(Updated Oct. 21)

How to start trading options – another post or tutorial, if you like, about trading is in front of you, published by Traders Paradise.

In just a few minutes, you will find all you need to know about trading options:

- What Are Options

- Why Use Options

- How Options Work

- What Are Types of Options

- How to Buy Options

- How to Sell & Write Options

- How to Choose the Right Options Trading Strategy

- Options Spreads

- Benefits of Trading Options

Options are the most complex financial instrument ever invented, so I wish to write about it and show you how simple they can be.

I presume that you know very little or nothing about trading the options. That’s why you are reading this and that’s the reason I wrote this.

I will show you the fundamental concepts of options trading and close with some basic strategies. You will see. You’ll be able to use them in a jiffy.

This tutorial is intended for both, beginners and advanced interested in learning about the ins and outs of options trading.

Information presented here can’t be taken for granted. Every single word here came from serious research, personal experience and experience of professional traders.

I will explain how they function. Also, when is the right time to trade them. And how they can be traded.

In the tutorial Trading options, you will find their advantages and disadvantages.

Also, here you can find the variety of option trading styles and a summary of some of the strategies that can be used to trade options successfully.

First statement: Options have a reputation for being difficult to understand.

Yes, they are. But, at the same time, they are brilliant tools for hedging speculation when you properly use them. As I presume that you are eager to start learning about trading the options, without further ado let’s go to the point.

What are the options?

An option is a contract that allows an investor to buy or sell an underlying asset, for example, security, ETF or index at a specific price over a specific period of time.

Pay attention to the word “allows”. That means there is no obligation.

There is no obligation to buy.

So, let’s see what is – options trading?

Buying and selling options are made in the options market. The options market is a place where you can trade contracts based on securities. Buying an option allows you to buy shares later. It is a so-called “call option.” But if you buy an option that allows you to sell shares later it is a “put option.”

The benefits of trading options are flexibility, leverage, the limited risk for investors, and contract performance.

Flexibility means, when buying or selling options, you have the right to exercise that option at any time until the expiration date.

The limitation of risk exists because options are derivative securities. Meaning that their price is derived from the value of underlying assets, like the market indices, securities or other financial instruments. For this reason, options are often less risky than stocks.

Because of their nature, (you are buying the right to purchase, but you have no obligation) options allow you to profit from the price movements of underlying assets. But, without spending large funds which are needed to buy, for example, stocks.

An option is a contract that allows you to buy or sell a stock at a pre-negotiated price and by a certain date. Usually, they are bundles of 100 shares of stock per contract.

The potential of options lies in their versatility, and their capacity to mix with conventional assets such as individual stocks, for example. They let you modify or alter your position depending on various market conditions that may occur.

For example, you can use options as a powerful hedge against a declining stock market to limit downside losses. Options can be used for speculative plans or to be extremely conservative, as you require. Employing options is, therefore, best defined as part of a wider strategy of trading.

I’ll show you how trading options could work on an example.

Let’s say that the stock of “Plum Ltd Inc Gmbh” (a makebelieve company) is currently priced at $10. You are confident that it will go up over the next month. So you would go and buy the call option for $2 to purchase those stocks for $12. This price at which you can buy the stocks is called the strike price.

If the stock’s price grows to $16 on the expiration, then you will be able to exercise your call option and buy the stock at the strike price of $12. Then, you can sell those stocks, and close out your position with a tidy net profit of $2. You have purchased the stocks for $12 and sold them for $16. Which makes your gross profit of $4. But you need to also take into account the cost of purchasing the option for $2. Or to put it in numbers – $16(sell price)-$12(buy price)-$2(cost of the option)=$2(net profit).

Options give you options.

You’re not just limited to buying, selling or staying out of the market.

With options, you can tailor your position to your own financial situation, stock market outlook and risk tolerance.

When most people think of investment, they think of buying stocks in the stock market. Most of them completely misunderstand terms like options trading.

One of the more common investment strategies is buying stocks. Hoping that their value will grow over time and holding on to them in order to make long-term gains.

Yes, that is the reasonable way to invest if you have some idea about which stocks you should buy or use some broker’s help to give you advice and guidance.

Every advanced trader would tell you that investing with options is all about customization. Actually, it is all about what you think may happen. About your estimation. Buying options is essentially betting on stocks to go up, down or to hedge a trading position.

Yes, you can get high rewards. But you also must be aware of the potential loss.

Choices are plenty and you must be careful. Starting to trade options isn’t easy because there is a potential for mistakes. But mistakes which could be much less costly than buying stocks. So let’s look at an example of how a mistake could cost you.

Let’s go back to our makebelieve company, the “Plum Ltd Inc Gmbh.” And their stock is currently priced at $10. You are confident that it will go up over the next month.

So you would go and buy the call option for $2 to purchase those stocks for $12 strike price. But alas, you were wrong and the value of the stock went down, all the way to $7.

As a shrewd investor, you will not exercise your option, because it would mean purchasing stocks for a price $5 above their market value. You would just cut your losses of $2, how much it cost you buying the options. If you were to invest directly, by purchasing those stocks for $10, you would be in this situation at a loss of $3. In this way, the options give you the ability to hedge your investment from negative price movements.

Trading options are known as a buy and hold strategy.

It can help you boost your wealth in the long run, but it doesn’t provide much in short-term gains. These days more popular are immediate returns.

Frankly, options trading is more for the DIY (do-it-yourself) investors.

Options traders are self-directed investors.

They never work directly with a financial adviser to help them to manage their options trading portfolio.

There are historical findings that confirm their use during the Antiquity period. The first options were practiced in ancient Greece to speculate on the olive harvest.

But the fact that trade options have prospered in the last 50 years.

The most significant event that enabled the popularization of trading options was the establishment of the first arranged stock exchange option in Chicago in the year 1973 under the name of the Chicago Board of Options. Since then, a number of stock options have been established in the US and around the world.

Options are a very useful financial instrument because of their characteristics.

They offer investors a range of options.

They can be used as an instrument for speculation, for the protection and management of market risks (hedging) or for arbitration.

In this way, for any investor following own goal of trading, options can create the aspired position.

The right to buy is called a call option and the right to sell is a put option.

Once again, options are the type of derivative.

People a bit familiar with derivatives may not see an evident difference between this definition and what a future or forward contract does.

To clarify this thing.

Futures or forwards give both the right and obligation to buy or sell in the future.

For example, you buy a futures contract for corn. In that case, you are obliged to deliver real corn to a buyer unless the buyer closes out his/her positions before expiration.

An options contract does not have the same obligation. That is exactly why it is called an “option.”

Once again, options are a great way to add flexibility to your portfolio since they can be used for both hedging risk and speculation.

The benefits that options offer are (to repeat once again, you MUST remember this) high profitability, risk limitation, financial leverage, flexibility and the ability to stay on the market without the need to own a marketable asset.

What does it mean? This means you can be an options trader and never have real stock in your hands. Just by having the right to trade them. That right you can afford by buying options.

Unfortunately, people know little about these instruments. Also, the majority of the investors is not able to trade options because of ignorance about their use.

The options, like all derivative instruments, are complex in nature, and we have to know their capabilities and limitations so that we can effectively use them.

Trading with options is also specific and differs from trading with conventional financial instruments. Hence, the investor needs to be well aware of trading rules with the option.

The brief review of options basics:

1) An option is a contract which gives you the right, but not the obligation, to buy (which is a call) or sell (which is a put) shares of the underlying security at a specific price (which is the strike price) on or before a negotiated date (which is expiration day). After this assigned date, the option stops to exist. The seller of some option is, on the other hand, obligated to sell (if it is a call option) or buy (if it is a put option) the shares to the buyer at the defined price in the buyer’s demand. Option contracts regularly are 100 shares of the underlying stock.

Option contracts usually represent 100 shares of the underlying stock.

2) Strike price or exercise price is the fixed price per share. For that price, the underlying security may be bought or sold. The strike price, which is a fixed stipulation of an option contract, should not be mixed with the premium. The premium is the price at which the contract trades, which varies daily.

3) Regulation to an option contract size or strike price may be created to account for stock splits, mergers or other corporate actions.

Overall, at any given time a particular option can be bought with one of four expiration dates.

4) Option holders don’t have the rights like stockholders. They don’t have voting rights, dividends, etc. A call holder is obliged to exercise this option and get ownership of underlying shares to be fit mentioned rights.

5) Sellers and buyers in the exchange markets, where all trading is handled in the competitive mode, set option prices.

Market Dictionary and Jargon In Trading Options

LONG – Describes a position in which you have bought and keep that security in your brokerage account.

Let me explain, if you have purchased the right to buy 100 shares of stock, and are holding that right in your account, you are long a call.

If you have purchased the right to sell 100 shares of stock, and are keeping that right in your account, you are long a put.

If you are long an option contract, you have the right to exercise that option at any time previous to its expiration and your possible loss is limited to the price you paid for the options contract.

SHORT – Defines a position in trading options in which you have written a contract. Meaning sell the one that you don’t own.

Now you have the obligations according to the option contract. If the owner exercises the option, you have an obligation to fill the contract.

When you sell the right to buy the shares of stock, you are short a call contract.

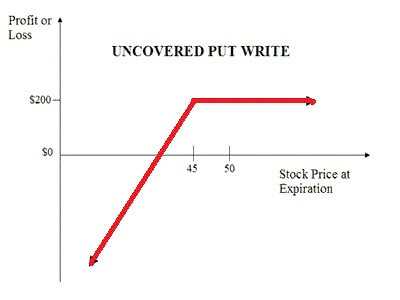

If you sell the right to sell the shares of stock, you are short a put contract. Say you write an option contract. That means you create it.

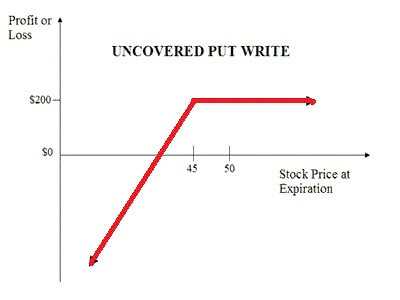

So, you are the writer of an option contract. The writer gets and holds the premium taken from its initial sale. When you are short, you are the writer of an option contract. You can receive an exercise notice at any time during the period of the option contract. All option writers have to know that possible loss on a short call is probably unlimited.

But the risk of loss is bounded by the fact that the stock cannot fall under zero.

This possible loss could be very high if the underlying stock drops in price.

OPEN – The opening transaction is what adds to, or creates a new trading position. It can be a purchase or a sale.

Opening purchase is a transaction when the buyer’s aim is to produce or improve a long position in a set of options.

An opening sale is a transaction when the seller’s aim is to produce or improve a short position in a set of options.

CLOSE – A closing transaction is decreasing or eliminating an existing position by balancing out buying or sell. This transaction is recognized as “covering” a short position.

LEVERAGE AND RISK – Options can provide leverage. That implies an option buyer has to pay a modest premium for market exposure in connection to the contract price. It is regularly 100 shares of the underlying stock.

The investor may have respectable gains from relatively small but beneficial moves in the underlying assets.

Leverage also has downside results. If the underlying stock price does not rise or fall as expected, leverage can grow the loss.

Options give their owners a calculated risk.

But, if the owner’s options lapse without value, the loss can be the full payment paid for the option. That’s why an uncovered option writer may have extensive risk.

THE STRIKE PRICE or EXERCISE PRICE

In trading, options define if the contract is “in the money”, “at the money”, or “out of the money”. If the strike price of a call option is less than the current market price, the call is known as in-the-money. Why? Because the holder of such call has the right to buy the stock at a price that is lower than the price in the stock market. If the strike price matches the current market price, the option is called at-the-money.

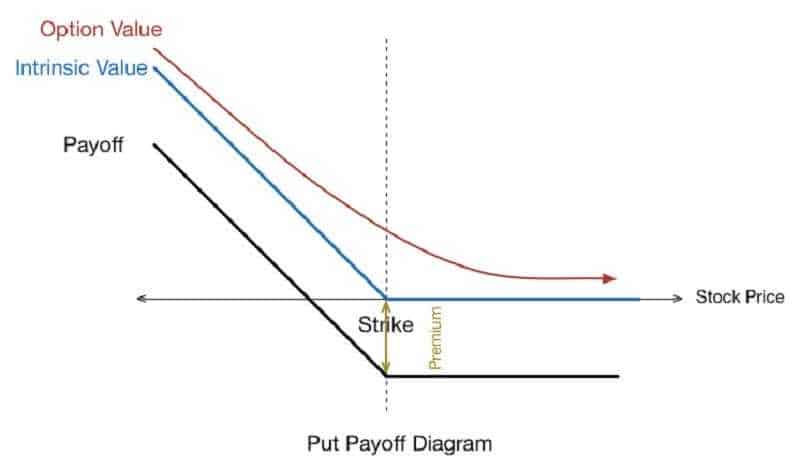

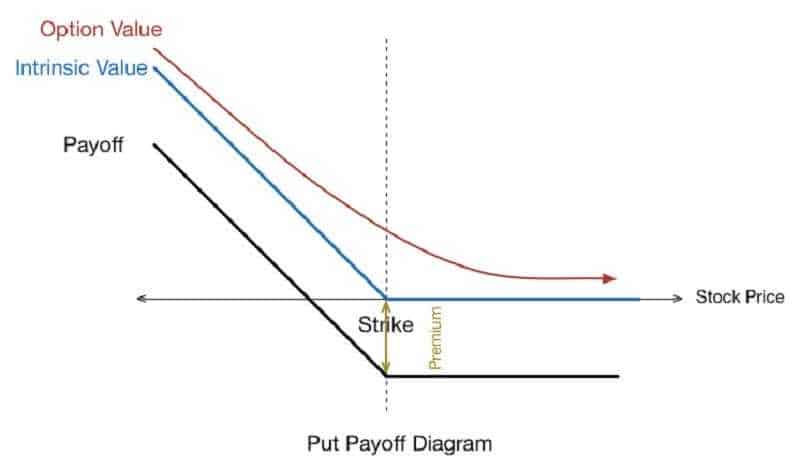

INTRINSIC VALUE

This is the sum by which an option, call or put, is in-the-money at any time. By definition, an at-the-money or out-of-the-money option has no intrinsic value. The time value is the entire option premium. This doesn’t signify that you can take certain options at no charge.

