By Guy Avtalyon

You’re never too young to invest.

This post Trading With Success – a guide for beginners published by Traders Paradise is for those who want to invest in the stock market but don’t know how to go about it.

Are you scared of investing? Disturbed that you will lose money if you take part in the stock market? Do you think investing in the stock market is like gambling?

What?

Who thinks something like that, is totally wrong. Investing in the stock market it isn’t gambling.

Stock market investing is all about investing in your own wealth and trading with success.

How?

Owning stock is like having a part of some company. By buying a company’s stock, you are actually funding the company’s development. If the company expands, the economy expands. And your share will become more worth. It is a kind of chain of wealth. What do you think now? Is the stock market good for you?

Here, I want to clarify investing and I want to show you how profitable it can be in the long term.

If the company performs well, it provides income to shareholders through dividends. And if the company performs really great, it’s share price rises. This is named as Capital Gains.

The best part of trading with success?

If you own a share for more than a year and you sell it for a profit, you don’t have to pay any tax on that profit! Interested already?

Who doesn’t wish they could have invested in the early days of Facebook, Amazon or Apple?

If you don’t have any experience investing on your own, getting started can be rather terrifying. It can be difficult to define how much of your money should be in stocks, what type of stocks you should look for, how to manage a portfolio and risks, or what common “rookie mistakes” you should avoid. With that in mind, I wrote this article.

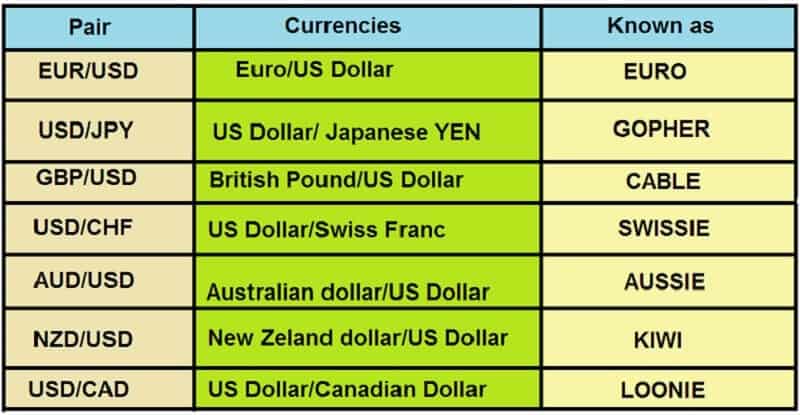

For you who come in the stock market for the first time, have a desire, have some fears, have no knowledge but you want to step to this wonderful world of stocks, shares, commodities, currencies or cryptocurrencies.

DESCRIPTION of Trading with success

No one likes to lose money. That’s why I wrote this Trading with success guide.

Also, the pain threshold of some is greater than it is with others. If you’re bearing in your mind investment in the stock market but the thought of a loss upsets you, you likely shouldn’t invest.

However, when you invest there are several things you should know to increase your chances of winning.

That’s the subject of this article Trading With Success – a guide for beginners.

Although there are numerous details and cautions, this article will help you understand the basics of how the stock market works and why stocks react as they do. I’ll also discuss a few things that every investor should know. Let’s omit the mystery, take a look behind the cover, and this terrifying name: trading markets.

What I want to say is, historically, the opacity and transaction costs involved in this asset class meant that venture capitalists often had to spend thousands of dollars and hours to execute one single investment. Because of this, investing was liable to be open only to the big players on the scene. Thanks to equity crowdfunding platforms this is no longer the case.

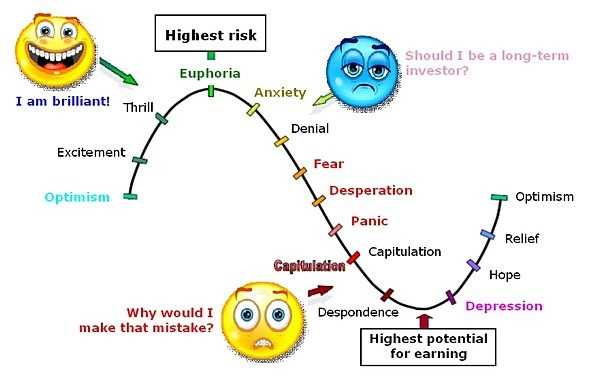

The biggest reason traders fail is because they cannot handle the psychological pressures of trading.

Pressures often lead to stupid mistakes or terrible judgment and this naturally leads to unnecessarily losing money.

What is important in Trading with success?

The most important thing when trading is that you have a good and clear reason for every trade you take.

At first, you will find instructions on how to become a trader. What your first step should be, how to register on a trading platform, what you have to have for that, I want to show you steps for investing or trading.

And you will see how easy it is.

First of all, you have to know that all successful traders were once beginners who studied trading from the very basics while they gained experience over time. We are not going to explain the background of the cryptocurrency or stocks and how it works, because it is not relevant to trading for the average user.

The trading principle is the same – buy low, sell high.

Investing in market securities can be discouraging for the beginner. But with instruction, anyone can trade on the market. Trading with success on the market can be an exciting way to earn income on your savings or prepare for the future by investing for retirement.

KNOWLEDGE IS IMPORTANT

If you want to trade, the first thing is understanding the financial markets and how they work.

I always like the example given by economist Andre Kostolany. He was famous for his investing skills and gave us wonderful quotations about markets and finance, like this one:

“Never run after a bus or a stock. Just be patient – the next one will come along for sure.”

In his books, he often suggested to the reciprocity between the cool, relaxed and concentrated investors, and the tense, panicky, scared rookies.

“Always be fearful, never panic!” – André Kostolany

The trader with the solid hands buys when the asset is cheap. Such a trader has both experience and capital, which have a positive influence on nerves too. The solid hands stick around. The trader is not confused by the ups and downs of the market and knows exactly what to do. He or she makes his/her move at exactly the best time, purchasing at the bottom and trading at the peak, or at least pretty close. That is trading with success.

Some traders sell in panic, desperation or simply they buy. So, how trading with success? The solid hands will sell again at a big profit when the market turns around again.

And to whom do they sell to? To the nervous small newbies with their borrowed money and the nasty mixture made of both loss and regret. Such traders are uncertain, unsafe, insecure with weak hands. This isn’t trading with success.

The weak hands jump off the runaway train in the middle of a crash.

So, you have to know what kind of hands do you have.

How will you find out?

Trading is really not for everyone, that’s true. But also the truth is that everybody should have a fair amount of money in investments to build own wealth.

If you have the right psychological structure and adequate funds you are able to speculate and take risks. In that case, you will run with patience, calm and with all those other things that make investing successfully. And this absolutely involves genuine knowledge of the stocks and markets themselves.

Well, introspection is very important in the field of investment. It is essential to know what you can handle in cold blood, to understand your own psychic boundaries, to be conscious of your biases.

It is absolutely important to know what you could actually lose on your investments and figure out can you live with it. If you are trembling, it is better to miss all of this.

To avoid the majority of problems, new investors taking their first steps towards learning the basics of stock trading should have access to multiple sources of quality education.

So that’s why they usually open a free demo account

Practicing and errors united with the capacity to keep pushing forward will eventually lead to success.

The excellent benefit of stock trading lolls in the fact that this tournament can last the whole life, so you will have years to improve and sharpen your skills.

Strategies practiced decades ago are still valuable today for trading with success.

But you have to know, you have to play this game constantly in full force.

THE VERY FIRST STEP – Open a stockbroker account.

You have to find a trustworthy online stock broker and open an account. Become familiarized with the design and to take benefits of the free trading tools and research given to clients. Many brokers offer paper-money trading, demo account, which is helpful because you can trade with virtual money and have practice and learn.

You should find the best online broker, the one that suits you the best. Some online stock brokers will provide you access to their award-winning client services. The others are known for cheap stock trades or robust trading tools.

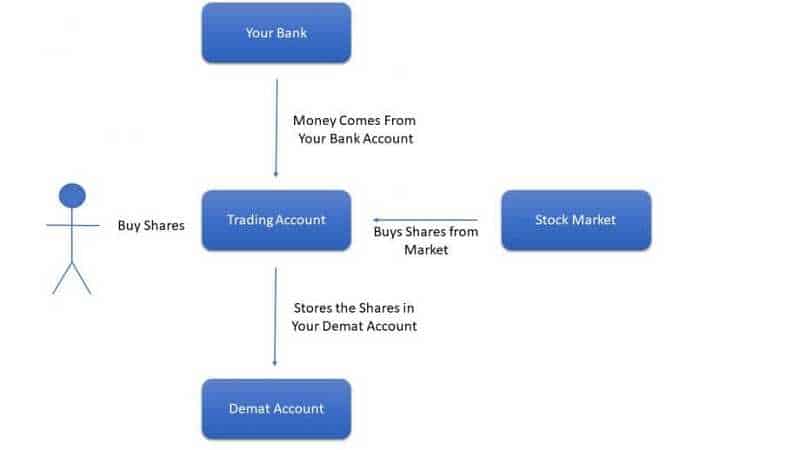

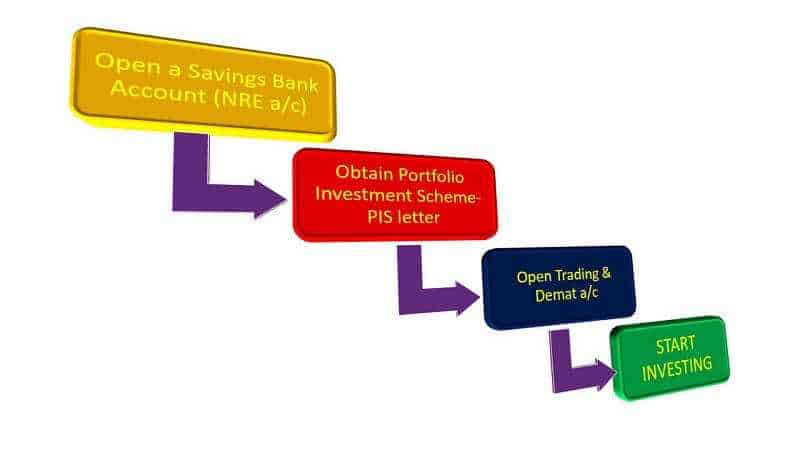

Since 2000, the stock markets are trading managed online. All you need are demat (See below) and trading account to invest in the stock market.

