Value stocks have underperformed since the beginning of 2007. But Goldman Sachs and Morgan Stanley claim that they have great potential.

Value investing is coming back according to data from the last autumn. This granddaddy of all investment types was set up in the first half of the 20th century and it is still actual.

For example last year, value investing has gotten fired by a typical value sector, energy. Last September made value investors satisfied, as returns of winners among cheap stocks outperformed big companies by a wide margin. The value-stock rally was exciting, unexpected, and fabulous. The past 10 years weren’t good for value investing. Actually, the value stocks were underperformed the growth stocks. They had weaker performances than it was the case with growth stocks. Moreover, some fund managers didn’t want to invest in utilities. What a great mistake! Utilities are the value stocks backbone. Their explanation was the value stocks are too expensive. Really? The fact is that utilities had a great performance last year and those managers suffered in a loss.

Why value investing is still a good opportunity?

Historically, they beat Grand Depression, played well during recessions, and inflation periods. Moreover, growth stocks have not become more profitable. So, the value stocks should finally be better. The reason is simple. They are unfairly cheaper. And that’s the point of value investing – finding under-appreciated stocks trading at low prices.

The stock market analysts found that stocks traded with low P/E and P/B ratios can easily beat the wider market. This opinion is supported by the facts.

A historical outlook

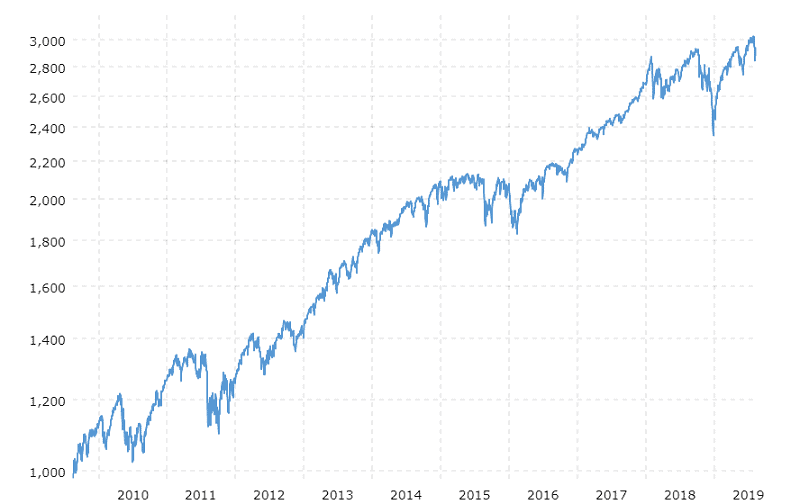

At the time of the financial crisis in August 2007, the S&P 500 index has returned 175%. The total return of value stocks in the US market was 120%. The return of growth stocks was fantastic 235%. Let’s go in the past more. Almost 20 years ago, value investors were devastated. For example, in 1999 and 2000 were so bad years for the value investing that some value investors had to step out of the market and retired.

But let’s stay for a while in 2007 and analyze growth investing deeper. What did happen?

That growth-strategy outperformance ended with the fall of the dot-com bubble. Value stocks came out of favor after the 2007 Global Financial crisis. On the other hand, growth stocks are performing remarkably well. Value stocks became unfairly cheap. You can notice that investors are expecting this global trend to continue since the global economic growth is slow. So, value stocks are trading at a discount compared to its more expensive growth peers.

But, is this discount a reason to invest in value stocks? It looks like that because value investing builds up. Slow economic growth caused value stocks to continue to produce stable free-cash flows. Yes, their businesses have slowed, but not damaged. At the same time, some of the growth stocks become extremely expensive. Moreover, the risk of failure in growth stock investing during slow economic conditions has grown.

Value Investing continues to make the headlines and not only in the US but also in Europe. We all can witness an increased number of headlines and publications, most recently, on the coming death of value investing. But now, something has changed.

Value investing is not dead

Timing the market seems to be difficult for investors. The intraday volatility grew over the last year, therefore, investors prefer not to bet as it will hurt long term goals. But this situation is beneficial for value. The value stocks start to outperform.