The value by which an option’s total premium exceeds intrinsic value is called the time value portion of the premium. It is influenced by fluctuations in volatility, dividend values, interest rates, the movements in time.

There are various circumstances that provide options value and altering the premium.

Altogether, these circumstances determine the time value.

WHY USE OPTIONS

One of the largest benefits of using options is leverage.

Buying an option gives you exposure to price movement in the underlying stock. In comparison with a percentage change in the underlying price, the change in option price in percentage is higher. Frankly, if you trade options, you can enjoy the rewards of leverage. Only if you calculate in the risk of losing the premium, or the price paid for that option.

The other biggest advantage is the limited risk.

Options trading has the capacity to have a perspective on the market trend with limited risk. At the same time, have limitless profit possibility. To recall, option buyers have the right, not the obligation, to exercise the contract for the underlying at the exercise price.

If the price is not right at the time of expiration, the buyer will lose his right and utterly allow the contract to expire worthlessly.

Insurance is another reason.

Investors may use options for portfolio insurance. Options contracts can give the investor a method to protect his downside risk in the event of a stock market crash.

Speculation is one of the greatest advantages.

Options are the world in which you will not be restricted to making a gain only when the market is successful. Due to the adaptability of options, you can produce a profit even when the market goes downward or even sideways.

If you consider speculation as betting on the movement of a security.

That’s why options have the reputation of being insecure in which big profits are made or lost. When you are buying an option you must correctly forecast whether a stock will go up or down if you want to succeed.

Also, you will have to forecast how much the price can fluctuate also the length of time it will take for this process.

Don’t forget commissions too.

The mixture of these factors means the odds are arranged against you.

Another function of options is hedging as an insurance policy.

Options are used to ensure your investments against a downswing. Critics of options comment that if you are not sure of your stock picks, and you need a hedge, you should reconsider making the investment. Vice versa, there is no apprehension that hedging strategies can be helpful, particularly for large institutions. Even the individual investor can benefit. By using options, you will be able to confine your downside while enjoying the full upside in a cost-effective way.

Like everywhere, in trading options, we can find some adverse effects.

Leverage is a double-edged sword. If the common stock had stopped at, for example, $100 or worse, dropped below the $100 strike level by the expiration date, the option would have declined to zero and the loss would have been 100%.

The cost of trading options adds commissions and the bid price is higher on a percentage data than the underlying stock itself.

In order to be a successful options trader, you must make an attempt to educate yourself about how options work. You have to learn different trading strategies. Remember, one of the features of trading options is its complexity.

Options, by their nature, are time-sensitive. You have to exercise a contract before its expiration date. If you don’t the option will mature as worthless.

HOW OPTIONS WORK

Options are the most versatile trading instrument ever invented.

Options are the most versatile trading instrument ever created.

Yes, options require less money than stock. They give high leverage. That can notably limit the risk of a trade or provide a nice income.

How?

Here is a very realistic example: You want to buy some estate. You are searching around asking everyone, visiting the agencies, etc. שnd you find the one you like. The cost is $200,000, for example. But that estate is expensive for you at this moment. You can’t pay the estate at an overall price, the full amount. Bad luck? Let’s see what can you do? You can talk with the owner of the estate and arrange an option to purchase it within 10 months for $200,000 but the owner decided to sell you that option for $4,000.

What are the possible scenarios?

Case 1: Within those 10 months you found that this estate lies in a wonderful position. You find a source of gold there. What will happen? The value of the property will go to the sky. Let’s say, you can sell it off at $2 million. Will the owner have the right to raise the price for that estate according to new circumstances? There is the trick. He is the writer of the option and he is obliged to sell you that estate at a pre-agreed price. That means, he has to sell at $200,000. You will buy the estate for that price plus the $4,000 premium for the option. And you will sell your estate for $2 million, and put the difference of $1,796,000 on your bank account and travel all over the world.

Case 2: You find a deadly garbage hole in your backyard. You can do nothing with it. Nobody can. The price of your estate sinks to zero. And you choose not to exercise the option to buy that estate. That’s your right. To give up.

Wait, you have to pay the premium. You have to pay a $4,000 option premium to the owner.

What do we see here?

Option buyers have rights and option sellers have obligations.

Option buyers have the right, but not the obligation, to buy (call) or sell (put) the underlying stock (or a futures contract) at a specified price until the 3rd Friday of their expiration month.

There are two kinds of options: calls and puts.

Call options provide you the right to buy the underlying asset.

Put options provide you the right to sell the underlying asset. It is important to be familiarized with both.

It is crucial. All strategies depend on the knowledge of these two kinds of options.

In trading options the risk is limited to the price of the option, that’s why there is no margin if you want to buy an option.

The option seller gets credit in his/her account for selling an option. Also, the seller will hold this amount if the option expires worthless. But, option seller has an obligation to buy or sell the underlying asset if their option is exercised by an assigned option holder.

That we learned from the cases mentioned above.

Obligation to buy is called put, and an obligation to sell is called the call option

That’s why selling an option requires a healthy margin.

The simplest way to use options is to buy or sell options and hold the same position to maturities of the option when the option is either executed or not without exercising rights from the option.

The option can be used independently (uncovered position) or in combination with the asset to which it relates (covered position).

It becomes much more complex when merger more the same or different options, whereby the basic terms of the option contract can be varied, which are: the size of the contract, the market price of the option (premium), the executive price and the maturities, to which the investor creates the most favorable position with regard to market movements.

Different combination options are called trading strategies with options.

The use of long and short positions in options and underlying assets is based on six basic strategies that can be subsequently combined in complex strategies, such as long position and short position in assets, long and short position in the call option and long and short position in the offer option.

Thanks to these six basic positions, the investor can apply these strategies: basic simple and covered strategies, complex strategies involving different types of ranges, combinations such as straddle, strangles, guts, and synthetic strategies or advanced delta neutral, proportionate trading and combining combinations, ranges, etc.

Which strategy the investor will apply accurately depends on its characteristics of risk, income, timing of payment (and bound with the value of the initial payment), the complexity suits the goals of trading, market position, expectations regarding market trends, risk and profit relationship and the skills of the investor, as well as the market availability of options.

SHORT REVIEW

Options, when bought, are done so at debit to the buyer.

Hence, options, when sold, are done so by giving a credit to the seller.

Options are available in several strike prices. They are expressing the price of the underlying instrument.

The cost of an option is called the option premium.

The price shows a mixture of parts including the current price of the underlying asset, the strike price of the option, the time waiting until expiration, and volatility.

Options are good for a particular period of time. After that, they expire and you lose the right to buy or sell the underlying asset at the defined price.

Options are not available on every stock.

There are approx 2,200 stocks with options able to be traded.

Each stock option is 100 shares of a company’s stock.

WHAT ARE THE TYPES OF OPTIONS?

The main types are call and put options.

Also, there is an important difference between European and American style options. These options, where the payoff is calculated in a similar way, are known as “vanilla options”.

Options, where the payoff is calculated in a different way, are classified as “exotic options”. Exotic options can offer challenging puzzles in valuation and hedging.

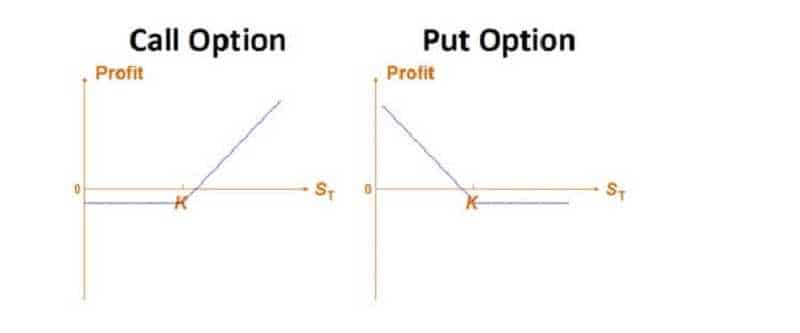

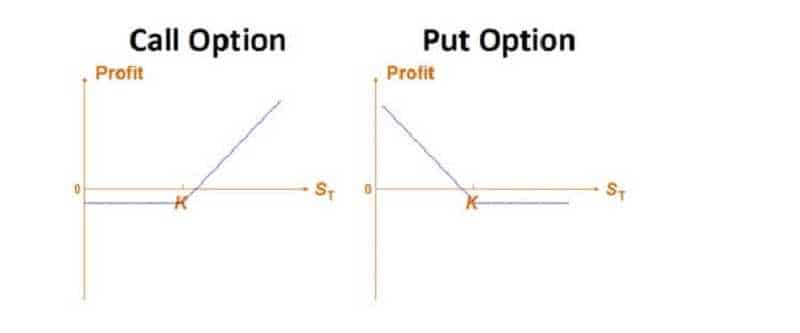

First: the difference between call and put:

A Call Option gives the buyer the right, but not the obligation to buy the underlying security at the exercise price, at or within a specified time.

A Put Option gives the buyer the right, but not the obligation to sell the underlying security at the exercise price, at or within a specified time.

These are definitions. But what does this exactly mean?

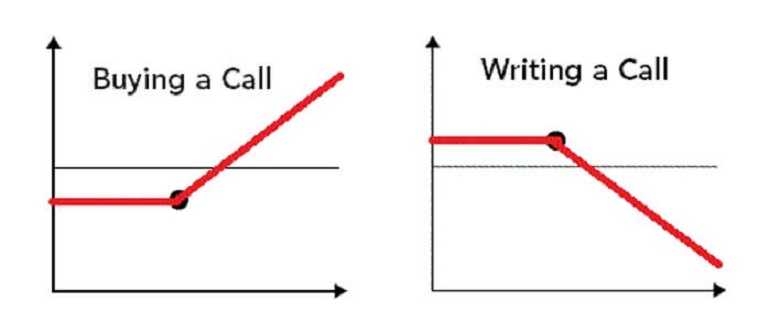

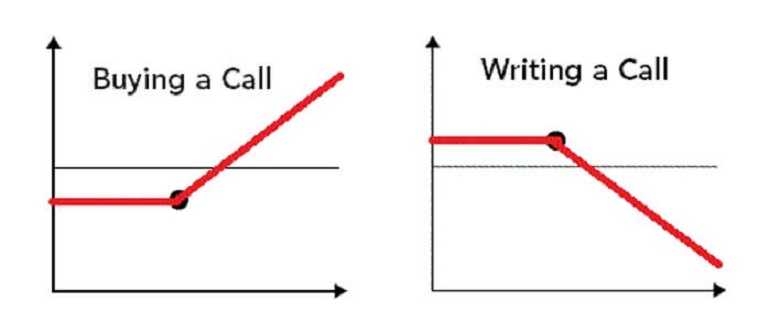

Investors purchase calls when they think the share price of the underlying asset will rise. Hence, they sell a call if they think the price will drop.

Call options give to trader the right (but not the obligation) to buy an underlying security at a specified price (called strike price), for a certain period of time.

If the stock doesn’t meet the strike price before the expiration date, that option expires and becomes worthless.

Selling an option is also called as ”writing” an option.

What is CALL OPTION?

A call option is an option contract in which the buyer has the right (but not the obligation) to purchase a specified amount of a security at a specified price (strike price) within a determined period of time (until its expiration).

The seller is also called a writer.

For the writer of a call option, it expresses an obligation to sell the underlying asset at the strike price if the option is exercised.

The call option writer takes a premium for taking on the risk connected with the obligation.

This sounds like repeating well-known things. But, trust me. It is very important to understand the differences, obligations, and rights of each participant in the options market.

For stock options, each contract covers 100 shares.

Let’s see how options work in case you would like to buy a stock option.

A call option gives the holder the right, but not the obligation, to purchase 100 shares of a particular underlying stock at a specified strike price on the option’s expiration date.

The stock, bond, or commodity is known as the underlying asset.

For example, a single call option contract may give you the right to buy 100 shares of some stock or bond at $100 until the expiration date. The expiration date is within 2 months.

There are many expiration dates and strike prices for you to choose within this time frame.