What is the demat account?

A Demat account is an account that enables you to hold your shares in an electronic form. Stocks in Demat account live in dematerialized format. That’s why this kind of account is called DEMAT.

Dematerialization (DEMAT) is the converting material certificates to electronic accounting. Real stock warrants are removed and withdrawn from distribution in exchange for electronic recording.

So, your physical shares are converted into electronic format.

Dematerialization is the way of converting physical shares into electronic format.

Opening a demat account it is the very first step.

The benefits of demat:

– Provides an easy and comfortable way to handle securities

– Prompt transfer of securities

– There is no stamp tax on the transfer of securities

– Safer than paper-shares

– Lessened paperwork for transfer of securities

– Decreased transaction cost

– There are no “odd lot” difficulties: you can sell even one share

– Address change is registered with a Depository Participant (DP) and, at the almost same time, registered with all companies in which you hold securities. There is no need to communicate with each of them individually.

– Transmission of securities is done by DP

– Automated credit into demat account for all shares

– One demat account can cover all investments

– You have access to your demat account from anywhere on the planet

HOW TO OPEN DEMAT ACCOUNT

– Choose the stockbroker or company. You must be sure that the broker is solid and will take your orders right on time. Time is very important in the stock market. Even a few minutes can switch the price of the stock. So, you have to choose a trustworthy broker.

– Examine brokerage’s prices. Every broker will charge you a specific fee to handle your orders. But, some will charge more, some less. Some will provide discounts based on the number of trades handled. You must take all into account before you open the account. One friendly advice. Try not to choose a broker who is cheapest. Sometimes a brokerage service with higher fees will give you more benefits. You have to estimate.

– Next step, contact the brokerage company and ask about the procedure. It is regular for the firm to send an agent to your home, or where you want, with an account opening application. It is the Know Your Client (KYC) application. Usually, the agent will bring two forms. You will be able to read them and fill them. As I mentioned before, you will also need two documents to prove your identity and address.

– Your application will be confirmed through an in-person check or through the phone-call. They will ask you to tell your personal details.

After processing, you will receive your trading accounts details and that’s all. You are ready to place the trades in the stock market.

HOW TO OPEN A TRADING ACCOUNT

– Select the stockbroker or company. Ensure that the broker is good and will take your orders in a timely manner. Time is the most important in the stock market. Even a few minutes can change the market price of the stock. Ensure that you select a good broker.

– Compare brokerage rates. Every broker charges you a certain fee for processing your orders. But, some may charge more, some less. Some give discounts on the basis of the number of trades conducted. Take all this into account before opening an account. It is not necessary to choose a broker who charges the lowest fees. Good quality brokerage services provided often may need higher than average charges

– Next step, get in touch with the brokerage company or broker and inquire knowledge about the account opening procedure. Very often, the firm would send a representative to your house with the account opening form and the Know Your Client (KYC) form. Fill these two forms up. Submit along with two documents to prove your identity and address.

– Your application will be verified either through an in-person check or on the phone. You will be asked to reveal your personal details.

After processing, you will get your trading accounts details and, you are ready to conduct trades in the stock market.

Documents required

It’s like the procedure for opening a demat account. You need to submit proofs of identity and address along with a passport size photograph and the account opening form for opening a trading account.

PROOF OF IDENTITY: PAN card, voter’s ID, passport, driver’s license, bank attestation, IT returns, electricity bill, telephone bill, ID cards with applicant’s photo issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions, colleges affiliated to universities.

PROOF OF ADDRESS: Ration card, passport, voter ID card, driving license, bank passbook or bank statement, verified copies of electricity bills, residence telephone bills, leave and license agreement or agreement for sale, self-declaration by High Court or Supreme Court judges, identity card or a document with address issued by the central or state government and its departments, statutory or regulatory authorities, public sector undertakings (PSUs), scheduled commercial banks, public financial institutions.

And now you are really ready to start your first trade.

Wait! There are more. Read the next chapter. 🙂

How to learn about trading

First of all, don’t worry, you are not alone. There are a lot of people who are trying to make money. You can find a very good way to make money and for free. I am not a fan of pay-to-be-rich-quick scams online.

For new investors wanting to take their first steps, I offer great answers to the simple question:

“How do I get started? How can I learn about trading?”

Your first step toward learning the basics of trading should have multiple sources of a good education. Trials and errors combined with the ability to continue will finally lead to success.

Read books, read articles, find a mentor or advisor, study the greats, read and follow the market, consider paid subscriptions and be careful.

For some starting level investor, the stock market can be a lot difficult to understand. Without a good knowledge, no one is capable to dive into it.

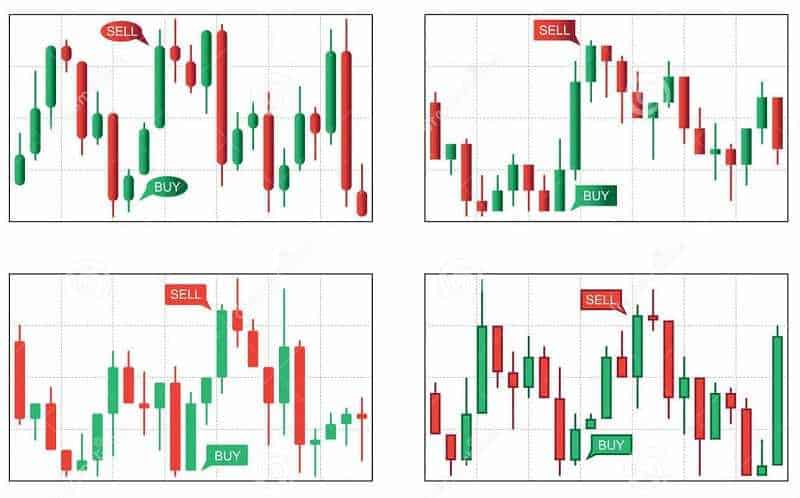

There are two main methods of how to choose stocks while trading with success.

The first is called fundamental analysis and the second is technical analysis.

The first refers to the use of a company’s financial reports and public statements. Use them to examine the health of the business. Balance sheets, income statements, yearly and quarterly earnings, and news releases are great tools for fundamental analysis. You can find almost all the reports online. The good news is that you may find the tutorials on how to read them. They are not so simple, to be fair.

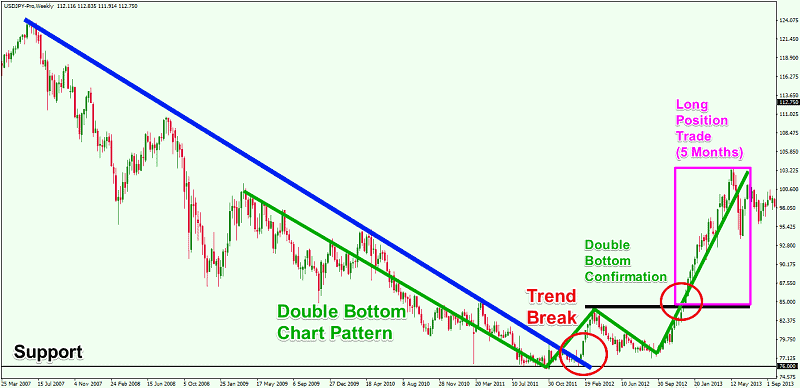

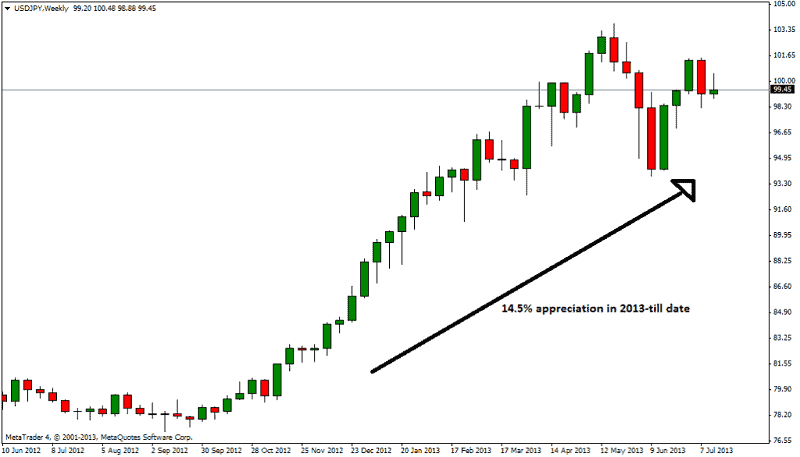

The second, technical analysis, suggests that fluctuations in stock prices come following a certain pattern. You have to learn to identify them and profit. Technical analysis is not as broadly taken or followed as fundamental analysis. Usually, traders use a mixture of the two techniques to pick stocks.

Trading with success means to choose a healthy company

Choosing a company with healthy fundamentals and then from time to time trading on a technical indicator is a safer strategy than relying only on technical indicators.

