There are many differences between European and American styles in trading call options. Here are all.

There are many differences between European and American styles in trading call options. Here are all.

By Guy Avtalyon

A European call option means an option for the right to buy a stock or an index at a certain price on a certain date. Notice the expression “on a certain date.” This “European style call option” is different from the “American style call option” that can be exercised at any time “BY a certain date.”

A European call option provides the investor with the right to purchase an asset, while a put option provides the investor with a right to sell it.

In other words, unlike an American option, the European option has no flexibility in the timing of exercise.

Formula

In theory, a European option has a lower value than an otherwise equivalent American option. It is because a European option does not enjoy the convenience that arises from the flexibility in the timing of exercise.

Value of a European Call Option = max (0, Asset Price − Exercise Price)

Value of a European Put Option = max (0, Exercise Price − Asset Price)

Asset price is the price of the underlying financial asset at the exercise date.

The exercise price is the price at which the option entitles its holder to sell or purchase the underlying financial asset.

Some examples

European call option

To differentiate between a European call option and an equivalent American call option we have to compare them here.

Let’s say, a trader bought 100 American call options stock. The option has an exercise price of $42 and an expiry date of 27 July 2018. The trader believes that stock price on 24th, 25th, and 26th of July is expected to be $43.5, $44.5, and $43.

Assuming a trader is very confident in owns projections, what is the maximum can gain on the options and when should exercise them?

Since trader bought American options, he/she can exercise them at any time before 27th. Based on the projections:

Value on 24th = max [0, $43.5 – $42] = $1.5

Value on 25th = max [0, $44.5 – $42] = $2.5

Value on 26th = max [0, $43 – $42] = $1

The trader should exercise the options on 25th and gain $2.5 per option.

But, the trader bought European options, and he/she would have been able to exercise them only on 26th July 2018 for a gain of $1 per option.

Assume that traders used European options instead of American options.

Solution

Since trader purchased European options which she can exercise only on the exercise date i.e. 26th July 2018 and not before, trader’s gain per option will be only $1 (i.e. option value at the exercise date = price of underlying asset ($43) minus exercise price ($42).

If the trader had bought American options, he/she could have exercised them on 25th July 2018 (the day it offered maximum gain) for per option gain of $2 (= $44.5 − $42).

Like their American Option counterparts, a European option is traded on an exchange. The contract will specify at least four variables.

- Underlying Asset: stock indexes, foreign currencies, as well as derivatives.

- Premium: the price paid when an option is purchased or sold.

- Strike Price: identifies the price at which the holder of the contract has a right to sell (put option) or buy (call option) the underlying asset.

- Maturity Date: also referred to as the expiry date; the option no longer has any value if not exercised on this date.

As is the American Options, European-style options also come in two basic forms:

Call Options: also named calls. This contract gives the holder the right to purchase the asset at the strike price on the maturity date.

Put Option: also named puts. The contract gives the holder the right to sell the asset at the strike price on the maturity date.

Most stock or equity options in the U.S. are American Styles, whereas most index options traded in the U.S. are European style. Since you can’t actually “exercise an index option” and by the index, index options are cash-settled. Cash-settled means that your broker simply deposits the “in the money” amount at expiration.

What does the European style option mean for the trader?

It means that you are concerned ONLY with the price of the stock or index at its expiration. European style options tend to be cheaper than American style options because if a stock spike prior to expiration. An American style call option trader can profit on that increase in value. The European style option trader has to hope the price increase holds until expiration.

When to buy a European Call Option

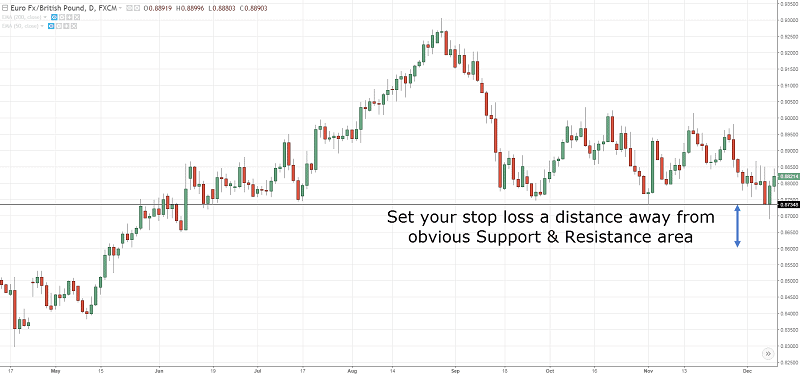

If you think a stock price or index is going to go up, then you should buy a call option. Unluckily, you don’t get to select if you want to buy a European style option or an American style option. That decision is already made by the exchange that the option trades on. Most index options in the U.S are European style. Take a look at the chart below:

Example of a European Call Option

If you bought an S&P500 Index option, it would be a European style option. That means that you can only exercise the option on the expiration date. Of course, it is still an option, which means that you have the right but not the obligation to exercise it.

Obviously, if you have a call option and the Index closes below the strike price on the expiration date then you would not exercise it. And that option would just expire worthlessly. Likewise, if you have a put option on the Index and the Index closes above the strike price on the expiration date then you would not exercise it. And that option would just expire worthlessly, too.

Notice in the chart above that the S&P500 Index (SPX) is a European style while the S&P100 (OEX) is American style.

In the U.S., most equity and index options contracts expire on the 3rd Friday of the month. Also, note that in the U.S. most contracts allow you to exercise your option at any time prior to the expiration date. In contrast, most European options only allow you to exercise the option on the expiration date.

Twitter’s Jack Dorsey believes that

Twitter’s Jack Dorsey believes that

If you have no other option you’ll take a bad credit loan. But it isn’t the end of the world.

If you have no other option you’ll take a bad credit loan. But it isn’t the end of the world.

Analysts have black predictions for the coming year. The crisis is knocking the door.

Analysts have black predictions for the coming year. The crisis is knocking the door.