Say that the price of the stock rise. What will happen with the price of its option? It will rise too. They are growing together. And vice versa.

What rights you as the buyer has?

You may hold the contract until the expiration date. At that point, you can take delivery of the 100 shares of stock. But you also have the right to sell the options contract at any moment before the expiration date. And you can do that at the market price of the contract at that time.

The market price of the call option is called the premium.

It is the price you have to pay for the rights that the call option provides.

Let’s say, at the expiry date your asset is less valued than the strike price. You as a call buyer will lose the premium.

This is called the maximum loss.

But If the price of the asset is bigger than the strike price at the expiry date? Well, your profit will be the current stock price, reduced by the strike price and the premium. This amount multiplies with how many shares you control.

To be more clear let’s go back to our makebelieve company, the “Plum Ltd Inc Gmbh”.

For example, it is trading at $220 at expiry, and the strike price is $200. The options cost the buyer $4. What is profit?

$220 – ($200 +$4) = $16

The other situation. The buyer purchased one contract at $1600. You already know that 1 contract is equal to 100 shares, so we have:

$16 x 100 shares

Or at $3,200 the buyer purchased two contracts

$16 x 200 shares

If it expiry below $200, then the option owner loses $400 ($4 x 100 shares) for each contract the trader bought.

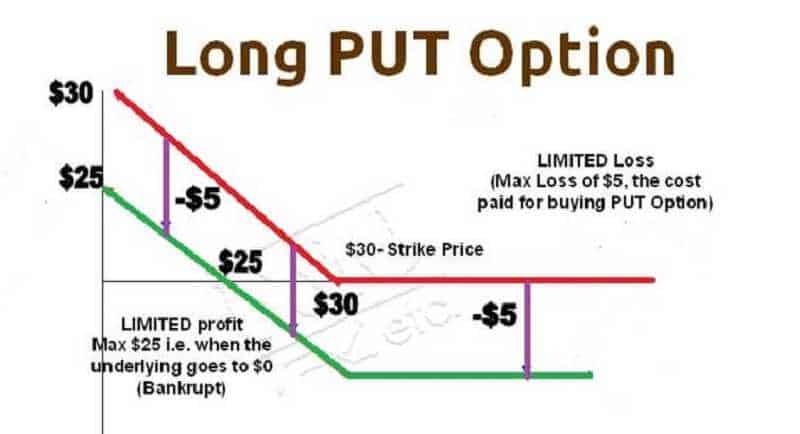

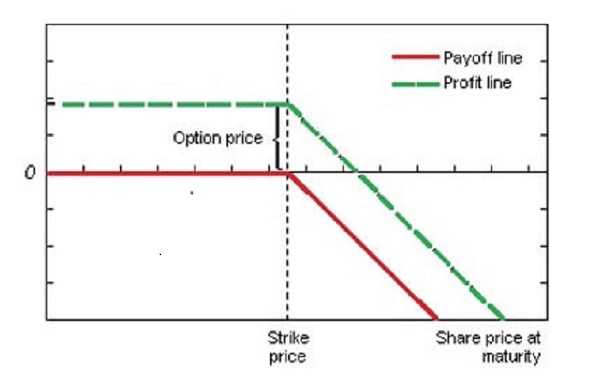

What is PUT OPTION?

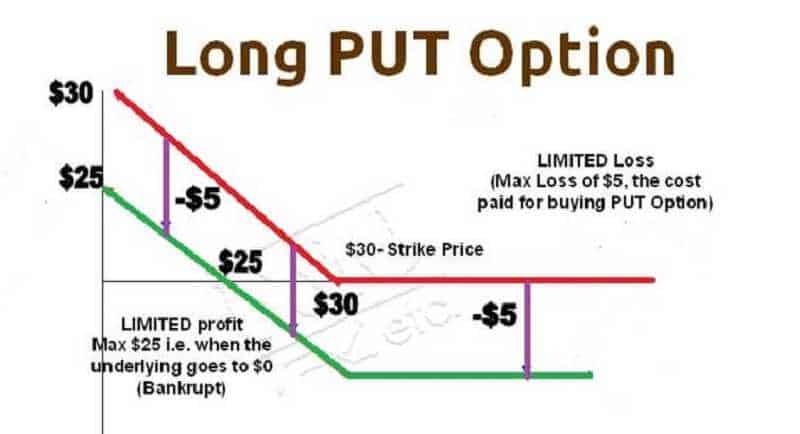

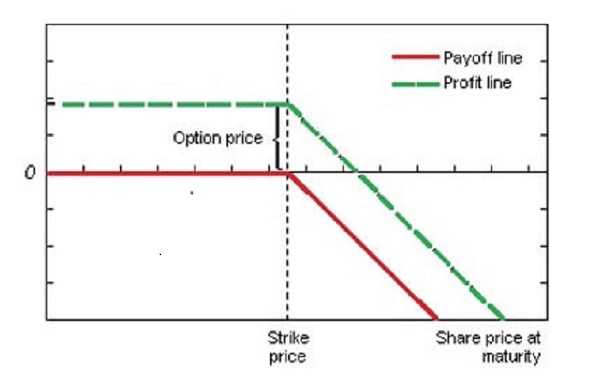

A put is an option contract giving the buyer the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified time.

The owner of a put option believes the underlying asset will drop below the exercise price before the expiration date. The exercise price is the price the underlying asset must reach for the put option contract to hold value.

Each option contract includes 100 shares.

Let’s observe the investor who purchases one put option contract on “Plum Ltd Inc Gmbh” for $200.

The exercise price of the shares is $20, and the current “Plum Ltd Inc Gmbh” share price is $24. This put option contract has given the investor the right, but not the obligation, to sell 100 shares of “Plum Ltd Inc Gmbh” at $20.

If our “Plum Ltd Inc Gmbh” shares drop to $16, we can say the investor’s put option is in the money. The owner can close the option position by selling the contract on the open market.

On the other hand, the owner can purchase 100 shares of “Plum Ltd Inc Gmbh” at the existing market price of $16, and then exercise the contract to sell the shares for $20.

Ignore commissions. The profit for this position is $400, or

100x($20 – $16)

Keep in mind that the buyer of the options paid $200 premium for the put, giving the right to sell shares at the exercise price.

And trader’s total profit is $400 – $200 = $200.

SUMMARY:

A call option gives the holder the right, but not the obligation, to buy a stock at a certain price in the future. (Again? Yes!)

When investors buy a call, they expect the value of the underlying asset to go up.

A put is an opposite.

When investors purchase a put, they expect the underlying asset to decline in price.

The investors then profit by selling the put option at a profit or exercising the option.

Some investors can also write a put option for another investor to buy.

If investors write a put contract, they don’t expect the stock’s price to drop below the exercise price.

HOW TO BUY OPTIONS

Buying and selling stock options isn’t just new territory for many investors, it’s a whole new language, new world.

Regardless, there are historical findings that confirm their use during the Antiquity period as we said before.

You might suppose these options markets are another superfine financial instrument that Wall Street gurus created for their own dishonest purposes, but you would be wrong.

Actually, options contracts did not originate on Wall Street at all.

These instruments exist for thousands of years – long before they began officially trading in 1973 under the name of Chicago Board of Options.

Since you have a better understanding of what options are (calls and puts) let’s look at how to buy a call option in a more detailed explanation.

At first, to buy a call you must recognize the stock you think is going up and find the stock’s ticker image.

image source: screenshot from Yahoo finance

image source: screenshot from Yahoo finance

When you get a quote on stock on most sites you may click on a link for that stock options chain which lists every actively traded call and put option that exists for that stock.

Let’s go step by step:

1) Identify the stock that you think is going to go up in price

2) Review stock Option Chain

3) Select the Expiration Month

4) Select the Strike Price

5) Determine if the market price of the call option seems reasonable

You must realize that not all stocks have options that trade on them. Only the most popular stocks have options.

You cannot always buy a call with the strike price that you want for an option.

Strike prices are generally at intervals of $5 e.g. $30, $35, $40. From time to time, you can find $34,5 or $32,5 available for popular stocks.

You will not always be able to find the expiration month you want on the option for which you wish to buy a call. The most you will have, you will notice the expiration dates for the nearest two months.

Then every 3 months following.

Surprisingly, if you find the option that you wish to buy a call on, you still have to be sure it has enough volume trading on it.

Why? The answer is obvious, to provide liquidity. To give you the opportunity to sell it if you choose to.

The most options are infrequently traded and therefore have a higher bid/ask spread.

To buy a call you have to understand what the option prices mean and you have to find one that is reasonably priced.

If trading is at $22,5 a share in September and you are looking to buy a call of the November $32 call option, the call option price is regulated like a stock, fully on a supply and demand basis.

If the price of the call option is $0.5 then not many people are expecting to rise above $60, and if the price of that call option is $4,000 then you know that a lot of people are expecting that option to rise above $60.

The most important things to understand when you want to buy a call is that option prices are the function of the price of the underlying stock, the price, period left to expiration and volatility of stock itself.

The volatility and the expected volatility of the stock are keeping traders in different opinions and hence drives prices.

Many genuine investors and traders wake up in the morning and sneak a peek at the stock futures to anticipate where the market will open in comparing to the previous day’s close.

The main characteristics of call options

- The security on which to buy call options.

Suppose you think “Plum Ltd Inc Gmbh” stock is going to rise over a specific period of time. You can consider buying “Plum Ltd Inc Gmbh” call options.

-

The number of options contracts to buy.

Each options contract consists of 100 shares of the underlying stock. Buying 2 call options contracts, for example, grants the owner the right, but not the obligation (Again!!!), to buy 200 shares (2 x 100 = 200).

The price at which the owner of options can purchase the underlying asset when the option is exercised. For example, “Plum Ltd Inc Gmbh” 100 call options allow the owner the right to buy the stock at $60, regardless of what the current market price is. In this case, $60 is the strike price. It is known as the exercise price too.

-

The trade amount that can be supported.

Means the maximum amount of money you want to use to buy call options.

Options do not last forever. They have an expiration date.

If the stock closes below the strike price and a call option has not been exercised by the expiration date, it expires worthless. So the trader has no longer the right to buy the underlying asset.

Hence, the trader loses the premium paid for the option.

Most stocks have options contracts that last up to nine months.

Traditional options contracts typically expire on the third Friday of each month.

-

The price to pay for the options.

When you buy the stock for the stock price, you buy options for what’s known as the premium. Premium is the price to buy options. In 100 “Plum Ltd Inc Gmbh” call options example, the premium might be $6 per contract.

It means the total cost of buying one “Plum Ltd Inc Gmbh” 100 call option contract would be $600

$6 premium per contract x 100 shares that the options control x 1 contract = $600

If the premium were $8 per contract, instead of $6, the total cost of buying 2 contracts would be $1,600

$8 per contract x 100 shares that the options control x 2 total contracts = $1,600

Options prices are constantly changing, like stocks. So, you may choose the type of trading order with which to purchase some options contract.

There are several types of orders, including market, limit, stop-loss, stop-limit, trailing-stop-loss, and trailing-stop-limit.

HOW TO SELL & WRITE OPTIONS

When we are talking about writing a put or call option we are speaking about an investment contract in which a charge is paid for the right to buy or sell shares at a future. Put and call options for stocks are sold in lots consists of 100 shares.

A little review of history. The beginnings of writing an option go back to ancient times. Don’t think it is something new.

Aristotle, the Greek philosopher, wrote about a maybe first example of options trading in his ”Politics”. Thales of Miletus, the philosopher and mathematician examined astronomy to be able to foretell olive harvests for his area.

The tale is coming. Thales concluded there would be a generous olive harvest, but he didn’t have the money to buy his own olive presses.

So, instead, he paid a fee for the right to use the olive presses of other owners.

Do you see? This was the first options contract.

So, writing a call option means that you are selling a call option. If you sell a call (also known as a “short call”) then you are obliged to sell stock at the strike price.

Typically, a call is sold against long stock.

When you buy some option $400 call option that you have the right to buy 100 shares of some company at $400, and maybe you asked yourself the question “who exactly am I buying it from?”

To have the right to buy the stock at the strike price, somebody has had to take the other side of that transaction and agreed to give you the right to buy it.

The ones that take the opposite side of the call option buyer are the “call option sellers.”

And sometimes they are known as “call option writers”.

When you BUY call options, you bought it from someone.

That means that someone is giving you the rights to buy the underlying stock at the strike price by selling you that option.

The CREATING and SELLING that call options contract is the WRITING a call option.

In execution, this means opening a call options position using the SELL TO OPEN order.

When you do that, you create a new call options contract for trading in the options market and that is known as “Write” a call options contract because you are exactly “writing it up”.

Selling options, whether Calls or Puts, is a popular trading technique to increase the returns on the portfolio.

Selling premium can prove successful when performed on a selective basis. But, if you don’t follow some specific guidelines, your long-term prospect of profitability is doubtful.

Selling options for Income can be debatable because you don’t know are you making money with your options trading. When you take a look in your overall portfolio it can be difficult to measure each transaction success.

But in this environment is yield-seeking, and selling options is a strategy designed to generate current income. Selling options, whether Calls or Puts, is a popular trading technique to increase the returns on the portfolio.