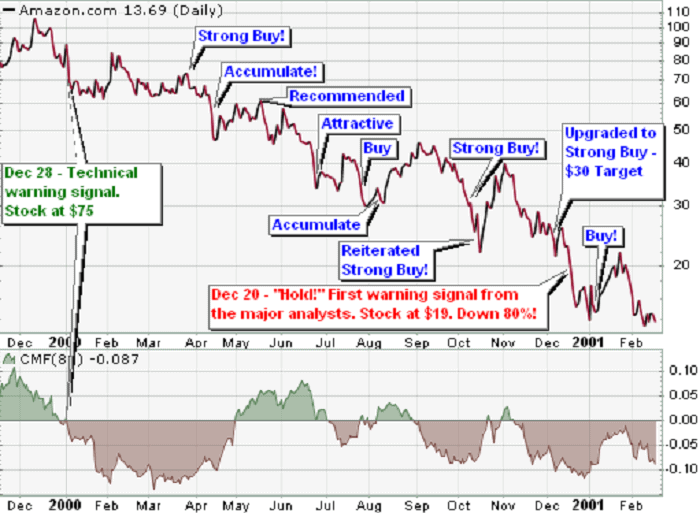

Before you decide to buy or sell any stock, you should completely research the company, its leadership, and its competition. Various sites offer excellent compilations of news stories, financial statements, and stock price charts. Stock sites also show professional analysts’ ratings of a given stock, with indicate whether that analyst advises a trader to buy, hold or sell a stock.

Before you begin buying and selling stocks, you have to decide which online trading service you want to use. ou have to choose your brokerage partner carefully because he or she has an influence on your trading and, moreover, on your bottom line.

The best advice I got as an online trader is to choose my brokerage partner with open eyes.

What you have to do:

Practice with an online stock simulator: This will allow you to exercise your skills with zero risks. Some of you will start with advice from tutorials and forums. Still, keep in mind that simulators don’t display real emotions while trading. Hence, it is best to use them to examine your theory about your trading systems. Many advanced traders use the simulator to test some new system before they execute the trade.

But you would like something more realistic. So, trade penny stocks. You can find companies that provide inexpensive stocks to trade. This is an excellent chance to exercise leveraging the market and doesn’t have a lot of risks. Well, you can trade penny stocks outside the main stock exchanges. It is usual.

Penny stocks are regularly traded on the over-the-counter-bulletin-board (OTCBB) or through daily publications called pink sheets.

Educate yourself about financial performance indicators: It is not a good idea to simply hop in the market and start trading. You must have some knowledge and practice. If you do such a thing, despite the advice, you will lose money, get depressed and leave.

And you didn’t even give yourself a chance to win.

So, read the news reports and financial websites, you can find plenty all over the internet. Watch podcasts or investment courses. Learn from more qualified investors. Books will give you a wealth of data and they are cheap compared to the costs of seminars and tutorials on DVDs which you can buy on the web.

The Barriers to Learning About Stocks

When you step into the world of investments, you may think it is full off many puzzles.

The truth is, while there is a lot of literature out there, like books, websites, reviews, etc, investing still looks like a tricky business. You may think it is packed with hazards and risks of any types. It is not simple to earn a regularly good return at a reasonable level of risk without something going wrong at various times.

This raises a basic question — what and how much can you really learn about the stock market?

At any point in time, there are some people who claim that the markets will go up and others who claim that it will drop, while others rather like to say it will move sideways.

And you can use the same source of information to draft similar contradictory conclusions.

What does this mean? This means that you have to be very careful about “knowledge” of any kind about the stock market, or other investment markets.

I have no doubt that it is hard to learn anything reliable and consistent about the daily (or short-term) ups and downs of the markets. You can really consciously learn about something that is stable enough, like a foreign language, the principles of mathematics or economics. This can be used only to a limited range for the stock market.

Stocks theoretical are not much different than they were decades or centuries ago.

There are trusty structured principles of asset allocation and arbitrage, short selling, and many other basics, intermediate and advanced concepts and methods.

The problem is that there is a terrible amount that is not stable. Especially, the identical starting position for investments can, at different points in time, lead to completely different factors and results. With each situation, different characteristics dominate, and what worked or failed before, may do the opposite in some other time.

Trading with success means: experience is crucial, and skill and plain luck too.

Learning the “theory” is necessary as a starting point, but from there you need to develop a feel for real situations and learn to recognize the model of activity and behavior, as well as how they interface with one another.

But in the investment scene, experience and expertise like this are not always reliable.

That explains why even the best pros fail from time to time. You can find examples of failure among people who are really well-educated and informed, but they were simply in the wrong market at the wrong time.

Knowledge is absolute, but the experience is relative to other people and to a particular situation. We can not know where our knowledge begins and ends or what we do not know, which is more important.

The economy has always been characterized by unresolved issues and opposing views.

For example, neo-classicists are keen on markets and leaving them free.

Keynesians, as direct contrast, like to get involved in markets.

There is no clear right and wrong on this field. There is no approach to economic and financial issues that works perfectly at all times. That’s why economists are always manipulating trying to get things right, and often making it wrong. This means you can surely learn about the controversy, but not the one right way, which just does not exist.

The other thing, you can be sure that something that is truly illogical can be excluded. Yes, people take stupid risks sometimes. But illogical is something else.

For instance, if someone asks for a low-risk investment, they will not deliberately agree to a high-risk one. That is illogical for them and it won’t happen. In the same sense, people make mistakes, but they don’t on purpose do things that cannot realistically pay off and that is blasted from the beginning.

There are a lot of things that are never a good idea. Investment portfolios should always be well-diversified, rebalanced, not unreasonably costly and so on. There are many pros and cons that can save you from disaster.

You must know your personal limitations

And you have to count on people who are unethical and dishonest. The problem is that new technology and ideas invariably lead to new rackets, scams, and miss-tradings. You have to know the limitations of theoretical knowledge in investing.

We can figure out what to keep away and what should work. But there is nothing and no one out there who can tell us what will work for sure.

How To Remove The Barriers

First of all, never base your judgments on passions, rumors or hurry to the next hot spot.

You will lose all your money in the end. Some investors despite their miss-judging, continue with the same activities and have the same bad results. You have to remove the barriers to success. It is crucial to change behavior and enable you to become successful. You must try for permanently removing new barriers as they appear.

What kind of barriers to success you may have?

Emotions

The fear and greed! Many investors experienced the absence of the rationally think during investing. This ends in bad investment choices and usually with wasting of money.

For instance, it is in your best interest to sell high and buy low. However, some investors avoid to sell winners and don’t like to buy out-of-favor stocks. Hence, they hold the winning investments too long. When they drop, they continue to hold. Because the have some cloudy hope they will return to their former highs. They even lie, claiming that they would sell if the price turns to the level at which they got it.

Then there are the traders who hold the losing investments for too long. They have some crazy hope that if they wait until their shares recover, they can sell to at least break even. It is usual that such traders gain loses. Why? Because their money is stacked in a losing investment. The investment like that is unable to give a return. This decreases account balances and increases stress degree. Most traders agree that holding investments too long is the mistake that was most damaging their success.

Less knowledge

You may think if you just buy and sell the top stock, you will always earn money. That’s wrong! Totally mistake! Sometimes, traders don’t have enough knowledge about how markets work. For them, it is still unknown what drives stock prices to make successful investing. Further, many investors usually overrate their experience. As a result, they take on additional risks. People are frequently attracted to magnificent performance, even when they are not skilled enough to handle them. Many traders follow the hottest sector without enough understanding of the risks involved.

For instance, traders understand they should not overload their portfolios with too much capital in one investment, but they continue with the same attitude. It isn’t rare that people purchase too much stock in the company where they are working. The reason is the company’s retirement funds. The possible consequence is a portfolio without proper diversification.

Some other investors avoid bonds because don’t understand how they work. Do you understand that bonds provide you a favored position if a company declare bankruptcy? Yes, I know that some of you will answer yes but do you really understand that and where that benefit comes from?

Do you understand that when interest rates increase, bond prices go down? Do you know how a central bank sets interest rates and the yield curve? Only a few investors have enough knowledge to make wise decisions. Remember this

Investors without knowledge

To add more pain in their lives, most investors do not know when to sell a stock that has substantially valued. They continue to hold the stock instead of selling part of them. That way, they could take some of the profit and make capital convenient and available for other investments. They don’t realize that as the price of the stock goes up their portfolio becomes even more unbalanced.

The market has the ability to balance portfolios for investors, sometimes to their astonishment. Many investors are confused by the idea that rebalancing entails selling some of the investments that have performed best and buying more quality stocks that have lagged.

Losing the Bigger Picture

Despite the fact that many investors like to say they invest with a long-term perspective, they continue to make decisions based on short-term movements and ideas. Most investors believe that setting long-term goals for such things as buying a home or providing for retirement are important. But still, they fail to establish viable financial plans to do so.

Without these plans, their decisions are decaying. Basing decisions on unpredictable market fluctuations can be very dangerous because there is a good chance that these investors will make the wrong decision. That can obstruct their ability to achieve their long-term goals. When the investors realize that the market has risen, they pour cash into stocks and mutual funds, trying to grab part of the profit the professionals have realized. When the market declines, some investors panic and sell close the bottom. And very often, this pattern continues, causing such investors to lose much of their capital.

How to remove barriers

No matter what your barriers are, it is important to put together a plan to remove them. Here are some steps you can take to eliminate these barriers to your investing success. Experts advise doing this.

* Learn to monitor your performance:

Measuring your performance forms a history of what worked and what did not. This can help you to recognize problems that you copy over and over again. You should, at least, record the general market trend, the sector trend, the reason for executing the trade, the exit target, and the trailing stop.

It is a MUST for any buy and sell. This document is very useful to evaluate your investing actions. Later, you will use it to identify what barriers block your success.

