2 min read

It is easier than ever to find good online stock brokers. The benefits are numerous. You can learn and invest in the comfort of your own home. The research team at Traders Paradise made some research. We tried to find the options on the market that are good for you. So, we wanted to find the best online stock brokers for beginners and super investors alike. We had to deep into the financial world with stock experts.

And we hope that this research will help anyone get started.

The popularity of index fund investing and robo-advisors is rising. It may seem the trading of individual stocks is lost. But, it isn’t the truth.

Millions of investors continue to trade individual stocks and other securities. Because online stock trading sites make investing easier it’s important to do so using the best online stock trading sites.

Investors should know the best online stock brokers to trade with. They have the right to know. Some online stock brokers are known for their award-winning customer service. But the others are known for low-priced stock trades or powerful trading tools. Traders Paradise-Finance wants to highlight some of the best brokers available today. Actually, we want to give you some tips for choosing a broker.

Criteria for the best online stock brokers

The best online stock brokers offer low fees, great customer service, and smart research tools.

Discount brokers charge as little as $4.95 for online trades. Compare that to the $100+ that many full-service brokers charge. It seems like a no-brainer choice to choose the discount broker. But, you must know how to pick the right one.

Trading online is a self-directed practice, and you need the right broker backing you up.

But it is a stormy time for online stock brokers.

Between significant cuts in commissions and a few major acquisitions, the competition is fierce.

YOU SHOULD READ Stocks Online for Free – How to Invest

So, let’s like this, there is no one best online stock broker. But each one has different strengths and weaknesses. Our aim is to spotlight them and help you find the best one for your investing style.

Every trader should care about cost. A few of the fees we analyzed include:

Cost per transaction:

Commissions are typically an investor’s biggest cost base. For example, in 2016, a usually unassisted transaction fee averaged about $8. But early 2017 brokers decrease their commission. Fidelity, E*Trade, and TD Ameritrade, also did that. Now, you can trade for as low as $4.95. No matter what the price, though, for us, transparency is key. We wanted to see affordable pricing structures.

Account minimums:

Seeing your wealth shrink due to a tough market or bad strategy isn’t fun. It’s worse if you’re also getting dinged by your broker’s minimum account balance requirement.

Charges for data and tools:

The best online stock trading sites have quality market data like real-time quotes, educational resources, and stock-screening tools built right into their platforms. But some, we have to say, like Fidelity and TD Ameritrade, stand out for also providing top-shelf resources. And it is totally free of charge.

Extra costs:

Executing a trade over the phone, for example, can increase an $8 commission fee to $25 or more. Some platforms offer free education on sophisticated strategies but require an upgraded platform with an annual fee. Besides cost, we valued educational material, reports and tools, and the usability of the platform itself.

After Traders Paradise conducted this research, the following to be our top picks:

The best for cheap trading is Ally Invest. But beginners would like E*Trade. Speaking about the platform the best has TD Ameritrade. Best research and tools have Fidelity.

Why use a discount broker

A discount broker costs you much less money per trade. You won’t have the steep commissions that full-service brokers charge. What this means is more cash in your pocket and the opportunity to make more trades.

The main reason is cost.

But here we will break down who would do better with a full-service broker and who could get by with a discount broker.

Because cheaper isn’t always better.

Let’s see in this way.

Do you have a large number of large investments?

Or you not have the desire nor the know-how to handle your portfolio?

Can you afford high commission fees?

Maybe you not have time to manage your portfolio effectively?

If your answers are “yes” to each of these questions, a full-service broker might be the best option for you.

But, if you want to save money on each trade made or like to be in control of your investments, the discount broker will suites you better.

Because you don’t want to be pressured to take other investments and you want to make frequent trades.

The other things to consider when you have to choose your online stock brokers are:

Minimum deposit/balance:

Some brokers require a minimum deposit to open the account. Others don’t have a minimum. Yet others require a minimum average balance over the life of the account. Determine what you can afford to keep in the account if choosing accounts with a minimum requirement higher than $0.

Customer service:

Take a trial run on any broker’s website that you are considering. Check out the support they have readily available on their website. But you should also email and call them with questions. See how long it takes to get an answer.

A discount stock broker can save you a lot of money and save your portfolio. But they aren’t for everyone. Here are a couple of other choices you may want to consider:

Robo-Advisors: If you are familiar with a completely “hands-off” approach, robo-advisors can save you even more money. The automated system uses an algorithm to invest your money for you. After you input your risk thresholds and investment goals, the computer does the rest.

YOU SHOULD READ Automatic Trading – What Is It

Peer Lending: This is those who want to stay away from stocks and bonds for now. If you are one of them, consider peer-to-peer lending. You decide how much money you want to invest and what type of risk you want to take. The minimum investment is often about $25. You can break your investment up into as many loans as you want. This helps diversify your portfolio.

Full-Service stockbroker: If you have a lot of money to invest or need that in-person advice, a full-service stockbroker is for you. You’ll find them at your larger brokerage houses, but keep in mind that their commissions are higher than discount brokers. In the most common situations, you will have to pay $100 – $200 per trade versus $4 – $7 per trade.

The bottom line

Using a discount broker is a great way to trade and keep your profits. Choose your broker wisely by paying attention to hidden fees and understanding account minimums. A discount broker is a great way for beginning and experienced investors alike to invest in their future.

To find which online brokers suits you the best, you should read Traders Paradise’s WALL OF FAME.

Why invest in stocks online for free, where to find broker, is it really free? Read this post to the end.

Why invest in stocks online for free, where to find broker, is it really free? Read this post to the end.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Is it possible to buy stocks without a broker? Why shouldn’t be? Here is how to do that.

Blue-chip stocks are popular because they can provide a safer position during economic downturns.

Blue-chip stocks are popular because they can provide a safer position during economic downturns.

Building a diversified stock portfolio is just the beginning but an important part of investing. Here is how to do that.

Building a diversified stock portfolio is just the beginning but an important part of investing. Here is how to do that.

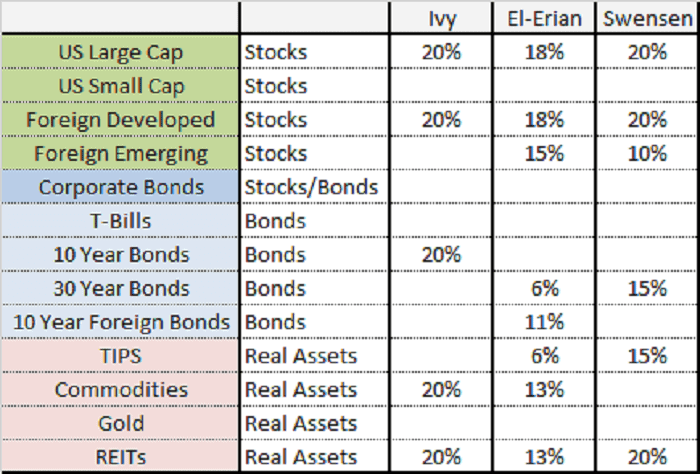

The structure of the investment portfolio depends on many factors but risk appetite is maybe the most influential one.

The structure of the investment portfolio depends on many factors but risk appetite is maybe the most influential one.