2 min read

Bitcoin and the Bear market? Why the bear markets are the best time to be in crypto?

Recently, Bitcoin made a strong rally. Enough to break past the neckline of its double bottom at $3,600 to $3,700. This can be an uptrend underway. If buyers keep the price above the area of interest, it will be possible.

If you apply the Fibonacci retracement tool on the latest swing low and high shows that the 38.2% to 50% levels span the former resistance. That might now hold as support. That means bitcoin could recover to around $4,035 and beyond.

Analysis indicates that the current Bitcoin price chart entirely mirrors that seen in late-2014 and early-2015, this market’s last moody bear market.

What happened then?

2013 marked a very significant year not only in the history of Bitcoin’s bear market but in the history of Bitcoin as a whole. In October 2013, FBI officially shut down the Silk Road.

Silk Road was an online black market. It also represented the first modern darknet market. However, Silk Road’s represented the crypto asset’s first form of widespread user adoption.

The Silk Road closed activity in October of that year. But the price of Bitcoin continued to rally until the end of November before the market had fully systemized the effects of that event.

It is impossible to know when Bitcoin has reached its peak while events are ongoing. Even more, the media didn’t help paint a clear picture of reality. At the time, even as the price of Bitcoin began dropping, headlines were incredibly optimistic.

But, during Bitcoin’s reversal period in January 2015, the general sense in media’s headlines was negative.

These headlines did not provide any positive signals to indicate the bottom of Bitcoin bear market, at that time.

Let’s go back to 2018! What is happening now with Bitcoin?

Although many have claimed that Bitcoin, has finally touched the bottom in 2018’s market downturn, data indicates that many investors still see plentiful amounts of value in blockchain-based assets.

The research group divulged that the 30-day moving average of Bitcoin flow into investors’ wallets has been on the rise, eclipsing the $400 million milestones as of November 1st. Well, $400 million out of Bitcoin’s current $65 billion market capitalization isn’t especially important. In June, this same figure was $300 million. In that period, the price of Bitcoin was approx $6,000. Those days it is about $3,750. November’s inflows should be seen as a bullish indicator.

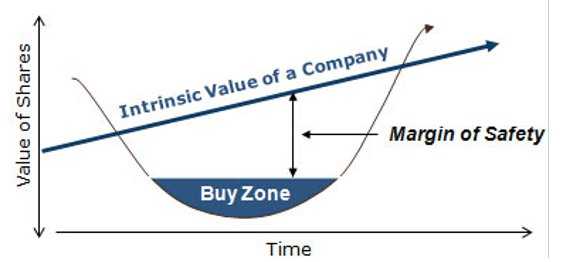

The data suggests that investors have sought to accumulate Bitcoin at lower prices. Many investors started to allocate more capital towards Bitcoin, due to their long-term belief in the asset’s underlying value.

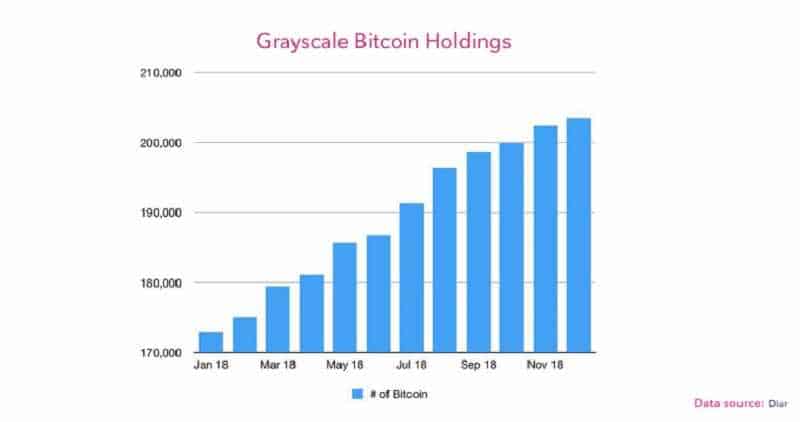

That wasn’t the case only with “personal wallets”. The institutional players via Grayscale Investments saw an increase in Bitcoin balances. It is an investment-centric subsidiary of the conglomerate that is Digital Currency Group (DCG).

Since the start of 2018, Grayscale has seen its Bitcoin coffers swell by 30,600 BTC to 203,000 total.

Now it accounting for more than 1% of the asset’s total circulating supply.

As seen in the chart above (sourced from LongHash), the wallets pertaining to Grayscale’s GBTC, a vehicle that allows retail and investors to purchase customized BTC on the U.S. OTC market, has seen month-over-month increases.

Markets move solely based on the demand from investors. Hence, if investors think a large rally cannot be maintained throughout the years to come, then some of the largest markets can experience steep sell-offs.

Bitcoin made the recovery and market watchers are pinning it on a number of factors. First is the Coinbase offering of crypto to crypto trading that could boost volumes in the retail sector. Next is the report that Mark Dow, the former IMF economist that opened a major short play on bitcoin after it hit its all-time highs, closed his remaining position also led many to think that he may already be seeing a market bottom.

Bitcoin could take a longer time to recover than in previous years.

Because the market is more structured.

But, it is wrong to claim that Bitcoin could drop to zero because of its 85 percent decline in price this year. This because, in the previous year, it demonstrated a 1,850 percent gain. And a major correction was expected after such a large movement.

But many aren’t convinced that lines can be accurately drawn. The Bitcoin industry has matured beyond measure in the past year alone, and even more so in the past four. Moreover, others have claimed that the worst has yet to come for crypto assets.

Vinny Lingham, CEO of blockchain-centric identity ecosystem Civic, explained that trading within the aforementioned $2,000-wide range is likely to continue for a minimum of three to six months, a common timeline in the eyes of Bitcoin’s short-term bears. The entrepreneur added that if a convincing breakout isn’t established by the end of Bitcoin’s six-month range, a strong foray under $3,000 wouldn’t be out of the realm of possibility.

The Civic chief noted that Bitcoin will likely remain range-bound between $3,000 and $5,000 “for a while.”

But Fundstrat’s Tom Lee said: ”Bear markets are a ‘Golden Time’ to be in crypto.”

Bitcoin bear market is far from over, this is the opinion of analytics.

What are the benefits and disadvantages of this trading style? All explained.

What are the benefits and disadvantages of this trading style? All explained.

Both CPUs and GPUs are inventions made from billions of microscopic transistors packed on a small piece of silicon. But they have some differences.

Both CPUs and GPUs are inventions made from billions of microscopic transistors packed on a small piece of silicon. But they have some differences.

How can we apply artificial intelligence to the financial markets

How can we apply artificial intelligence to the financial markets