* After you have measured your actions

You can identify what you have to change: Inspect your past tradings and find patterns that show to barriers to success. Maybe you impulsively buy the next stock without thinking? Does your explanation prove to be wrong most of the time? The key is to identify the investing behavior that inhibits your performance.

* Stay focused on what you need to change.

Like any effort to change behavior, you must remain focused on the actions you take to reinforce the investing behavior you wish to have. If you think you are not focused on how to change your behavior, then take a break from your investing until you recover your focus

* Determine how you will understand your losses.

Keep in your mind that losses are part of investing. Learning how to handle them is one of the most important pieces of successful investing behavior. You have to define what your loss looks like through your stop loss and reasons for the trade. You must accept the loss as part of the trading. Accepting a loss is a trading skill that is a crucial behavior. If you accept a losing trade as a natural process in your trading strategy, you will eliminate the emotion that comes from a loss. This will provide you the next opportunity but without fear.

* Become an expert at one investing strategy:

There are many ways to evaluate the market and select stocks which offer good investment opportunities. Don’t try to understand every perspective on a stock. It is best to get to know one reliable investing strategy. In that way, you will gain confidence in your investing access. This knowledge will form a valid base for your investing. And when you become an expert you can expand your knowledge base by adding a new approach.

* Think in probabilities:

The market is in permanent movement. It forces the investor to continually evaluate the risk-reward ratio of each opportunity. You can’t change the market, that’s why you need to figure out where and what is the highest possibility that will move the market, key sectors and the stocks you are watching. Evaluating what is most likely to happen, in the sense of expectations, could help you to make a valid investing estimation.

* Learn how to be objective:

Many traders like to think that the market will give what they believe it should perform, rather than what it really makes. If you place limits on the market you will see very soon and painful, that you are wrong. The market performs what the market performs. You will use it the best if you have an objective view and attitude.

If you are objective, then you will not feel urged to act promptly. You will not feel anxious about making an investment decision. You will do it based on facts, not on your emotions. And the most important, you will not force your ideas on the market. You have to understand what the market wants to tell you. Your purpose is to listen and act according to that. The market itself is the best advisor. Just learn how to listen. Put aside all the rumors, try to be focused on market performances without biases. And you will see.

Do not expect this to happen overnight. Removing the barriers is a long-term process. But if you have a clearly defined plan, you will be able to eliminate the barriers that keep you from your success.

How to research and choose stock?

Investors have a name for all types of research, one of them is fundamental analysis.

Fundamental analysis

Involves looking at numbers and other measures in a company’s financials as well as assessing the less tangible aspects of a business. This approach can help you decide whether a stock deserves a spot in your portfolio. Pick a company you’re interested in. Read current and past annual reports and letters to shareholders. Gather the numbers and financial ratios and put them all into context by comparing the company’s performance history to the industry and its peers. Then work through the list of qualitative questions.

So, what you have to do after fundamental analysis, step by step:

Perform a technical analysis

– Technical analysis is a way to understand market psychology or what are investors feelings about a company, which are manifested in the stock prices. Technical analysts are mostly short-term holders. Their objective is to find the proper timing of their buys and sells.

The point here is to identify a pattern of how some strategy or stocks were performed.

If you can identify a pattern, you might be able to predict when stock prices will fall and drop. This can inform you about when to buy or sell certain stocks.

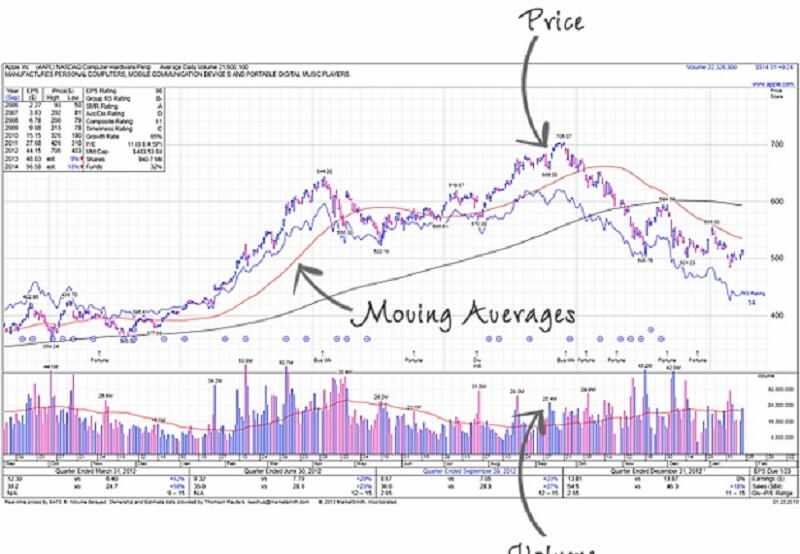

The technical analysis makes use of moving averages to track security prices. Moving average is a measure of the average price of the security over a certain period. This assists traders to quickly recognize trends.

– Identify patterns:

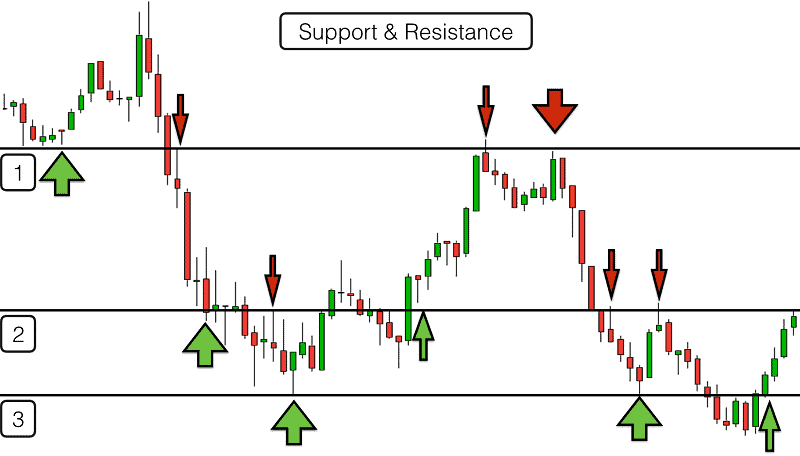

Patterns include known price boundaries in the market price of a stock. The high boundary is known as the “resistance.” The low boundary is called “support.”

Recognizing these levels provide a trader to know when to buy (at resistance) and when to sell (at support). And there are some specific patterns are also noticeable in stock charts. The most usual is “head and shoulders.” This is a peak price then drop, followed by a taller peak then drop, and finally followed by a peak similar in height to the first. This pattern signals that an upward price trend will end. There are also inverse head and shoulders patterns, that marks the end to a downward price trend.

Register the difference between a trader and an investor:

An investor search for a company with a competitive advantage in the marketplace that will provide sales and earnings growth over a long period. A trader wants to find companies with a price trend easy to identify and that can be utilized in the short-term. Traders use technical analysis to recognize price trends. Investors use fundamental analysis because they are focused on long term investment.

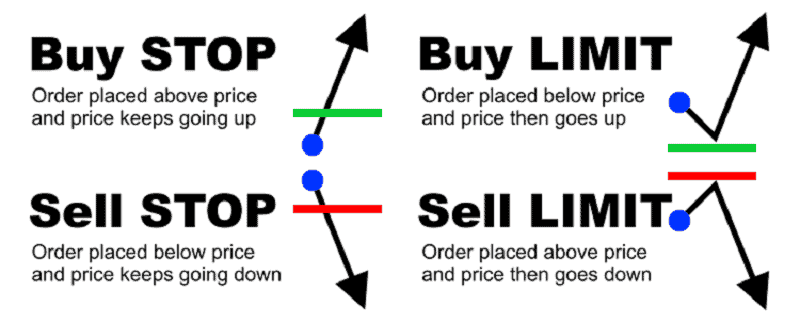

Learn about different orders traders make:

Orders are what traders use to describe the trades that they want their brokers to make for them. There are a lot of different types of orders.

The simplest type of order is a market order, which buys or sells a set number of shares of a security at the prevalent market price.

For example, the shares of some company are priced at $20 as ask price and $22 as the bid price. Of course, 100 shares are accessible at the ask. And let’s say, you want to buy 400 shares and you place a market order to buy them. The first 100 you will buy at $22. The rest, you will buy at $24 or higher if this stock is rarely traded and you just showed the interest and the price is growing thanks to you. The price of this kind of security is managed by the market and occasionally this will lead you to more cost.

That’s why is important to use the limit order.

A limit order buys or sells security when its price reaches a decision point.

For instance, placing a buy limit order on security will order the broker to only purchase the security if the price fell to a some defined level. This allows a trader to specify the maximum amount willing to pay, a limit order guarantees the price the trader will pay or be paid, but not that the trade will happen.

For example, you want to buy some stock and it has a limit of $20. You can buy that stock at a price of $20 or below. If you want to sell shares of stock with a $20 limit, you will not sell it until the price is $20 or bigger.

Stop order tell the broker to buy or sell a security if the price rises above or falls below a certain point. But, the price that the stop order will be filled at is not guaranteed because it is the current market price.

Also, there is a combination of stop and limit orders called a stop-limit order.

When the price of the security passes a certain level, this order specifies that the order becomes a limit order rather than a market order as it does in a regular stop order.

Understand short selling: Short selling is when you sell shares of a security that you don’t hold or you borrowed. Short selling shows the hope that the market price of the stock or some other security will drop, and you will be able to buy cheaper than you sold in the short sale. Yes, you can use a short-selling to make a profit, but remember, it is very risky. You will need more experience and knowledge about the market before you start to practice this.

Let’s see how short selling works in real trade.