That will be a major market change. Value stocks’ years-long downtrend begins to turn. For some, it may seem a bit strange because investors in more cases neglect bargains. Everyone is trying to catch the major winners, famous companies, expensive stocks. They prefer to overpay some stock because of excitement. Oh, how wrong they are! But as we said, value stock investing is coming back.

Firstly, value stocks are cheap.

Value investing is the main principle for equity managers. There is long-term potency to buying cheap stocks over expensive growth stocks. Value investing was attractive over the entire history. Why shouldn’t it continue?

No one could say value investing is dead.

Goldman Sachs predicts a new life for value investing

Value investing has been decayed after years of underperformance. But Goldman Sachs says there’s still great growth possibilities in this classic factor strategy. And here are some reasons behind.

Value stocks will come back in favor very soon.

David Kostin, Goldman’s chief U.S. equity strategist explained that during the last 9 years the difference in valuation of expensive and cheap stocks was wider than ever.

Kostin said: “A wide distribution of price-to-earnings multiples has historically presaged strong value returns. However, a rotation into value stocks would require a sustained improvement in investor economic growth expectations, potentially driven by global monetary policy easing.”

The renaissance is coming

Value investing has gone out of favor particularly because the economic expansion gets stretched longer. Value brands continue to falter due to modest GDP.

But this course could start to change for value stocks. In the US an easier monetary policy from the Federal Reserve could increase growth expectations. Also, a rate cut could support the economy additionally. Bankers announced that possibility. Also, we already saw signs of resilience in US value stocks last September. Analysts predict that value stocks could finally enjoy a rebirth in 2020. Value investing means buying stocks that are trading below their value in the hopes of notable profit when the company comes into favor.

By default, value stocks have underperformed since the financial crisis. The investors have shifted into more energetic growth stocks, for example into technology. But last autumn, growth stocks were trading at high valuations and they became too expensive. In the same period, value stocks have shown important strength.

From October last year, the Russell 3000 Value index has dropped 2.4%, and the Russell 3000 Growth index has experienced a worrying 7.1% reversal.

Yes, growth stocks had a bounce, and outperformed value stocks. But there is some rule pointed by Morgan Stanley’s analysts. The markets are in the process of a regime change. That means the investors’ willingness to buy growth stocks will decrease as interest rates rise.

Goldman’s High Sharpe ratio

For investors assured on value stocks comeback, Goldman has selected value stocks with “a quality overlay.” Do you understand what does it mean?

These stocks could easily generate three times bigger returns than the average S&P 500 company with similar volatility. It is Goldman’s Sharpe ratio basket composed of 50 S&P 500 stocks with the highest ratios. This ratio measures a stock’s performance related to its volatility.

Goldman named the stocks with the highest earnings-related upside to consensus target prices. That are Qualcomm, Western Digital, Marathon Petroleum, Halliburton, Facebook, and Salesforce.

Bottom line

Many of the world’s most successful investors hold value stocks. They are buying cheap value stocks and benefit as the companies manage to work better.

For this to work, the stock has to stay cheap, so the company spends money on tremendous dividends and buybacks. The other option is the company be re-valued at a more relevant valuation, meaning more expensive. That is happening when the market recognizes the previous mistake in valuation.

For example, take a look at Altria (MO).

When the evidence about how toxic smoking is, appears to the public and more and more people stopped to smoke, investors had a feeling that cigarette producers will have a problem, the stock valuation was low. Well, something different happened to the company. The fundamentals remained strong. These stocks had good returns and still have.

How is this possible?

The stocks had higher dividend yields and investors reinvesting their dividends. Very good play. Tobacco companies also reinvested. They were buying back their cheap stocks and increased their earnings-per-share and dividend-per-share.

Smart investors know that value stocks can outperform most other factors. Some of the cheapest stocks in the market today are banks, oil companies, and so on. Keep it in mind.

So is value investing coming back? Do we really need to think better what the definition of value is?