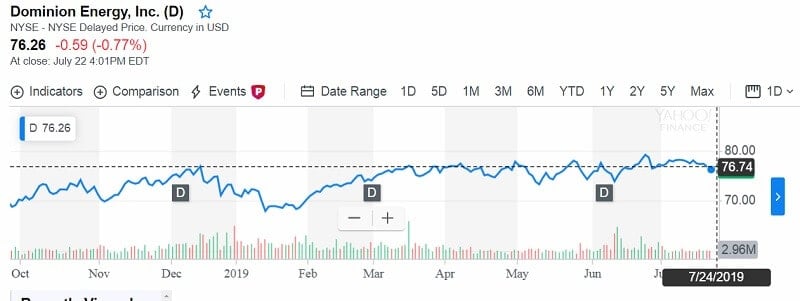

Dominion Energy (D)

Yield: 4.7%

Revenues: $13.8 billion

Market Cap: $62.1 billion

12-Month Range: $67.41-$79.47

Why this company from Virginia, US? They have about 7,5 million clients, users of its electricity and natural gas. This company is one of the major producers and suppliers of energy in the US.

It has approximately $100 billion of assets.

Its stock grows at approx 6% from the beginning of this year. Last year Dominion had cash dividend growth of 10% and it is up 10% this year. Domino reported first-quarter net operating income of $873 million which is less for 17,8% in comparison with last year. But, as we said billion times, everything may influence the revenue or stock price, in one word the market. This time it was unusually warm and sunny weather. That decreased this utility’s earnings by approximately $0.06 per share. But its stock is qualified at the 15%-20% rate. Don’t pay more than $85 for them.

Citigroup (C)

Yield: 2.8%

Revenues : $72.6 billion

Market Cap: $161.2 billion

12-Month Range: $48.42-$75.24

Some investors believe that this is the best time for the main banks. Citigroup is one of them but it is the sole bank that continues 30% under its pre-financial crisis top market value. Its stock is much lower than the other three of the four main banks. The global big four are JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup.

Citigroup improved and develop good relations with its clients, increase client support by digital developing, and has enough capital to invest in the franchise. It is very possible the share buybacks can double Earnings Per Share which is a guarantee that share price can be doubled too. That sounds good. Buy up to $75.

Amazon (AMZN)

Yield: 1,21%

Revenues : $59.7 billion

Market Cap: $977,589 billion

12-Month Range: $1812,97-$1985.63

Amazon reported earnings for the first fiscal quarter of this year: the revenue $59.7 billion, net income $3.6 billion, and earnings per share $7.09. Its international sales increased 9% to $16.2 billion. That was much over analysts expectations. Amazon revealed second-quarter revenue direction in the range of $59.5 billion and $63.5 billion. Its current price is $1985.63 in July this year.

Amazon Web Services is growing 41% in sales to $7.7 billion. It is about 13% of its total revenue. There is a possibility to raise more. Pay up to $1990,00, after that price it will raise more, above $2,000,00, so you could make a good return.

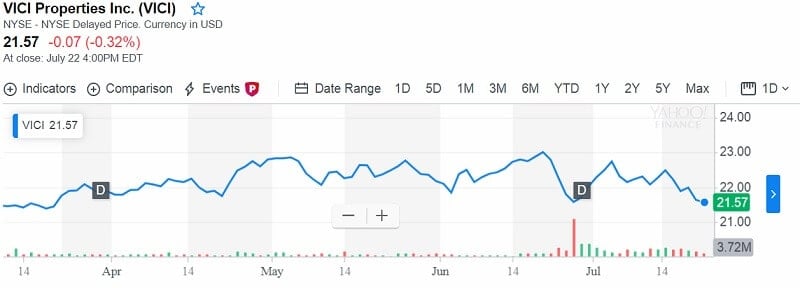

Vici Properties (VICI)

Yield: 5.2% Revenues: $893.7 million

Market Cap: $10.0 billion

12-Month Range: $17.64-$23.27

Vici Properties is a spinoff from Caesars Entertainment Operating Co. Vici controls 22 gaming businesses over the U.S. Also, Vici holds almost 15,000 hotel rooms in Las Vegas, Lake Tahoe, and Atlantic City and 4 golf fields. There is also some land but undeveloped for now. The last ownership is great potential.

Leasing revenue for the first quarter of this year, was $206.7 million, a 6.4% increment related to first-quarter 2018. Net income increased 34% to $150.8 million. Last year it was $112.1 million.

Its adjusted funds from operations increased 21.6% to $151.5 million from 2018. Current price is $21.60. The yield is well-covered and Traders-Paradise expects future dividend hikes. Buy up to $22,00. The predictions are that the price could easily hit $ 23.804 to the end of the year.

Kraft Heinz Company (KHC)

Yield: 5.2%

Revenues: $26.3 billion

Market Cap: $38.5 billion

12-Month Range: $26.96-$64.99

Kraft Heinz is one of the largest packaged food companies in the world.

The cheese (Kraft) and ketchup (Heinz), bring this company to the portfolio of over 200 brands internationally sale. Revenues remain stable (if not growing), backed by still-popular brands and products. Its profit margins generate important cash flow. It had some problems in the US market, but foreign effects were better.

The $0.40 per share quarterly dividend is covered and provides a 5,2% yield. In order to stimulate its debt paydown, Kraft Heinz Company could cut the yield.

KHC’s stock price could provide significant gains. Current price is $31,63. The target price is $45. Buy up to $42.

Bottom line

The trade wars, real wars, elementary catastrophes, all around the globe.

So, it isn’t so hard to recognize possible risks that could turn over the bullish trend. It is possible for the long-interest rates to go higher even they went down from the beginning of this year.

What you have to follow in order to choose stocks to buy to the end of this year?

The indicator of industrial production.

It is usually presented as an index in volume terms. The annual difference is shown in percentage and reveals the change in the volume of industrial output in comparison with the prior year.

Why is this matter?

Annual variation in industrial production presents the status of the economy in one country. If you notice the decreasing in production of consumer durables and capital goods you can be sure that the economic downturn is here.

The indicator of industrial production is a principal symbol of GDP growth. It is incredibly sensitive to consumer demand and interest rates.

Leave a Reply