You believe that some stock will drop in the near future. And you ask your broker to find 100 shares of that stock for you to borrow for a short sale. Let’s say the current price is $30 per share. Your broker found the shares for you to borrow and you sell them for $3,000 in total. After a few weeks, your expectations are confirmed and the price of that stock drops so can trade them for, let’s say at $25. What you have to do is to buy back the same shares at the current price. This is so-called covering the short position. You will spend $2,500 in total to buy the shares back and return them to the owner.

And the calculation is:

– you sold borrowed shares for $3,000

– later you bought them for $2,500 and give them back to the owner

– your profit is $500.

($30×100) – ($25×100) = $500

How to pick a broker

Choosing an online broker seems like a simple process. But in reality, it can be a nightmare because finding the right broker is not easy. Not at all!!!

On the very beginning, you want to be sure that the broker has the right credentials, understands the market, has similar wealth-building beliefs as you do. Trust me. You can also find our list of highly respected brokerages on our wall of fame.

The main point in choosing a broker

a) make sure a broker offers the services and features you most need,

b) don’t pay extra for services and features you don’t need or want.

The best way is to make a list of tools you want from your broker. There are some tips and tricks you have to take attention:

Minimum Trades – Check if there is a requirement about minimum trades that you will have to do or maybe the penalty for not complying with the condition. You can easily find brokers who have no minimum requirement or require only a small amount.

Costs – Examine the commissions and other fees that brokerage charges. Brokers typically have a broad variety of fees for cost per trade. That’s the holy grail of the online brokerage universe.

Customer service – Read customer reviews online or on forums, please. Make sure that the broker offers such support and it is available during more than just “regular business hours”. You have to know if it is available in various forms: email support and live chat can be more available contact methods than the direct phone, for example.

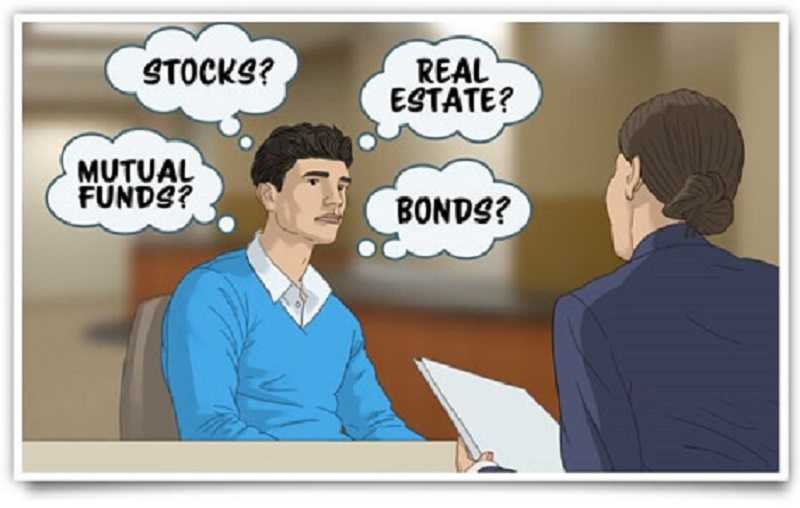

Investment options – Some ‘’full service’’ brokers may not give products of all asset management. A good broker is one that offers you the ability to invest in a broad number of assets: stocks, bonds, mutual funds, ETFs, real estate.

You will want a broker who can afford you all of the possibilities if you want to develop your investment potential.

Investment Advice – There can be some problems if you are not a do-it-yourself type. Some brokers will offer poor investment advice, but others will give you a full investment service. It can be for a small fee, but some will charge a higher fee. You have to decide what suits you best.

Asset Allocation Guidance – Especially for new investors Asset allocation is one of the more difficult investment parts. Even to decide about initial asset allocation is a tricky part, and it can become more complicated when you maintain it in the future

And periodic rebalancing – It is not the simplest of tasks if it must be done manually. But you have to do that from time to time. Here is, for that purpose a robo advisor. A robo advisor will manage your asset allocation and automatic rebalancing. If you want to stay a bit more uninvolved investor, robo advisors can be the best for you. You have to find out if the broker offers this service and if there is an additional charge.

Types of Retirement Accounts – It’s best to confirm this at the very beginning that the broker offers multiple types of retirement accounts to invest in. And even if you want only a regular investment account right now, you may decide to open a custodial account for one of your children in the future. If you have confirmation that options exist before you first sign-on, you can be relaxed. I know that most investors like to have all of their various accounts with a single broker, particularly if they are happy with the service. You have to find out if the broker offers this service and if there is an additional charge.

The most important question is about what type of trader you want to be.

Are you an active trader or buy-and-hold investor? Whatever you are, it will affect your choice of broker. If you are a buy-and-hold investor and invest in index funds, making a few trades per year, fund selection may be more important to you than low transaction fees.

You have to determine if you’re an investor which means long term investing, or an active trader, short term trading.

If you are still learning how to trade stocks online, you shouldn’t rush into choosing a broker.

Everyone eventually develops their own trading style.

Online stock brokers offer a wide array of features and fees. Choosing a broker with a good reputation is worth. Someone with the features you really need and a reasonable fee structure.

Don’t let yourself be attracted by a platform with the bells and whistles. Especially when you are in the beginning.

How to Start Trading

Investing in the stock market is simple if you know how to begin.

Don’t begin to invest or trade on your own. You will need advising by some expert. It is always best to access a financial advisor who will tell you how you to invest or trade based on your financial condition and risk tolerance.

Talk to other investors. Read books, journals, and newspapers for recommendations. You can ask your advisor for advice but don’t listen to everything he suggests. Ask a second opinion because some brokers might have conflicting interests. In the beginning, it is best to go for well-known names and big companies that have a good professional status. Never start trading without previous knowledge, because you may find yourself off track.

Let’s make clear the basic because you’ve decided to join the crazy world of trading stocks and shares.

You have to know that shareholders usually have a right to vote at company conferences. But, if you possess just one of the three billion Facebook shares don’t expect Mark Zuckerberg to listen to your opinion!

Another thing you need to know is that a company’s shares are indivisible. You cannot buy fewer than one. Shares were pieces of paper that shareholders kept in a safe but since the ‘90s, this all changed to virtual shares.

Before you start trading stocks, you have to buy them!

You can buy your stocks in many ways.

Some companies will allow you to buy their shares directly. If there is no such possibility or you have some difficulties to choose which company to invest in, you should ask your bank. It will be much easier if your bank offers a trading service connected to your accounts.

If your bank doesn’t offer a trading service, you can buy shares through a brokerage company.

Brokers buy and sell securities in exchange for a commission. You can set up a simple brokerage account online or hire a so-called ‘full-service broker’ who will trade stocks on your behalf. They can be a consultant or advisor for you. This will cost a little more but it is worth because you know nothing about shares or stocks or trading or investing.

So, you want to start investing in stocks or CFDs, but you must always remember three things:

- Don’t invest the money you can’t afford yourself to lose. There is always a risk to lose all the money you have invested.

- Follow your head, not your heart. Your heart will always draw you towards some stocks. Your head will tell you: Stop and think. Only invest in companies that seem able to grow their profits, despite your emotions.

- Never invest your savings in just one company. ‘Never put all your eggs in one basket,’ as the saying goes. Place your investments across many different companies.

If you follow the suggestions above, you will be able to reduce the risk Your first trade should be made with 1, 10, or 20 shares. That’s quite enough to enter the game.

To repeat one of my suggestions: start practicing with a demo account. Almost every single broker will allow you that opportunity. Yes, there are some that don’t have free demo account but you should find the one that has.

It’s too easy to lose money on a stock market.

Yes, the account is virtual and the money is virtual, but the stock prices are almost real. You can virtually “purchase” them, start your trade and test how they will perform. Try to find the right time to sell them.

Before you start placing your real money, you will learn the tricks of the trade with virtual money.

Take it slow.

Fast money and easy earnings are mostly what young people want to succeed in the business world. They are attracted by exchanges, money is invested in shares.

However, there are many curves, curvatures, spirals and twists that, and if you don’t know how to avoid them, your trip to the stock market can be very short-lived.

What are the golden rules for investing in the stock market, which should be known primarily to beginners in this business, but also to more experienced stock traders?

Let’s see them.

* Create portfolio

You can do this in a simple way. There are many free portfolio managers on the Internet, so use some of them to make a free account. Create a fictitious portfolio in which you would potentially invest and monitor the situation for a while, a minimum of one month. This will give you the best insight into market volatility. Before you take the first step, the goal is to create a profitable fictitious portfolio as an investor on the stock market.

* Read business magazines

In order to successfully start investing in the stock market, you need to be aware of the world’s stock market and what are the social events that affect the rise or fall the price of shares. There are many respectable business magazines dealing with this topic (Forbes, The Economist, Kiplinger’s are some of the most famous ones). Follow the events in the global economy and finance and you will be able to swim more easily in the very turbulent waters of the stock market.

* Buy stock from a field you know well

Before investing money into something, you should understand the business the company is dealing with. The first stock you will buy on the stock market should be from the sector you understand and it is familiar to you. For example, if you know the banking sector, try to explore the market and find a bank whose stocks are good and worth investing. Never invest in the action itself, but in the company.

* Have realistic expectations

There may be a problem if your financial goals are based on unrealistic presumption. Try to be realistic in your ambitions and goals – in this way, there are fewer chances to lose money or be disappointed in your stock market business.

* Do your own research

You will hear from people who are dealing with the stock exchange that they have bought some stocks because the same was done by their friend or family member who understands this business. Accept everything with reserve. Before buying a stock, do research. If some stocks brought in earnings in the past doesn’t necessarily mean that this trend will continue. Always believe more to yourself than other people’s estimation.