Selling Premium can prove successful when performed on a selective basis. But, if you don’t follow some specific guidelines, your long-term prospect of profitability is doubtful.

Selling options for Income can be debatable.

Because you don’t know are you making money with your options trading. When you take a look in your overall portfolio it can be difficult to measure each transaction success.

But in this environment is yield-seeking, and selling options is a strategy designed to generate current income.

Selling options is a bit more complex than buying options and can involve extra risk. If sold options expire worthlessly, the seller gets to keep the money received for selling them.

Let us be clear with more details.

There are two types of call option selling.

Say, you purchased a call option and the price has grown. What to do? You can sell the call. This kind of trade is described as a “sell to close”.

Why?

Because you are selling a position that you presently hold.

What will happen if you don’t currently hold the call option? You may create a new option contract. So, you’ll be able to sell the right to buy the stock. This is named as “writing an option”, “sell to open”, or occasionally just “selling an option.”

Writing or selling a call option

That is the situation in which you give the buyer of the call option the right to buy a stock from you at a specific price by a specified date.

Simpler, the seller (or the writer as you already know) of the call option can be compelled to sell a stock at the strike price.

The seller of the call will take the premium that the buyer of the call option pays.

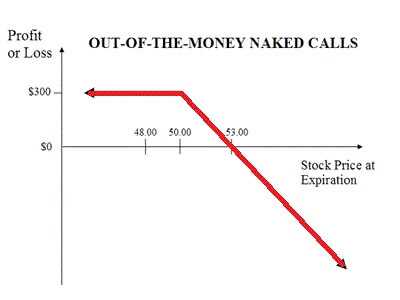

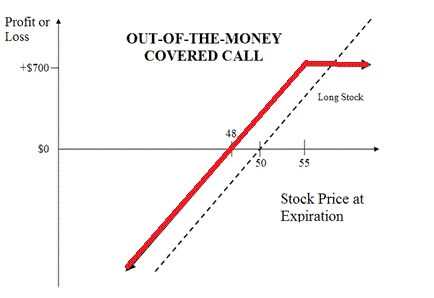

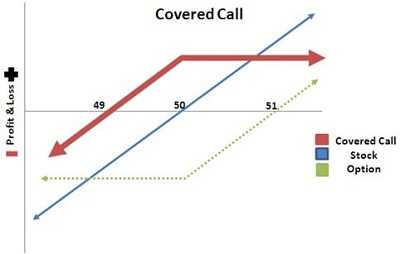

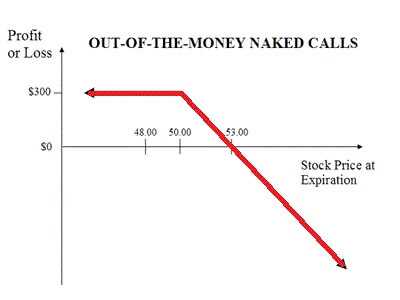

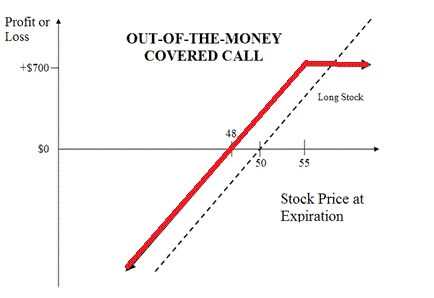

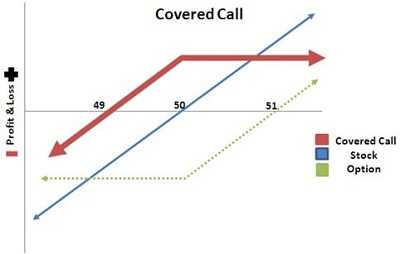

If the seller of the call owns the underlying stock, then it is described as “writing a covered call.”

But, if the seller of the call doesn’t own the underlying stock, then it is named “writing a naked call.”

Let’s make this more realistic.

You own 100 shares of “Plum Ltd Inc Gmbh” (one day I’ll start the company under this name) stock that you purchased a few years ago at $200. The stock price is at $700 now.

You may believe that the price of “Plum Ltd Inc Gmbh” will stay the same or drop soon. But you want to hold this stock for a long time. Some other guy thinks “Plum Ltd Inc Gmbh” will go up for $30 over the next month.

Say, you get a quote on $710 call on “Plum Ltd Inc Gmbh” and notice the price at bid $6.00 and ask $6.10. And you place the order to sell at $710. The other guy also places an order to buy the “Plum Ltd Inc Gmbh” option contract at $710, because he believes that it will close above that figure. Your order instantly gets filled at $6.00.

What is next?

You will get $600 for selling the call option. The other guy gets filled at $6.10 and pays $610 for the “Plum Ltd Inc Gmbh” $710 call. Because the options are always consisting of 100 stocks, though the price of buy/sell is expressed with the price of a single stock. Then the intermediary between you two withholds the $10 spread.

When the trade was made, you were hoping that the stock stays below $710 and the other guy that it will go above. If the Plum’s stock closes at or under $710, then the call option expires as worthless. So, you will profit $600 for selling the option. The other guy will lose $610 he paid for the option, as it is logical to presume that he will not exercise the option to buy stocks at price above the market value. If Plum closes at $720, for example, then the other guy (I should give him the name) would exercise the call option. When he goes and buy the 100 shares of Plum from you for $710 per share. You have now received $600 for writing the call option. But also you have lost $1000, as you were obliged to sell a stock that was valued at $720 for $710. The other guy would be very pleased with himself for spending those $610. Because now he can sell at $720 shares he purchased at $710. This will give him a tidy net profit of $390.

A covered call enables you to own a stock with unlimited downside risk and collect a premium for the call you sold.

When you are selling a covered call you are selling a synthetic put.

Say you are not satisfied by selling naked puts, then you cannot be satisfied by selling a covered call.

It is precisely the same as selling a put.

If you are satisfied with the covered call, then there are many circumstances to examine when opening any options position.

Now, it is convenient to look at what factors can make a trade more likely to be profitable than another.

The first is liquidity or the percentage of the difference between the bid and ask. Check the percentage you are giving to the market-makers or algorithm. It should not be high. The high percentage can make your entering as very expensive.

You should look to trade an options contract that has a bid/ask spread of less than 1.5%. If you give more away to the bid/ask spread, not only entering but exiting the transaction, you can be sure you will make less money.

Well, this may prove difficult at times, but it isn’t easy to make money.

Besides this, for all trade, you must evaluate the cost of commissions. Yes, the costs make profitable trading much more difficult. But they must be added to your review.

You should consider the relative strength index of the underlying assets. Some extreme conditions can provide more interesting trading opportunities.

A seller has the obligation to buy or sell an underlying asset at a defined strike price if the buyer decides to exercise the option.

There must be a seller for every option buyer.

There are several resolutions that must be made before selling options:

1) What security to sell options on

2) The type of option (call or put)

3) The type of order (market, limit, stop-loss, stop-limit, trailing-stop-loss, or trailing-stop-limit)

4) Trade amount that can be supported

5) The number of options to sell

6) The expiration month

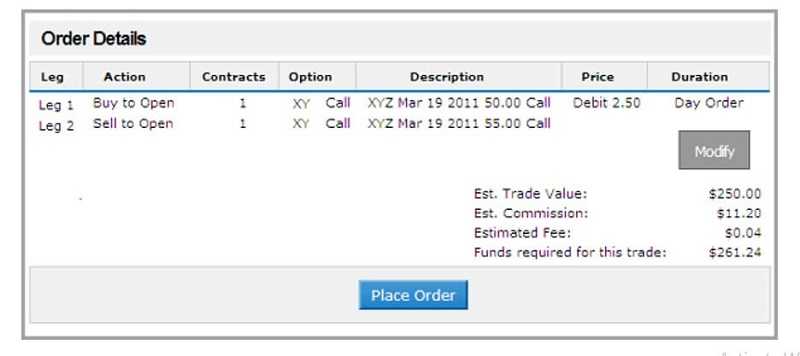

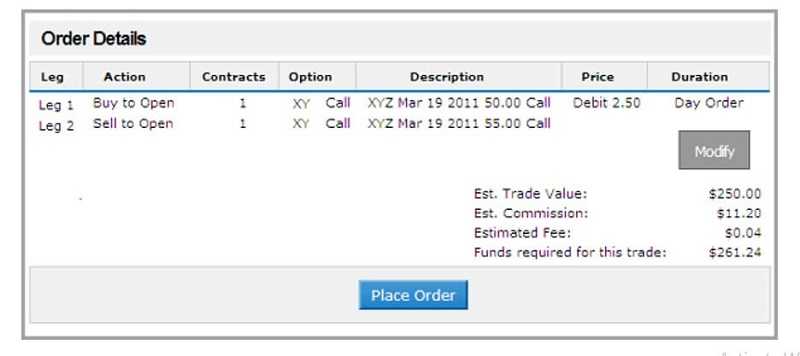

When all this information is collected, a trader goes into the brokerage account, select security and go to an options chain.

Once an option has been selected, the trader goes to the options trade ticket and enter a sell to open order to sell options and makes the appropriate selections (the type of option, order type, number of options, and expiration month) to place the order.

Here are the key characteristics you should remember about buying and selling call options.

Buy a call option only when you are confident about the underlying asset.

In expiry, the call option is profitable only if the underlying jumped above the strike price.

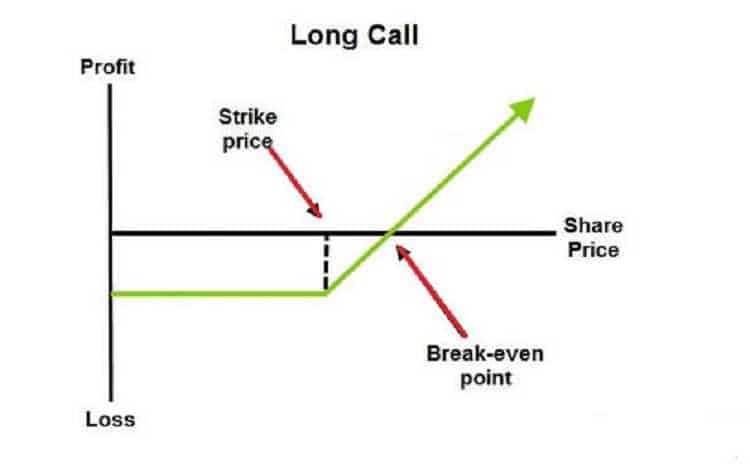

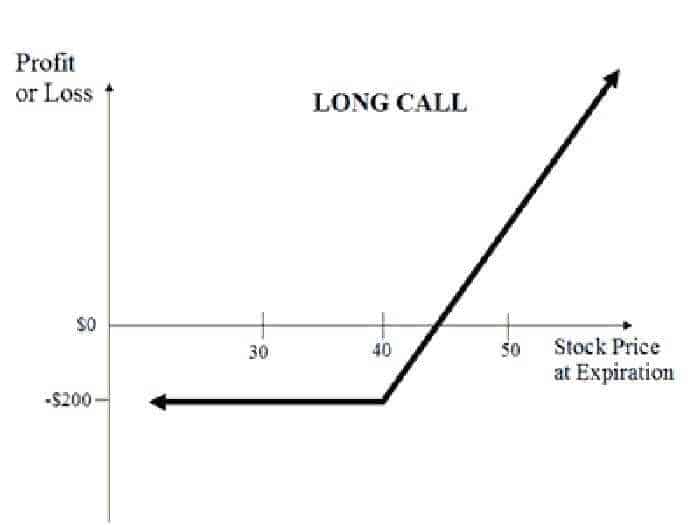

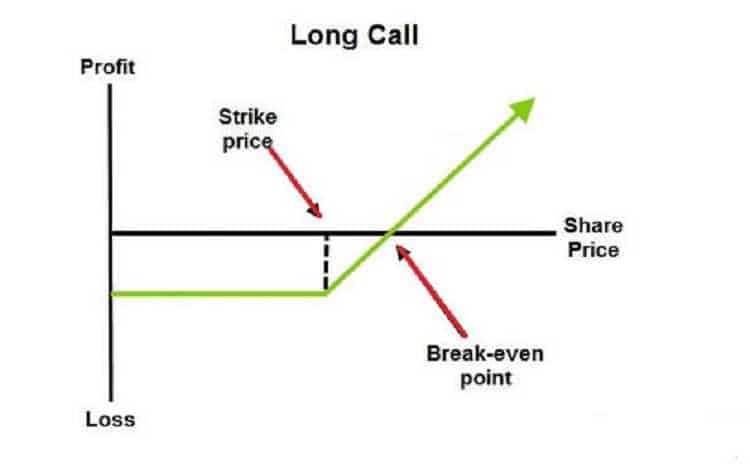

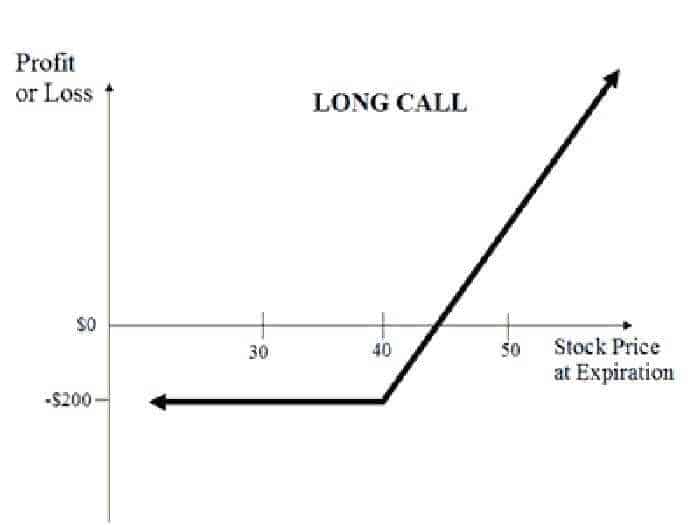

Buying a call option is frequently named as ‘Long on a Call Option’ or just ‘Long Call’. If you want to buy a call option you have to pay a premium to the writer of that option.

