Pure play method represents an approach practiced to estimate the beta coefficient of a company whose stock is not publicly traded.

What is a Pure Play method in investing? Have you ever heard about this? How do you estimate the companies when you want to invest your money in different stocks? What tools do you use? Do you make your investment decisions by looking at cash flow, dividends, the strength of the company? What are your criteria? Maybe it is easier for you to estimate the company that produces only one single product. If you do the latter mentioned, you already know what is a Pure Play method in investing. But do you know all Pure Play’s performances and risks?

Before we explain them to you we’ll explain what is a Pure Play method.

What is a Pure Play method?

Investors use this method when estimating the beta coefficient of the company whose stock isn’t publicly traded.

A Pure Play company is focused on one type of product. It is different from the companies that are conglomerates, offering many products. Pure Plays are easier for investors to analyze. When investing in Pure Plays you’ll have maximum exposure to a distinct market part. For example, if you want exposure to car makers stocks you might prefer buying Tesla stock. As compared to Yamaha Motor Co.which is engaged not only in making cars but also in many other industries. This company is producing motorcycles, boats, guitars, outboard motors, etc.

A Pure Play method is a procedure that investors use to estimate the beta of such a company. But the Pure Play method is also a way to discover the cost of capital for a product or project that is different from the company’s principal business.

Many companies are pure plays. They are selling or producing one singular kind of product. So, you can understand that this kind of investing can be very risky because if interest in this particular product or service declines even a bit, such a company will be affected negatively. A Pure Play method is helpful to estimate a project’s beta or the risk of a project. For example, a Pure Play company could use this method to identify publically traded companies that are involved in projects similar to the one they want to develop.

Use it to estimate the cost of equity capital of a private company

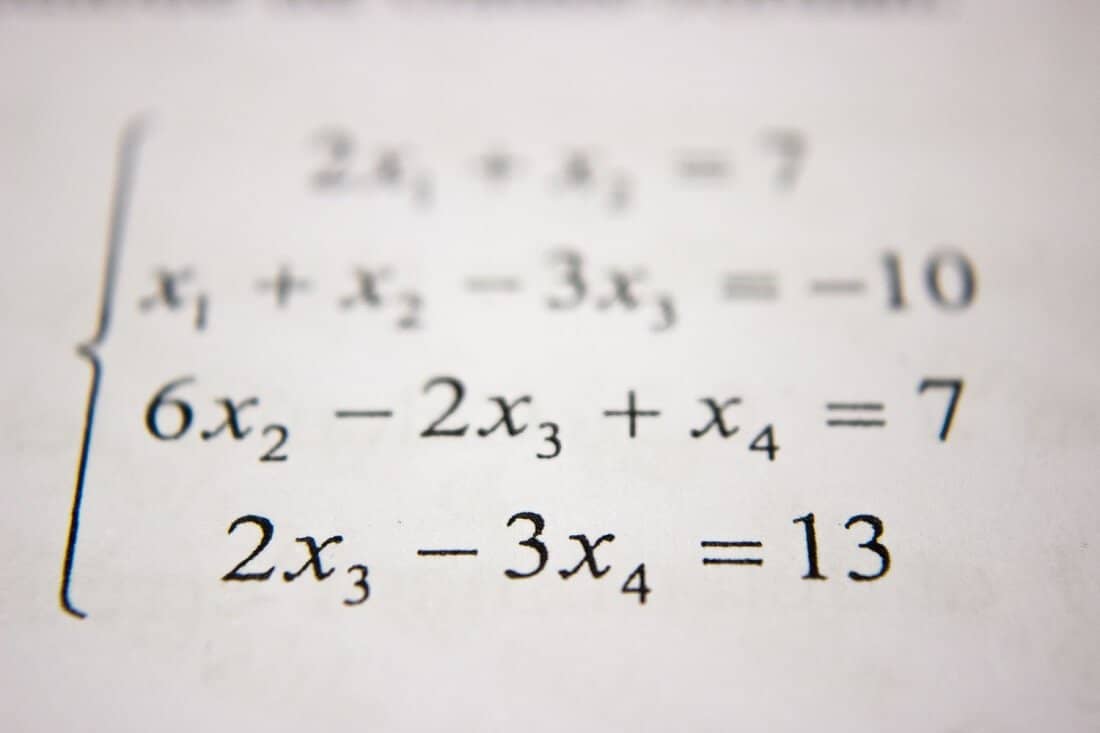

This involves examining the beta coefficient.

When evaluating a private company’s equity beta coefficient, you’ll need a beta coefficient of a public company. The latter you can calculate when regressing the return on public company’s stock on the appropriate stock index. The resulting calculation is then applied to return the beta coefficient of a private company. Here is how to do that. Let’s mark the private company as P and public company as PB.

In our equitation, we’ll mark debt to equity ratios as DEB and DEPB for the private and public company respectively.

Unlevered Beta of PB = Equity Beta of PB / (1 + DEPB × (1 − Tax RatePB))

Equity Beta P = Unlevered Beta of PB × (1 + DEP × (1 − Tax rate))

Advantages and disadvantages of the Pure Play method

The stock of Pure play company is different than stocks of diversified ones. They are popular among investors who want to make a particular trade on particular products. In short, they are not interested in investing in a company that has different business lines. They found reasons to invest in Pure Play stocks and we’ll try to explain them. Firstly, these stocks are easier to analyze. Also, when you have to analyze a company with diversified businesses and several sources of income, you might have a problem evaluating the strength of the company. Its income is generated from many products, with different profit margins, and could be exposed to different growth benchmarks.

Further, despite the fact that investing in Pure Plays can be riskier, they can be a great opportunity for very high rewards when doing well. Should we mention Tesla? But wait! Pure Play method in investing has its disadvantages too. These companies are not diversified. What will happen if difficult times appear? When the company is focused on just one product and that one isn’t able to generate revenue, the stock price of such a company will drop, sometimes sharply. These companies don’t have other products to balance the poor production. That’s a great problem for investors.

The risk of Pure Play method in investing

First of all, the risk comes from some conditions that may affect the company badly. However, that isn’t the only reason. The additional risk might come from the type of investing style. Here is one example. Let’s assume the growth investors favor some Pure Play company. In periods of the bull market the company will perform well. Even more, its stock could easily outperform the market. But what will happen when the bear market appears? Well, we know that during the bear markets the value investing is a more successful strategy. The consequence is that the Pure Play method will have poor results if growth investors stick with it.

These companies depend on one product or one investing strategy. So they are often followed by higher risk. They are completely the opposite of diversified. However, the higher risk gives greater potential for higher profits. When circumstances are in their favor, Pure Play stocks can grow tremendously since the company is focused on a sole product with full strength.

Reasons to use it in investing

We’ve been writing so many times about the importance of diversification in investing. Also, we pointed out that investing in a single company isn’t always the smartest idea. But when it comes to the Pure Play method in investing, things are a bit different.

There are really a few good reasons to invest in pure plays. Pure Play company is considerably easier to analyze. You have, as an investor, only one type of product or business line to analyze. Moreover, it is easier to understand the cash flow and revenue of one company than it is a case with several. Further, you can with a better result predict how it will perform in the future.

Pure play can be a very attractive investment. These companies work a strictly defined niche market. They are specialized for a particular one. That is a quality per se and could be extremely beneficial for investors.

Bottom line

Pure play is a method used in stock trading and investing. It is all about companies with a focus on a specialized and particular product or service. The “Pure Play method” is also helpful when estimating a project’s beta, or the risk of a project.

Leave a Reply