* Stock exchange is NOT a money-making machine

Most of those who want to participate in the stock market, have an unrealistic desire to double or triple investment in a short time frame. If you are one of them, then that’s not a job for you. For those who want to invest, 10 to 12% of the earnings for a long period is quite a good investment. You need to realize that you are just a small fish in a big lake and that your success depends on many factors. Follow the clues and make conclusions.

* 3 or 4 good stocks are enough

Don’t overplay, especially because you are a beginner in this business. More than 10 stocks are a good portfolio, but for investment funds. It is true that they make more profit, but if you make a smart and wise decision you will earn enough money.

* Don’t try to predict the stock price

Not even the biggest billionaires and owners of the largest multinational companies in the world are doing this. No one is able to predict, at least for a longer period, several stock market cycles. Ability to guess the moment when the stock will have the highest value is still a myth. Even for those who have an insight into the business of some companies.

Therefore, for successful business and investing in the stock market, you need to acquire certain knowledge and skills. According to the research, the risk of investing in the stock exchange is most often taken over by young people who have just finished college. But, like in every other business, the experience you get, will help you to be wiser in making decisions in the future.

That’s how it works!

Five Tips For Beginners In Cryptocurrencies Investment

If you are reading our post Trading with success, I am sure you are one of those who has been tracking what’s happening on the crypto’s market, but you don’t dare to start investing.

Therefore I want to tell you several things about trading cryptos.

Many people believe that the cryptocurrency is the most popular investment option currently available. There are many stories about how people become millionaires.

Bitcoin and Ethereum are definitely by far the hottest investment product currently available among cryptocurrencies. The proponents of cryptocurrencies claim that they will replace all national coins. On that way, the world currency will be created

But slowly, we’ll soon get to that point. The first things come first.

What should you know at the beginning, before any move?

First of all, READ THE WHITEPAPER AND EVALUATE THE USE CASES.

It is best to thoroughly understand their concept and try to ask as many questions as you can.

You can join their various social media channels to interact with other people or the concerned teams and make more clear your findings.

Educate yourself further and frame a self-made case study including all positive and negative aspects.

SECOND, thoroughly investigate the chosen trader website to find out about the team members. You have to do so to find out whether or not the members or founders have a questionable history. Finally, after you evaluate some of them and find out about the founders or suspicious about their business or working history, you can decide not to participate.

THIRD, keep your eyes on what is their announcement on various forums. Try to get into the feelings and attitudes of people on forums.

You have to be very careful here because a good number of ICO teams have their own bots, but competition also does not regret money to downplay them.

Do they give the answers? Are they interested? Are they avoid your questions? Have they banned you from asking questions?

Well, it’s good if they banish you, then you know you’re dealing with fraudsters.

FOURTH, you should find an expert who has some knowledge!

You should follow such people who can enable you to have reasonable judgment. Follow expert people in the same field.

FIFTH, you should understand the coin distribution matrix and total supply and understand the project’s token economics.

It’s highly recommended that you should not invest until you are sure. Also, you should not invest more than what you are ready to lose. That’s the rule.

Let’s get back to shares and stocks.

How To Read A Stock Charts

Traders without experience act led by their emotions and this is a misunderstanding. Misunderstanding with the market, because all is not as it looks in the market.

But first comes first.

When you enter the stock market, which means that you have done everything from previous chapters and you bought your first stock, you will find that you have to follow the movement on the stock market through stock charts.

Chart-reading is the single most important investing skill you’ll ever learn.

First of all, you have to understand that the fund managers and big investors account for 80% of all trading activity in the market. Their buying and selling will either push your stock up or down. But you are an individual investor and your primary intent is to buy stocks big investors are buying and of course, you want to stay away from stocks they’re aggressively selling.

That’s where charts enter.

Once you know what to look for, you’ll see that charts literally show you what these big investors are doing. You’ll be able to quickly realize when a stock is being ponderously bought or sold. You’ll be able to use that information to identify the best time to buy, sell or hold your stock positions.

There are many different types of stock charts: line, bar, OHLC (open-high-low-close), candlestick, mountain, point-and-figure, and others, which are viewable in different time frames: most commonly, daily, weekly, monthly, and intraday charts.

Trading with success- Different types of stock charts

Line chart

Bar charts

Each style and time frame has its advantages and disadvantages, but they all provide you information that you can use to make investment decisions and trading with success.

Also, there are many different types of stock charts that display various types of information. But all stock charts display price and volume. On each stock chart, you can find the price history. The amount of trading history each bar represents is based on the period of a chart. For instance, on a daily stock chart, each price bar represents the prices the stock traded during that day. On a weekly stock chart, each price bar represents the prices the stock traded during that week.

The length of each vertical bar illustrates a stock’s high-low price range.

What you can see in the part of the chart which is called the top of the bar?

The top bar shows the highest price paid for the stock over some period. On the other side is the bottom of the bar, it shows the lowest price paid. The small horizontal slash tells the current price. Also, it provides you information about where a stock closed at the end of some period.

Can you see the price bar?

It is blue if the price of the recent trade is equal to or higher than it was in the previous period. But when the price is less than it was in the previous period you will see magenta (the color similar to pink).

Pay attention to the vertical lines at the bottom of the chart. They will show you the number of shares traded during the period of the chart.

It can be day, week, month, year or many years.

The length of the volume bar shows a value that matches the scale at its right. The color of a volume bar is determined by its price bar.

Well, you are beginners so it is important to show you, step by step how to read charts.

You can use different websites but I think that Google Finance has a smooth user interface.

Now let’s take a look at a typical stock chart.

We’ll use Dow Jones Industrial for this article Trading With Success – a guide for beginners.

You can see, the series of letters after the name of the company is the ticker symbol. It identifies the company on the stock exchange.

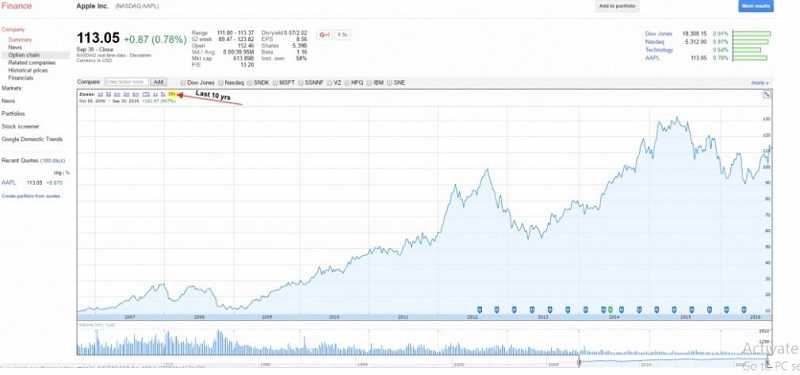

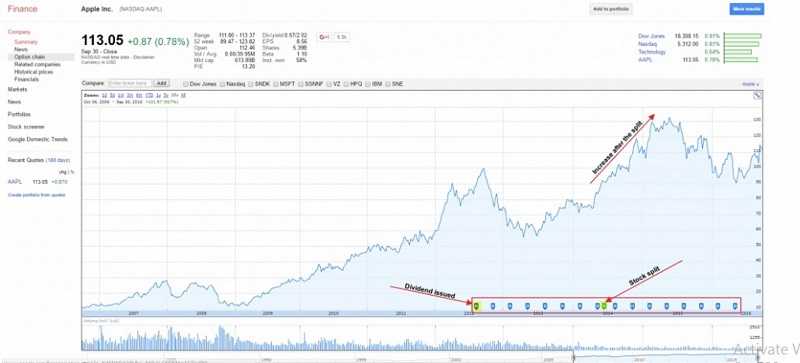

We’ll search for AAPL, which is Apple’s ticker symbol. This is what we get:

You can expand the chart by one click on the right side.

Now let’s jump into the different pieces and parts of the stock chart so you can begin to read like a pro.

For Trading with success – you have to identify the trend line.

The blue line exists for every stock and you will see it no matter if the price is going up or down. The trend line seems understandable, but there are a few things I want to show so you can understand it in more details.

You heard that stocks may deep fall. Yeah, but also can make huge rises. If you’ve read previous chapters you’ll know that you have to hold your emotions in control to be a successful investor.

You should never react to big drops or large gains positively or negatively.

You have to use this stock chart only to see what’s going on.

The trend line should guide you to investigate further.

For instance, Apple was really good from 2009 to 2012. But in the next 12 months, the stock went down more than 40%!

This is where the trend line is very helpful. Notice, something is happening and you have to pay attention to. You have to find out what’s going on with this company. Most strong companies can recover from hits like this, but you have to be careful.

We have to recall some history here.

Apple felt a few important changes at that time. First, it’s CEO, Steve Jobs, resigned. Also, around 2012, Apple informed that their profit margins were significantly reduced, despite increasing smartphone market. They were trying to expand the smartphone into developing countries, but they were too expensive to enter there.

And the stock price was falling.

But new CEO Tim Cook made strategic moves with the company and the rest of the trend line shows that.

The lesson here is how to use your trend line as a first peek, an indicator of something worth to look into. So, we can say the Apple had some problems, but they successfully handled them.

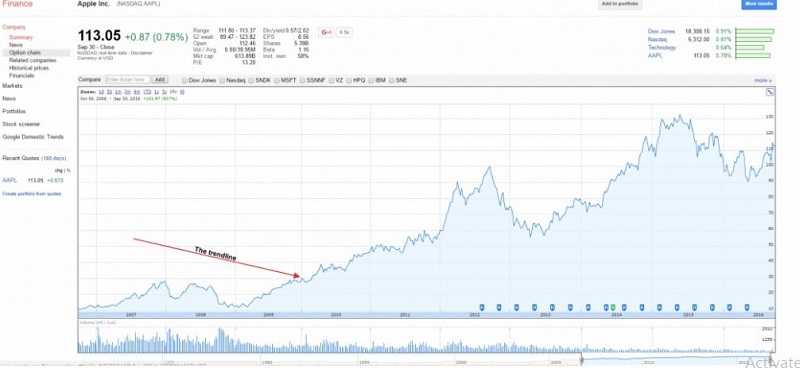

The next thing you have to look at are the lines of resistance and support.