The call option buyer has limited risk and the potential to make a large profit.

The breakeven point is the point at which the buyer of the call option doesn’t make money but doesn’t have a loss too.

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

Breakeven point = Strike Price + Premium Paid

When you sell a call, you have the obligation to sell stock at the strike price. Usually, a call is traded against long stock.

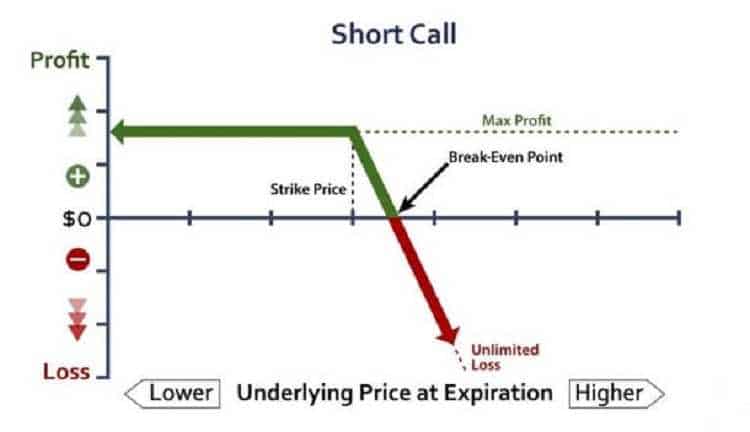

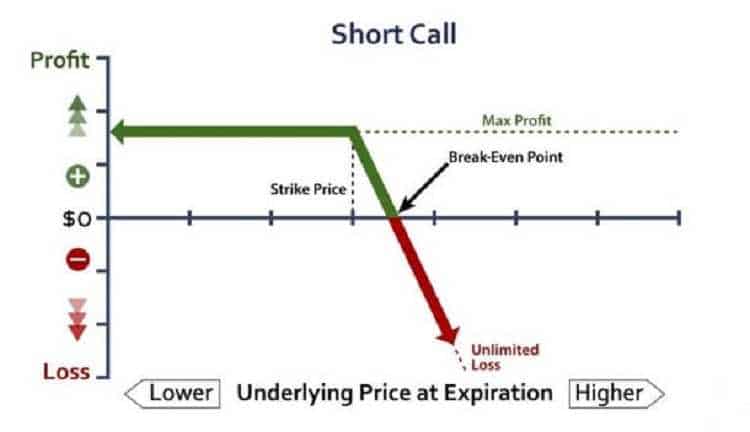

This is so-called ‘shorting a call option’ or just ‘short call’.

Selling call options against stocks you hold leads straight to the money. How?

Risk is decreased by the value of the premium you receive. The money you receive can be reinvested in more stocks carrying the covered write, or anything else that looks good.

P&L = Premium – Max [0, (Spot Price – Strike Price)]

Breakdown point = Strike Price + Premium Received

So when you should sell call options?

As we know, income is the goal. Right?

So, you should find what changes the worth of call options and premium sums. The intrinsic value of a call option is priced by the amount of in-the-money value. The quantity of variation in option premium comes from the time value of the option. It is obvious that the biggest variation comes from volatility. But also the call premiums are larger when volatility is high. Low volatility isn’t a good period for selling a call option.

So, you should write call only when the volatility is high to gain more income.

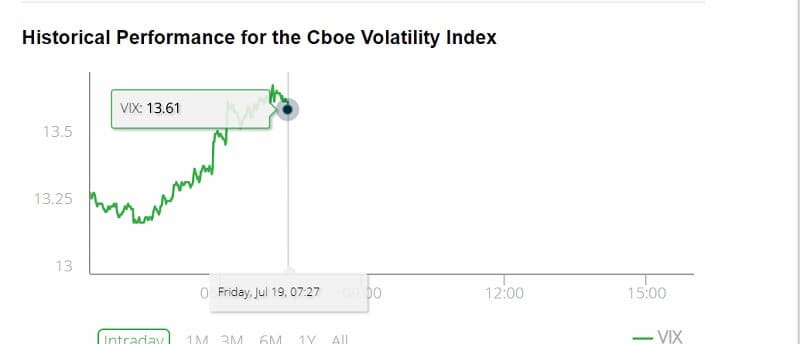

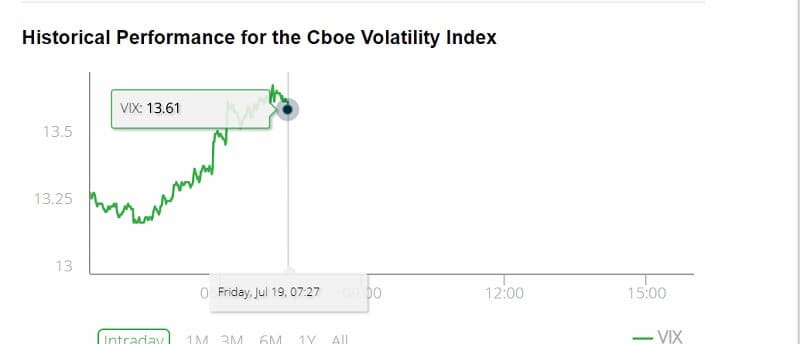

Let’s go further. How to determine market volatility or Volatility index or VIX?

I have to tell you that the VIX is often called the “fear index.” And you will see why is that. My goal here is to encourage you to be familiar with the idea of VIX.

VIX is a measure of expected price fluctuations options over the next 30 days.

In periods when the price of options is high, investors are afraid, they are frightened. High VIX means that an option is above its intrinsic value and such option will cost investors more. But for sellers this situation is fantastic. As I said, when volatility is high, the call premiums are larger.

Chicago Board Options Exchange (CBOE) created the VIX.

Let’s say you are a layman and know nothing about the VIX or how to calculate it.

You can call CBOE for help. But this is simpler. You can find on the official CBOE website the formula on how to calculate the VIX or just find their charts and see the VIX for certain date.

Image source CBOE

As you can se the VIX is 13,60. (Updated: 19/07/2019)

When you find the VIX is above 30, you can be sure that option premiums are high

You have to know something. The options on the VIX are not as simple as regular equity options. Okay, the equity options are complex instruments but this kind of trading options is very exciting. Moreover, this can provide you a really huge return.

So, let’s go step by step.

First of all, the VIX doesn’t have tradable shares but has tradable options. Instead, VIX options are valued to the volatility future with the same payment date.

Options on the VIX are some of the most frequently traded contracts in the options market. Last year, VIX options traded 167 million contracts. Just calculate the average daily volume. It was around 666,000 contracts.

One of the characteristics of options on the VIX is that they are not priced to the VIX Index. Why is this?

You can’t trade the VIX Index directly.

The point is that you will take more premiums when the VIX is over 30. Hence, the less if the VIX is near to 10 or under. Any point between these two provides you higher option premiums.

I don’t want to say you shouldn’t sell call options at a time when the VIX is low. But I want to say that your income will be lower if the VIX is low.

So, when to sell calls?

After a spike in the VIX.

After the spike, the shares will drop and create a cheaper entry price. The new price will gradually grow in the next months. The two things creating this. The first is that the rise in the VIX will lower the price. But premiums will be higher and that will cause lag behind.

Because you will not receive the income until the new trades are completed. That will give you time to enter the trade before the higher income is achieved.

If you want to calculate the VIX you will be faced with a very complicated formula. It is easier to check with CBOE.

But let’s say, when the market is under high turbulence, the VIX has tendentious to rise. If you check the historical charts you can notice that the VIX was high at the end of the 1990s. The next peak was in 2008 when the crisis appeared. Investors could see higher VIX in late 2018. And we all know that these weren’t pleasant times. That’s why it is called “fear index”

To summarize.

When you are bullish on a stock you can buy the stock in the position, buy its futures, or buy a call option.

When you are bearish on a stock you can sell the stock in the position, short futures, or short a call option.

The calculation of the intrinsic value for a call option is the same for everyone in the market. It will not adjust based on you or your wishes. This calculation of the intrinsic value is the same no matter if you are an option buyer or seller.

You should sell a call option when you are bearish on a stock.

When you sell a call option you have to deposit a margin.

If you sell a call option your gain is limited to the amount of the premium you receive but your loss can possibly be unlimited.

Nothing more, nothing less.

HOW TO CHOOSE THE RIGHT OPTION TRADING STRATEGY

Option trading strategies have elegant names like “bear spreads”, “condors” and “butterflies”. But option strategies have complex mathematical relationships driving by their value.

The jargon and mathematics of options trading all too often scare the average investors and keep them away from examining the power of options.

Even if you are not intending to invest using options in the near future this article will be of interest to you as you get a brief look at the fascinating potential of options.

The most difficult part of planning each individual trade, probably, is choosing which strategy to use. This is particularly true if you are new to trading options, or if you don’t have the knowledge of the different strategies that can be used.

Even experienced traders can sometimes struggle to decide what the best strategy to use is.

It’s fair to say that the more options trading experience you gain, the easier that decisions become.

We have to say, there’s actually no such thing as the right strategy.

There are many factors to take into view because a strategy that might be suitable in one situation could be totally inappropriate for a different set of financial position.

A lot depends on the individual because what is right for one trader might not be right for another. We would never claim that we are able to tell you exactly which strategy you should be used for any situation.

But we can tell you how you can make that decision yourself.

In this article ”Trading Options’‘, we’ll show you a number of the considerations you need to be taking into account.

If you are new to trading options, then we suggest you to spend some time working out the best strategy to use each and every time you enter a new position.

As you become more experienced, you will have a better idea about how each strategy works and the process of making a decision should become less complicated for you.

What is Your Outlook?

Options traders have four potential outlooks to consider:

- The bullish, such trader is expecting the price to rise;

- The bearish, trader who is expecting the price to fall;

- The neutral, trader who is expecting the price not to move, or at least remain relatively stable and volatile, who is expecting significant swings in price.

If you are more exact in your outlook, it’s much easier to choose a suitable strategy.

For example, if you expected underlying security to grow notably in the price you will not use a strategy that returned a profit on a small price hike and didn’t keep making profits after the price proceeded to rise.

There are strategies, however, that are especially suitable for individual outlooks.

Options trading strategies come with different levels of complexity. You can find some very simple. Some of them involve one or two transactions. But, also, there are some that are more complicated. They could require three or more transactions.

The complexity of a strategy is unquestionably something that you need to study when deciding which one to use.

The more transactions you employ, the more you will pay to your broker as commission. This can have an impact on your potential returns, particularly if you are trading on a small budget.

Complexity of Strategy

Using more complicated strategies can also make it harder to work out what the potential profits and losses of trade are, and what price movements will be best for you.

Deciding about the ideal entry and exit points of a position is a key part of planning a trade. This is generally a lot easier to do when you are using simpler strategies.

The more complicated ones also give you some excitement. Should you carry out all the needed transactions simultaneously, or it is better to place each order separately?

What a challenge!

Online brokers add functionality that enables you to simply select your strategy. The orders that it requires will automatically be done at the same time.

Options trading is complex but exciting.