These are the levels at which the stock stays within, over a certain period. A level of support is a price that a stock is unlikely to drop below, while a level of resistance is one that it’s unlikely to go above. It will stay the same until some major change occurs, such as a reduced profit margin.

A stock’s price is moving within the lines of support and resistance.

The point here is to know when to buy and when to sell.

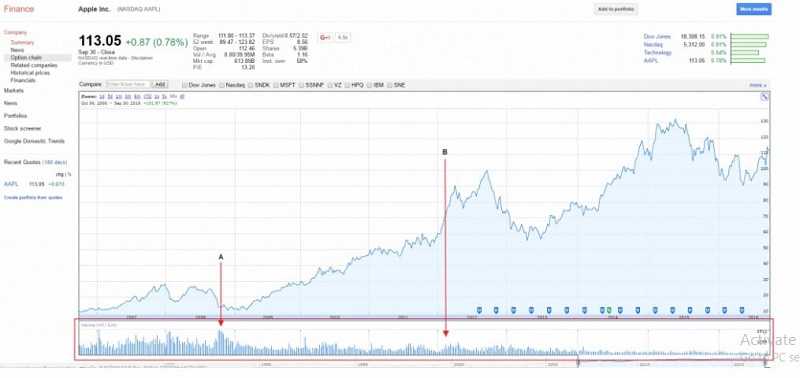

Take a look at Apple’s stock chart again:

The point here is to know when to buy and when to sell.

Take a look at Apple’s stock chart again:

I want to show you how the process is important. You have to know that everyone will draw lines of resistance and support differently, depending on how long they plan to hold the stock. If you’re a short-term investor, you may draw more lines to examine trends over a shorter period. For example, you may draw for every day or week the lines of support and resistance.

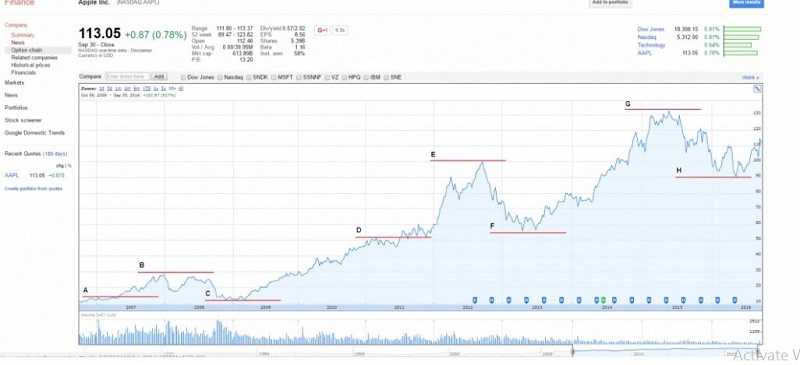

So, what we can see in this image?

Line A represents the very first line of support shown. Based on trends earlier to this, Everyone feels comfy that the stock price won’t go below this point and probably consider buying at this price or higher.

Line B is the first line of resistance. It is obvious that the stock has peaked at that point for now and it is expected to go higher. Maybe it’s time to consider selling at this price or slightly lower.

Line C shows, the stock has bottomed out again, thus creating a new line of support.

Line D shows the stock price has increased significantly and it’s comfortable to establish this as a new line of resistance.

The trend continues with Lines E, F, G, and H, bringing new lines of support and resistance as time goes on.

If it seems complicated, don’t worry. because it is. And a lot of this is speculations.

Knowing the lines of resistance can help you decide when to buy or sell a stock.

But remember, it’s subjective and it won’t give you a clear opinion about what to do. You have to use some of your analysis and evaluation.

On the next chart, you can see if and when the company issued a dividend, as well as if there was ever a stock split:

A dividend is when the board of directors decides to give a portion of its earnings back to its shareholders. If you own their stock, you get a small piece of the profit.

Some companies distribute dividends, but some don’t. Just because the company doesn’t issue a dividend you should never think it’s not worth invest in.

Some companies are focused on growth. This means they will reinvest their earnings. That is opposed to giving it back to the shareholders. But, if you want to be a long-term investor you will have your dividends later, when the company you invested in, achieves its goals. Also, you may get more. Apple, in this case, could pay dividends quarterly without influence on growth.

Also, you can see that there was a stock split in 2014. That is a strategic move made by the company’s board of directors to issue more shares of stock to the public.

In this case, Apple did a seven to one stock split, noted as 7:1, which means that for every share of AAPL shareholders owned before the split, they now have seven.

The value of the company doesn’t change, but the share price might.

Companies will often do this to attract smaller investors when the share price decreases.

Many times when a stock split happens, more people invest because the share price is often lower. That increases demand and the overall share price.

On the bottom of the chart, you can see many small, vertical lines. This shows a trend of the volumes at which the stock is traded. Volumes shouldn’t be the only determining factor when buying a stock. Usually, trading volumes increase when the company is in public focus, in a positive or negative sense.

When volumes are growing, it can also change the price of the stock instantly. Take a look.

Line A, shows a high volume of trading activity that corresponded with a drop in the stock price. Maybe some bad news that day caused people to panic and pushed them to sell the stocks.

Line B, you can see a small uptick in trading volume that corresponds with an upward trend in the stock price.

You shouldn’t necessarily have to assume that there will be a connection between stock price and trading volume. But it’s good to know what the volumes have been in the past and what they are currently.

If the volumes are high, a lot of people are trading the stock that day and it is a good idea to buy or sell it quickly.

This is the fundamentals of how to interpret a stock chart. Once you’ve mastered most of these techniques, you should be able to analyze a stock’s historical activity with high success.

How To Know Which Asset To Invest

The main asset classes are:

a) Shares/stocks also known as equities.

b) Bonds, known as fixed-interest stocks or debt

c) Property

d) Commodities

e) Cash and cash equivalents

What are the best assets to invest in?

(the return criteria is based off trying to generate $10,000 a year in passive income)

1) Certificates of Deposit (CDs).

2) Fixed Income / Bonds.

3) Physical Real Estate.

4) Peer-to-Peer Lending (P2P)

5) Dividend Investing.

6) Private Equity Investing.

7) Creating Your Own Products.

8) Real Estate Crowdsourcing.

And you have to decide which asset to invest. Among those?

Let’s say like this, investing is about laying out money today expecting to get more money back in the future. This is best done by getting productive assets.

What is that?

Productive assets are investments that provide you money from some sort of activity and do it in the long run. To be clear, if you buy a piece of art, it will never bee a productive asset. After 200 years you’ll still own piece of art. It can be worth more or less money. But, if you buy an extra house you’ll not only have the house. You will have all of the money it delivered from rent for over 200 years.

So, how to pick the asset suitable for you?

First of all, never invest all your money into one asset. You should mix them. The right asset mix should help balance risk with your expected rate of return on your investments, fit your tolerance for risk, let you get your money when you need it, help provide the growth you need to reach your goals, and change as your needs and goals change over time.

But first it is smart to know each of the assets classes individually and below you will find the answers.

Shares (also known as equities)

You can buy shares through a stockbroker.

If you want the cheapest and fastest way to buy and sell shares you should do it online and choose ‘execution-only’ broker.

This means your broker will take your order and execute it without giving you some advice. The broker will provide you everything about the stocks, for example, information, researches but this service doesn’t include advice.

But, if you need advice you will need a stockbroker that offers an advisory or discretionary service. Discretionary service means that you allow the broker to buy and sell shares on your behalf. All you have to do is to set limits. Of course, the broker will ask you for permission before executing the trade.

Bonds (also known as fixed-interest stocks).

These represent a form of IOU issued by governments and companies when they want to borrow money from investors. They will pay a fixed level of interest for that. The higher-risk borrowers are paying more interest than lower-risk borrowers.

Property

The property has a good history in providing a financial return that beats inflation. Property can be residential or commercial, it doesn’t matter. It will provide you a nice return. You can buy ‘bricks and mortar’ or you can buy shares in property or real estate investment companies. If you choose to invest in some real estate fund, you should know that funds are generally focused on commercial property, but some invest in the residential property also.

Commodities

You can find a huge assortment of commodities traded on global markets: oil and gas; gold and silver; copper and iron. Also, you can trade ‘soft’ agricultural commodities, for example, wheat, rice, corn or soya. It is exactly like shares or bonds. The prices of those commodities will

Just like shares and bonds, commodity prices increase and decrease as an answer to supply and demand.

Cash

It may be a bit strange that cash is considered to be an asset class. Isn’t the whole reason for investing in the first place is to grow your money faster than if it was left in the bank? Yes. But you must have in your mind that cash provides a useful reference for all investments. Finally, investments that don’t beat cash have failed. Cash also provides a safe shelter for funds when markets are bumpy or overvalued. Do you know that funds also trade in currencies to increase their returns from cash when interest rates are low?

Being an expert asset picker isn’t actually necessary to grow your wealth.

The majority get in trouble, especially when they think of investing as a way to get rich quickly.

“People will overpay for the prayer and dream of getting richer. So if you stay away from glamour stocks, you’re going to avoid being the wrong side of those transactions,” said Bruce Greenwald, a professor of finance and asset management at the Columbia Business School.

Your path to success as an investor or trader shouldn’t hinge on whatever hot stock your friend thinks you should buy ASAP. Your path depends more on how smart a portfolio you put together, as well as how you progressively modify or rebalance it over time.

Well, how to invest intelligently, if slowly? You have to respect some basic principles

First of all, why do you want to start investing?

The main argument for putting your money in anything is to avoid losing your wealth during inflation. In your checking account, cash will still be there in 40 years, if you don’t touch any of it. But you won’t be able to buy anything.

Other crucial reasons might include growing a substantial enough saving for retirement and earn enough cash for buying a home. For those kinds of goals, you might want assets with higher returns and therefore you’ll have to take on higher risk.

The riskier assets might include stocks and bonds as well as mutual funds, or balanced funds that mix equities and fixed income.

Also, a very important question is when should you begin investing?

You might already know, but you need to be investing for old age. If you start investing in your early ages you will have many advantages as an investor. Just to name two: you have more time for your money to grow and more time for market downturns to correct themselves.

And how to choose the right asset?

Each type of asset has its own features and pros and cons. Here is a quick summary of some of the potential investments you might make as you start your journey:

Business Equity

If you own investment in a company, you will share the profit or losses caused by the company’s activity. It doesn’t matter whether you are investing in a small company fully or buying shares through the buying of stock on the market. Business investment has historically been the most pleasant asset class for investors. It is wise to note that a good business is a best-spent money, without dilemma.

That provides you a super-nice income for a long time.

Fixed Income Securities

When you buy fixed-income securities, you are really lending money to the bond issuer in exchange for interest income. There are billions of ways you can do it, from buying certificates of deposit and money markets to corporate bonds, tax-free municipal bonds, etc.

Real Estate – This is maybe the oldest and most easily understood asset class which you as investors may think about. There are several ways to make money investing in real estate but it typically comes with developing the property and selling it for a profit or owning something and letting others use it in exchange for rent.

Intangible Property and Rights

When it is done properly you can create things out of the air that will print money for you. Adorable! Intangible property includes everything from trademarks and patents to music royalties and copyrights.

Farmland

It often involves real estate. Investments in farming projects are basically different in that you are either producing or obtaining something from the soil or from nature. Anyway, you hope to make a profit. For instance, if the oil is found on your property. So, you can exploit it and earn money when sell. If you grow wheat, you can sell it and earn money. But the risks are remarkable: hail, flood, drought can and have caused fails.

Many people went bankrupt by buying this asset class. But also it can make big rewards. Do you remember? High risk may provide a high return.

How to create your first trading strategy

Okay, I understand your dilemma. You would like to be successful and you want to know, what strategy should you choose to score it.

Listen there!

First, let’s make clear what the Trading Strategy is.

A trading strategy is a set of trading settings that serve the currency trader or stock to determine whether to buy or sell currency or stock, where to enter and exit the position, and how much capital they invest in trade, and in doing so, earn a difference in price. The trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets.

A broker can offer you the opportunity to enter into trades that are multiple times of the value of the margin that you place. The market is fluid and you can open trade or exit from one very quickly, so there is potential to make considerable returns.

And what the Investing Strategy is?

The investment strategy is a set of rules, behaviors or procedures, designed to guide an investor’s selection of an investment portfolio. People have different profit objectives, and their skills make different tactics and strategies appropriate.

To complicated? Wait!!! There are more!

Trading strategies can be – automated (various robots for trading, etc.) – manual (the vast majority of traders use their trading system.)

I would like to show you some of them which are successful. I will give you a brief description of 5 simple strategies that can help you maximize your profits:

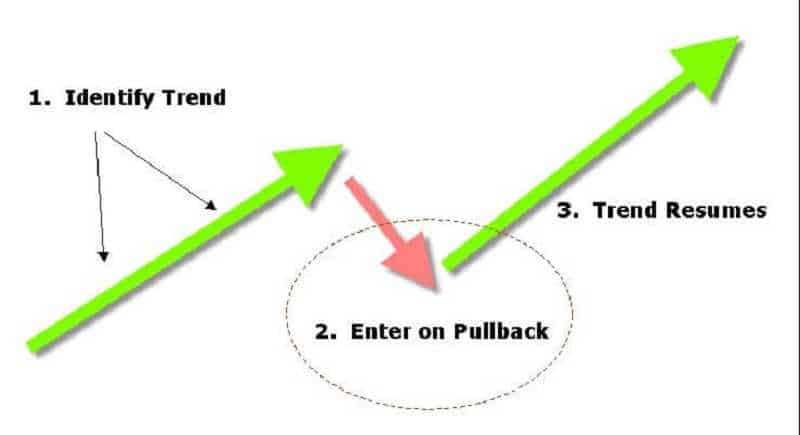

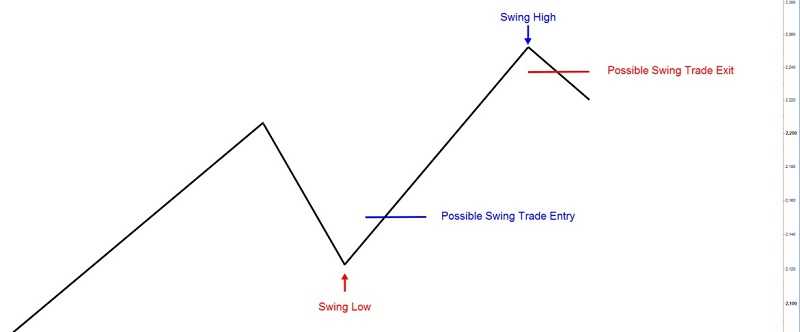

Swing trading

Swing trading is a method that you will run in the short-term. You can trade stocks, currencies or options. Swing trading position ends after two to six days. But sometimes you can hold this position a bit longer, even two weeks.

The purpose of swing trading is to recognize the general trend and then catch gains within that trend.

If you choose to be a swing trader, you have to pay attention to the main trend in the chart. If the security is in an uptrend, you will “go long” by buying shares. But, if the trend is declining, you will short shares.

There are various strategies you can apply to swing trade stocks.

But always you must have three key points: entry point, exit level, and stop loss.

Swing trading tries to recognize “swings” inside a medium-term trend. The point is to enter only when there is a great chance to win.

For example, in an uptrend, your point is to buy which means to go long at “swing lows.” And vice versa, you have to sell, meaning to go short at “swing highs”. That will provide you to profit.

Rangebound trading

In range-bound trading, you will use a completely technical method of predicting short-term highs and lows of some stock. This type of trades is more powerful in range-bound markets because you have to trade stocks inside a defined channel.

If you choose this type you have to look for stocks with precise support and resistance level.

Then buy at the support and sell at the resistance.

To create a channel you have to connect high chart points and low chart points. The range inside is the area (channel) where you will perform your trade.

In Forex, you will need to identify a currency pair that trades within a certain range. Then, you have to identify the support and resistance levels and then time your trade by taking these movements into account.

Likely, there will not be a big difference between the upper and lower prices of the range. Because of this reason, you could trade in one of two ways.

The first option is to trade within the range which will limit your profits as the price difference is bound to be minimal.

The second way is to look for a breakout from the range. If this happens, you will have to react quickly. You can make a quick profit, but you can lose out. A “false breakout” may result in the market moving in the opposite direction and lead to losses.

Position trading

A position trade is not a short-term trade.

This trading style means holding positions in stocks for a long time, even years.

For example, you want to profit off of stocks earning large gains, sometimes more than100%. To achieve this, you have to look for long runs. That’s why you have to look at longer-term charts like monthly or weekly.

It is the truth that position trading seems very alike investing. Yes on the first sight, but there are a few important differences.

The investor usually is buying an asset to hold it for a long time. So, the investor has to find a trustworthy company with good future potential. So, the investor will hold that stock for years and collect the dividend yield.

On the other side, if you want to be a position trader, you will be more focused on the overall price move. Because you have to catch the major trend of the stock but to get out when the trend turns.

Also, you have to use stop-loss similar to swing traders.

In Forex, it is based on macroeconomic trends. You must understand how inflation or the rate at which an economy is growing, will affect the price of a currency. If you want to adopt this strategy, you have to stay stick to two rules.

First, do not use much leverage. A maximum of 10:1 is recommended. Second, the size should be small. This is because you expect that there will be a reasonably large movement in the price of the currency pair.

Carry trade

This is a trade where you borrow bonds because you want to buy something else with higher interest. For example, when short rates are lower than long rates, you can borrow at low rates and buy long-term bonds. The carry income is the coupon on the bonds lessen for the interest costs of borrowing. Of course, if long-term interest rates suddenly grow, the carry trade will be profitless. Why? Because a lot of investors would like to sell long-term bonds. That could cause the rates to go higher.

In Forex, a carry trade involves entering into a trade in a currency pair that will take advantage of the interest rate differential of the two currencies. That means you will be selling a currency with a low-interest rate and buying one that provides a greater rate of interest.

Normally, you would choose a currency pair where the higher interest rate currency will appreciate to the lower interest rate currency.

Carry trades can be high-risk. They are based on a combination of technical and fundamental analysis.

Momentum trading

Momentum trading is a method when you buy and sell according to the strength of current price trends.

So, the momentum is defined by trading volume and the rate of price changes. To explain this. In momentum trading, you have to guess that the price will continue to move in some direction until the trend loses strength.

It is like momentum in physics: mass multiplied by speed grows the probability that some object will stay on its route.

Fact: “Price frequently lies, but momentum generally speaks the truth.”

In Forex, you can use momentum trading when rates are growing and buy. When the rates are falling, you should sell and take your profits. If you want to implement this strategy, you have to identify the currency pairs that have the biggest momentum and have moved most strongly. So, you have to track price changes over several weeks or so. Then trade those pairs with the greatest momentum.