Options Trading Strategies

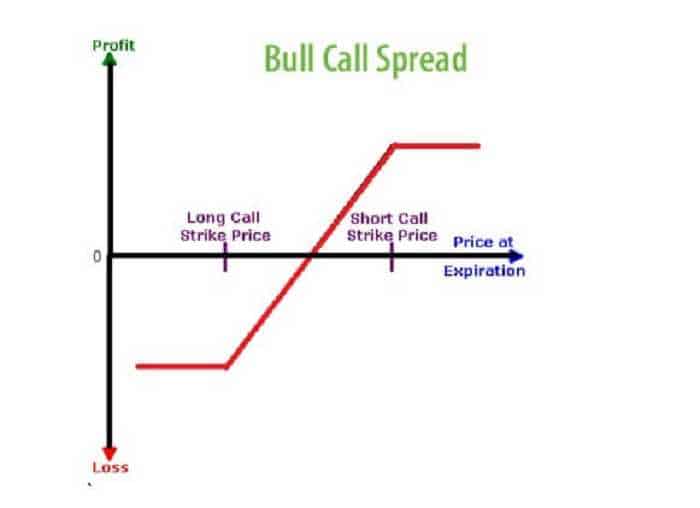

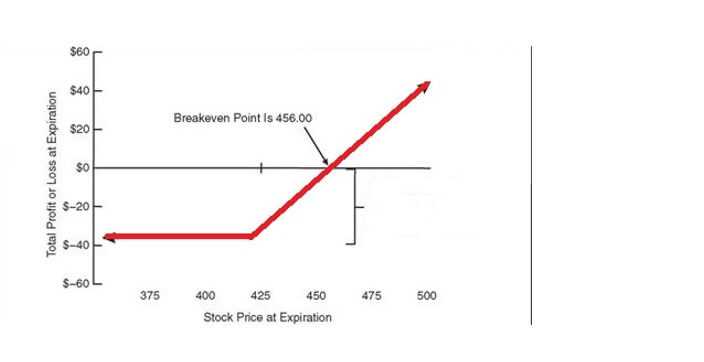

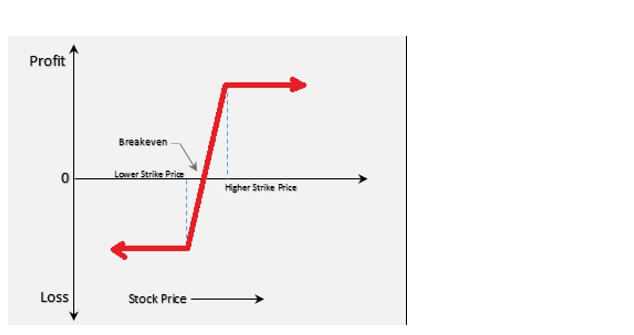

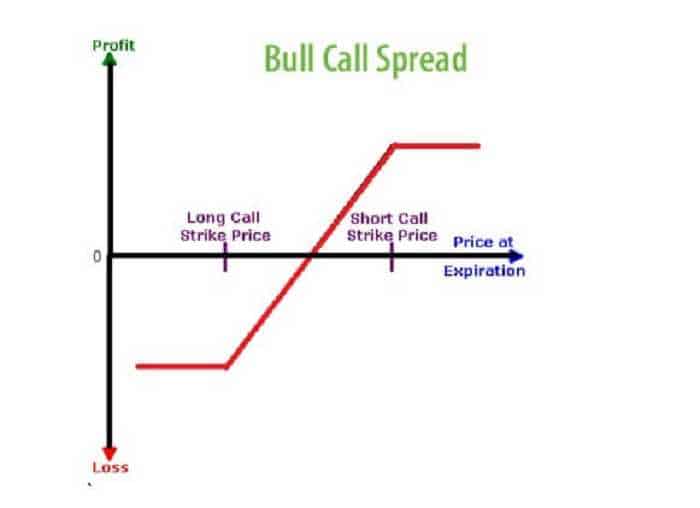

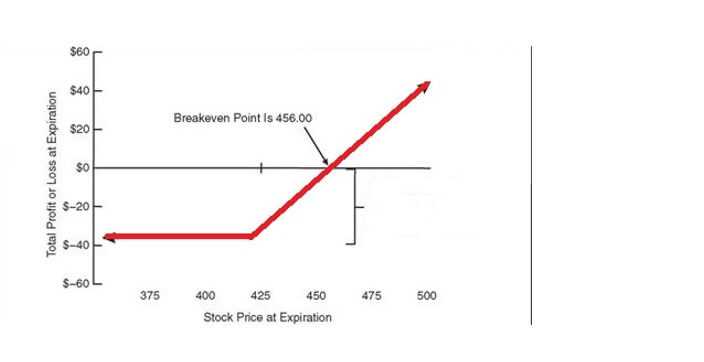

1) Bull Call Spread

This is one of the most often used options trading strategies there is. It’s relatively simple, demand just two transactions to execute, and perfectly suitable for novices.

It’s used when the outlook is bullish, and the expectation is that an asset will increase a fair amount in price. You use the buy to open order to buy at the money calls based on the relevant underlying security, and then write an equal number of out of the money calls using the sell to open order. This results in a debit spread, as you spend more than you receive.

The basic idea of writing the calls in addition to buying them is to reduce the overall costs of the position. The decision you have to make is what strike price to use for the out of the money contracts you need to write.

The higher the strike price, the more potential profits you can make but the less money you receive to balance the costs of buying at the money calls.

You have to write the contracts with a strike price equal to where you expect the price of the underlying security to move to.

`

For instance, if you are expecting the underlying security to move from $100 to $110, then you have to write contracts with a strike price of $110. If you feel the underlying security will increase by $3, then you write them with a strike price of $103.

The advantage of using the Bull Call Spread strategy is

You have the chance to make a bigger return on your investment. This is a simple strategy, which appeals to many traders, and you know exactly how much you stand to lose at the point of putting the spread on.

The disadvantages of this strategy

They are limited, maybe that’s why it’s such a popular strategy. There are more commissions to pay than if you were simply buying calls, your profits are limited and if the price of the underlying security rises beyond the strike price of the short call options you won’t make further gains.

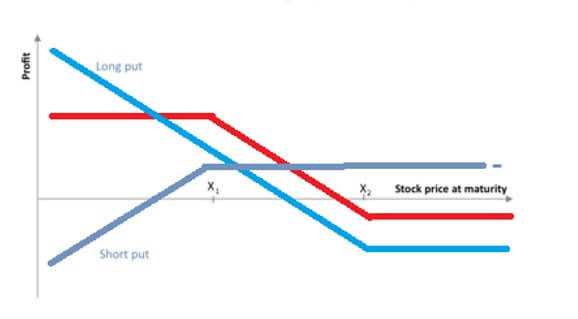

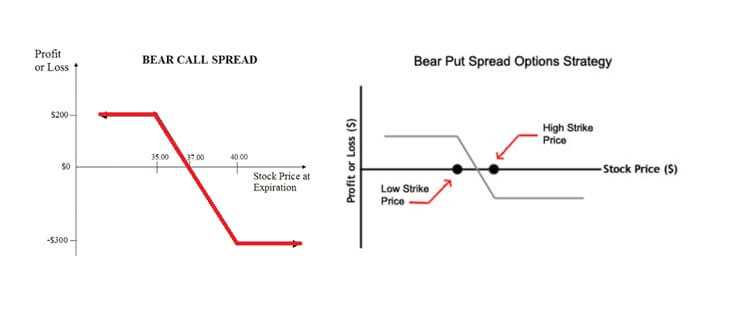

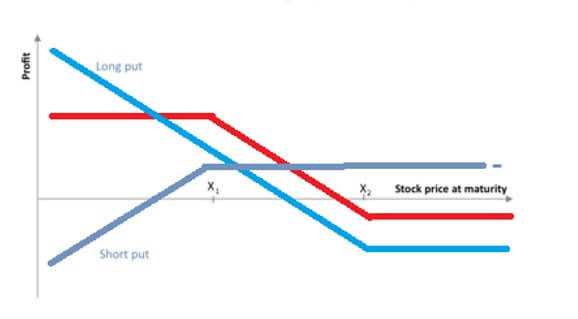

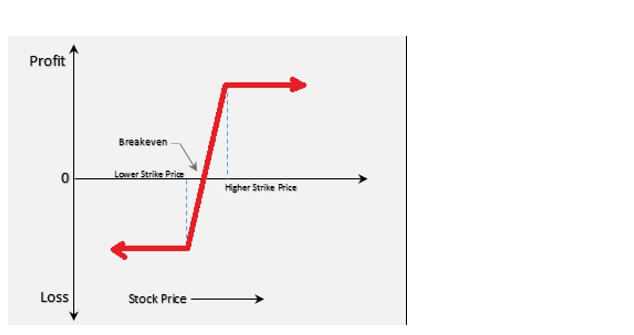

2) Bearish Trading Strategies

When you expect underlying security to fall in price, you will want to be using suitable trading strategies – bearish.

New-come traders believe that the best way to generate profits from underlying security falling in price is simply to buy puts, but unfortunately, this isn’t necessarily the case. Buying puts isn’t a brilliant idea if you are expecting a small price reduction in a financial instrument. And you have no protection if the price of that financial instrument doesn’t move or goes up instead.

There are other strategies that you can use to overcome that kind of problems, and many of them offer other advantages.

Purchasing puts is indeed a bearish options trading itself.

And sometimes the right thing to do is to simply buy puts based on an underlying security that you expect to fall in price.

But, this approach is limited in a number of ways.

A single holding of puts could expire worthless if the underlying security doesn’t move at price. That means that the money you spent will be lost and you will make no return.

The negative effect of time decay on holding options contracts means that you’ll need the underlying security to move a certain amount just to break, and even further if you are to generate a profit.

You have to be aware of how some of the downsides can be avoided through the use of alternative strategies.

If you want to take a position on underlying security going down in price but didn’t want to risk too much capital, you could buy puts and also write puts (at a lower strike) to reduce the upfront cost.

Also, this will help you offset some of the risks of time decay. Or you can write calls.

You can even use strategies that return you an initial upfront payment (credit spreads) instead of the debit spreads that have an upfront cost.

Disadvantages of this strategy are limited profit potential, which means that to get an extra benefit (such as limited risk) you have to make a sacrifice (such as limited profit).

Also, you will have to pay more in commissions.

A number of different strategies to choose from are a disadvantage in itself because it takes extra time and effort to decide which is the best one for any particular situation.

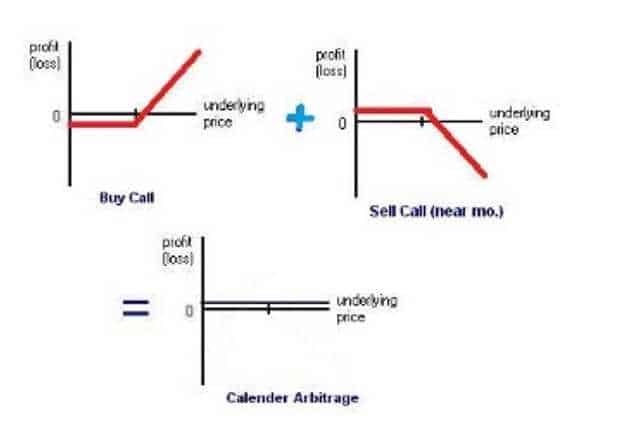

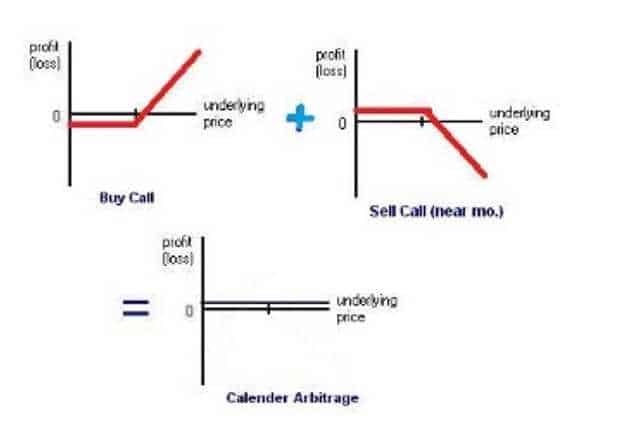

3) Arbitrage Strategies

This strategy defines circumstances were price inequalities means that an asset is effectively underpriced in one market and trading at a market price in another.

Arbitrage exists if it’s possible to simultaneously buy an asset and then sell it immediately for a profit.

Such scenarios are popular because they provide the potential for making profits without taking any risk.

But these scenarios are a bit rare.

They are marked by professionals at the big financial institutions.

They come occasionally in the options market though, primarily when an option is mispriced or when accurate put-call parity is not maintained.

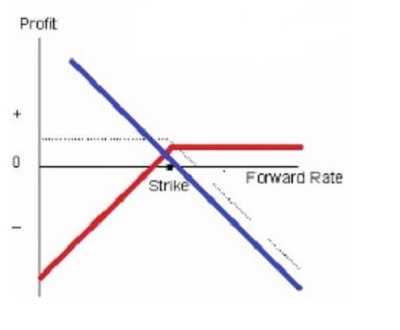

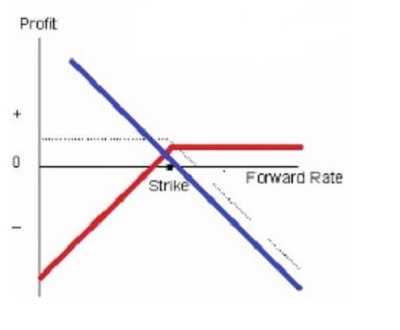

4) Synthetic Trading Strategies

Combination of options and stock to emulate other trading strategies are said to be synthetic.

They are used to adjust an existing strategy when the outlook changes without having to make too many additional transactions.

Synthetic trading strategies are essentially an extension of synthetic positions.

A synthetic position is a position that recreates the characteristics of another trading position by using different financial instruments such as an options position that has the same characteristics as holding stock.

The three most commonly used are the synthetic straddle, the synthetic short straddle, and the synthetic covered call.

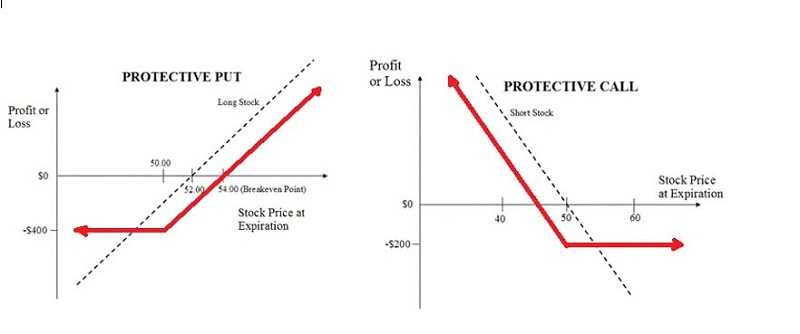

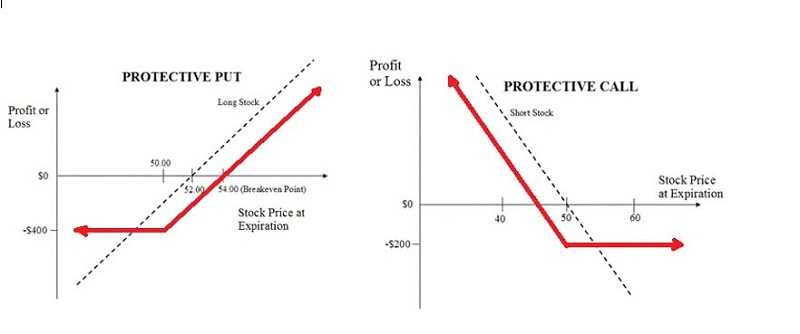

5) Protective Puts And Protective Calls

Strategies that use options to protect existing profits that have been made, but not realized, from either buying or short selling stock.

When a long stock position or a short stock position has performed well, a trader can use a protective put or a protective call respectively to preserve the profits that already have been made in the event of a reversal.

But also allow continued profitability should the stock continue to move in the right direction.

For instance, you bought a particular stock at $15, and the price then rises to $25.

If you wanted to be able to profit from further price increases, but also safeguard against the price dropping back down, then the protective put will help you do this.

It’s essentially a straightforward hedging technique.

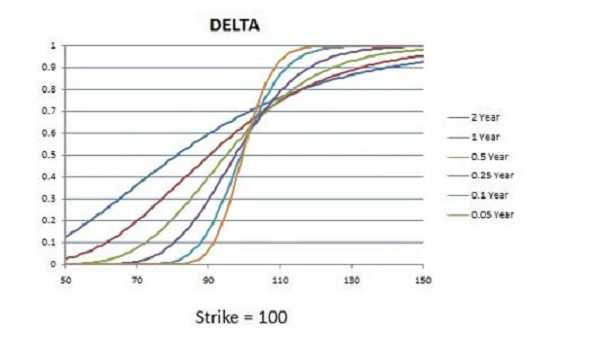

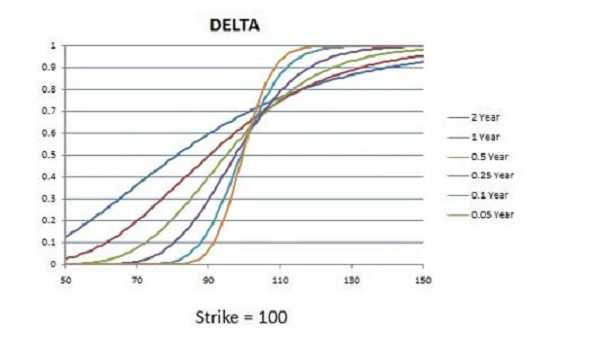

6) Delta Neutral Strategies

Delta is one of the five main Greeks that influence the price of options.

Actually, the most important of these, because it’s a measure of how much the price of an option will change based on the price movements of the underlying security.

They are used to create positions where the delta value is zero, or close to it.

Such positions aren’t affected by small price movements in the underlying security, meaning there’s little directional risk involved.

They are typically used to hedge existing positions or to try and profit from time decay or volatility.

To build a delta-neutral strategy, you must be sure that the delta risk connected with each element of his portfolio is compensated in total. The other possibility is to gather the delta risk from each of your positions and then delta hedge the entire portfolio.

For example, you may hold a call with a 30% delta and also hold a put with a -30% delta. This is recognized as a strangle.

In your case, it is delta-neutral. To recall, the deltas from the call and put, cancel each another. Let’s say the put has a -16% delta.

So, the strangle as a whole would have a 14% delta.

[30% + (-16%) = 14%]

To make this strangle delta-neutral, you have to sell the underlying asset in the right ratio. Or you need to sell call options or buy more put options because you will need to hedge anyway.

For example, if the option’s delta value is 1, the option will grow in price by $1 for every $1 rise in the price of the underlying asset. And contrary, it will decrease in value by $1 for every $1 drop in the price.

But delta value is more theory than exact mathematics. Anyway, the price changes are almost correct in practice.

The delta value in option can also be negative. This means the price will run inversely relative to the value of the underlying security. If delta value is -1, for instance, that will show a decrease in price by $1 for every $1 rise in the price.

The delta value of calls is always positive and it is between 0 and 1. For puts, it’s always negative, between 0 and -1.

For example, if you hold 100 calls with a delta value of 1, then the overall delta value of them have to be 100. For every $1 increase in the price, the cumulative price of your options would grow by $100.

This is very important to know: when you write options, the delta value is completely turned. This means, if you write 100 calls with a delta value of 1, then the delta value for all have to be -100.

Equivalently, if you write100 puts options with a delta value of -1, the delta value has to be 100.

When you have the overall delta value of a position is 0 or close to it, you have a delta neutral position.

So if you owned 100 puts with a value of -1which is total value -100, but ate the same time you hold 100 shares of the stock with total value of100, you can say you are holding a delta neutral position.

You have to know that the delta value of an options position can vary if the price of the underlying security changes. As option go more into the money, its delta value goes more away from zero.

To be more clear, when delta moves in call towards 1, in put it will go toward -1.

You can see, as option go more out of the money, its delta value moves more towards zero.

Where this lead us? To conclude the obvious thing. Delta isn’t certain neutral because if the price of the underlying asset goes to any high level.

7) Gamma Neutral Strategies

Gamma is another of the Greeks. This is the neutral strategy, designed to create trading positions where the gamma value is zero or very close to zero.

That would mean that the delta value of those positions should remain stable regardless of what happens to the price of the underlying security.

You should use gamma strategy to reduce the volatility of your position. Also, it is useful as an attempt to benefit from changes in assumed volatility.

For more stable hedging, you should use gamma in combination with delta-neutral strategies.

As the gamma value of an options position actually describes the volatility of that position, there is a reason to produce a gamma neutral position as help if you want to be exposed to the smallest volatility.

If you create a gamma neutral position and delta positive, you can expect gains and not be exposed to the large losses if things don’t direct as you divined. This is beneficial if you want to take a long term position on a contract that you expect to grow in price in the future, but you want to overcome sudden moves.

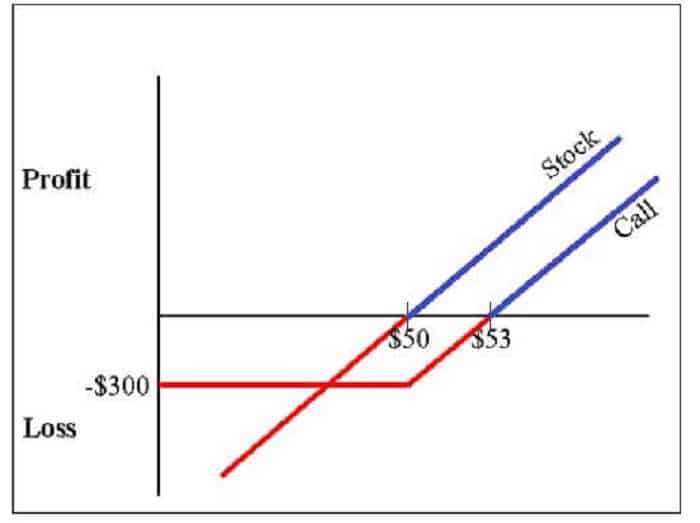

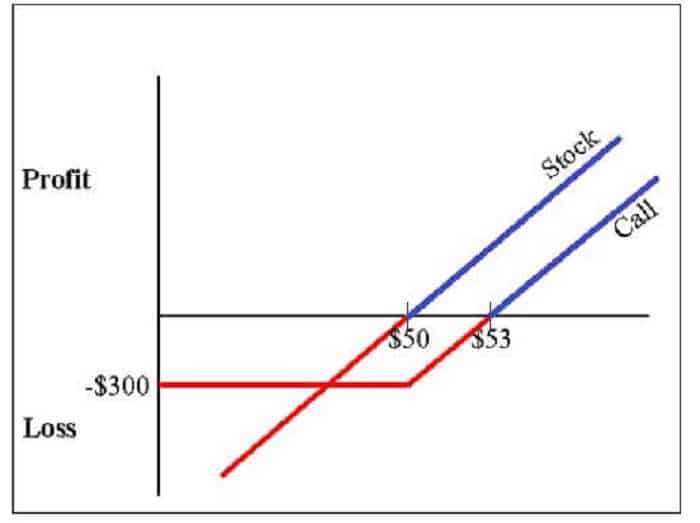

8) Stock Replacement

One of the most commonly used stock replacement strategies involves buying calls instead of buying stock.

It’s actually a very simple strategy, and even complete beginners should have no problem using it.

More advanced traders can also use hedging techniques to further limit the risks and volatility that are involved.

The essential concept of the stock replacement strategy is that instead of purchasing a stock, you buy calls with stock as the underlying security. The calls you buy must have a strike price lower than the current trading value of the underlying security. This means they have to be deep in the money.

Let’s go back to our makebelieve company “Plum Ltd Inc Gmbh”.

For example, its stock is trading at $100 per share.

Calls based on Plum’s stock with a strike of $60 are accessible at $42.

And you hold 100 shares which are $10,000, right?

But someone else holds 100 of the calls which are $4,200.

If Plum’s stock moves above to $110 per share, the calls would be worth about $52 each.

So, your investment now worth $11,000. The investment of another guy would be worth $5,200, also an increase of $1,000.

But if Plum’s stock drops to $90 per share, the calls would be worth roughly $32 each.

In this case, your investment would be worth $9,000, because of a decrease of $1,000. The other guy investment would be worth $3,200, the same decrease of $1,000.

What can you see in the example above?

The net effect is almost the same from holding the calls as it is from holding the shares. The other guy created your position without purchasing any of the stock.

And he invested notably less you did.

Do you see how this strategy works?

This is the fundamental benefit of the stock replacement strategy.

9) Stock Repair

Stock repair is a technique that stock traders can engage, using options, to increase the chances of recovering from being long on a stock that has fallen in price.

It’s possible to break even from a smaller price increase in the stock than would otherwise be possible, without having to commit any more capital if you use this technique correctly.

Stock repair using options is quite simple for use.

Let’s see how.

You purchased 100 shares of Plum’s stock at $40 per share, which is an investment of $4,000. The price then falls to $20 per share, and suddenly your investment is worth just $2,000 meaning you have lost $2,000.

To apply the repair strategy you purchase 1 call options contract with a strike of $20. And that cost you, let’s say, $400. You then write 2 call options contracts, that is 200 shares, with a strike of $30. Suppose these call options are half the price of the bought options. Your credit would be $400 to equal the $400 given on buying the at the money call options contract.

So, the trade has cost you nothing if we neglect commissions, of course.

If the price of Plum’s stock stays at $20 or decreases more, by expiration then all contracts will expire as worthless.

So, you will not profit but you will not have any losses if use this strategy. An extra drop will decrease the value of your position.

But if the price of Plum’s stock jumps to $30 by the expiry, then the written call options will expire as worthless.

So, what can you do?

You can apply your option to purchase 100 more shares at $20. You would now own 200 shares with a medium price of $30 each (100 purchased at $40, 100 purchased at $20). With the price at $30, you are able to close your position by selling your shares. In case you don’t apply the repair strategy you will make a loose of $10 per share.

In case the Plum’s price crossed above $30 by the expiry, for example, up to $40, you still can make breaking even. You can repeat the exercise of your option to purchase 100 more shares at $20 to hold 200 shares at an average price of $30. The call options you write will oblige the other holder to exercise them. So, you must sell 200 shares at $30. That will give you a break-even position.

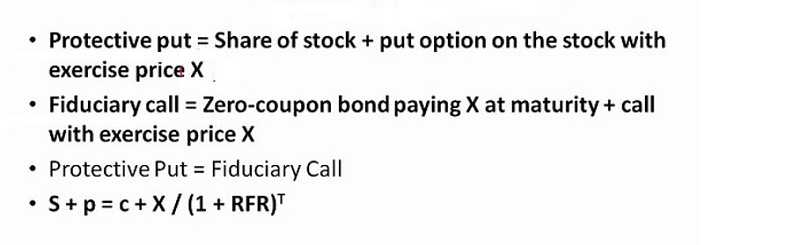

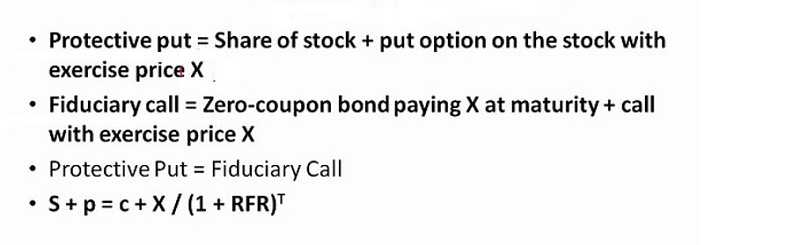

10) Married Puts, Fiduciary Calls, and Risk Reversal

The last three!

The married put mixes a long stock position with a long put options position on the same stock. It is the same as a protective put but it’s performed differently. It is not used for exactly the same purposes. It requires making the two needed transactions (buying stocks and writing puts) at the same time and is used essentially to limit the potential risks associated with buying stocks.

The fiduciary call means buying calls and also investing capital into a risk-free market such as an interest-bearing deposit account. It’s a stock replacement technique but serves for a bit a different purpose. Its main purpose is to efficiently reduce the costs involved with buying and exercising calls.

For example, you want to buy 1000 shares of “Plum Ltd Inc Gmbh” stock. The trading price is at $50 but you choose to practice a fiduciary call.

In the money calls on Plum’s stock, with a strike of $50, are trading at $4. Then you will spend $4,000 to buy 1000 shares instead of the $50,000 to buy those shares directly. This gives a balance of $46,000.

You can invest the $46,000 into some interest-bearing account, for example.

Where is the point?

By the time the options will expire, you will already make sufficient interest to somewhat reach the cost of purchasing them. Hence, if they expire as worthless you will have balanced some of the losses. Also, if they expire in the money you will have balanced the cost of exercising them. This will increase your earnings.

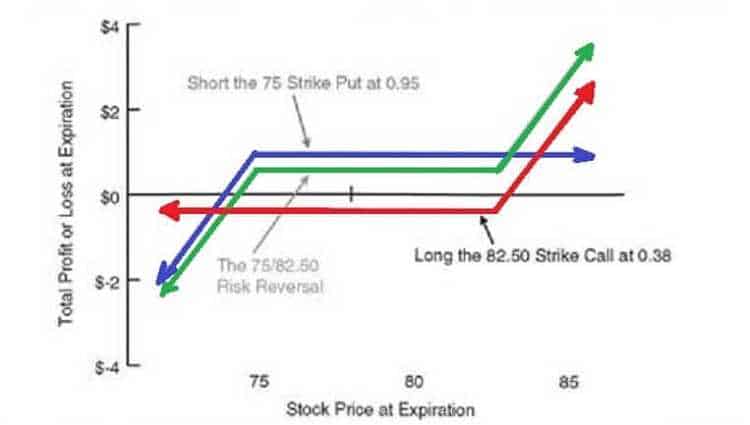

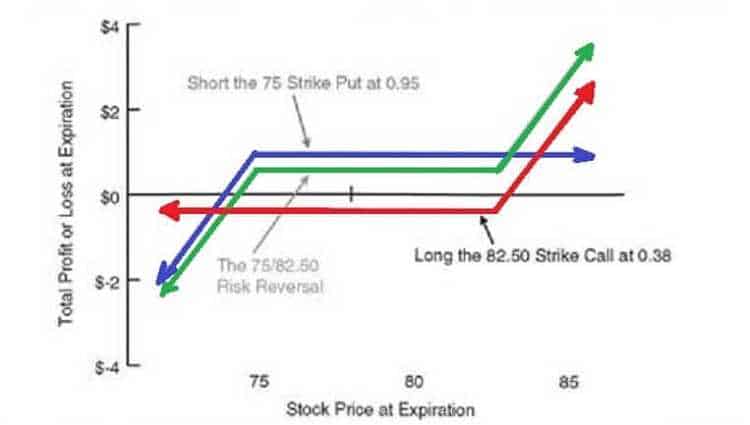

Risk reversal is an expression that has two meanings in investment. It can be used to indicate a strategy involving options that are employed, usually in commodities trading. Basically, it’s a hedging method practiced to protect against a drop in price. It can be applied in forex options trading to explain the difference in volatility between call options and put options.

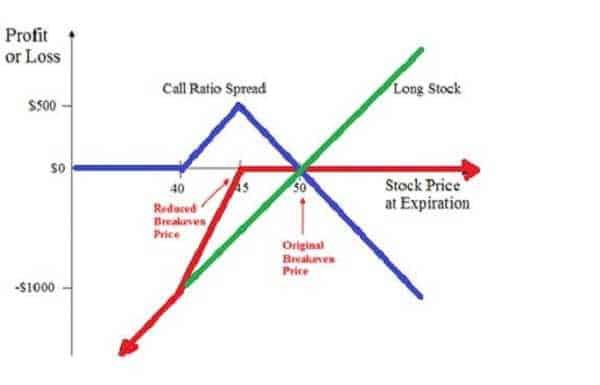

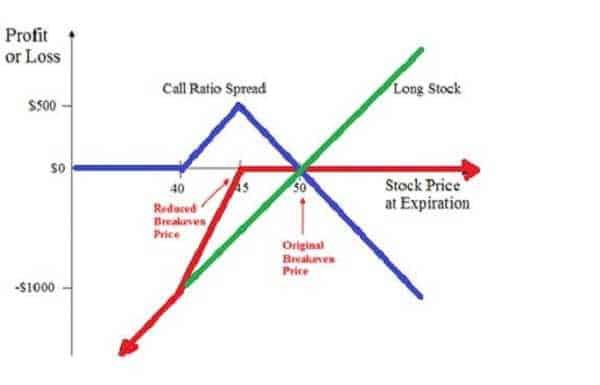

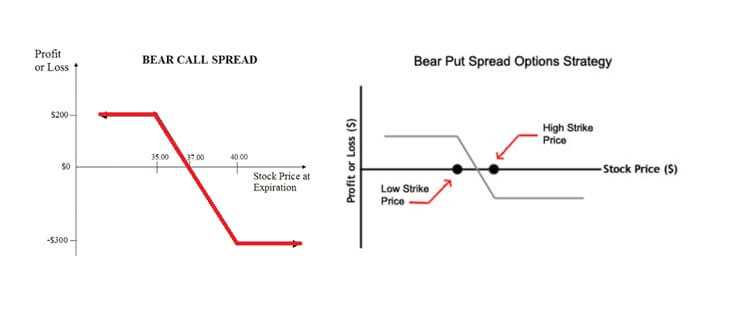

OPTIONS SPREADS

Options spreads are the basic parts of many options trading strategies.

You enter the spread position by purchasing and selling the equal number of options of the same class and on the same underlying security. But where is the difference? They have different strike prices or expiration dates.

So, we can say the spread is the bridge between the basic options strategies and advanced strategies.

In fact, most advanced strategies are composed of the spreads I covered in this tutorial ”Trading Options”.

For the engaged professional, Spreads offer the right mixture of reward and risk.

The three main classes of spreads are:

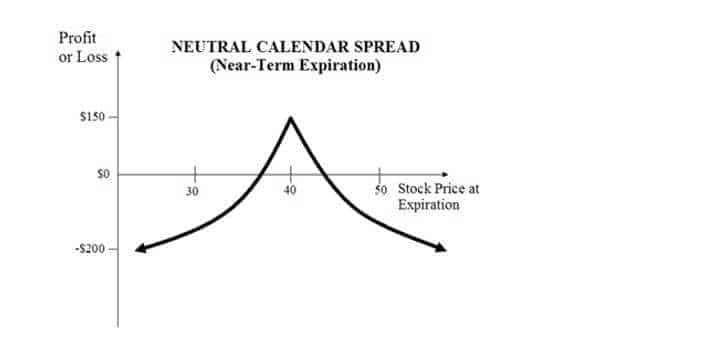

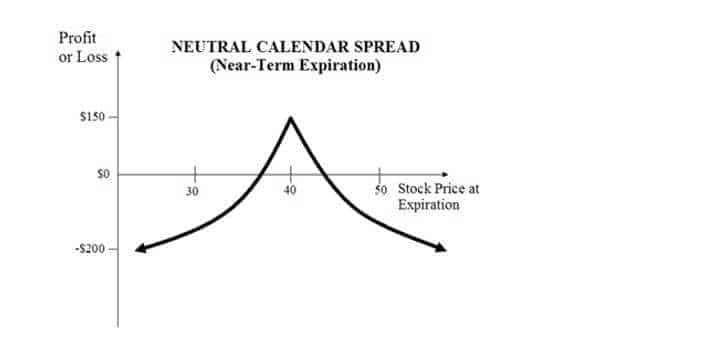

a) The horizontal spread

Horizontal, calendar spreads or time spreads are created using options of the same underlying security, same strike prices but with different expiration dates.

A horizontal spread is created by writing options contracts of a particular type and buying contract of the same type but with different expiration months.

At first, you have to use a sell to open order to write contracts of a certain type with an expiration date of, for instance, September.

Then you have to use the buy to open order to buy contracts of the same type but with an expiration date of the following April for example.

You can use calls or puts.

You can make the positive return by making more in time decay through the short term options you write than you lose in time decay through the ones you buy.

The longer-term contracts have the benefits of reducing the margin requirement of the short position and offsetting the potential losses should the underlying security involved. The principle of horizontal spreads is based on how time decay affects the value of options contracts.

Let’s say my Plum is trading at $92 per share. And you believe the stock will increase in volatility very soon.

And what you do?

In the following weeks, you sell $92 call for $2.70, for example. Right, you earn $270 because options are traded in portions of 100 shares

$2.70 x 100 = $270

Next month you buy $92call for $3.56. That costs you $356

$3.56 x 100 = $356

Hence, your entire debit for this transaction is

$86 = ($356 – $270)

That is your maximum loss.

As we can assume, the stock act more volatile at the time just before the company’s earnings report. Speculative investors jump on the stock and change the price.

That rise in volatility increases the value of the long-term option because it has a higher vega.

Vega measures the sensitivity of an option’s price to implied volatility (IV).

So, the positive move in implied volatility boosts your long-term call option in value from $356 to $400.

In the same line, your short-term option position will rise in value too. The time-decay will obvious reduce its price.

But, you sold a near-term option, and you need the price to fall. That is the way you make money.

Let’s assume that your near-term option decreases in value to $150.

Now, you are able to close your trade with profit. How?

Just buy back the short-term option for $150 and sell the long-term for $400. That provides you a $250 credit.

You turned a $86 investment into $250. This isn’t bad.

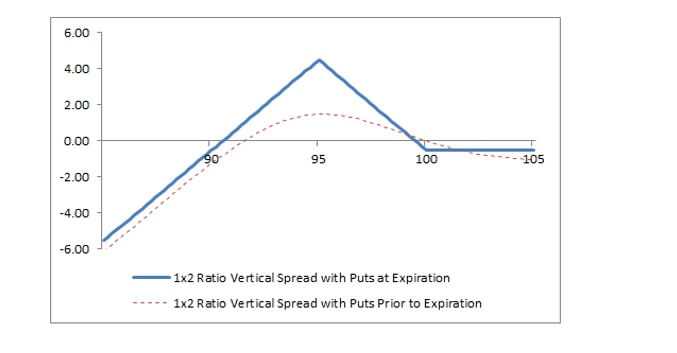

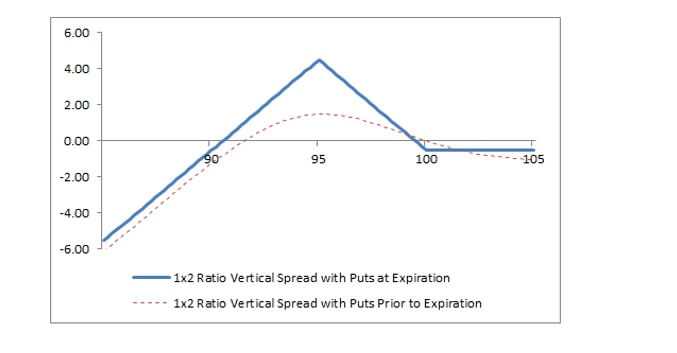

b) The vertical spread

Vertical spreads involving options of the identical underlying security, equal expiration date, but at different strike prices.

You can create a vertical spread very simple.

It can be done by buying options contracts, using the buy to open order, and selling contracts, using the sell to open order.

The contracts have to be of the same type.

The options contracts arrive vertically piled when you are looking at them on an options chain. That’s why they are named vertically spreads.

To be more understanding, this options strategy is when you make a simultaneous purchase and sale of two options of the same type with the same expiration, but different strike prices.

If you buy calls at one strike price and write calls with a different strike price you have to create a vertical spread.

You can also do the same with puts.

For example, you use a buy to open order. Actually to buy 100 of the options contracts. And here is a possible scenario.

Based on the stock in Plum company.

Plum’s stock is trading at $100, the expiration date is, let’s say, July 2019. And the strike price is $98, the ask price is of $4. What you have to do? Of course, you have to use a sell to open order and write 100 of the contracts.

The next call would be, based on my Plum which stock is trading now at $100, and the expiration date is July 2019 but the strike price is now $104 and the bid price is $1.40.

What I want to show you is, by buying calls at one strike price, and writing calls with a different strike price you have created a vertical spread.